March 30, 2008

Those who control oil and water will control the world

New superpowers are competing for diminishing resources as Britain becomes a bit-player. The outcome could be deadly

John Gray

The Observer

Sunday March 30 2008

History may not repeat itself, but, as Mark Twain observed, it can sometimes rhyme. The crises and conflicts of the past recur, recognisably similar even when altered by new conditions. At present, a race for the world's resources is underway that resembles the Great Game that was played in the decades leading up to the First World War. Now, as then, the most coveted prize is oil and the risk is that as the contest heats up it will not always be peaceful. But this is no simple rerun of the late 19th and early 20th centuries. Today, there are powerful new players and it is not only oil that is at stake.

It was Rudyard Kipling who brought the idea of the Great Game into the public mind in Kim, his cloak-and-dagger novel of espionage and imperial geopolitics in the time of the Raj. Then, the main players were Britain and Russia and the object of the game was control of central Asia's oil. Now, Britain hardly matters and India and China, which were subjugated countries during the last round of the game, have emerged as key players. The struggle is no longer focused mainly on central Asian oil. It stretches from the Persian Gulf to Africa, Latin America, even the polar caps, and it is also a struggle for water and depleting supplies of vital minerals. Above all, global warming is increasing the scarcity of natural resources. The Great Game that is afoot today is more intractable and more dangerous than the last.

The biggest new player in the game is China and it is there that the emerging pattern is clearest. China's rulers have staked everything on economic growth. Without improving living standards, there would be large-scale unrest, which could pose a threat to their power. Moreover, China is in the middle of the largest and fastest move from the countryside to the city in history, a process that cannot be stopped.

There is no alternative to continuing growth, but it comes with deadly side-effects. Overused in industry and agriculture, and under threat from the retreat of the Himalayan glaciers, water is becoming a non-renewable resource. Two-thirds of China's cities face shortages, while deserts are eating up arable land. Breakneck industrialisation is worsening this environmental breakdown, as many more power plants are being built and run on high-polluting coal that accelerates global warming. There is a vicious circle at work here and not only in China. Because ongoing growth requires massive inputs of energy and minerals, Chinese companies are scouring the world for supplies. The result is unstoppable rising demand for resources that are unalterably finite.

Although oil reserves may not have peaked in any literal sense, the days when conventional oil was cheap have gone forever. Countries are reacting by trying to secure the remaining reserves, not least those that are being opened up by climate change. Canada is building bases to counter Russian claims on the melting Arctic icecap, parts of which are also claimed by Norway, Denmark and the US. Britain is staking out claims on areas around the South Pole.

The scramble for energy is shaping many of the conflicts we can expect in the present century. The danger is not just another oil shock that impacts on industrial production, but a threat of famine. Without a drip feed of petroleum to highly mechanised farms, many of the food shelves in the supermarkets would be empty. Far from the world weaning itself off oil, it is more addicted to the stuff than ever. It is hardly surprising that powerful states are gearing up to seize their share.

This new round of the Great Game did not start yesterday. It began with the last big conflict of the 20th century, which was an oil war and nothing else. No one pretended the first Gulf War was fought to combat terrorism or spread democracy. As George Bush Snr and John Major admitted at the time, it was aimed at securing global oil supplies, pure and simple. Despite the denials of a less honest generation of politicians, there can be no doubt that controlling the country's oil was one of the objectives of the later invasion of Iraq.

Oil remains at the heart of the game and, if anything, it is even more important than before. With their complex logistics and heavy reliance on air power, high-tech armies are extremely energy-intensive. According to a Pentagon report, the amount of petroleum needed for each soldier each day increased four times between the Second World War and the Gulf War and quadrupled again when the US invaded Iraq. Recent estimates suggest the amount used per soldier has jumped again in the five years since the invasion.

Whereas Western countries dominated the last round of the Great Game, this time they rely on increasingly self-assertive producer countries. Mr Putin's well-honed contempt for world opinion might grate on European ears, but Europe is heavily dependent on his energy. Hugo Chávez might be an object of hate for George W Bush, but Venezuela still supplies around 10 per cent of America's imported oil. President Ahmadinejad is seen by some as the devil incarnate, but with oil at more than a $100 a barrel, any Western attempt to topple him would be horrendously risky.

While Western power declines, the rising powers are at odds with each other. China and India are rivals for oil and natural gas in central Asia. Taiwan, Vietnam, Malaysia and Indonesia have clashed over underwater oil reserves in the South China Sea. Saudi Arabia and Iran are rivals in the Gulf, while Iran and Turkey are eyeing Iraq. Greater international co-operation seems the obvious solution, but the reality is that as the resources crunch bites more deeply, the world is becoming steadily more fragmented and divided.

We are a long way from the fantasy world of only a decade ago, when fashionable gurus were talking sagely of the knowledge economy. Then, we were told material resources did not matter any more - it was ideas that drove economic development. The business cycle had been left behind and an era of endless growth had arrived. Actually, the knowledge economy was an illusion created by cheap oil and cheap money and everlasting booms always end in tears. This is not the end of the world or of global capitalism, just history as usual.

What is different this time is climate change. Rising sea levels reduce food and fresh-water supplies, which may trigger large-scale movements of refugees from Africa and Asia into Europe. Global warming threatens energy supplies. As the fossil fuels of the past become more expensive, others, such as tar sands, are becoming more economically viable, but these alternative fuels are also dirtier than conventional oil.

In this round of the Great Game, energy shortage and global warming are reinforcing each another. The result can only be a growing risk of conflict. There were around 1.65 billion people in the world when the last round was played out. At the start of the 21st century, there are four times as many, struggling to secure their future in a world being changed out of recognition by climate change. It would be wise to plan for some more of history's rhymes.

· John Gray is author of Black Mass: Apocalyptic Religion and the Death of Utopia, published by Allen Lane in paperback on 24 April

March 28, 2008

Partners to study nuclear role in oilsands

Alberta Research Council and U.S. energy department sign agreement

Gordon Jaremko

Edmonton Journal

Friday, March 28, 2008

CREDIT: Chris Schwarz/Edmonton Journal

The Alberta Research Council has signed an agreement

with the U.S. government to study the use of atomic

energy in the oilsands.

EDMONTON - Use of atomic power for oilsands development will be investigated by a research partnership, announced today, between the Alberta and United States governments.

The Alberta Research Council and the U.S. energy department's main nuclear laboratory in Idaho signed an agreement calling for work on potential bitumen belt applications of electricity, heat and chemical byproducts from reactors proposed north of Edmonton.

"This is a marriage made in heaven," said Idaho laboratory associate director Bill Rogers. Although no budget for the collaboration was announced, he said potentially all his operation's 3,800 scientists can be drafted into the Alberta project.

"The U.S. is dependent on Alberta for energy security," Rogers said, pointing to the province's "essential" role as the biggest source of increasing American oil and natural gas imports.

In the U.S. view, Alberta stands out for reliability and stability as a supplier, he emphasized. Elsewhere "we face nationalization of resources in countries that are hostile to the U.S.," Rogers said.

ARC vice-president Ian Potter said the partnership plans to work out a research agenda by late summer or early fall.

Potential topics range from making nuclear reactors provide heat for steam used in thermal oilsands production to production of hydrogen and oxygen used in high volumes by bitumen upgraders, Potter said.

"Meeting our province's electricity demands both now and in the future begins with reliable and clear information on all of the available energy options," said Mel Knight, Alberta's minister of energy.

