April 28, 2008

Miller Creek project failing: report

Power project is not meeting its commitment to go green and to protect species at risk

Larry Pynn

Vancouver Sun

Monday, April 28, 2008

An independent power project on Miller Creek near Pemberton is failing to meet its commitments to produce "green power" and to protect species at risk, according to an environmental consulting report.

The 33-megawatt power project, owned by the City of Edmonton's EPCOR Utilities Ltd., had an oil spill on site as well as fish kills resulting from "dewatering" of the creek for four hours during a malfunction last September, reports TRC Biological Consulting Ltd. of Port Coquitlam.

The December 2007 report also notes that harlequin ducks and tailed frogs, both species at risk, have vanished from the creek since construction of the plant in spring 2003.

The report suggests the generating station "does not produce green energy as identified by the BC Hydro power Green Criteria" and "has not fulfilled their commitment, as well as their responsibility respecting the oil spill clean-up and have not protected the species at risk."

The criteria require, in part, that projects "avoid unacceptably high environmental impacts such as damage to fish populations, endangered species or air quality."

The report, obtained by the Western Canada Wilderness Committee, finds that EPCOR lacks an "adequate environmental management system" and recommends "ongoing surveillance to ensure that these deficiencies are fully completed."

It urges removal of all fuel contaminants, re-vegetation of road slopes and annual ditch clean-outs, and compensation for loss of species at risk.

Miller Creek is only the latest in a slew of environmental problems dogging so-called green independent power projects, both run-of-the-river plants and wind turbines, all over the province.

"It's like the Wild West out here," said Gwen Barlee, a campaigner with the Western Canada Wilderness Committee in Vancouver.

Barlee complained the province continues to process scores of applications for similar projects without the ability to monitor them and avoid tragic environmental outcomes.

Tim Bennet, a water-allocation section head with the Ministry of Environment, said the province continues to meet with the company to ensure environmental concerns are addressed. He added the conservation officers' service has an active investigation into the dewatering incident.

Julia Berardinucci, regional manager for water stewardship, added that a lack of solid background data on species at risk in the creek means that further studies are required to better determine the impact of the power plant.

EPCOR spokesman Jay Shukin said that as part of its licence to operate, the company has undergone a five-year environmental monitoring project, ending in 2007.

The company has discussed the latest report with the ministry and is "committed to a second monitoring period using more rigorous methodologies" to ensure "all environmental standards" are met.

The company is already proceeding with road and culvert repairs, slope stability work and a remediation plan for the diesel fuel spill, which he said occurred in 2003 on the plant's access road during the construction phase.

Not more than 100 litres leaked from a fuel truck well away from the creek, he said, adding that some clean-up work was done, but further sampling indicated the "presence of hydrocarbons."

Shukin also noted that flood-control work not associated with EPCOR has had negative downstream impacts on fish in the creek.

He added that the consultant's report does not make the case that the Miller Creek facility is failing to meet its "green energy" obligations.

Independent power projects elsewhere in B.C. have generated fears about environmental and visual impacts from transmission lines, roads and other infrastructure.

The province in March refused a developer's request to punch a transmission line through Pinecone Burke Provincial Park as part of a run-of-the-river development in the upper Pitt River.

EPCOR has water and power facilities throughout western Canada and Washington state, including the seven-megawatt Brown Lake run-of-the-river power plant near Prince Rupert and the Britannia mine water-treatment plant on the Sea-to-Sky Highway near Squamish.

© The Vancouver Sun 2008

Miller Creek Hydro Project

High in the Coast Mountains lays the source of Miller Creek's abundant water supply, the Ipsoot Glacier. Another run-of-river project nestled in the Sea to Sky Corridor, the Miller Creek hydro project, on a tributary of the Lillooet River, lies four kilometres north of Pemberton and produces 29 megawatts (MW) of power.

Owned by EPCOR Power Development Corporation and completed in May 2003, the facility includes water intakes on North and South Miller Creek at elevations of 1,100 metres and 1,200 metres. The water then travels through a 4.2-kilometre steel pressure pipeline linking to a 33-megawatt power station in the lower reach of the creek. Behind the three-metre high concrete dam and steel water-release gate is a two-hectare pond reservoir.

BC Hydro's Miller Creek info page

April 24, 2008

Innergex Renewable Energy to Acquire Rights to Develop 200 MW of Hydro Projects in BC

CNW Group

Wednesday, Apr. 23 2008

LONGUEUIL, QC, Apr 23, 2008 (Canada NewsWire via COMTEX) -- Innergex Renewable Energy Inc. (TSX: INE) (the "Corporation") announces it has reached an agreement with Ledcor Power Group Ltd. ("Ledcor") to acquire 66 2/3% of a joint venture, holding rights to develop 18 run-of-river hydroelectric power projects with secured water licences located in Lower Mainland in British Columbia. These projects would represent a potential installed capacity of more than 200 MW and produce over 1,000 GW-hr of clean energy for the Province, filling the needs of approximately 98,000 BC homes.

