September 29, 2008

'They are flexing their muscles'

Companies want to mine a remote region of B.C., but, unlike some previous bands, the Tahltan insist on controlling access to the area

MARK HUME

Globe and Mail

September 27, 2008

VANCOUVER -- Between the abandoned mining town of Cassiar and the struggling port of Stewart, in the northwest corner of British Columbia, Highway 37 runs through one of the most dramatic and resource-rich landscapes in Canada.

It is the kind of place where the cabins are festooned with moose antlers, where grizzly bears can be seen fishing for salmon and where caribou herds stand dumbstruck by the roadside because they seldom see traffic.

The Stewart-Cassiar region, home of the Tahltan First Nation, is as remote an area as you can find in B.C. and isn't a place you'd expect highlighted on political and corporate agendas.

But a significant shift taking place in the native political structure there has drawn attention all the way from Victoria to Europe, as the Tahltan strive to assert control over a region that contains such abundant mineral resources that it has been dubbed the Golden Triangle.

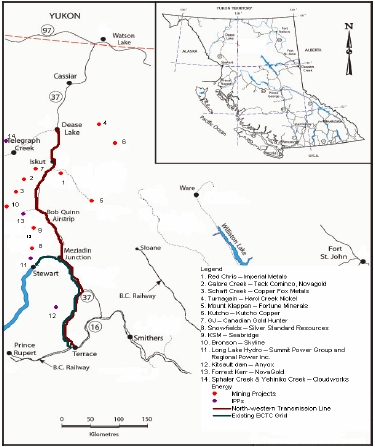

There are eight mining projects proposed along Hwy. 37, and a recent study projected that they could generate $3.5-billion in capital investments, create 2,000 jobs and result in more than $300-million in annual revenues.

That is the kind of resource activity that the B.C. government, now in a run-up to a spring election, is starved for. And with a dead mining town at one end of the highway (Cassiar closed in 1992 when asbestos mining halted), a bulk shipping port at the other that is struggling because of a logging downturn, and with two active mines facing scheduled closing, the Tahltan need new job opportunities.

Drive Hwy. 37 north from Stewart and it isn't long before you see heavy lift helicopters clattering overhead carrying mining supplies. But there are also protest signs, declaring "Get the Shell Out." And close to the native community of Iskut there is a spur road that runs off into a region named the Sacred Headwaters where, for the past three years, Shell and Fortune Minerals have run into roadblocks set up by Tahltan elders.

Shell wants to drill 1,000 wells to extract coal-bed methane gas, and Fortune wants to mine 123 million tonnes of high-grade metallurgical coal. But first they need the band's approval.

The Sacred Headwaters, named because three major salmon rivers - the Skeena, Nass and Stikine - were born there, has become the symbol of wider conflicts in B.C. between native bands and resource companies.

Annita McPhee, the newly elected head of the Tahltan Central Council, says that, before dealing with any proposed mines, the band must first find a way for everyone to express their views.

"We're developing a process for decision making, a new governance structure, and it's going to take some time," she said in an interview this week.

"There's a high concentration of development proposed in our area and our people need to have a say in what is developed, and what isn't. ... We want to find a balance between protecting the land and providing employment for our people."

Ms. McPhee, who has a law degree from the University of Victoria, was elected in July on a ticket that emphasized the need for the Tahltan to speak with a united voice. Her decision to enter politics was spurred largely by a burning debate over Shell's controversial proposal to drill for coal-bed methane gas in the Sacred Headwaters.

Will Horter, executive director of the Dogwood Initiative, a non-profit group that helps indigenous people gain control over their traditional lands, said the Tahltans are at the forefront of a growing movement in B.C., which is seeing bands demand more say about resource development.

"There's a handful of vanguard first nations that are working internally and with partners like us and others ... to promote a positive vision of how they want their region and their territories to be managed," Mr. Horter said. "They are flexing their muscles."

He said that, in the past, resource companies have been able to push their projects through over the objections of often poorly organized local bands. But the Tahltan have realized that if they speak with a unified voice, they can gain control over which projects proceed and which do not, Mr. Horter said.

Other bands in B.C. are watching with interest, he said, and a coming native mining summit, to be held in Prince George next month, is an indication that native leaders want direct control over what resource activities take place in their regions.

