July 29, 2008

Betting on carbon capture

Betting on carbon capture CO2 storage could solve most of Alta.'s emissions problems -- if it works

Archie McLean

The Edmonton Journal

Monday, July 28, 2008

CREDIT: CNS This is the pipe that brings in the co2 gas from 320 miles away in North Dakota, ending at the EnCana Weyburn facility.

Alberta's climate change policy is under increasing global scrutiny.

With oilsands companies ramping up production and the province still heavily reliant on burning coal for power, greenhouse gas emissions will almost double from 2005 levels by 2050 without aggressive action.

To solve this problem, the Stelmach government is betting heavily on carbon capture and storage (CCS), a promising but largely undeveloped technology.

They are counting on CCS delivering a staggering 70 per cent of the province's greenhouse gas reductions by 2050. That amounts to 139 megatonnes a year, roughly as much as the entire country of Argentina put into the atmosphere in 2004.

To kick-start investment, the provincial government recently pledged $2 billion to develop the technology. But questions still linger and critics charge the plan may be too pricey, too slow and too uncertain to deal with the problem.

It's easy to see why politicians and business leaders love carbon capture and storage. For a price, it allows industrial expansion to continue, but emissions to fall.

If it succeeds, the technology could be exported around the world.

It is also pretty simple for the public to understand -- capture industrial carbon dioxide emissions at their source, liquefy and compress them, and pipe them underground, where they can sit in depleted oil reserves or saline aquifers.

"These are things we already know how to do in Alberta," says Jim Carter, the former CEO of Syncrude, who heads a provincial government task force on the technology.

According to a 2005 report by the International Panel on Climate Change, CCS has the potential to reduce emissions by 80 to 90 per cent at a plant compared to a similar facility without the technology.

It's happening on a small scale all over the world, including projects in Norway, Algeria and Weyburn, Sask.

The same report claims the risks of carbon dioxide seeping to the surface are minimal, with retention in underground reservoirs likely to exceed 99 per cent over 1,000 years.

Large point releases are possible, but could be dealt with using current well blowout techniques.

David Keith, the Canada research chair in energy and the environment at the University of Calgary and one of the world's top experts in carbon capture and storage, is confident the risks can be managed.

"If you want a technology with no risk, you better choose no technology," he says. "Any of the large-scale things we're going to do for climate change, including wind power, hydro power or nuclear power, have significant environmental consequences."

Given the right market incentives, Keith believes carbon-capture technology could be built right away.

The obstacles have more to do with cost than technology.

"If you ask me why isn't there technology to make blue elephants, the answer is there's no financial incentive for making blue elephants.

"So essentially world governments have not seriously regulated the emissions of carbon dioxide, so of course technologies for avoiding such emissions are not big winners right now."

Who will pay?

Premier Ed Stelmach and Saskatchewan Premier Brad Wall often make their case for CCS in opposition to other climate change policies such as a carbon tax or cap-and-trade system.

In meetings this month with western U.S. governors and Canadian premiers, they carried a clear and co-ordinated message -- no carbon tax, no North American cap-and-trade system.

Stelmach says both ideas are little more than a money transfer from the West to the rest of the country.

"There is one inter-regional transfer of wealth in this country, it's called equalization, and there won't be another one from the province of Alberta," Stelmach said at the premiers conference in Quebec.

But experts say they are confusing the end with the means. Carbon-capture technology has plenty of potential, but industry has no reason to invest in it without a strong price on carbon.

"We're not regulating the CO2 emissions in a serious way, so why would anybody do it?" Keith says.

Mary Griffiths, a senior policy analyst at the Pembina Institute, says Stelmach and Wall are being disingenuous with their arguments. "If you have a higher price on carbon, then it will be economical to do the carbon capture. Those two are separate issues and it's a red herring to connect the two."

Norway's Statoil, for example, developed its CCS technology after the government there introduced a $60 carbon tax in 1991.

Former deputy prime minister Anne McLellan, who praised carbon capture in a speech last week, also said a carbon tax or cap-and-trade system are not "mutually exclusive" with CCS.

Right now, Alberta charges businesses $15 per tonne of carbon dioxide they put into the atmosphere above their limit (the money goes into a technology fund).

The federal government will likely put a slightly higher price on carbon in the coming months.

According to Carter, the current cost of CCS is between $85 to $100 a tonne.

"There's a big gap there," Carter says.

Enhanced oil recovery may cut costs somewhat, but that still leaves a $25 to $40 gap between simply paying the fine and investing in technologies to save money.