"We welcome collaborations such as the one announced between the Alberta Research Council and Idaho National Laboratories to provide the solid analysis and research on the options available to address Alberta's unique needs."

gjaremko@thejournal.canwest.com

© Edmonton Journal 2008

Things like this don't come out of the blue, and just because BC has a no-nuclear energy policy, doesn't mean it isn't at the table. In fact, here it is at Idaho National Laboratories last fall. (www.inl.gov)

http://www.inl.gov/featurestories/2006-12-14.shtml

http://www.inl.gov/featurestories/2008-02-07.shtml

INL proudly describes its facilities thus:

"In operation since 1949, the Idaho National Laboratory is a government reservation located in the southeastern Idaho desert. At 890 square miles (569,135 acres), the INL Site is roughly 85 percent the size of Rhode Island. It was established in 1949 as the National Reactor Testing Station, and for many years was the site of the largest concentration of nuclear reactors in the world. Fifty-two nuclear reactors were built, including the U.S. Navy's first prototype nuclear propulsion plant. During the 1970s, the laboratory's mission broadened into other areas, such as biotechnology, energy and materials research, and conservation and renewable energy.

"INL consists of several primary facilities situated on an expanse of otherwise undeveloped terrain. Buildings and structures at INL are clustered within these facilities, which are typically less than a few square miles in size and separated from each other by miles of undeveloped land. In addition, DOE owns or leases laboratories and administrative offices in the city of Idaho Falls, some 25 miles east of the INL Site border. About 30 percent of INL's employees work in administrative, scientific support and non nuclear laboratory programs and have offices in Idaho Falls. These include engineers; scientists; and administrative, financial, technical and laboratory employees. "

http://www.inl.gov/visitorinformation/index.shtml

One of its largest projects is a $2.9 billion cleanup of earlier work:

"The Idaho Cleanup Project (ICP) involves the safe, environmental cleanup of the Idaho National Laboratory site, which has been contaminated with waste generated from World War II-era conventional weapons testing, government-owned research and defense reactors, laboratory research, and defense missions at other U.S. Department of Energy (DOE) sites. The 7-year, $2.9 billion cleanup project, funded through the DOE's Office of Environmental Management, focuses equally on reducing risks to workers, the public, and the environment and on protecting the Snake River Plain Aquifer, the sole drinking water source for more than 300,000 residents of eastern Idaho."

https://idahocleanupproject.com/

March 23, 2008

Lessons from Germany's energy renaissance

ERIC REGULY

Globe and Mail

March 21, 2008

BERLIN — Solar power will cost next to nothing. The fuel – the sun – is free. The price of the photovoltaic cells used to covert sunlight into electricity will plummet.

Just give it time.

That's the theory of Ian MacLellan, the founder, vice-chairman and chief technology officer of Arise Technologies, a Canadian photovoltaic (PV) cell company. But there's one small hitch: Arise doesn't have time.

PV cells are still expensive. The solar energy market needs priming. Arise shareholders want profits. Mr. MacLellan is 51 and would like to see his company make a buck before he's a senior citizen.

Arise CEO Ian McLellan.

Canadian Solar

First Solar

Enter Germany. The ever-so-generous Germans tracked him down and made him an offer he couldn't refuse – free money, and lots of it – as long as Arise promised to build a PV factory on German soil. The German love-fest even came with flowers for Mr. MacLellan's wife, Cathy.

Today, Arise's first factory is about a month away from completion in Bischofswerda, a pretty eastern German town about 35 kilometres east of Dresden, in the state of Saxony. Covering two storeys and 100,000 square feet, the sleek grey metal building will have some 150 employees and produce enough PV cells each year to power the equivalent of 60,000 houses. The value of the annual output, based on today's prices, will be $375-million, or more than three times the company's current value on the Toronto Stock Exchange.

“I couldn't build this in Canada,” Mr. MacLellan said. “Germany is a very high-quality environment for us. I have nothing to worry about.”

Arise couldn't build the plant in Canada because the level of financial incentives, engineering and construction expertise and general awareness of the growth potential of renewable energy simply don't exist there.

Those factors are abundant in Germany and it shows: The country has become the world leader in renewable energy technology, manufacturing, sales and employment. The German map is dotted with hundreds of renewable energy companies. They make PV cells, wind turbines, solar thermal panels, biofuels and technology for biomass plants and geothermal energy.

No PV cells are made in Canada. The Canadian solar industry, lured by money and markets, is jumping across the Atlantic and landing in Germany and a few other European countries with generous incentives.

The German and Saxony governments, with a little help from the European Union, offered Arise about €50-million ($80-million) in financing. The package included a €25-million grant, which is being used to offset half the cost of building the factory and installing the three assembly lines, and €22.5-million of working credit lines and equipment loans at highly attractive rates.

The land was cheap and included a handsome, though abandoned, brick building from 1818 that began life as an army barracks, became a dance hall after the First World War and a Soviet military barracks during the Cold War.

Arise plans to restore the old pile and use it as an office and corporate retreat. “We're turning an old military base into a solar factory – how 21st Century is that?” Mr. MacLellan asked.

Germany has created 240,000 jobs in the renewable energy industry, 140,000 of them since 2001, said Matthias Machnig, State Secretary for the federal Ministry of the Environment. Renewable energy technologies already make up 4 to 5 per cent of Germany's gross domestic product; Mr. Machnig expects the figure to rise to 16 per cent by 2025.

Renewables generated 14 per cent of the country's electricity last year, significantly ahead of the 12.5-per-cent target set for 2010. “We are making a huge investment in the markets of the future,” Mr. Machnig said.

How did Germany turn green technology into a leading industry? And is the aggressive effort to attract renewable energy companies, backed by scads of taxpayers' money, a formula that should be imitated in Canada or its provinces? Mr. MacLellan thinks so. “I think Ontario is in a leading position to clone Germany,” he said.

GERMANY'S VAST renewable energy industry is a careful and deliberate blend of industrial, political and green policies. Wind power has been leading the charge. Germany is a windy country and the ubiquitous wind farms generated 7.4 per cent of Germany's electricity last year.

With onshore wind energy growth starting to level off – offshore wind probably will take off once favourable regulations are in place – the Germans are injecting the photovoltaic industry with growth hormones. “In a few years, the PV industry could be bigger than the German car industry,” said Thomas Grigoleit, senior manager for renewable energy for Invest In Germany, a government investment agency.

It should come as little surprise that Germany has become green energy's focal point. The country is a natural resources desert. It lacks oil and natural gas and its coal production, which is heavily subsidized, is falling. The country has a moratorium on nuclear energy development. Renewable energy is more than just a feel-good exercise; Germany sees it as securing its energy future in a world of disappearing fossil fuels.

There's more to it than energy security. Germany is both latching onto, and propelling, an industrial trend. It wants to do to renewables what it did to the car industry; that is, create a jobs and export juggernaut. “We are at the beginning of the third industrial revolution,” said Mr. Machnig, referring to the growth potential for renewable energy.

Germany is using its political might to ensure it benefits mightily from the green revolution. The country is Europe's biggest economy and the continent's (and the world's) biggest exporter. As the economic heavyweight, it has a lot of political influence over its neighbours, said Paul Dubois, Canada's ambassador to Germany. “This is the key country,” he said.

Nineteen of the European Union's 27 countries count Germany as their main trading partner, he noted. The figure for France is only three (Germany, Spain and Malta) and only one (Ireland) for the United Kingdom.

The upshot: If Germany builds green technology such as wind turbines and solar panels, its friendly neighbours will be sure to buy them, or so the German government believes. That translates into the things politicians and economists like – jobs, export earnings, trade surpluses, international prestige.