For Shell and Fortune Minerals, the go-slow approach of the Tahltan has caused some obvious difficulties.

But spokesmen for both corporations expressed patience in interviews this week, and said they remain optimistic they will eventually proceed, with full Tahltan support.

Larry Lalonde, a Shell representative, said the company had planned to do test drilling in the Sacred Headwaters region this year, but called it off to allow the Tahltan to reorganize their governance structure.

"We aimed to go back in [drilling] this fall, but we've put a pause on that," Mr. Lalonde said in a phone call from The Hague. "... We realized that in order to have effective conversations and dialogue with them, [we have to] give them the opportunity to work out the issues that they have on governance."

Mr. Lalonde said Shell remains "hopeful" it can get its project under way soon.

Robin Goad, president of Fortune Minerals, is also watching with interest. He said there have been conflicting opinions within the Tahltan community for years over resource development, which has made it hard for industry to know exactly where the goalposts stood.

But he rejected the suggestion his project has been stalled because of resistance from the Tahltan. The roadblock in 2005 did halt Fortune Minerals work on site, but Mr. Goad feels the protesters represent only a small group within the Tahltan First Nation.

"We are not running into resistance from the leadership of the Tahltan. We have had some resistance from a fringe group which have backing from what I would describe as radical environmental movements. But we have an excellent relationship with the leadership," he said.

Mr. Goad said the native community remains "fractured" over the issue of resource development, and he hopes Ms. McPhee can lead the community to consensus - and that the view will favour the project his company is proposing.

He said that while the Tahltan may not agree to all the proposals in the area, he's certain they'll go for some of them.

"There are some people within the Tahltan community who are very pro-development, there are some that are very aligned with the radical environmental groups that want no development whatsoever, and then the vast majority of the people fall somewhere in between," he said.

The big question is, how will that "majority" vote when the Tahltan Central Council asks the people where they stand on the new projects proposed for the area?

And that's a $3.5-billion question.

OPPOSITION MOUNTS

Shell's proposal to drill for coal-bed methane in the Mount Klappan area has run into increasing opposition.

While the Tahltan First Nation is still formulating its official position, elders have blockaded an access road for the past two years, keeping Shell drilling rigs out of the area. And while the group of elders, known as the Klabona Keepers, have stalled Shell's plans on the ground, opposition has grown outside the area.

This week, the Union of B.C. Municipalities passed a resolution calling on the B.C. government to shelve Shell's plans, saying the Sacred Headwaters area, at Mount Klappan, should not be put at risk.

The City of Prince Rupert sponsored the resolution, with support from the towns of Hazelton, Fernie and Princeton.

And Friday, the First Nations Summit, a provincial native leadership organization, passed a resolution calling for a 10-year moratorium on all coal-bed methane drilling in B.C.

The resolution states that coal-bed methane extraction "has caused significant harm to water, wildlife and rural economies" in other jurisdictions in North America.

It notes that coal-bed methane projects are currently proposed in the Sacred Headwaters area, in the Telkwa coalfield, and near the cities of Fernie, Princeton and Hudson's Hope.

"The areas of B.C. in which coal-bed methane development is proposed are areas of culturally, economically and ecologically significant fish and wildlife populations, including three of North America's most important wild salmon runs," the resolution states.

It says that in assessing coal-bed methane projects, B.C. "does not consider cumulative regional impacts, the interests of downstream communities or meet the Crown's obligation to consult and accommodate aboriginal title and rights."

It calls for a moratorium in order to allow British Columbia to develop more rigorous regulations.

After that is done, it says, the province should proceed only with coal-bed methane development "in areas where it does not infringe aboriginal title and rights."

ROCK AND COAL

A mountain of coal lies in the Sacred Headwaters area, but while it has been the focus of a lot of interest, it still hasn't been turned into a mine.

And if the Tahltan reject the proposal, the project may never go ahead.

A series of resource companies have been interested in the Mount Klappan coal deposit since 1981, when Gulf Canada Resources Ltd. began to do preliminary work on the site. Between 1981 and 1991, Gulf spent $70-million trying to bring the mine into operation, doing engineering, transportation, power, environmental and socioeconomic studies.

Gulf also did extensive drilling. Of 33 coal seams identified, 12 were identified as being good targets for mining.