The Corporation will invest $8 million for this acquisition in addition to issuing 200,000 warrants to Ledcor. Subject to TSX approval, the warrants will be exercisable within 24 months from closing of the transaction, at a strike price of $12.50 per warrant. Ledcor will remain the owner of 33 1/3% of the joint venture.

"We were aiming at developing the sites with a dynamic, serious and experienced development partner, having complementary strengths with Ledcor" said Scott Lyons, President, Ledcor CMI Ltd. "We've seen the success the Corporation already has in BC and elsewhere, and we are confident these projects will provide clean hydropower to the Province in the near future."

"This acquisition will consolidate our position in BC by adding over 200 MW to our existing portfolio of prospective projects, bringing the total to more than 1,800 MW" remarked Michel Letellier, President and CEO of the Corporation. "Pre-development studies, as well as technical assessments were conducted by Innergex' development team which confirmed the projects' feasibility."

Most of these projects are in their early stage of development but some are ready to be submitted to BC Hydro's Clean Power Call and to BC Hydro's Standing Offer Program. The acquisition price for the 18 prospective projects represents an attractive purchase price of less than $40,000 per MW.

The Corporation and Ledcor will work together over the next few months to further finalize the details of the agreement and close the transaction. The closing of the acquisition which is expected to occur within 90 days is subject to customary conditions for similar transaction including satisfactory due diligence review. The Corporation intends to finance the acquisition with cash on hand.

Innergex Renewable Energy Inc. is a developer, owner and operator of hydroelectric facilities and wind energy projects in North America. The Corporation's management team has been involved in the renewable power industry since 1990. The Corporation owns a portfolio of projects which consists of one operating facility (8 MW), interests in nine development projects with power purchase agreements under construction or to be constructed between 2008 and 2012 (gross expected capacity of 565 MW), and prospective projects (gross expected capacity of more than 1,600 MW). Innergex Renewable Energy Inc. also owns 16.1% of the Innergex Power Income Fund, a publicly traded income fund listed on the Toronto Stock Exchange (IEF.UN), and acts as its manager under long-term management agreements.

Ledcor Power Inc. is an independent power producer (IPP) currently focused on developing environmentally friendly "green" energy projects in British Columbia. Ledcor Power is a wholly owned subsidiary within the Ledcor Group of Companies. Founded in 1947, Ledcor is a leading, privately-held, employee-owned group of companies, specializing in building, civil, industrial and telecommunications projects and services. Ledcor brings an established history of construction excellence with a team of professionals who measure their success by client satisfaction.

Forward-looking statements

Investors should note that some statements in this press release are forward-looking and may not give full weight to all potential risks and uncertainties. Forward-looking statements are, by their nature, subject to risks and uncertainties, and actual results, actions or events could materially differ from those set forth in the forward-looking statements. All forward-looking statements are only valid as of the date they were made. The Corporation does not undertake to update forward-looking statements except in accordance with applicable laws.

SEDAR: 00026108EF

SOURCE: INNERGEX RENEWABLE ENERGY INC.

Mr. Jean Trudel, MBA, Vice President - Finance and Investors Relations, Innergex

Renewable Energy Inc., (450) 928-2550, jtrudel@innergex.com

Copyright © 2008 CNW Group. All rights reserved.

Possibility grows of spectacular gas find in northeast

Second firm drilling in Horn River Basin cites vast potential natural gas reserves

Scott Simpson

Vancouver Sun

Thursday, April 24, 2008

The possibility that the remote northeastern corner of British Columbia harbours a spectacular, untapped natural gas resource is growing increasingly certain.

Calgary-based gas explorer Nexen Inc. became the latest company to herald a vast new opportunity in B.C. when it announced that drilling results on its property in the Horn River Basin suggest a potential reserve as great as six trillion cubic feet of gas.

"This is the first time these kind of rock properties have shown up on the radar screen in Canada, and you guys [in B.C.] just happen to have a whole bunch of it," said Nexen's Michael Harris, vice-president of investor relations.

Email to a friendEmail to a friendPrinter friendlyPrinter friendly

Font:

* *

* *

* *

* *

AddThis Social Bookmark Button

"This is clearly the most exciting thing we've had in B.C. for a long, long time."

The Nexen announcement follows a similar declaration in February by EOG Resources that its potential net reserve at Horn River is approximately six trillion cubic feet.

All inferences to date about the size of the resource are preliminary -- based on results from barely a handful of holes drilled.

But if the projections are correct, they would collectively increase Canada's total proven natural gas reserves by about 20 per cent -- and that may be at the low end of what's possible.

Earlier this month, the partnership with the largest land holding to date in Horn River, Calgary's EnCana and Houston-based Apache Corp., announced large volumes of gas from three wells drilled this past winter in the basin.

Horn River was the focus of record provincial revenue from gas lease auctions over the past fiscal year, and pending the release of results from April's monthly auction -- which took place on Wednesday -- the spree may continue thanks to gas commodity prices making the venture economic.