There's more. As Europe's most influential country, Germany can pretty much guarantee that renewable energies will be the growth machine of the future. How? By insisting on aggressive, EU-wide carbon reduction targets, care of Angela Merkel, the German Chancellor who is no doubt the greenest European leader.

In February, the EU vowed to reduce greenhouse gas emissions by 20 per cent by 2020 and said it would try to raise the target to 30 per cent. “If you take climate change seriously, we have to reduce carbon dioxide emissions by 60 to 80 per cent by 2050,” Mr. Machnig said. “This is the biggest industrial change ever. This means reducing emissions [in Germany] from 10 tonnes per capita to two to four tonnes per capita.”

Germany doesn't think the reductions are possible without a broad effort that includes renewable energy, the EU emissions trading system and, of course, a fortune in subsidies to kick-start the green technologies and guarantee them a market for many years. The main subsidy for renewable energy generation is the “feed-in tariff,” which was established in 2000 under the Renewable Energy Sources Act.

As far as subsidies go, this one is a beauty. The feed-in tariff for solar electricity is about 50 euro cents per kilowatt-hour, or almost 10 times higher than the market price for conventionally produced electricity (the subsidy for wind energy is considerably less, though still well above the market rate).

German utilities must by law buy the renewable electricity. The cost, in turn, is passed on to the consumer and is buried in his electricity bill. “The feed-in tariff has put Germany on the world [renewable energy] map,” said Mikael Nielsen, the central European vice-president of sales for Vestas, the Danish wind turbine company that makes turbine blades in Germany. “If it weren't for the tariff, you wouldn't have a market like this.”

The subsidy for all forms of green energy, largely wind, with solar just starting to come on strong, costs the government about €3.5-billion a year. The figure is expected to rise to €6-billion by 2015, and then will slowly decline. No wonder the renewable energy industry is on fire in Germany.

But Germany's lunge into renewable energy is not without its critics. The solar industry in particular is sucking up tens of billions of euros of grants and the question is whether taxpayers are getting value for money. “The construction of a solar power plant is currently an almost riskless investment,” the German newspaper Berliner Zeitung said in November.

RWI Essen, a German economic research institute, published a paper earlier this month [March] called “Germany's Solar Cell Promotion: Dark Clouds on the Horizon,” which concluded the feed-in tariff has not accomplished two of the government's most cherished goals – job creation and carbon reduction.

The subsidies for German solar energy probably rank as the highest in the world, thanks to the feed-in tariff and other subsidies. RWI estimated the total subsidies per job created in the PV industry (based on the subsidies and direct PV employment in 2006) at an astounding €205,000.

The tariff has created more demand than the German PV market can satisfy. In fact, most of the PV cells have been imported, creating jobs abroad, not in Germany (though this may change as Germany attracts manufacturers like Arise). RWI argues that billions of euros in subsidies have crowded out investment in other, perhaps more promising, technologies and has probably made the PV industry less efficient that it might otherwise be.

RWI said “the subsidized market penetration of non-competitive technologies in their early stages of development diminishes the incentives to invest in the research and development necessary to achieve competitiveness.”

Finally, RWI says the feed-in tariff “does not imply any additional emission reductions beyond those already achieved” by the EU emissions trading system. Its argument is that reductions under the cap-and-trade system would be made whether or not the feed-in tariff existed.

The indictment is dismissed by the German Environment Ministry and by the PV industry. Mr. MacLellan notes that every form of energy is subsidized to some degree and that the PV subsidies will help Arise's German factory become profitable quickly, allowing the business to pay income taxes within two years. “This is not charity,” he said.

For his part, Mr. Machnig said the subsidies will help establish an export market – three-quarters of the wind turbines made in Germany are exported, for example – as the number of technology manufacturers expands. Furthermore, he said, renewable energy can only make Germany more competitive as the price of fossil fuels rises. By 2020, renewables will provide 27 per cent of Germany's electricity production.

ARISE TECHNOLOGIES was launched in 1996 by Ian MacLellan, an amiable motormouth and Ryerson electrical engineering graduate who calls himself a “solar geek with a spread sheet.” Five years later, it formed a partnership with the University of Toronto to develop a high-efficiency “thin-film-on-silicon-wafer” solar cell.

The company, whose headquarters are in Waterloo, Ont., went public in 2003 in Toronto (it's also listed in Frankfurt) and at times came close to running out of money. Its fortunes reversed in the past couple of years as energy prices soared and Arise displayed a remarkable talent for snagging government freebies. The feds' Sustainable Technology Development Canada fund handed the company $6.4-million in 2006. The general enthusiasm for clean energy technologies allowed Arise to raise $34.5-million in a bought deal last October.

The company's biggest break came entirely by accident. In March, 2006, a German PV magazine called Photon International carried a story on Arise. Two months later, Mr. MacLellan was in Hawaii for the World Photovoltaic Conference. “A guy from Invest In Germany tracked me down,” he said. “We met and he said: ‘We're very interested in your company and we want all the best companies to build in Germany. We'll give you half the money.' ”

Invest In Germany has offices around the world (though not in Canada) and its 80 employees, most of them young, multilingual and highly educated, are considered superb salesmen and women. Its goal is to convince foreign companies to build plants and create employment in Germany and the appeal is quick, one-stop-shopping.

The team offers everything from assistance in site selection and construction engineering to German financing and incentives from the European Union. Boozing even features into the sales pitch. In the “Quality of Life” section of the promotional literature, the agency cheerily notes the country is home to “1,250 breweries with more than 5,000 different kinds of beer” (a statistic not lost on Mr. MacLellan, who loves German beer).

The agency has had particular success in attracting renewable energy companies. Some of the industry's best-known players – among them Shell Solar, EverQ, First Solar, Nanosolar and Signet Solar – have built factories in Germany and created thousands of jobs. “We work hard to find suitable companies,” said Mr. Grigoleit of Invest In Germany. “We go to conferences and trade fairs. We open up kiosks and we have offices in Chicago, Boston, Shanghai, Tokyo and other cities. What we can offer is speed of entry into the German market.”

Mr. MacLellan was impressed by Invest in Germany's efficiency. Within months of the Hawaii meeting, the financial and engineering machinery for the German plant were in place. The funding package, including the €25-million grant, was approved in December, 2006, only seven months after the Hawaii encounter. Construction of the factory started last August and the first cells will roll off the assembly by the end of April. “This is amazing,” he said. “We've gone from the first meeting to production in less than two years.”

He optimistically predicts PV cells made by Arise and other companies “will hit a wall of infinite demand” and he's evidently not alone. At last count about 55 solar companies had set up in Germany. The majority are in the former East Germany, where the incentives are fatter because the employment rate is lower than in the industrialized western half of the country.

There are a similar number of wind energy companies. More of both are coming. The German government's “GreenTech” environmental technology atlas, which describes the technologies and lists companies that develop and build them, runs 500 pages.

In July, a Quebec company called 5N Plus will open a plant in Eisenhuttenstadt, a town on the German-Polish border southeast of Berlin. The plant, its first foreign operation , will employ 45 and make high-purity metals for thin-film PV panels. Jacques L'Ecuyer, the CEO, said he built there because of the incentives – Germany provided about one-third of the plant's €9.5-million cost – and because he wanted guaranteed access to the European market. “If we have a presence in Germany, it will be easier for us to do business in Germany and in Europe,” he said.

CANADA SEEMS to have taken notice of the German example. Make that parts of Canada.