In 1985-86, a 200,000-tonne bulk sample was mined and processed in a pilot plant at the site, with half of that amount shipped to customers in North America, Asia and Europe.

The Mount Klappan property became inactive in 1991, however, after the collapse of one of Gulf's major shareholders.

In 2001, Fortune Minerals Ltd., a London, Ont.-based resource company, purchased the property from Conoco Canada Resources Ltd., which had taken over Gulf.

Fortune has spent about $5-million on the project, including doing studies on various transportation options. Fortune sees three possible ways to get the coal out of the area: by truck down Highway 37 to Stewart; by a slurry line to Stewart; by rail to Prince Rupert.

The rail option would require laying about 70 kilometres of track along an old BC Rail right-of-way that runs through the mine site.

The Fortune proposal would see about two million tonnes of coal mined in an open-pit operation each year.

The Tahltan First Nation, however, has not yet given approval for the project.

Mark Hume, mhume@globeandmail.com

September 27, 2008

UBCM calls for LNG tanker ban and GHG ban

Local government delegates attending the Union of BC Municipalities annual convention in Penticton this past week endorsed two resolutions put on the docket by the Powell River Regional District:

B76 calls on the provincial government to require zero greenhouse gases from new natural gas-fired generation plants.

http://ubcm.fileprosite.com/contentengine/launch.asp?ID=3884

At present, a new gas-fired plant must emit "net zero" greenhouse gases - which means that a plant can emit the GHGs into the atmosphere as long as it purchases carbon offsets or green credits. The policy for coal doesn't allow this - it says that no GHGs are allowed to be released. B76 would apply the uncompromising rule for coal, to natural gas.

B143 calls on the federal government to ban liquefied natural gas (LNG) tankers in Georgia, Malaspina, and Haro Straits, and in Boundary Pass.

http://ubcm.fileprosite.com/contentengine/launch.asp?ID=3885

The LNG import terminal would entail 36 large tankers per year arriving at Texada Island. The safety and security issues with LNG tankers is serious stuff, not to be accepted with the blithe assurances offered by industry. US communities are strongly resistant to LNG import proposals, so coastal communities in Canada and Mexico are being targeted as neo-colonial doormats to satisfy US appetites for energy.

Powell River Regional District originated these resolutions in May 2008, in response to a proposal by WestPac LNG to build a LNG import terminal and a huge gas-fired generation plant on Texada Island. In the promoter's dreams, the generation plant could grow to 1200 megawatts - nearly five times the capacity of the Duke Point Plant which was cancelled by BC Hydro in 2005.

Both resolutions were supported by regional governments around Georgia Strait, including the Islands Trust, through the summer.

In the federal election, candidates will be asked: "Do you support a LNG tanker ban in Georgia Strait? Will your party work in Ottawa to implement a LNG tanker ban?”

You can help. If you are at an all-candidates meeting or other place where candidates are assembled, please ask them these two questions. And please let us know what they say.

The Alliance to Stop LNG is 15 environmental, labour, conservation and other public interest groups who came together in 2007. More info at www.texadalng.com.

Streams go to work for green power sector

Run-of-river hydroelectric facilities currently provide about 10% to 15% of BC Hydro's electricity

Scott Simpson

Vancouver Sun

Friday, September 26, 2008

Tom Cleugh, aquatic biologist and environmental monitor, walks the tunnel

that, when completed, will run 4.5-kms long and be a conduit for the water

flowing from farther upstream on the Ashlu River at the intake.

CREDIT: Bonny Makarewicz/Special to the Vancouver Sun

Kelly Boychuk is standing on a steep ridge overlooking Ashlu Creek, a fast-flowing stream that is one of the environmental movement's poster children for the presumed sellout of BC Hydro's legacy of cheap electrical resources.

At present, the Ashlu is as wild and untamed a creek as you could find anywhere in the world, but soon it will become a working stream in British Columbia's vast industrial forest.

Down at the base of the ridge where Boychuk stands is a broad gravel plain, the bed of the Ashlu, where a backhoe is packing huge broken chunks of granite in preparation to divert the creek's course as part of a new power project about a half hour's drive northwest of Squamish.

It is a scene that has already been played out on 32 small streams around B.C., where so-called run-of-river hydroelectric facilities built by private developers are currently contributing about 10 to 15 per cent of the electricity that flows each year through BC Hydro's provincial grid.