That's where the government's $2-billion development plan comes in.

The July 8 announcement won lots of praise, but was also criticized from both the right (potential boondoggle, government getting in the business of business) and the left (why is government paying private business to clean up their mess?).

The government will issue a request for proposals in the coming months and is hoping for projects that are innovative and fast.

Carter believes the money will help bridge the gap for companies that want to get in the game, but need some help with the initial investment.

"Once we get going here, two things will hopefully happen. One will be to reduce the costs of capture and storage as we learn more about it. And secondly, we'll have a better understanding in Canada and society in general what the price of carbon will be."

Already a number of companies -- including Epcor and a Calgary-based company partly owned by former premier Don Getty -- have expressed interest in applying for money from the fund.

Can we afford to wait for all this?

Carter estimates the five demonstration projects will be up and running by 2015. It sounds like a long time from now, but industry will be pressed to get things done by then.

"These are big capital investments and it takes that long to get them in place," Carter says.

Even if those projects get built, they will only capture and store roughly five million tonnes of carbon dioxide annually, a small fraction of Alberta's overall emissions. It will take decades more before enough CCS is in place to make real greenhouse gas reductions.

The plan simply doesn't reflect the urgency of the problem, says local Greenpeace campaigner Mike Hudema.

"The next 10 years are the critical years," he says.

"Carbon capture is being used more as a greenwashing technique than a way to make real reductions."

Hudema wants more investment in renewable energy and a stronger focus in reducing, not storing, emissions.

But not all environmental groups see things the same way. The Pembina Institute believes CCS is one of many areas the government needs to move on.

"It's not as if we have the luxury of the status quo," Griffiths says.

"We feel that we need to move very, very rapidly on a number of fronts."

Keith believes those who oppose CCS are either using faulty reasoning or haven't decided what they're fighting.

"We have to cut emissions to zero or below zero within 50 years, and if you say you're going to do that only with small renewable and efficiencies, you're effectively saying you're not going to do it," he says.

amclean@thejournal.canwest.com

© The Edmonton Journal 2008

July 25, 2008

Wind: The Power. The Promise. The Business

A partial answer to America's energy crisis is springing up. But the struggle to harness the winds of Kansas shows the difficulty in building an industry that threatens the status quo

Wind evangelist: Pete Ferrell on his 7,000-acre ranch in southeastern Kansas Bob Stefko

by Steve Hamm

Business Week

3 July 2008

It's an ordinary day on Pete Ferrell's 7,000-acre ranch in the Flint Hills of southeastern Kansas. Meaning, it's really windy. When he drives his silver Toyota Tundra out of the canyon where the ranch buildings nestle, the truck rocks from the gusts. Up on top of a ridge, surrounded by a sweeping vista of low hills, rippling grass, and towering wind turbines that make you feel like a mouse scampering underfoot, Ferrell carefully navigates into a spot where the wind won't damage the doors when they're opened. Then he points to an old-style windmill, used for pumping water, which was erected by his father decades earlier when the ranch was in the throes of a drought. "That's the windmill that saved us in the '30s," he explains, his voice growing husky with emotion.

Windmills on the high plains have raised

the ire of prairie preservationists Bob Stefko

Ferrell, 55, is a fourth-generation Kansan who looks the part. He's slim with gray hair, squint-lines, and a cowboy hat. His great-grandfather established Ferrell Ranch on the high plains east of Wichita in 1888, and it has nearly failed several times over the years. Ferrell has held the place together through cattle grazing, oil wells, and, now, wind. He owns the land under 50 of the 100 turbines of the Elk River Wind Project, a 150-megawatt wind farm that opened in 2005.

Ferrell is one of the fathers of Kansas wind farming. He ran through three different developers before getting the operation going on his land. There was stiff opposition to wind farming in the Flint Hills from preservationists concerned about marring the landscape and from politicians tied to the coal industry, but, finally, Ferrell had his way. He now travels the state as an evangelist. "He has been a great spokesman for wind in Kansas," says Mark Lawlor, project manager in the state for Horizon Wind Energy, a wind farm developer. "He has lived off the land, and he's found something new he can tap into."

For centuries, the wind has been the enemy of the farmer. It blows away soil, dries out crops, and the howling makes some people crazy. So it's a twist of fate that wind is now emerging as an ally. Some call the vast American prairie the Saudi Arabia of wind, capable of producing enough electricity to meet the entire country's needs—assuming there's the will to harness it.