The West is still obsessed with oil. Quebec has few incentives for wind and solar power, probably because it has so much cheap (and renewable) hydro power, Mr. L'Ecuyer said.

But Ontario, battered by manufacturing job losses and the high dollar, has made renewable energy part of its industrial salvation plane. The province now has its own feed-in tariff for renewable energy and recently announced a five-year $1.15-billion program, called the Next Generation of Jobs Fund, to help finance everything from “green” auto research to pharmaceuticals manufacturing. Arise may tap into the jobs fund to expand in the Waterloo area, where it is building a plant to refine silicon for PV cells.

Ontario's new incentives, Mr. MacLellan said, “are not as attractive as Germany's but they're getting close.” With Germany still on top, Arise is already making plans to add a second, and possibly third, PV factory, in Bischofswerda, next to the one opening in April. Arise has more than enough available land and the town, one of eastern Germany's Cold War victims, would welcome the jobs.

More foreign companies are bound to rush to Germany while the financial goodies last. Mr. Grigoleit said Invest In Germany is targeting other Canadian renewable energy companies. He won't say how close they are snagging them but seems confident they will be unable to resist what he calls the “magnet” effect.

Even if Canada decides it wants a renewable energy industry of its own, it will face formidable competition from Germany.

Germany's Solar Cell Promotion: Dark Clouds on the Horizon

French utility eyes Spanish energy market

Globe and Mail

Associated Press

March 21, 2008

PARIS — The French utility Electricite de France SA has had exploratory talks with the Spanish construction company ACS and is interested in the Spanish energy market, a spokeswoman for EDF said Friday.

But spokeswoman Carol Ritrivi declined to comment on a report Friday in The Wall Street Journal that EDF and ACS are in advanced talks about teaming up to buy two Spanish utilities for more than $100-billion.

The newspaper, citing unidentified people close to the discussions, said EDF and ACS — whose full name is Actividades de Construccion y Servicios SA — have discussed forming a bidding team that would make simultaneous offers for two Spanish utilities, Iberdrola DS and Union Fenosa SA.

The deals would have a combined value of $134-billion including debt and excluding possible premiums, the report said.

Iberdrola, based in Bilbao, is expanding internationally and is in the final stages of a deal to acquire Maine-based Energy East — parent of Central Maine Power, Rochester Electric and Gas Corp., and New York State Electric & Gas Corp. — for $4.6-billion and the assumption of $4-billion in debt.

Ms. Ritrivi noted that EDF chief Pierre Gadonneix has said his company is interested in the Spanish market but would not make a hostile bid if the Spanish authorities were opposed.

Ms. Ritrivi confirmed EDF has had “contacts” with ACS that she qualified as “more or less exploratory.”

The Journal report said the deal is far from certain, and could run into possible resistance from Spanish authorities and potential opposition from competition regulators in several countries and jurisdictions, as well as Iberdrola.

ACS, Iberdrola and Union Fenosa spokesmen were unavailable for comment on Friday, a public holiday in Spain.

March 22, 2008

The Rising Price of Coal

By Kelpie Wilson

t r u t h o u t | Environment Editor

Friday 21 March 2008

As the global energy/climate crisis deepens, coal has become the starkest symbol and most telling measure of our predicament. Coal produces more carbon emissions than other energy sources - more than twice that of natural gas per unit of energy output. Consequently, coal-fired power plants are responsible for about one-third of US emissions of carbon dioxide. Despite this, we are mining and burning more coal than ever.

On March 18, the nonprofit Environmental Integrity Project (EIP) released an analysis of EPA data showing that carbon dioxide emissions from the electric power industry increased by 2.9 percent in 2007 and have risen 5.9 percent since 2002. Coal is the culprit.

According to an Associated Press report, the cause of last year's increase was a combination of three factors: increased electricity demand; a shortage of hydroelectric power, leading to greater reliance on coal, and the reduced efficiency of aging coal-burning power plants.

While utilities around the nation have plans to construct more than 100 new coal-fired power plants, public concern over global warming and toxic pollution has put the brakes on many of them. Last year in Texas, public interest groups prevented TXU Energy from going ahead on eight new coal-fired plants that would have increased the state's emissions by 24 percent, according to the EIP report.

But as demand for electricity rises and cleaner fuels like natural gas get scarcer and more expensive, the relentless pressure to burn coal fuels delusions such as "clean coal."

"Clean coal" is a combination of two technologies, one of which is expensive and the other completely unproven. The expensive one is coal gasification, and it is a genuinely cleaner way of burning coal. It involves baking coal to drive off gasses that aren't much dirtier than natural gas, and the gasses then are burned for power production. This technology costs a minimum of 20 percent more than a conventional pulverized coal plant, which is why only two such plants exist in the United States.

The other part of the "clean coal" scheme involves carbon capture and storage. This technology is not proven and the potential costs are enormous. A US Department of Energy pilot project called FutureGen was recently canceled with the DOE citing soaring cost projections among its reasons for ending the project.

But even if the "clean coal" idea were workable, the realities of the coal fuel cycle ensure that coal can never be truly clean.

At the Public Interest Environmental Law Conference in Eugene, Oregon, in early March, a panel of citizen activists talked about the front and back ends of coal use: mining and waste disposal. Teri Blanton, of Kentuckians for the Commonwealth spoke about the heartbreak of mountaintop removal coal mining in Appalachia. The mining technique is dynamiting hundreds of thousand of acres of biologically diverse forest ecosystems to get at the coal underneath, and dumping the waste into streams. Blanton told the story of one of her neighbors who lost his land to a mining company. "When I say he lost his land," she said, "I mean he literally lost his land. One day he found that his land was just gone, blasted away to nothing."

According to the group Appalachian Voices, more than 800 square miles of mountains have already been destroyed by mountaintop removal and if the blasting continues unabated it will devastate an area the size of Delaware by 2010.

Coal mining also uses great quantities of water and pollutes streams in the process. Slurries of waste laden with toxic heavy metals are leaching into streams and river systems. Earthen impoundments that hold back the sludge are unstable and threaten communities. A sludge dam breach in 2000 in Martin County, Kentucky, dumped more than 300 million gallons of toxic sludge, killing virtually all aquatic life for 70 miles downstream of the spill.

Brad Bartlett of the Energy Minerals Law Center talked about the post-combustion end of coal. Air pollution controls at existing coal plants capture 125 million tons of pollutants, amounting to "the largest solid waste stream in the US," according to Bartlett. He said that it is not formally regulated as hazardous waste despite the presence of heavy metals and other toxins. Some of it is used to make building materials and roads, but the rest is just landfilled.

When you think of Alaska, you usually think of oil, not coal, but Vanessa Salinas of Alaskans for Responsible Mining said that Alaska also has huge amounts of coal - about one-eighth of the world's coal reserves and half of US coal reserves. Currently there is only one operating coal mine in Alaska, but BHP Billiton, the largest mining company in the world, is conducting an extensive coal exploration program and four new strip mines are being proposed.

Alaskans should be more concerned than most people, Salinas said, because global warming impacts are being felt more strongly in the Arctic than anywhere else. On February 26, the tiny village of Kivalina sued two dozen oil, power and coal companies over their greenhouse gas emissions that contribute to global warming. Melting sea ice is exposing the village to erosion from storm waves and surges.

Coal burning also threatens Alaska's famed fishing industry. Coal is notorious for its mercury pollution, and older marine fish are showing increasing levels of mercury. Salinas blamed coal burning pollution from Asia and noted that most of the coal mined in Alaska would be shipped to Asia. In this way Alaskans would poison their own fishing industry.