A further 46 independent projects are in development.

Billions of dollars, typically sourced from public sector pension funds and insurance companies looking for slow, steady rates of return, have already been invested - $135 million for the Ashlu project alone.

Over the last decade, the B.C. environment ministry has received 562 applications for water licences, including 97 new applications since January 2008.

An application is no guarantee of a project. Since 2001 the ministry has issued 70 licences for power generation, including 12 replacement licenses for existing BC Hydro facilities.

This summer, Hydro issued a call for new supplies of green power and 25 companies responded with proposals for 168 projects - mostly run-of-river enterprises like Ashlu.

The Independent Power Producers association of B.C notes that the offers represent about five times the amount of electricity Hydro is looking for.

"There is only one buyer, and that buyer only swings by every three years," IPPBC president Steve Davis noted.

Of course, not all of the projects will succeed.

"A hundred staked hydroelectric sites will quickly narrow down to five sites or less that can be developed to economically produce electricity for more than the cost to build them," said Boychuk, construction project manager for Vancouver-based Ledcor Power Inc.

The Ashlu is one of the successful ones.

By the time the project is complete, the Ashlu will be responsible for the generation of enough electricity at peak times to light 23,000 homes.

Come back to the ridge a year from now and you will see the stream broadening into a modest pond at this location, resting against a rubber-and-concrete barrier that will trap a portion of the Ashlu's flow and divert it into a man-made tunnel.

This barrier - you can't really call it a dam - would fit onto a football field, twice over.

The remainder of the Ashlu's flow will continue on its natural path, plunging steeply downhill through a perilous Class Five whitewater route known to extreme kayakers as Commitment Canyon - once you are in it, there's no way out except down.

The surface and tunnel portions of the stream rejoin about 4.5 kilometres downstream, where a small, 49-megawatt hydroelectric generating station is, like the diversion upstream, still under construction.

At both locations, excavators and gravel trucks clang and rumble, dust flies, and there are still-raw scars on the stream banks that were cleared to make room for the hydro facilities.

To Boychuk, the primary allure of a creek like the Ashlu is the rapid descent of its stream course - impassable for migrating salmon, but ideal for the production of electricity.

"Beauty is in the eye of the beholder," he avers.

"A nice, flat, meandering stream is a fish-bearing stream, and that's the last place you'd want to build a hydroelectric project."

Ledcor is working with Quebec-based Innergex on 18 potential small-hydro projects in B.C.

The partners are also building a much smaller run-of-river project on Fitzgerald Creek in Whistler, where the ski resort operator lauds the local enterprise as a sterling model of sustainable development.

Ledcor and Innergex haven't been so lucky at Ashlu, where the Squamish Regional District council expressed such strong opposition that it eventually forced the provincial government to revoke the authority of local governments to regulate independent power projects, or IPPs.

Whitewater kayakers were opposed as well, on the premise that water diverted into the hydro project's tunnel would rob them of the flow volume they deem necessary to travel down the stream.

However, an agreement was struck that obliges the plant operators to relinquish some of their water volume on weekends in spring and fall in order to accommodate the paddlers. There's no issue with stream flow during summer peak.

Ledcor and Innergex also struck a deal with Fisheries and Oceans Canada to compensate for their impact on the stream, by creating 5,000 square metres of new fish habitat in backwaters off the lower Ashlu.

The companies unilaterally bumped their habitat quota to 60,000 square metres.

They were told to carve out tiny brooks and ponds, and fill them with woody debris as refuge for baby salmon, effectively enhancing an old project undertaken by fisheries a decade earlier, and upgrading some existing intermittent backwaters.

"We placed the stumps and root wads from the various work areas in here for the fish. A few years ago I would have said it was just a mess, a bunch of junk, but now I understand that it's actually a good thing," Boychuk said.

Most of that work was completed in August 2007. A month later, the project's full-time biologist Tom Cleugh counted 40 adult coho salmon in there, and this spring, an estimated 14,000 coho fry had taken up residence.

"It's in our business model," said Richard Blanchet, western region vice-president of hydroelectric energy for Innergex.

"We do the extra mile so that the project will contribute to the community. These projects are there for 40, 60, 80 years, so you need to have good communication with the community."