Wind power, while still just a speck in America's total energy mix, is no longer some fantasy of the Birkenstock set. In the U.S., more than 25,000 turbines produce 17 gigawatts of electricity-generating capacity, enough to power 4.5 million homes. Total capacity rose 45% last year and is forecast to nearly triple by 2012. Right now, only 1% of the country's electricity comes from wind, but government and industry leaders want to see that share hit 20% by 2030, both to boost the supply of carbon-free energy and to create green-collar jobs.

Such a transformation won't come easily. While much of America's wind energy is in the Midwest, demand for electricity is on the coasts. And the electrical grid, designed decades ago, can't move large quantities of electricity thousands of miles. There's plenty of wind off the coasts, but it's both expensive to harness and controversial; not-in-my-backyard sentiment has slowed some of the most high-profile projects.

Kansas, in the middle of the wind belt, has become a battleground for the wind revolution. Advocates of alternative energy are pitted against defenders of the status quo, which in Kansas means coal. The flash point: a proposal by Sunflower Electric Power to build two 700-megawatt, coal-fired power plants in western Kansas. State regulators denied permits on the basis of CO2 emissions, the Republican-controlled legislature passed bills to overturn the ruling, Democratic Governor Kathleen Sebelius vetoed the bills, and the legislature has narrowly sustained her vetoes. So ferocious is this fight that Sunflower and its allies placed ads in newspapers suggesting that because Sebelius is against their coal project she's playing into the hands of Iranian President Mahmoud Ahmadinejad. The poisoned atmosphere helps explain why Kansas has only 364megawatts of wind power capacity from about 300 turbines, despite having some of the hardest-blowing wind in the country, while Texas produces more than 10 times as much.

ELECTRICITY HIGHWAY

Making matters worse, Kansas has a poor electrical transmission grid. Most of the coal-fired plants are clustered around Kansas City in the east, yet most of the wind energy is on the thinly populated plains to the west. Now, emboldened by Sebelius' interest in wind energy, independent transmission outfits are lining up to build high-capacity lines from the windy west to consumers not only within the state but also beyond its borders. The U.S. Energy Dept., among others, would like to build the equivalent of an interstate highway system for transporting electricity around the country—if it could only find a budget for it.

The part of the project targeting wind alone would cost about $20 billion. Another hang-up: Major new transmission projects take up to four years to get approval from municipalities and state utility authorities. "The process just doesn't work," says Joseph L. Welch, chief executive of ITC Holdings, a Michigan-based transmission company that hopes to build a major line through wind country.

Ferrell, in trying to save his family spread,

became an early advocate of wind farming

Bob Stefko

The struggles to get wind projects going weigh on Ferrell's mind as he drives west on Route 96 through Wichita, Hutchinson, Great Bend, and the smaller towns of Albert, Timken, and Rush Center. Ferrell is on his way to tiny Bazine, a community in Ness County 208 miles from his home, to talk to landowners who have banded together to attract a wind farm developer. This is his new gig. He travels the state advising locals on how to get projects going, sometimes collecting consulting fees from landowners. He also is working with partners who have money to develop his own projects. "I learned my lessons in the Flint Hills. [Wind opponents] beat me up good. Now I know how to get things done," says Ferrell.

In Great Bend, Ferrell passes a gas-fired power plant operated by Sunflower. Running a utility company isn't simple. Since electricity can't be stored cheaply, you have to match supply and demand. Typically, that's done with a combination of low-cost coal and nuclear power, gas plants like this one that can be started quickly, and wind and other alternatives. Wind blows harder at some times than others, so you can't depend on a steady supply—though that may change in a few years if there are enough wind farms in different places.

Coal, for the most part, is a cheaper alternative. It costs Sunflower about 1.5 cents per kilowatt-hour to produce electricity at coal plants, 10 cents to 14 cents in gas plants, and 4.5 cents for the electricity it buys from wind farms. But the economics of energy are changing fast. Coal prices have doubled in a year. And if you compare the costs of coal from new plants with wind energy from new wind farms, taking into account capital costs, they're roughly comparable, according to the National Renewable Energy Laboratory, which is funded by the Energy Dept.

"BATTLEGROUND" FOR THE NATION

Sunflower’'s Watkins has met stiff opposition

trying to build two giant coal plants

Bob Stefko

Still, Sunflower hopes to forge ahead with its new coal plants, with a victory either in the legislature or the courts. Earl Watkins, its chief executive, complains that Kansas didn't have the right to deny permits because CO2 emissions are not specifically cited in the regulations. "It's like being pulled over and ticketed by a policeman for running a stop sign—and there's no stop sign there," he says.