Salinas has worked with Native Alaskans to stop these coal mines. She said Native people have told her that they feel coal functions as "the liver of the world" and it should be left in the ground. Coal as the "liver" of the world is not a bad metaphor. Coal is not just another mineral; it is biological. It is the remains of ancient life. The liver cleanses toxins from the body, and coal, if left in the ground, keeps our climate cool and our air and water clean.

While Alaskan coal is destined to be shipped to Asia, it looks like Appalachian and even Wyoming coal will increasingly be shipped to Europe. Recent reports in The New York Times and The Washington Post describe a spike in global coal consumption. With the falling dollar value, American coal is now a bargain for overseas buyers; however, that is in the context of an overall price rise that is unprecedented. Spot market coal prices have risen by 50 percent or more in recent months. Coal consumption worldwide has increased by 30 percent over the last six years.

American electricity consumers are used to hearing that coal is much cheaper than renewable alternatives like solar and wind, but that might not be true for long. Consumers haven't seen the impact of expensive coal yet because most utilities lock in coal supplies with long-term contracts. Electricity rates will begin to shoot upwards when those contracts expire in the years ahead.

There is no chance that prices will come back down again either, because Peak Coal, like Peak Oil, is fast approaching. Journalist David Strahan, in a January 17 article for New Scientist, has documented what's known about coal reserves. He concludes that the official figures, like the official figures for recoverable oil reserves, have been vastly inflated.

On March 18, Standard & Poor's released a study concluding that utilities and states with Renewable Portfolio Standards need to do a better job of revealing how expensive their mandates for renewable solar and wind power will be. By that same token, utilities should be required to reveal all of the current and future costs for dirty and increasingly expensive coal power.

Kelpie Wilson is Truthout's environment editor. Trained as a mechanical engineer, she embarked on a career as a forest protection activist, then returned to engineering as a technical writer for the solar power industry. She is the author of "Primal Tears," an eco-thriller about a hybrid human-bonobo girl. Greg Bear, author of "Darwin's Radio," says: "'Primal Tears' is primal storytelling, thoughtful and passionate. Kelpie Wilson wonderfully expands our definitions of human and family. Read Leslie Thatcher's review of Kelpie Wilson's novel "Primal Tears."

See also The Great Coal Hole

David Strahan, New Scientist, 17-Jan-2008

States’ Battles Over Energy

Grow Fiercer With U.S. in a Policy Gridlock

By FELICITY BARRINGER

New York Times

March 20, 2008

Utility executives in Kansas were shocked last fall when a state environmental official rejected two coal-fired power plants because of the millions of tons of carbon-dioxide emissions they could produce. In a state where coal generates 73 percent of the electricity, the pro-coal forces were unable to work their will.

That ineffectiveness will be underscored as early as Friday if Gov. Kathleen Sebelius, as expected, vetoes an effort by the Kansas State Legislature to ensure the plants are approved. A handful of lawmakers seeking a new energy policy are blocking the attempt to override.

The struggle over those plants is an example of a growing trend in climate-change politics. In the absence of clear federal mandates for emissions from smokestack industries, states that have been proving grounds for new environmental approaches to energy are becoming battlegrounds as well.

“There are certainly battles happening all over the nation,” said Steve Clemmer, the Clean Energy Program research director at the Union of Concerned Scientists. In Kansas and Washington State, the battles are over individual plants. Other fights, as in California, are over how to structure carbon controls — essentially, who will have to pay, and how much. Some, as in Minnesota, are over how much renewable energy must be created and what forms are appropriate.

And that list does not take into account major battles between the states and the federal government, exemplified by the Environmental Protection Agency’s refusal to let California control greenhouse-gas emissions from automobiles.

What to do about the greenhouse-gas emissions from fossil fuels — particularly the coal that fuels the lion’s share of electricity in 25 states — is a question Washington has largely dodged. But politics, like nature, abhors a vacuum. The national gridlock over climate-change policy has led to an ever-increasing number of state initiatives.

Currently 18 states seek to cap carbon dioxide emissions for industry and 25 support mandates for renewable energy; renewable-mandate legislative battles are under way in Ohio and Michigan. There are three multistate compacts intended to limit emissions and allow trading of carbon allowances; governors of 10 Midwestern states, including Ms. Sebelius, joined such a pact last fall.

The trend has not been slowed by the Bush administration’s approval of new gas-mileage standards for new trucks and cars, or its nearly simultaneous refusal to give California and 17 other states the waiver needed to control emissions from cars.

For example, Washington State last year passed a law limiting the amount of greenhouse-gas emissions that any new power plant could produce. After the law was passed, regulators blocked a power plant that would be partly coal-fired, saying it would emit an illegal amount of carbon dioxide.

But in a state reliant on emission-free hydropower, that is a less controversial decision than the rejection of new coal plants in Kansas.

The more a state depends upon coal, the more likely resistance will be fierce. About half the states get more than half their electric power from coal.

In states like California that are well on the way to establishing a carbon-constrained regime, the battles are over how to structure carbon controls, how to distribute permits allowing limited emissions and how to ensure that companies with tight controls are given credit for acting before new rules are adopted. But when the public utilities commission’s first rough draft was unveiled, the largest coal-consuming utility in the state, the Los Angeles Department of Water and Power, lashed out at state regulators, saying their proposals would unfairly favor some utilities over others.

The Los Angeles facility is not alone. The industry, generally united five years ago against controls on carbon emissions, now presents a broad spectrum of opinions, with low-coal utilities like Pacific Gas & Electric in Northern California favoring the certainty that carbon controls will bring, and embracing mandates for renewable energy. Meanwhile, coal-dependent utilities like the Southern Company in Georgia firmly resist both ideas.

All the utilities cite fairness as their objective, but they define it differently. The same is true in discussions about climate-controls in the political arena. In Kansas, the arguments over fairness and economic harm took on a particular fierceness after two plants proposed by the Sunflower Electric Corporation were rejected by Rod Bremby, the secretary of health and environment, in October. A pro-coal lobbying group, Kansans for Affordable Energy, was soon formed. Its report, filed with the Kansas Ethics Commission and obtained by DeSmogBlog.com, shows $120,000 of its $140,400 assets came from Peabody Coal, which could supply the new plants from its mines in Wyoming. Another $25,000 came from Sunflower itself.

The new group placed newspaper advertisements with pictures of the smiling faces of Presidents Mahmoud Ahmadinejad of Iran, Vladimir V. Putin of Russia and Hugo Chávez of Venezuela — suggesting that if the coal plants were killed, those natural-gas exporting countries would benefit. The advertisement made no mention of the fact that none of these countries actually export natural gas to the United States.

Then the Republican-controlled Legislature moved to save the project by stripping state officials of any power to base power-plant decisions on potential greenhouse-gas emissions.

Eighty-five percent of the power would be sold out of state, mostly to Colorado. The fact that most of the electricity is not needed now by Kansans is a central argument made by the anticoal forces. Steve Miller, a spokesman for Sunflower, argues that Kansas’s economy depends on exports of commodities like grain, and that the new electricity would be another valuable export.

Both chambers of the Legislature passed bills to strip Mr. Bremby of the power to make a decision on the plants based on greenhouse-gas considerations. But the majority in the House was not veto-proof. At the end, the pro-coal forces tried to win over dissenters by sweetening the measure with an amendment requiring that renewable sources, like wind, make up 10 percent of electrical generation by 2012, 15 percent by 2016, and 20 percent by 2020.