The Horn River gas is locked in a shale deposit that is more costly to exploit than conventional gas -- for example, it costs about $10 million to drill a well, compared to $1 million at a conventional deposit.

Shale gas deposits can be cost-effectively exploited -- the Barnett shale deposit in Texas is the second-largest on-shore gas deposit in the United States.

"When our geologists realized that B.C. has these shales, they considered the potential for tight gas and thought we should grab a little bit, and take a look," Harris said.

Projects in the B.C. region likely won't proceed without a trading market price for gas of at least $8 per unit. A unit is 1,000 cubic feet -- a typical B.C. home uses an average of about 10 units per month.

Gas moved into the $10-per-unit range this month amid expectations that prices will range higher than they have for two years, due to a cold winter that took a large bite out of existing reserves.

B.C.'s low-cost royalty framework for unconventional gas reserves also provides incentives for drillers to operate in this province.

ssimpson@png.canwest.com

© The Vancouver Sun 2008

April 19, 2008

Province has 8,000 potential run-of-river power sites: B.C. Hydro study

COMMENT: When it comes to generating power on BC's streams, big numbers abound, bandied about by antagonists of the government's private power policies just as they are by gleeful greedy project proponents - dozens of rivers, hundreds of 'em, 500, 800. This report, claiming 8,242 sites in the province with hydroelectric potential, is about as useful as an inventory of grains of sand on BC's beaches.

This doesn't come easy, friends, but I'm almost ready to agree with Richard Neufeld on this one. Let's get real.

BC Hydro has electricity purchase agreements with about 60 small hydro projects. A large number of those will never get built - the attrition rate on EPAs since BC Hydro started its power calls a few years ago suggests it should improve its filtering for competence and capacity before wasting a lot of time and money on fanciful, but unviable, proposals.

The 60, though, represent a good proportion of the cherry picking. After that, the streams get less productive, more seasonal, more fish-bearing, more remote, further from load centres and transmission lines, more costly. Anybody talking about 800 sites is wasting your time - ain't gonna happen. 8,000 sites, and well, let's start counting sunbeams, and waves, and gusts of wind, too. The estimated cost of power produced at nearly 3000 of the sites KWL identified would be over $1000 MWh. And you thought BC Hydro's reference price of $88 was dear.

The full report is here.

And a map is here.

In conjunction with its 2008 Long Term Acquisition Plan, BC Hydro put together a set of resource option sessions with presentations and reports, including this one. There is info on biomass, coal, wind, and small & large hydro. It's all here:

http://www.bchydro.com/planning_regulatory/integrated_electricity_planning/2008_ltap.html

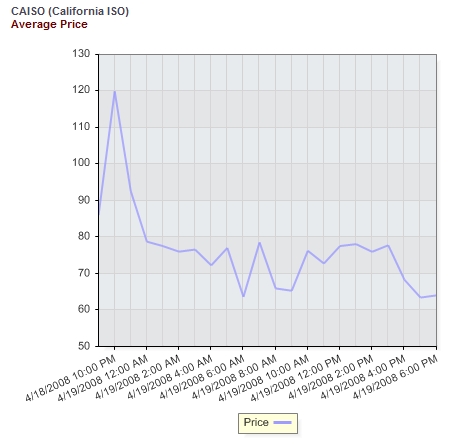

As a matter of interest, here's what they've been paying per megawatt hour for electricity on the spot market in California over the last 24 hours. It's a good time to be in British Columbia, with all our reservoirs full - selling hydroelectricity from our legacy infrastructure is very profitable at the moment. But if we're paying a marginal rate of $88/MWh, what happens to the netbacks?

By Stephen Hui

Georgia Straight

April 16, 2008

There are more than 8,000 sites in the province with the potential to be developed as run-of-river power projects, a study commissioned by B.C. Hydro and the B.C. Transmission Corporation has found.

All together, the 8,242 sites would have a potential installed capacity of more than 12,000 megawatts and could generate nearly 50,000 gigawatt hours of energy per year, the November 2007 report, prepared by Kerr Wood Leidal Associates Ltd., says.

The electricity from 121 of those potential sites would cost less than $100 per megawatt hour, the study found. There are 450 sites in British Columbia where the energy would cost $100 to $149 per megawatt hour, while 7,671 sites would produce power at a cost of more than $150 per megawatt hour.

“There is large potential for future development of run-of-river hydroelectric projects in BC,” the report concludes.

“The density of projects in BC relative to the density of the transmission / distribution and road network in BC, in addition to the large portion of the province that would be considered remote, indicates that clustered developments or construction of new transmission lines and road infrastructure could greatly improve the cost effectiveness of many projects.”

If all of the 121 sites with a potential energy cost of less than $100 per megawatt hour were to be developed, they would have a combined capacity of 1,388 megawatts, produce 6,113 gigawatt hours of power annually, and impact a total land area of 7,205 hectares (assuming 10-metre-wide corridors for roads, power lines, and penstocks, and excluding intakes and powerhouses). In total, these sites would have a dependable capacity of 60 megawatts and generate 4,925 gigawatt hours of firm energy.