This point will be debated in legislatures and courtrooms across the land over the coming years. "We have become a battleground for the whole nation," says Lieutenant Governor Mark Parkinson, a Democrat, who has spearheaded Kansas' energy initiatives. CO2, which has been linked to global warming, is not covered by most environmental rules. Yet other states are turning down coal plant permits for the same reasons Kansas did. In fact, wind power advocates argue that if the cost to the environment and the economy of CO2 emissions were included when comparing the expense of running coal plants vs. wind farms, wind would be cheaper.

In Bazine, a town with a smattering of houses, Ferrell pulls up in front of the Golden Years Senior Center. It's a single-story metal building on the edge of a cornfield. Inside, he helps rough-handed farmers set up folding chairs, and soon most seats are filled. Ferrell gives a primer on wind. Landowners typically get about $2,000 per turbine per year, but he advises them to stick together to gain negotiating strength on price. Also, they should own a piece of the project, not just collect lease royalties. He adds he'd be willing to develop their project or be a consultant.

Meetings like this are happening all over Kansas. More than a dozen projects are on the drawing board, and a slew of wind farm developers are aggressively mapping out the plains and ridgelines looking for the best locations for turbines. In some cases, they attempt to cut secret deals, giving different landowners different prices. That tends to anger the locals and is why the folks in Ness County decided to unite. "There's a wind rush going on out here," says Terry Antenen, who is one of the organizers. "Instead of being picked off, we're going out and picking our developer." He says he trusts Ferrell for advice more than he would an outsider.

On Ferrell's drive home from Bazine, the night sky is lit up with Kansas fireworks—huge lightning strikes. Thanks to the wind farm fees, he says, he has been paying off mortgages on his land. Now he has tied up with Tom Rinehart, a natural gas entrepreneur, to develop wind farms. In time, he hopes to hand off the Ferrell Ranch to his two children, now in college. And if things go really well, he says, he'll set up a foundation dedicated to community development within the Flint Hills.

HELP FROM WASHINGTON

He's sensitive about prairie protection issues. Some former friends in the Flint Hills who oppose putting turbines there don't speak to him anymore. "It's sad what he's doing," says Susan Barnes, owner of the Grand Central Hotel in Cottonwood Falls. "I'm sure wind helped save his ranch, but there are other ways."

Kansas Governor Sibelius has emerged as a

vocal proponent of wind energy

Chuck France /AP Photo

The era of the small-time wind developer may already be passing, anyway. Ferrell says it's tough to compete with big outfits with economies of scale and easier access to capital. It costs roughly $225 million to build a 150-megawatt wind plant. Horizon, the big wind developer, has 11,000 megawatts of projects in the works and is hoping to add Ness County to the list. A few days after the meeting in Bazine, Ferrell calls Antenen to say he won't bid on the project. There's a shortage of good transmission lines in the area, and it could take several years to upgrade them.

Even the big players need government help to get major wind projects off the ground. Twenty-five states require their utilities to use a percentage of renewable energy, and in all of them, alternative-energy projects rely on the federal government's production tax credit. That expires at the end of this year, so wind advocates are pressing Congress to renew it. In the past, every time it was allowed to expire, wind development plummeted the following year.

It's morning at the Ferrell Ranch. In the house the family built in 1923, Ferrell's mother, 95-year-old Isabelle, sits in the living room while Pete helps her put on support stockings. A tiny woman with a shock of white hair, she says she likes to look at the wind turbines outlined against the blue sky. Her favorite memories, she says, are of riding the range on horseback in the old days with her late husband, Jack. "He'd say we're just stewards of the land," she says. "It's Pete's feeling and mine. You've got to take care of the land."

Hamm is a senior writer for BusinessWeek in New York.

http://www.businessweek.com/magazine/content/08_27/b4091046392398.htm

Is the EU Turning its Back on Biofuels?

'WE NEED MORE RESEARCH'

By Charles Hawley

Der Spiegel

7 July 2008

The storm of critique against biofuels may finally be having some effect. Even as the European Commission remains true to its goal of increasing the use of biofuels, others aren't so sure. The European Parliament is trying to put on the brakes.

In January, the European Union's policy on biofuels seemed clear. By 2020, the European Commission decided, 10 percent of the fuel used by cars and trucks on roads in the EU should come from biofuels and other renewable energy sources. It was a far-reaching plan, hammered out in 2007, that aimed at cutting the emission of harmful greenhouse gases from European exhaust pipes.