The dissenters did not budge. Utility lobbyists like Scott Segal of the Electric Reliability Coordinating Council see these state-by-state battles as examples of why a single national policy is preferable. Congress is considering several bills setting mandatory controls on carbon dioxide emissions; the Bush administration remains committed to voluntary actions.

“There is a growing recognition among national politicians and many in the states that it will not do to have a state-by-state approach to global climate change,” Mr. Segal said, adding, “the notion that any one state or group of states could make a material contribution to solving the problem is farcical.”

Joshua Svaty, a representative from central Kansas, disagrees. He said in an interview that the pro-coal forces in the state “started with the mindset of how can we maintain business as usual?” But he added, “The national mood — not just of politicians but of people — is that we’re tired of business as usual and we want to move forward with a new energy policy.”

Copyright 2008 The New York Times Company

March 20, 2008

Energy giant eyes $5B hydro project

TransCanada, ATCO assess Slave River

Geoffrey Scotton

Calgary Herald

Thursday, March 20, 2008

CREDIT: Graphic: Rachel Niebergal, Calgary Herald

Energy and pipeline giant TransCanada Corp., along with ATCO Power Ltd., is eyeing the development of Alberta's last remaining major hydroelectric prospect, on the Slave River -- a potentially $5-billion project supplying emissions-free power.

"We are presently assessing the feasibility of the Slave River project with our partner ATCO," TransCanada's president for energy, Alex Pourbaix, told the Herald, suggesting the site could accommodate a 1,200 to 1,300-megawatt hydro development.

"A very key part of that feasibility analysis (is) we are doing some work to understand the project itself, understand the stakeholders up in the region and people that would be impacted by it. We're in an early feasibility stage," said Pourbaix.

The project is the latest of a raft of massive generating proposals that have emerged to serve a near-doubling of Alberta's power production required by 2027 to satisfy North America's fastest-growing industrial and residential demand.

The Slave River concept -- which would easily be Alberta's largest hydro facility -- comes on the heels of Bruce Power LP announcing it is pursuing an up to 4,400 megawatt, $10-billion or more, nuclear facility near Peace River.

"Obviously we're looking at a major project," ATCO power president Rick Brouwer told the Herald, adding the facility, if completed, would require transmission upgrades. Sister company ATCO Electric is

Alberta's second-largest transmission operator and controls the territory around the Slave River site.

"We're not averse to developing large projects," said Brouwer, adding that emissions-free generation is particularly attractive in the wake of changing and increasingly onerous standards around carbon-dioxide production, particularly in power generation.

"With this type of generation, we can help Alberta and Canada meet some of their environmental goals in terms of greenhouse gas production and reductions," said Brouwer. "This could make a very significant impact."

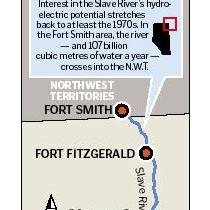

Interest in the Slave River's hydroelectric potential stretches back to at least the 1970s. In the early 1980s, Alberta Environment conducted a study on the hydroelectric potential of the area near Fort Smith., where the river -- and 107 billion cubic metres of water a year -- crosses into the Northwest Territories.

"Due to the high volume of water, the rapids along this stretch of river possess enormous hydroelectric potential," Alberta Environment said in a commentary.

"The monetary and environmental costs were deemed too high for the power demand and the project was put on hold indefinitely," the department added.

Now, TransCanada and ATCO, both Calgary-based, are examining the economics and social and environmental aspects of the project and have already decided a traditional hydro project with a large dam and reservoir is not appropriate.

As an alternative, a so-called run-of-river approach, where river water is directed through turbines without being stored, is being studied.

"The Slave River hydro development is looking at a number of different run-of-river concepts," says a brochure the two firms will use in community consultations. "Most require a structure on the river somewhere between Fort Smith and Fort Fitzgerald . . . without long-term water storage capability."

Brouwer emphasized that TransCanada and ATCO view extensive consultation with local residents and aboriginal communities as an essential first step in the evaluation process for the project, which would take at least 12 years to complete.

"Trust is absolutely critical -- and we have to earn it," said Brouwer. Atco Power, part of the broader ATCO Ltd. network controlled by Calgary's Southern family, operates about 4,800 MW of generation in Alberta and around the world, including the 1,000 MW Barking Power Station in London, England.

"We have people in the community over the next few months to talk about the process they, the community, feel is appropriate," said Brouwer. "That's the first point on our agenda."

Analysts note that a Slave River project will have to compete with roughly 20,000 MW in potential projects that are vying to satisfy the 5,000 MW of additional capacity required by 2017 and the 11,500 MW of additional output needed by 2027.

In a market where the risk of projects is borne completely by the developers, the very long lead times and massive capital costs of a major hydro-electric proposal can put it at a disadvantage.

"A project of that size, scale and magnitude, $5 billion, is significant with a long lead time. That's putting a lot of money at risk for a very long time in an uncertain marketplace," said Duane Reid-Carlson, president of the Calgary-based energy consultancy EDC Associates Ltd. "That's the problem with a project of this size and magnitude. It's very vulnerable."

gscotton@theherald.canwest.com

© The Calgary Herald 2008

March 19, 2008

Australia plans carbon storage under ocean

COMMENT: Just musing here, but think of the potential appeal to the BC government. Not only does it play to the climate change agenda, but it also allows you to get drills into your offshore, ostensibly to send carbon dioxide into the seabed, not remove gas or oil from it.

MICHAEL PERRY

Reuters

Globe and Mail

March 19, 2008

SYDNEY — Australia plans to allow greenhouse gas emissions to be stored in the ocean floor around the island continent, with exploration for suitable sites possibly starting in 2008.

Energy Minister Martin Ferguson said the government would amend the Offshore Petroleum Act this year to allow for seabed storage of carbon emissions from coal-fired power stations.

“Australia has significant geological storage potential, particularly in our offshore sedimentary basins,” Mr. Ferguson told an energy conference in Sydney late on Tuesday.

“I am hoping that amendments to the Offshore Petroleum Act 2006 will be passed in time for the government to release acreage for exploration in 2008, making Australia one of the first countries in the world to establish a regulated carbon capture and storage regime,” Mr. Ferguson said.

Green groups are critical of the plan to store carbon emissions in the ocean floor, saying they are concerned about the chances of leakage of emissions into the ocean environment.

“The coal and energy corporations are doubtless lobbying hard for the government to carry all liability for any leakages while they continue to profit from their polluting practices,” Greens Senator Christine Milne told local media on Wednesday.

Australia's Labor government, elected in November, 2007, ratified the Kyoto Protocol the following month, reversing an 11-year policy by the previous conservative government.

Prime Minister Kevin Rudd's government has made climate change a priority and has released a “National Clean Coal Initiative” which will see a regulatory regime for access and tenure to offshore Australia for geological storage.

Australia is the world's largest coal exporter and is reliant on fossil fuel for transport and energy. About 80 per cent of electricity is produced by coal-fired power stations.

The country is responsible for about 1.2 per cent of global greenhouse gas emissions and is one of the highest polluters per capita.

Its carbon emissions are forecast to continue to grow due to its heavy reliance on coal for electricity, although the government says the country will meet its Kyoto emissions targets by 2012. Emissions will grow by 108 per cent of 1990 levels from 2008 to 2012.

“Coal will continue to make a major contribution to Australia's energy needs well into the future and therefore we need to urgently reduce greenhouse gas emissions from coal-fired electricity generation,” said Mr. Ferguson.