Most public attention on the project, meanwhile, has been negative.

This spring the Western Canada Wilderness Committee produced a video highlighting the construction impacts on the stream-scape at Ashlu, and representing the emergence of independent power projects across the province as "the biggest heist of public resources in Canadian history and an enormous threat to the future of British Columbia's environment, economy and society."

Melissa Davis, executive director of Citizens for Public Power, said run-of-river power is "not quite as green as it appears on the surface."

"True, the power that is generated is greenhouse gas-neutral, but the developments themselves cause significant adverse environmental impacts . . . all of which have significant impacts on area wildlife, fish, and other aquatic species."

The government's decision five years ago to order BC Hydro to shift low-volume power projects to the private sector came "because the provincial government wants to create opportunity for business," Davis said.

"That kind of decision is more difficult to rationalize when you've got an incredibly profitable Crown corporation that provides fair rates to consumers and significant revenues to the public purse."

Proponents counter that a primary reason for Hydro's profits is its insulation from the financial risks associated with developing small projects.

"In many cases it's two years of fisheries work just to understand whether or not you an undertake a project," said David Andrews, an engineer with Cloudworks Energy.

"We will probably look at 20 possibilities for every application we put in. We've been around for a little while, and we have been involved in the development of two projects that have been constructed, and we are now working on a third that involves six facilities. But that's it.

"If you wanted to go out right now in the midst of the credit crisis and built a project, it's going to cost a lot more. If you are a taxpayer, that's the beauty of having these private-sector guys out there. That's not BC Hydro's risk, it's the private guys'."

One of the highest-profile operators has been Donald McInnes, a lapsed mineral exploration promoter who has used his considerable entrepreneurial skills to assemble one of the richest project rosters in the sector.

His company, Plutonic Power, has already spent $200 million, and arranged financing for a further $460 million, for a cluster of run-of-river projects at Toba Inlet on the B.C. coast north of Powell River.

The company's financial model is straightforward - go to the stock market to raise venture capital for the initial, multi-million-dollar exploratory stages of a project and if your engineers, hydrologists and biologists determine it's viable, talk to pension funds and insurance companies about financing the actual construction.

"I'm typically investing our company's money [through equity offerings] when the risk is highest and we have no certainty of outcome," McInnes said.

"Once the projects are construction-ready and all of that development risk is gone, then other companies typically come in to make an investment - but they're looking for less of a return."

In all cases, the company first looks for streams that have a waterfall - a natural barrier to migratory salmon.

But even then, there are risks.

"We were working on one stream near Gibsons called Rainy River. The natural barrier for fish wasn't a waterfall, but it was a fish ladder that the pulp mill told us had never worked.

"In our first two years of studying this stream there were no fish. In the third year there were two fish above the ladder and in the fourth year there were six.

"So all of a sudden the economics of the project changed. We were going to have to move our powerhouse upstream, which meant a loss of revenue.

"I still think Rainy River is a good project, but it's not of interest to us any more."

ssimpson@vancouversun.com

© Vancouver Sun 2008

Northwest power line worth $15 billion: study

Northwest power line worth $15 billion: study

Province announces $10 million to restart environmental assessmentScott Simpson

Vancouver Sun

Friday, September 26, 2008

Establishing a high-voltage transmission line in northwest British Columbia could attract at least $15 billion in new investment in mining and power generation for the remote region, according to a new study.

The study, commissioned by the Mining Association of B.C., says a power line along the Highway 37 route in B.C.'s distant northwest has the potential to create more than 10,000 new jobs, allow new green power projects to link to the provincial transmission grid, and annually generate $300 million in new tax revenue.

The report was released just as Premier Gordon Campbell announced to the Union of B.C. Municipalities in Penticton Friday that the provincial government will invest $10 million to restart the environmental assessment process for the line.

Mining Association of B.C. President Pierre Gratton applauded the government's move, noting that the assessment is an essential first step in any development of the line.

The $400-million power line near Telegraph Creek has been stalled since Teck Cominco and NovaGold announced in November 2007 that the cornerstone development for the project, a proposed gold mine at Galore Creek, needed a substantial financial review.

When Galore Creek stalled, a promised $158-million contribution to the power line was also put on hold, and so far the provincial government has spurned calls from the mining association to assume full development costs and recover the money later.