Sixty of the 121 sites with a potential energy cost of less than $100 per megawatt hour lie in the Lower Mainland transmission region. Thirty-nine of the 121 sites would have an individual capacity of more than 10 megawatts.

In the legislature on April 15, New Democrat environment critic Shane Simpson cited the report and asked if Minister of Environment Barry Penner would support the Opposition’s call for a moratorium on private power projects until the government has studied their impacts and developed a provincial plan with consultation.

“If this doesn’t perpetuate a gold rush mentality, then I don’t know what does,” Simpson said, according to Hansard.

Responding to Simpson, Penner attacked the NDP’s record on energy but didn’t address the report.

But, following a question from NDP energy critic John Horgan, Minister of Energy Richard Neufeld did.

“I’m glad they dream in 8,200 numbers, but what they should get to is reality,” Neufeld told the legislature. “British Columbia needs 30,000 gigawatt hours of electricity within the next 20 to 25 years, with the anticipated growth. That’s not my number. That’s the B.C. Utilities Commission’s number and B.C. Hydro’s number.”

Responding to another question from Horgan, Neufeld said: “Always interesting to hear the NDP try to blow everything out of proportion. I guess 8,200 is the new number today. Maybe tomorrow it’ll be 10,000. I don’t know. Maybe the next day it’ll be a hundred. They don’t speak reality at any given point in time.”

B.C. Hydro and the B.C. Transmission Corporation hired Kerr Wood Leidal in August 2007 to assess the run-of-river potential of the province. The Burnaby-based engineering-services company used a geographic-information-system model to complete the resulting Run-of-River Hydroelectric Resource Assessment for British Columbia report and map.

Run-of-River Hydroelectric Resource Assessment for British Columbia (Kerr Wood Leidal) Report Map

Save Our Rivers, Indeed

Why the private power battle is so critical.

By Rafe Mair

The Tyee

April 14, 2008

I must, in fairness, tell you that I support, and have publicly spoken for the Save Our Rivers Society, which, along with other groups and countless British Columbians, is actively opposing the privatization of our power and the abuse of up to 750 of our rivers and streams to make great wads of cash for the private sector. I'm sure you will bear my prejudice in mind.

...

The questions we must ask ourselves are these: Do we want private companies -- many of them large American outfits -- to develop our hydro power and make huge profits for largely offshore shareholders?

Or do we want to develop our own power and set our own course?

...

But there is one question that overrides all else. Were you consulted on this matter of enormous consequences? Was this even an election issue?

The answer is, of course, no. This has been policy by stealth.

Click here to read this article in its entirety, at The Tyee.ca

April 14, 2008

B.C. gains on Alberta's power pain

Deregulation handed $500M bonanza to BC Hydro, critics say

Darcy Henton

The Edmonton Journal

Monday, April 14, 2008

The deregulation of Alberta's electrical system may be controversial here, but it has been a bonanza for British Columbia, say industry observers.

They say B.C. has made windfall profits -- more than half a billion dollars -- selling its cheaply produced hydro electricity on Alberta's power market at prices that rocket to nearly $1,000 per megawatt hour (MWh) -- or $1 per kilowatt hour -- when supply is short.

By contrast, John Calvert, an associate professor of public policy at Simon Fraser University in Burnaby, B.C., says BC Hydro produces electricity at a cost of about 0.6 cents per kilowatt hour (KWh) and sells it to B.C.'s 1.7 million customers for around 6.4 cents per KWh to cover transmission, distribution and other costs.

Liberal MLA Hugh MacDonald says it is obvious B.C. taxpayers are the winners in this province's electrical deregulation experiment and Albertans are the losers.

"It's like BC Hydro won a lottery -- only they get a prize on an annual basis," he said. "They will get an annual dividend from our major mistake: electrical deregulation."

MacDonald suspects BC Hydro uses the Alberta revenue to keep its electricity prices amongst the lowest in Canada while Alberta prices are heading in the opposite direction.

"We have gone from some of the lowest prices in North America to some of the highest costs in North America and deregulation is to blame," he said.

NDP Leader Brian Mason said deregulation was supposed to bring lower prices and increased generation and it hasn't accomplished either.

"We're buying more power from B.C. at prices that must be a world-record mark-up," he said. "They are making out like bandits."

Neither Alberta Energy nor BC Hydro would reveal the exact dollar value of the electricity that is purchased by Alberta from B.C., but Alberta Energy reports on its website that it purchased more than $668 million worth of power from B.C. and Saskatchewan in the five years between 2002 and 2006. The province imported nearly $200 million in 2006 alone -- the last year for which figures are available.

While both B.C. and Saskatchewan export electricity to Alberta, the lion's share comes from B.C. SaskPower officials wouldn't say how much electricity it sells to Alberta, but its annual reports suggest it is a minimal amount -- about $13 million in 2006.

Wayne St. Amour, a vice-president with the non-profit Alberta Electric System Operator, said BC Hydro has the ability to close its spillways in the early morning hours and purchase power from Alberta's coal-fired plants when market prices are low. It then taps its recharged reservoirs when demand peaks and sells power into the Alberta grid at prices as high as $999 per MWh.