“Clean coal technologies involving carbon capture and storage will play a vital role in meeting future greenhouse constraints. A nationally co-ordinated effort is needed to bring forward the commercial availability of these technologies.”

March 17, 2008

Alberta's nuclear reactor plan doubles to four

by Shawn McCarthy

The Globe and Mail

March 14, 2008

OTTAWA -- Ottawa's new climate change rules have provided an important boost to Bruce Power's expanded nuclear ambitions in northwestern Alberta, Duncan Hawthorne, the company's chief executive, said yesterday.

Bruce, a private sector consortium that operates a nuclear site in Ontario, revealed a bold $10-billion plan to build as many as four reactors and bring nuclear power to a province that is run on fossil fuels.

The plan, outlined in a filing with the Canadian Nuclear Safety Commission, also calls for the dumping of Atomic Energy of Canada Ltd. as a preferred technology supplier and opens up the project to competitive bidding to build Western Canada's first nuclear reactors.

The news came as Bruce Power completed its purchase of Energy Alberta Corp., a startup company that was working with AECL on a bid to build a project less than half the size of Bruce's new application, which calls for as much as 4,400 megawatts of power at a site 30 kilometres west of Peace River.

Bruce Power said it would take a technology-neutral approach to the Alberta project, meaning it will consider AECL's new ACR technology along with types offered by France's Areva SA, Mitsubishi Corp.'s Westinghouse unit and the General Electric Co./Hitachi Ltd. group.

Bruce Power estimated it could cost $10-billion to build the four reactors, though costs in the nuclear industry - as with virtually all major construction projects - have been climbing rapidly.

Mr. Hawthorne, who conducted a series of town hall meetings in the area yesterday, acknowledged the firm faces some resistance to nuclear power in Alberta. The province relies on coal for 50 per cent of its nearly 12,000 megawatts of electrical generating capacity, and natural gas for another 40 per cent.

But he said federal Environment Minister John Baird provided a boost to the nuclear option when he announced this week that Ottawa would prohibit the building of coal-fired power plants after 2011 unless they capture emissions of carbon dioxide and sequester the gas in permanent underground storage.

Mr. Hawthorne said a clean-coal plant with sequestration could be as much as 50 per cent more expensive to build per megawatt of capacity than nuclear plant.

"It certainly does make it more realistic to think of nuclear as alternative. It could be a straightforward commercial debate," he said.

Alberta Premier Ed Stelmach refused to say yesterday whether the provincial government would endorse Bruce Power's plan to build a nuclear power plant in the province.

He said Alberta's recent election, which concluded last week with the Conservatives winning their 11th successive majority, delayed the province's plans to assemble a panel to help study the matter.

"We are speaking to them, we are interviewing them and it's just a matter of putting the group together," Mr. Stelmach said. "But it's something that will be advanced - this total picture for energy. The globe is changing around us. We've got to have that information at hand."

Mr. Hawthorne noted that booming Alberta has seen a sharp rise in electricity demand, which has climbed 29 per cent since 2000. The province's electricity planning authority has forecast a shortfall of 5,000 megawatts by 2017.

"I think the odds are pretty high that Alberta will come to the view that nuclear could and should play a role."

The rapid expansion in the oil sands is a major factor in that expanding demand, and Bruce Power is looking to sign a long-term power contract with project operators to help finance the construction of the power plants.

The company would also look to sell power to the broader electricity market.

While Energy Alberta was seen as an upstart with no nuclear operating experience, Bruce Power has an established track record in Ontario. It operates six Candu reactors at the Bruce facility on Lake Huron near Kincardine, Ont., is refurbishing two more and is looking to add another two reactors, though it has not chosen a reactor design.

Bruce Power is owned by Calgary-based TransCanada Corp., Saskatoon-based Cameco Corp. and the BPC Generation Infrastructure Trust, a trust established by the Ontario Municipal Employees Retirement System, the Power Workers' Union and the Society of Energy Professionals.

AECL spokesman Dale Coffin said the Crown corporation welcomed the decision by Bruce Power to proceed with an expanded version of the Energy Alberta project. "We're confident the ACR1000 will be the best choice for Alberta," he said.

March 13, 2008

U.S. may protect oilsands

Considering move to exempt region from new crackdown

Claudia Cattaneo

National Post

Tuesday, March 11, 2008

Chris Schwarz/CanWest News Service

The oilsands are likely to produce more than three million barrels a day

by the middle of the next decade.

CALGARY -- In response to concerns that new U.S. environmental legislation will drastically impact development of Canada's oilsands, Washington is considering classifying oil produced from the region as "conventional" fuel rather than subject it to the stringent standards expected of "alternative" fuels.

The U.S. government passed a law that prohibits federal procurement of alternative fuels that generate more greenhouse gases than "conventional sources," which spurred a warning last month from Canada's ambassador to the United States, Michael Wilson. Mr. Wilson said a narrow interpretation of the legislation would include the vast deposits of the oilsands -- where U.S. firms are major investors and the U.S. government is a major customer.

An interdepartmental working group with representation from several U.S. agencies is looking into how to classify the Alberta deposits under the new rules, said a source who suggested the step was taken because "D.C. does not want to hammer" the region.

Mr. Wilson's letter to several senior members of the U.S. administration -- including Robert Gates, the Secretary of Defence, and Condoleezza Rice, the Secretary of State -- outlined concerns with the Energy Independence and Security Act 2007, passed in December.

"The U.S. government would be seen as preferring offshore crude from other countries over fuel made in part from U.S. and Canadian sources," Mr. Wilson argued. "Further, the U.S. government would be contradicting other stated goals to encourage greater biofuels use and Canadian oilsands production."

The letter also warned of unintended consequences for both countries if it compromised the oilsands, which are a key supplier to U.S. military and postal fleets.

The rationale for classifying the oilsands as conventional oil is that, unlike alternative fuel sources, the deposits are well established, yielding more than one million barrels a day and likely to produce more than three million barrels a day by the middle of the next decade. As such, they are no longer "a science experiment," as one source put it.

A decision is expected this spring.

The administration of George W. Bush has encouraged oilsands development from its early days to help reduce U.S. dependence on Middle East imports. U.S.-based companies such as ConocoPhillips, Chevron Corp., Exxon Mobil Corp. and Devon Energy Corp. are among the deposits' biggest investors.

The legislation and new low-carbon fuel standards adopted in California are seen as major setbacks for the oilsands industry because they restrict the market for its oil, all of which is exported to the United States. A major worry is that such rules could have a domino effect and be adopted in other jurisdictions.

In his Feb. 22 letter, Mr. Wilson argued that Canada does not consider oil extracted from the oilsands as alternative fuel. "Oil produced from the oilsands, like oil from other sources, is processed in conventional facilities," Mr. Wilson wrote, noting that it would be difficult to identify fuel on the U.S. market that was 100% extracted by conventional means.

Mr. Wilson also notes that the U.S. administration recognized the oilsands as part of the mainstream when 174 billion barrels of oilsands reserves were included by the U.S. Department of Energy in its annual tally of proved world oil reserves.

Put carbon burden on consumers, petro leaders say

Gordon Jaremko

Canwest News Service

National Post

Monday, March 10, 2008

EDMONTON -- Oil industry leaders called for a national carbon tax on consumers Monday to help pay for building new greenhouse-gas disposal systems.

The levy would put the burden where it belongs -- on fossil-fuel users that cause the most emissions, said Nexen Energy president Charlie Fischer and Enbridge president Pat Daniel.