"The electrification of Highway 37 is an important part of the ongoing economic diversification of rural British Columbia," Campbell said in a news release. "It builds on the success we're already seeing in the northwest, including the new container port in Prince Rupert, the resurgence of the mining industry and the potential new Alcan smelter. We're making the investments needed now to continue that growth and help communities seize opportunities to diversify and create jobs."

The new 287-kilovolt line will extend 335 kilometres from Terrace to Meziadin Junction and north to Bob Quinn Lake, providing access to the electricity grid for customers while supporting the economic diversification of the area, according to the news release.

Currently, the electrical power grid along Highway 37 ends at Meziadin Junction to the north and Stewart to the west.

"We have the potential to create more than 10,000 jobs in a region where unemployment is high," Janine North, CEO of the Northern Development Initiative Trust, said in the news release. "Electricity can spur economic development through mining, tourism, clean power, transportation and supply industries in the northwest."

ssimpson@vancouversun.com

© Vancouver Sun 2008

Northwest power line could create thousands of jobs, attract billions in investment – Study

FOR IMMEDIATE RELEASEMining Association of B.C.

SEPTEMBER 26, 2008

Northwest power line could create thousands of jobs, attract billions in investment – Study

- Power line along Highway 37 could create 10,700 jobs

- Potential for $15 billion in capital investment

- Improves access to clean electricity sources

- Potential benefits include more than $300 million in annual tax revenues to governments

Vancouver – According to a new report by the Mining Association of British Columbia (MABC), building a power line along Highway 37 in northwest B.C. has the potential to create thousands of jobs, generate new sources of clean power and provide additional revenues to government to help pay for important programs and services.

“A new power line has the potential to spur economic development in mining, tourism and clean power projects,” said Pierre Gratton, president and CEO of the Mining Association of B.C. “The findings of the report provide a strong case for First Nations, the provincial government, industry and communities to work together to make the power line a reality.”

The study, MABC Report on the Electrification of the Highway 37 Corridor, cited ten potential mining projects in the study, and found that the power line has the potential to attract more than $15 billion in investment, create 10,700 jobs and generate $300 million in annual tax revenues to governments.

Demand for power in the northwest is driven largely by the mining sector, independent power projects and regional municipality growth, with additional opportunities to revitalize the tourism sector.

“We have the potential to create more than 10,000 jobs in a region where unemployment is high,” said Janine North, CEO of the Northern Development Initiative Trust. “Electricity can spur economic development through mining, tourism, clean power, transportation and supply industries in the northwest.”

“In principle, we support the new power line, as it provides opportunities for joint ventures with First Nations,” said Bill Adsit, President of the Tahltan Nation Development Corporation. “However, first there must be a process that considers all potential social, cultural and environmental impacts.”

“As one of the founding members of the Highway 37 Coalition, the Gitxsan Hereditary Chiefs are longstanding supporters of the proposed power line,” stated Chief Negotiator Elmer Derrick. “This study confirms that work should continue towards this important project.”

News Release, MABC, 26-Sep-2008

B.C. to move forward with northwest transmission line

News ReleaseOffice of the Premier

26-Sep-2008

PENTICTON – Premier Gordon Campbell has announced the Province will immediately start the environmental assessment process and First Nations consultation on the Northwest Transmission Line along Highway 37. This is the first step towards building a powerline that has the potential to generate billions of dollars in capital investment, create thousands of new jobs and open economic opportunities on a global scale in the Northwest.

“The communities in the North have a vision to further open their region to economic opportunities on a global scale, and today I want them to know that we share their vision and we are going to pursue the Northwest Transmission Line,” said Premier Campbell, who made the announcement during his annual Union of B.C. Municipalities address. “According to the Mining Association of BC, this project has the potential to attract $15 billion in new capital investments and create almost 11,000 jobs, as well as reduce greenhouse gas emissions by decreasing the reliance on dirty diesel-electric power for industry and communities in that region.”

The Province will invest the estimated $10 million to immediately restart the environmental assessment process, the first step towards building the Northwest Transmission Line (NTL). The new 287-kilovolt line will extend 335 km from Terrace to Meziadin Junction and north to Bob Quinn Lake, providing access to the electricity grid for customers while supporting the economic diversification of the area. Currently, the electrical power grid along Highway 37 ends at Meziadin Junction to the north and Stewart to the west.