"Those are the market dynamics," he said. "That is a price that is entirely reasonable when we think about the level of reliability it provides us to ensure the lights stay on in Alberta."

Alberta deregulated its electricity market in 2001. Since 2002 it has been a net importer of electricity, St. Amour said.

Jim Wachowich, a lawyer for the Alberta Consumers Coalition, said Albertans paid the costs of creating the deregulated system and all the rules and entities that operate it and now B.C. is cashing in on the rewards.

"The jurisdiction next door is enjoying the benefits of electrical deregulation without suffering any of the costs," he said. "I really do believe Albertans have paid costs and not seen commensurate benefits from those costs."

But Alberta Energy spokeswoman Tammy Forbes says the power line between B.C. and Alberta supports the sharing of electricity during high- and low-demand periods to ensure a reliable supply and Alberta benefits from that.

She added that restructuring the electricity system has enabled Alberta to lead the nation in generating wind power and resulted in proposals to build 7,200 megawatts to meet the province's staggering demand for electricity.

"Our load growth in 2007 was equivalent to Ontario's load growth and they have three times our population," Forbes said. "The amount of electricity that has been added -- 4,600 megawatts -- is estimated to be $5 billion in private investment that didn't use taxpayers' money ... That is adding an entire Saskatchewan worth of new generation."

Alberta's plans include construction of a second power line into B.C. within the next decade. Critics say that may only increase Alberta's dependence on B.C. power.

"There is always concerns around too much interconnectedness," Wachowich said. "If someone else's system goes down, it can bring you with it."

Calvert said B.C.'s electricity can be produced cheaply because most of its dams were built in the 1960s and 70s.

"We're paying prices that are 30 to 40 years old," he said.

Alberta electricity, which is produced by private companies primarily from coal-fired plants and natural gas-fired plants, is considerably more expensive to produce and it is sold into a supply-and-demand-based electricity market.

Joseph Doucet, who teaches energy policy at the University of Alberta, says B.C. is well positioned to take advantage of Alberta's restructured market.

"The juxtaposition of a hydro system and a thermal (coal) system is ideal," Doucet said. "You have a market that is close to you that you can serve and, by virtue of two things -- good luck in geography and good planning -- you can profit from that market."

He said Alberta would need more generation if it wasn't for its easy access to B.C.'s electricity. And the power it purchases is emissions-free, he added.

"I would suggest that before your readers get too hot under the collar about this, it's not that different from the way we Albertans feel about expensive oil and our proximity to the U.S. market," he said. "We can't begrudge them their hydro capacity. They should be able to profit from it."

BC Hydro, which trades power and natural gas through its subsidiary Powerex, earned $511 million from sales to other provinces in 2006 and more than $2 billion in the past decade.

The Crown corporation carries a $7-billion debt, but it is required to pay a dividend of 85 per cent of its annual surplus to the B.C. treasury. It made a $407-million profit in 2006-07.

Calvert, the author of Liquid Gold, which argues against efforts to privatize part of B.C.'s electricity system, is a strong proponent of a publicly-operated electrical system. "BC Hydro is a good deal for people here," he said. "The public is not keen to have it privatized."

Both Alberta's main opposition parties have vowed to pull the plug on electrical deregulation if they get into power.

"I never thought it was a good idea to restructure your system, but no one consulted me at the time," Calvert said.

dhenton@thejournal.canwest.com

© The Edmonton Journal 2008

April 12, 2008

BC Hydro introduces Standing Offer Program

BC Hydro launches Standing Offer Program to acquire clean energy

News Release, BC Hydro, 11-Apr-2008

STANDING OFFER PROGRAM

Program Overview

May 6 Information Session

Hydro hunts small power sources

Scott Simpson, Vancouver Sun, 12-Apr-2008

BC Hydro launches Standing Offer Program to acquire clean energy

News Release

BC Hydro

April 11, 2008

VANCOUVER – BC Hydro launched its Standing Offer Program today to help ensure the province can meet its growing electricity needs with power from clean or renewable sources. The program offers a standard contract with set prices and a streamlined administrative process to give smaller scale projects the opportunity to contribute to B.C.'s supply of clean electricity.

Specifically, the Standing Offer Program targets projects that generate up to 10 megawatts of power. A 10 megawatt project typically provides about 40 GWh per year of energy or enough electricity to power 4,000 households.

"The Standing Offer Program will help the province achieve two important goals of the BC Energy Plan – becoming electricity self-sufficient by 2016 and generating 90 per cent of electricity in the province from clean or renewable sources," said Richard Neufeld, Minister of Energy, Mines and Petroleum Resources.

To be eligible for the Standing Offer Program, projects must generate clean or renewable energy or involve high-efficiency cogeneration. Projects must be located in B.C. and use proven technologies.

"This program will help us meet our future energy challenges by developing innovative, sustainable solutions that will help B.C. maintain its natural, competitive advantage of having a clean and renewable energy supply for generations," said BC Hydro President and CEO Bob Elton.