"Our industry is prepared to do its share," Fischer said as environmental obstacles to oilsands development took centre stage at the 2008 World Heavy Oil Congress in Edmonton.

The comments came on the same day the federal government announced new measures to cut carbon emissions. They included requiring oilsands facilities that start in 2012 or later to capture and store the bulk of their carbon emissions. As well, emissions reductions would be required from existing facilities and those that start before the end of 2011.

About 30% of oilsands carbon-dioxide emissions come in Alberta from producing bitumen and upgrading it into synthetic light oil ready for conversion into fuels, Fischer said.

Refineries another 15% of the waste greenhouse gas into the atmosphere, he estimated, citing expert consultant studies commissioned by his company.

Fuel users account for a 55% majority of the emissions blamed for global warming, Fischer said.

A new carbon tax would serve a dual purpose of encouraging more efficient motoring and generating money for proposed industrial greenhouse gas collection and storage installations, Fischer suggested.

"Government has a big role to play if carbon capture and storage is to become a reality," Fischer said.

Suncor Energy president Rick George stopped short of calling for consumer taxation but said industry cannot shoulder the entire burden of paying for cutting greenhouse gas emissions.

"Everybody's got a piece of this," said George, whose firm leads an industry consortium proposing a multibillion-dollar collection, pipeline and disposal network for carbon-dioxide.

"Industry has taken the lead on carbon capture and storage. I'm glad to see governments are moving forward. Their support is absolutely essential," George said.

A task force appointed by Prime Minister Stephen Harper and Alberta Premier Ed Stelmach called in February for immediate creation of a $2-billion government fund to help kick-start construction of disposal networks.

Neither government has made financial commitments.

But the recommendation will be reviewed by a carbon capture secretariat that will be appointed as part of the province's developing green plan, Alberta Environment deputy minister Peter Watson said.

The technology is a cornerstone of provincial policy and a report making a detailed "business case" for construction partnerships between government and industry will be sought by the end of the year.

"We need clarity on greenhouse gas regulation," Fischer said.

An international carbon tax that treats all fuel users equally would be an ideal policy, Fischer said.

"We're doing very little to change consumer behaviour," he said. "People don't want to change and they want cheap fuel."

Collecting, transporting and disposing of waste carbon-dioxide will cost $80 to $100 per tonne of emissions, estimated Daniel, whose Enbridge is sponsoring a network stretching from the northern bitumen belt south to central Alberta.

"We're going in the right direction. We need to move a bit faster," he said.

The expense works out to "a couple of dollars a barrel," Daniel estimated.

The added costs would not likely be enough to force cancellation of any oilsands projects, the Enbridge president predicted. But the expense of carbon capture and storage would work out to one to two cents per litre of refined fuels.

Daniel urged enactment of "some form of carbon tax" because costs of cleanups should be felt by all that contribute to environmental problems, he suggested.

"It has to be a sharing."

Edmonton Journal

gjaremko@thejournal.canwest.com

March 12, 2008

Forest Grove passes resolution against LNG terminals

Jill Rehkopf Smith

The Oregonian

March 11, 2008

FOREST GROVE -- Forest Grove has became the first Oregon city to pass a resolution opposing construction of liquefied natural gas terminals near the mouth of the Columbia River and pipelines to Central Oregon.

City councilors on Monday unanimously supported the resolution, which cited the project's potential danger to the ecological balance of the Columbia, to the natural resources along the pipeline route and to the water supply of Forest Grove.

"It's not a case of 'Not In My Back Yard,'" said Councilor Pete Truax, who drafted the resolution. "This is 'in nobody's back yard.'"

Out-of-state companies have proposed building several LNG terminals in the state, including two on the Columbia River.

Proponents argue natural gas provides cleaner energy than coal and the projects will provide good jobs in Oregon. The gas would be extracted from other countries and shipped to a Columbia River terminal, then sent through underground pipelines to far-off distribution points, including California.

Two of the proposed pipelines, Palomar -- a joint venture between Northwest Natural Gas Co. and TransCanada Pipelines Ltd. -- and Oregon LNG, would pass near Gales Creek and Gaston and through Forest Grove's watershed.

Councilor Tom Johnston said that growing up in Gales Creek he lived through earthquakes and landslides and worries about damage to a pipeline located there.

Councilor Victoria Lowe pointed out that it's not just Forest Grove's water supply that might be affected because the pipeline would pass near Hagg Lake, which serves Beaverton, Hillsboro and other cities.

In addition to local testimony, Brent Foster, executive director of Columbia Riverkeeper, drove in from Hood River for Monday's hearing.

Foster cited damage from construction of a Coos County natural gas pipeline, a project approved by voters in 1999, such as erosion, landslides, stream pollution and tainted or blocked water supplies.

Foster also invited councilors to type "gas pipeline accidents" into the Google search engine on their computers to see all the references that come up.

Gov. Ted Kulongoski and key state agencies share Forest Grove's concerns, said Patty Wentz, a Kulongoski spokesperson.

The pipelines and terminals need state permits before they can be built, and state attorneys are looking into the extent of Kulongoski's authority to hold up those permits, Wentz said.

Kulongoski is also concerned that a 2005 law that took siting authority for such facilities away from the state and put it into federal hands also limited citizen involvement.

"People are trying to be involved in this process," Wentz said of the Forest Grove resolution. "It's not a hollow gesture. The governor is paying attention."

March 11, 2008

Enbridge mulls reversal of pipeline

Reuters

Globe and Mail

March 10, 2008

EDMONTON — — Enbridge Inc. [ENB-T] is looking at moving oil sands crude to the U.S. Northeast and Eastern Canada by reversing the flow of one of its pipelines or building a new one, its chief executive officer said Monday.

Enbridge, whose pipelines carry the lion's share of Canada's crude exports to the United States, may construct a new line to Philadelphia from southern Ontario or re-reverse the flow of Line 9 to Montreal from Sarnia, Ont., Pat Daniel said.

Enbridge switched direction of Line 9's oil flow a decade ago so it could ship imported oil into central Canada.

Speaking to reporters following a speech to the World Heavy Oil Congress in Edmonton, Mr. Daniel said the company could revamp the existing line at relatively low cost.

The price of changing the direction of Line 9's flow would be $100-million or slightly more, he said.

The company could reverse Line 9, which was built in the 1970s as part of a protectionist federal energy policy, before it completes its proposed Gateway pipeline to the Pacific Coast from Alberta. That project is expected to be in service some time between 2012 and 2014.

"If we move to reverse Line 9, that could come before Gateway," Mr. Daniel said. "If it is large volume, 400,000 barrels a day, Gateway would come first."

Line 9 currently has a capacity of 240,000 barrels a day.

It could move oil sands-derived crude to Portland, Me., where it would be shipped down the East Coast of the United States by tanker.

Enbridge is in the midst of a $12-billion expansion program to accommodate rising production from the oil sands. Output from the northern Alberta region is expected to nearly triple to 3 million barrels a day by 2015.

Mr. Daniel said new lines are necessary because the refinery-ready synthetic oil produced in the oil sands region is being priced at a discount to conventional crude.

Enbridge recently dusted off plans for the $4-billion Gateway line after advancing other capacity expansions to the U.S. Midwest and beyond.

Line 9 was built during the energy crises of the 1970s so refineries in Quebec could have secure access to Western Canadian crude.

By the late 1990s it sat idle, prompting Enbridge, with the support of major Ontario refiners, to reverse the flow of the pipeline at a cost of about $90-million.