“The electrification of Highway 37 is an important part of the ongoing economic diversification of rural British Columbia,” said Premier Campbell. “It builds on the success we’re already seeing in the Northwest, including the new container port in Prince Rupert, the resurgence of the mining industry and the potential new Alcan smelter. We’re making the investments needed now to continue that growth and help communities seize opportunities to diversify and create jobs.”

The environmental assessment is the first stage of the project and must be complete before construction begins. The Province is still seeking a partnership with the private sector to fund the total project, which is estimated to cost approximately $400 million.

Gross mining revenue in B.C. has nearly doubled over the last seven years, from $3.6 billion to nearly $7 billion, and 10 new mines have opened in that time. Investment in mineral exploration soared to a record high of nearly $416 million in 2007, up 1,300 per cent since 2001.

-30-

Media contact:

Bridgitte Anderson

Press Secretary

Office of the Premier

604 307-7177

News Release, Office of the Premier, 26-Sep-2008

September 26, 2008

LNG Partners books pipeline capacity with PNG

On September 25, 2008, Pacific Northern Gas (PNG) submitted an application to the BC Utilities Commission (BCUC) to enter into an agreement (a "term sheet") with LNG Partners, whereby PNG would deliver 75 million cubic feet of natural gas from Summit Lake to Kitimat. LNG Partners would source the gas, and would be the shipper on the pipeline.

The BCUC proceeding and documents are at:

http://www.bcuc.com/ApplicationView.aspx?ApplicationId=211

A description of the companies and the business arrangement is contained in PNG's letter of application to the BCUC:

On August 21, 2008 PNG was approached by a representative of Maverick LNG Holdings

Ltd. ("Maverick") to secure an option to contract PNG's uncontracted firm pipeline capacity (approximately 75 MMcflday) to transport gas sourced from Northeast B.C. to Kitimat. The gas would then be cooled to LNG on a offshore floating liquefied natural gas production ("FLNG") vessel moored in the Douglas Channel and stored on board for eventual offloading to an LNG carrier for export to Asian LNG markets. Maverick advised of their plan to commence their FLNG operations in the fourth quarter of 2010 or first quarter of 2011.

Maverick requested PNG to prepare toll proposals assuming a 3 to 5 year term and potential contract demands of 75 MMcUday, 120 MMcUday and 180 MMcfIday. PNG advised Maverick that the latter two expansion scenarios would require hydraulics studies to determine the new pipeline facilities required to meet the higher contract demands. It was subsequently acknowledged that the capital additions for the expansion scenarios would be significant in terms of both cost and scope having regard to the anticipated contract term of only 3 to 5 years. Therefore, PNG and Maverick decided to focus on negotiating the terms under which PNG could provide 75 MMcUday of firm gas transportation service to Maverick. In slightly less than a month, the parties were able to reach agreement on the Term Sheet. At Maverick's request, the Term Sheet was entered into with LNG Partners, one of the partial owners of Maverick. Background information on LNG Partners and Maverick is provided in the next few paragraphs.

LNG Partners, LLC, a Delaware limited liability company, was formed in late 2000 by Thomas P. Tatham and Frank C. Wade for the purpose of applying developing LNG technology to the monetization or commercialization of "stranded" or undervalued natural gas resources. The two principal owners have been involved in many grass roots oil and gas projects historically and were responsible for developing a good part of the deepwater pipeline infrastructure in the Gulf of Mexico through Leviathan Gas Pipeline Partners, LP and Offshore Pipelines, Inc. respectively.

LNG Partners initial focus was on opportunities in Eastern Canada and Newfoundland and Labrador in particular. It was responsible for developing a multi-purpose LNG terminal and gas to wire strategy for Newfoundland and Labrador Hydro in the 2000-2003 time frame. While the initial proposed facility at Holyrood, Newfoundland was not built, an alternate site at Grassy Point, Placentia Bay, Newfoundland was obtained in 2005 by Newfoundland LNG Ltd., a partially owned LNG Partners subsidiary which has recently received (August 2008) all provincial and federal environmental approvals to construct a multi-purpose LNG terminal with up to 3 berths, 8 LNG storage tanks, a tug basin and up to 200 MW of local power generation.