Feedback received through extensive stakeholder engagement influenced the design of the Standing Offer Program, resulting in revisions to the draft program rules and contract. These revised terms and conditions were part of the program application filed with the British Columbia Utilities Commission (BCUC) for regulatory review. The BCUC approved the program in March 2008.

Developers interested in applying to the Standing Offer Program are encouraged to review the Program Rules, Electricity Purchase Agreement and other documents, and to attend an upcoming information session.

Contact:

Susan Danard

Media Relations

Phone: (604) 623-4220

http://bchydro.com/news/2008/apr/release55742.html

STANDING OFFER PROGRAM

Program Overview

As directed by the provincial government in its BC Energy Plan: A Vision for Clean Energy Leadership, BC Hydro is implementing a Standing Offer Program to encourage the development of small and clean energy projects throughout British Columbia. The Program is a process to purchase energy from small projects with a nameplate capacity greater than 0.05 megawatts but not more than 10 megawatts.

Through a series of informal stakeholder engagement sessions and written comments, we received extensive feedback from stakeholders about previous calls for power and the design of the Standing Offer Program. As a result, the Program has been designed to:

* simplify the process, the contract and its administration

* decrease the costs of participation for developers while remaining cost-effective for the ratepayer

* meet the need identified by the BC Energy Plan and embody its policies and principles.

The Standing Offer Program Rules explain Program details including eligibility requirements, the application process and the Standard Form Electricity Purchase Agreement (EPA) terms.

Upcoming information sessions

BC Hydro invites you to attend an information session on May 6, 2008 in Vancouver to review the Program Rules and the application process. This session is intended for developers that are ready, or are planning, to submit an application.

* Register for this information session

We are also planning to hold regional information sessions over the coming months. Details on these sessions will be posted shortly.

Standing Offer Program details

Hydro hunts small power sources

Call goes out for projects generating up to 10 megawatts to join the grid

Scott Simpson

Vancouver Sun

Saturday, April 12, 2008

BC Hydro scaled its hunt for green electricity down to the micro level on Friday, announcing that it will welcome prospective producers of incremental bits of power any time they're ready to join the grid.

Projects of 10 megawatts or less are eligible and Hydro says it will take all it can get -- promising a streamlined application process for small-scale producers.

Proponents of larger projects must wait for the Crown corporation to issue a call for power before seeking an electricity sales agreement.

Under the Standing Offer program launched Friday, the little guys can fill out some standard application forms online and -- provided they have all necessary permits and other documentation -- they can join whenever they're ready.

Hydro has been working on the program for two years with independent power producers, and it was approved in March by the B.C. Utilities Commission.

Small run-of-river power projects would seem to be obvious candidates, but Hydro spokesperson Susan Danard said generating projects involving landfill gas, wind, solar, co-generation at industrial sites, and other green technology will qualify.

The program runs indefinitely, and Hydro is uncertain how many projects will join the grid in the near term -- it could be anywhere from 10 to 50 by 2010, Danard said in a telephone interview.

Standardized power sales agreements make it easier for proponents to contract with Hydro, but Danard noted that the list of other required documentation is lengthy, running to two pages in online documentation posted Friday afternoon on Hydro's website

"They have to have all their permits in hand to be ready to go," Danard said.

Hydro will pay between $71.37 and $84.23 per megawatt hour for power from small producers, which is more or less in line with the $71 to $74 amounts contracted in Hydro's major 2006 call for power.

There's a $3.10-per-megawatt-hour bonus for producers who get eco-certification.

Energy sector commentator David Austin said he expects most of the projects will be near the province's main population-electricity consumption centres, since additional transmission costs will eat into revenue at more distant locations.

Austin said he does not expect the program to trigger a gold rush.

"It's one thing to identify a resource, it's another to be able to produce it at the price being offered. This is always the hurdle that people have to overcome in order to be able to sell their electricity."

Melissa Davis, executive director of Citizens for Public Power, said the group is concerned that the process lacks the oversight that would be applied if Hydro itself were developing the same sources.

Davis said the electricity acquired under the program would be a "drop in the bucket compared to the provincial government's stated need for new generation -- unless Hydro is understating the scale of the response it expects."

"Can we expect to see a doubling or tripling of the more than 600 existing water licences and applications for private power projects on B.C.'s rivers and creeks through this program?" Davis asked.

ssimpson@png.canwest.com

© The Vancouver Sun 2008

April 11, 2008

Another Side to Private Power

First Nations, municipalities explore controversial energy source.

By Colleen Kimmett

The Tyee

April 11, 2008

Environment Minister Barry Penner decided not to go against a very vocal majority when he nixed a plan to run a power line through Pinecone Burke Provincial Park last month.

Groups opposed to the project, which had been rallying for months in advance of the decision and packed rowdy public hearings in Mission and Pitt Meadows, breathed a collective sigh of relief.

Underlying the controversy around this high-profile project is a greater concern about the private sector's role in power production.

...