In late 2005, LNG Partners initiated a second LNG project to develop small scale LNG production on board existing LNG caniers. Based on the results of conceptual engineering studies conducted with Hamworthy Gas Systems AS (Asker, Noway) and SNC-Lavalin (Canada) in early 2006, Maverick was formed in July 2006 and Maverick contracted to purchase its first LNG vessel, the Hoegh Galleon, which was delivered in October 2007 and renamed the Margaret Hill. Current plans are to modify the Margaret Hill to include the latest Hamworthy gas liquefaction technology for FLNG use. Maverick's current plans are to complete the conversion of the vessel and obtain all requisite classification society permits for FLNG use by the fourth quarter of 2010. If this timetable is met, it is likely that the Margaret Hill will become the world's first FLNG vessel to be placed in service with the intention that it be deployed to the Kitimat area. Evaluation of alternative mooring locations, related costs and permitting issues are currently in progress for the Kitimat operation. Maverick is in the process of acquiring 3 additional LNG carriers for prospective conversion to FLNG service and is also in the process of evaluating a number of prospective sites for initial production activities.

September 09, 2008

Company to test tidal power potential

COMMENT: The provincial government continues to accept applications for ocean and river power sites without anything other than a "first-come, first-served" policy guiding it in the appropriateness of sites or proponents.

Orca Power has applications for five tidal energy sites. For maps and a very few more details, click here.

By Grant Warkentin

Campbell River Mirror

September 02, 2008

For years the Orca Tidal Power Corporation has been eyeing the power generation potential of Campbell River’s tides.

Now, the company believes the time is right to do some field research.

Orca Tidal Power Corp. has applied to the Ministry of Agriculture and Lands for three investigative use permits to look at the feasibility of tidal power generation around Campbell River. The company has applied for permission to use Crown land sites in three areas: in the water immediately northwest of Surge Narrows Provincial Park; in Discovery Passage immediately south of of McMullen Point; and in the Seymour Narrows south of Browns Bay.

Five years ago the company expressed interest in setting up a tidal power research station – a small barge with instruments measuring tidal flows in the water – in the Dent Rapids, northeast of Sonora Island. At the time, Tony Duggleby, one of the company’s directors, said the company believed the area had huge tidal generation potential.

“We think it’s large, our assumption is that it’s quite, quite large,” he said. “I don’t think it would be economic to go in there for less than 200-300 megawatts, and I think it’s there.”

In comparison, the Island Cogen plant at the Elk Falls mill generates about 240 megawatts using natural gas.

In recent years, several companies have expressed interest in the tidal power potential of the Campbell River area. A 006 report prepared for Natural Resources Canada identifies potential sites around Canada that could be used to generate energy from the tides and the study ranks the Seymour Narrows as the ninth best site in Canada, with the potential to generate 786 megawatts, enough to power hundreds of thousands of homes.

However, the tides are too strong – Glen Darou, director with Clean Current Power Systems, told the Mirror in March 2007 that current and emerging underwater tidal technology would be ripped to pieces or seriously damaged in the strong 6.56 meter-per-second average currents through the narrows.

However, the Discovery Passage is the 14th-best site in Canada according to the study, with the potential to generate 327 megawatts. The currents in the Discovery Passage site have an average velocity of 3.06 metres per second – perfect for the technology with which Darou’s company is experimenting, and which Orca Power is considering.

Clean Current Power Systems has a $7 million pilot project operating at Race Rocks in Victoria and is keeping an eye on the Campbell River area. Closer to home, local businessman Thor Peterson and Chris Knight, chair of the 60-member Ocean Renewable Energy Group, plan to build generators under a bridge or walkway through at Canoe Pass between Quadra and Maud Islands.

Orca Power representatives could not be reached for comment prior to the Mirror’s deadline.

Orca Power recently purchased Orca Tidal Power Corporation. Orca Power was purchased in June by Creation Casinos, which has experience running casinos in Lithuania. Creation Casinos changed its name to Orca Power “to better reflect the new business direction,” according to a company news release.

Duggleby was appointed as the company’s vice-president of new business development.

To view Orca Power’s applications, or make comments, visit www.arfd.bc.ca and use the advanced search to look for file numbers 1413161, 1413162 and 1413163. The deadline for comments is Sept. 18.