Increasingly, First Nations and municipalities are the IPPs, working with the private sector but retaining full or partial ownership of their utilities and the revenue stream they provide.

Click here to read this article in its entirety, at the Tyee.ca

April 10, 2008

Tribal council allowed to appeal Rio Tinto deal

B.C. Court of Appeal decision stalls BC Hydro's efforts to renew sales

Scott Simpson

Vancouver Sun

April 10, 2008

BC Hydro's troubled efforts to renew a power sales deal with Rio Tinto Alcan have hit a new, and potentially monumental snag.

The British Columbia Court of Appeal has granted the Carrier Sekani Tribal council leave to appeal the multi-billion-dollar electricity purchase agreement that was approved in January by the British Columbia Utilities Commission.

The agreement gives BC Hydro long-term access to a portion of the electricity produced at Alcan's Kemano generating station near Kitimat.

The deal was struck in the context of Alcan's plan for a $2 billion modernization plan for its Kitimat smelter -- a plan that would lower the smelter's overall electricity requirements and leave about 15 per cent of annual electricity output for sales to Hydro.

However, the Carrier Sekani are looking for a new deal, either through a court fight or a negotiated settlement, to give some of that water back to Nechako River fish populations downstream of Kemano that have been devastated by the dam.

If they're successful, Hydro may lose some of the electricity production it negotiated with Alcan -- cheap, reliable power that is at a premium in B.C. and across North America.

The tribal council notes that Hydro has set ample precedents that recognize the crown's responsibility to first nations on this issue.

Over the past decade, Hydro has dedicated tens of millions of dollars in environmental restoration funds and foregone power generation in the form of improved water flows in rivers downstream of its dams around the province as a means of compensating for the adverse effects of its facilities.

The Carrier Sekani think Hydro needs to support the same sort of measures on the Nechako, although Hydro and Alcan were able to persuade the utilities commission otherwise in a ruling handed down last January.

The BCUC, in its ruling, stated that it had no authority to make a ruling on first nations issues.

Now, the tribal council says, the whole issue has been reopened.

In an interview, Carrier Sekani Tribal Council tribal Chief David Luggi said neither the province, nor a Crown agency such as BC Hydro, can absolve itself of a duty to consult first nations in matters involving traditional territory or interests.

"The province can't sign off on aboriginal rights or title. It's been long documented that they don't have that capability. So this is where we come in," Luggi said in a telephone interview from Prince George.

BC Hydro declined comment because the matter is still before the courts, spokesperson Susan Danard said in an interview.

"It's potentially a very significant decision," Greg McDade, legal counsel for Carrier Sekani Tribal Council, said in an interview.

"The grounds here are quite far reaching in terms of the utilities commission's role in dealing with first nations issues. They have tried to avoid that, despite the rest of the province and every other agency of the Crown becoming involved in aboriginal consultation."

An Alcan spokesperson said the company believes that the B.C. Utilities Commission made a correct decision, and is continuing with its plan for modernization of the Kitimat smelter.

"Rio Tinto Alcan believes that the BCUC decision is correct and specifically, the 2007 Electricity Purchase Agreement between the company and BC Hydro does not impact the flows in the Nechako River, therefore Rio Tinto Alcan is confident [that the BCUC ruling will stand]," corporate affairs and community relations manager Colleen Nyce said in an e-mail.

Nyce, whose office is located at Kitimat, said Rio Tinto Alcan's managers "are completing the necessary final pre-engineering and feasibility work before taking the Kitimat modernization business plan to the company board of directors for final approval."

That approval is expected later this year.

April 09, 2008

NEW: Oil and Gas Activities Act

The BC Government has introduced the new Oil and Gas Activities Act (OGAA) in the Legislature. OGAA consolidates a number of related statues, including the Petroleum and Natural Gas Act, the Oil and Gas Commission Act, the Pipeline Act and the Forest Practices Code Act.

OGAA also introduces more results-based "regulation" of the oil and gas industry, in which companies are expected to be self-policing. We have long maintained that the purported benefits of this approach to regulation - reduced cost and onus on government - are hugely offset by the risks, indeed likelihood, that companies will cut corners, dodge responsibility, and prefer to pay penalties if they are ever caught. The greatest risk is damage to the environment that will be discovered long after the event, at which point penalties etc. are an empty resolution.

MEMPR News Release, 08-Aug-2008

B.C. makes it easier for companies to exploit natural gas reserves

Wendy Stueck, Globe and Mail, 09-Apr-2008

B.C. makes it easier for companies to exploit natural gas reserves

WENDY STUECK

Globe and Mail

April 9, 2008

VANCOUVER -- Bracing for a boom, British Columbia has overhauled its oil and gas rules to nurture a sector where major players are sitting on what are believed to be some of the biggest discoveries in Canadian history.

The new Oil and Gas Activities Act is aimed in part at making life easier for companies that want to exploit, in particular, natural gas deposits that, while large, are technically difficult. Excitement surrounding exploration results in the province generated a breakthrough $1-billion in land rights sales last year.

B.C. has a "strong interest" in developing the province's emerging gas plays, energy minister Richard Neufeld said in a statement.

Northeastern British Columbia is the heart of the province's natural gas boom and the Horn River Basin, north of Fort Nelson, appears to be home to some of the most promising discoveries.

Yesterday, Apache Corp. of Houston, which is working with EnCana Corp. of Calgary, announced three new wells drilled this winter all delivered big amounts of gas. EOG Resources Inc., also Houston based, has made large discoveries as well.

Apache and EnCana have locked up about 400,000 acres at the centre of the Ootla shale play in the Horn River region.

Horn River is a shale gas play, for decades considered a fringe resource at best. Last year, to help spur development, the B.C. government adopted an oil sands-like royalty framework for shale and other complicated exploration areas, charging only a nominal 2 per cent until companies recover their costs.

With conventional natural gas deposits on the wane in North America, companies are pouring millions into unconventional gas plays, encouraged by advances in technology such as horizontal drilling and subsurface fracturing of the complex and difficult shale rock in which the natural gas is trapped.

Bidding for new exploration land in B.C. remains at a record rate, with $277-million spent by energy companies this year, leaving the province on pace to break its record of $1-billion set last year.

The new act will replace three existing pieces of legislation, consolidating requirements for industry while protecting the environment, Mr. Neufeld said.

Oil and gas exploration development is a contentious issue in several parts of the province, including northwestern B.C., where Shell Canada Ltd. has run into stiff opposition over its plans to explore for coal-bed methane.

"It's important that we get the regulation of oil and gas right, because it is such a huge economic driver for the province," said Greg Cowe of West Coast Environmental Law, adding that the sector is expected to generate more than $2-billion in royalties and land sales for the province in its current fiscal year.

"At the same time, it accounts for about 20 per cent of greenhouse gas emissions in B.C., so there is a tension of trying to balance those two sides."

The B.C. government has introduced a carbon tax and cap-and-trade legislation as part of its plan to slash greenhouse gas emissions by 30 per cent by 2020.

As part of its revamped oil and gas regime, B.C. on Friday launched a landowner notification program to provide registered surface owners in northeast B.C. with information about rights sales.

APACHE (APA) Close: $130 (U.S.) up $1.40

ENCANA (ECA) Close: $78.62, up 57Ct

April 03, 2008

Amended Utilities Act reflects new government issues

Scott Simpson

Vancouver Sun

April 02, 2008

The British Columbia Utilities Commission is expanding its traditional role from minding the public's money into one where social and environmental issues will also weigh on decisions about the future of crown agencies such as BC Hydro, Energy Minister Richard Neufeld said Tuesday.

Changes to the Utilities Commission Act were introduced this week in the legislature, and were described by one expert observer as the biggest shift in the commission's mandate in a generation.

Neufeld said the amended act is intended to reflect new government priorities including energy efficiency, conservation and demand management.

Key objectives include reduction of greenhouse gas emissions, enhanced regulatory support for clean and renewable energy, and more long-term planning for electricity generating and transmission infrastructure.

Neufeld said in the past the commission has made decisions exclusively upon economic considerations, and the government wanted to change that mandate "a bit."

"We depend on that quasi-judicial body to make some pretty significant decisions for us," Neufeld said in a telephone interview.

"It's not that the commission was doing anything wrong. They were actually living up to what the legislation said.

"The commission has to be aware that we want to maintain competitive [electricity] rates, to stay amongst the lowest rates in North America, but [also] to actually start looking at the social part of the world and also the environmental part of it. That's getting to be much more on people's minds than it used to be."

Energy sector commentator David Austin said government's concern about greenhouse gas emissions is central to the amended act, which incorporates most objectives of the B.C. Liberals' phase one and two Energy Plans.

"The electricity business in this province is at a critical juncture because for years we have been coasting along on the traditional way of generating and supplying electricity without regard to greenhouse gasses," Austin said in an interview.

"People haven't really taken into account what a reduction in greenhouse gasses is going to mean to the electricity business in this province.

"The government is looking ahead. It is not looking at the way we were doing things in the past because the utilities commission act itself was never set up to deal with something of the magnitude of GHGs."

Simon Fraser University energy economist Mark Jaccard, a chair of the BCUC in the mid-1990s, applauded the changes.

"The utilities commission act has needed updating for some time and I see these as welcome amendments that improve the ability of our regulated electric and natural gas companies to contribute to the province's greenhouse gas reduction goals. Once again, B.C. is proving to be a leader in North America and even globally," Jaccard said in an email.

NDP Opposition Leader Carole James said the party will take some time to study the proposed legislation, but she already has doubts that a utility regulator is the best tool for deciding policy on emissions.

"Is BCUC the right vehicle to be monitoring greenhouse gas?" James asked in a telephone interview.

"There will be questions from people I know -- it doesn't seem to us that it's the right mechanism to be doing that examining, to be reporting out.

"That will be the real issue for us to take a look at it."

Bill 15 - Utilities Commission Amendment Act, 2008