Rapeseed in bloom in Germany. The European Union may be considering a move away from biofuels.

Now, though, the European Union may be considering taking its first baby steps away from the once-touted environmental elixir. Over the weekend, French Ecology Minister Jean-Louis Borloo, at an informal meeting in Paris with his colleagues from other EU member states, suddenly remembered that not all of the 10 percent cut needed to come from biofuels.

"We reminded ourselves that the (Climate Action and Renewable Energy Package) also makes reference to powering vehicles with gas, electricity or hydrogen," Borloo said. "Renewable doesn't just mean biofuels."

Jochen Homann, a deputy in Germany's Economics Ministry, went even further. "We have to decide if the quota can be kept," he told reporters. "It might be changed."

At the Doorstep of Biofuels

The apparent shift comes as the storm of criticism against biofuels continues unabated. For months, many environmentalists have been criticizing the fuel -- made from plants and grains grown on farmland -- for providing only a marginal benefit to the environment. The big business of biofuels, say many, encourages farmers in the developing world to cut down rainforests and drain peat bogs, thus destroying areas valuable for their capacity to absorb CO2 from the atmosphere.

Furthermore, biofuels may be significantly contributing to the ongoing dramatic rise in food prices. An internal World Bank report, leaked to the Guardian last week, even claims that up to 75 percent of the rise in food prices can be laid at the doorstep of biofuels.

But is the European Union really considering an about-face? According to Ferran Tarradellas Espuny, the European energy commissioner's spokesperson, nothing has changed. In response to Borloo's sudden epiphany, Espuny told SPIEGEL ONLINE: "We never wanted to focus on biofuels to the exclusion of other technologies." Given the complexity of other technologies -- electric automobiles, hydrogen-powered cars and others -- biofuels is still likely to remain on the top of the list of renewable energies when it comes to vehicles in Europe, he said.

"It is true that we are under a lot of criticism," he went on, "but at this point in time the evidence is not that we should revisit our policy on biofuels."

There are many who would disagree. Environmental groups began attacking the EU commitment to biofuels even before the ink on the January agreement had dried. When one takes into account the fertilizer used for many biofuels crops, the destruction of rainforests and other carbon sinks for biofuel crop plantations and the costs of transport, so goes the argument, biofuels aren't carbon neutral at all, and may even do more harm than traditional fossil fuels do.

Slow Down

Soon, though, it wasn't just environmentalists going after plant power. In April, officials with both the Organization for Economic Trade and Development (OECD) and the European Union's own scientific advisory body told SPIEGEL ONLINE that the EU should reverse its stance on biofuels. United Nations Special Rapporteur for the Right to Food Jean Ziegler, with an eye on food prices soaring worldwide, even blasted biofuels as a "crime against humanity."

But even if the European Commission may not be listening for the moment, the European Parliament certainly is. On Monday evening, the parliament's Committee on the Environment is considering a proposed revision to the EU's biofuels targets. The primary aim of the draft opinion, written by member of parliament Anders Wijkman -- who is also the committee's biofuels expert -- is to encourage the European Commission to slow down on biofuels.

"There are many unknowns," Wijkman told SPIEGEL ONLINE on Monday. "We need more research... I think there is a feeling that what was decided in 2007 was not based on a thorough analysis of the pros and cons. We have to slow down the pace and tread with more caution so as to avoid a clash with food production."

Wijkman and his committee members would like to see a series of intermediate targets. By 2015, he said, the EU-wide fuel mixture should be made up of 4 percent biofuels, and then a major review should be carried out to see if the mixture should be raised.

He also would like to see a more ambitious goal when it comes to the amount of CO2 emissions saved by biofuels as compared with fossil fuels. The European Commission adopted a goal of 35 percent savings whereas Wijkman's parliamentary committee, should his proposal be adopted on Monday evening, would argue in favor of a 45 percent minimum, which would then rise to 60 percent in 2015.

In addition, the committee is looking into a certification program, to ensure that fields repurposed to grow biofuels crops were not just recently carved out of the rainforest. His proposal foresees the EU importing biofuels from developing countries -- primarily, he says, because weather conditions there mean more energy production per hectare -- but tries to ensure that such imports are sustainable.

'Get them Unstuck'

He told SPIEGEL ONLINE that biofuel crops harvested from fields created after the 2005 cut-off date would not be certified. Those currently producing biofuel crops below the 45 percent efficiency minimum would have until 2013 to improve, he said. Should the proposals be adopted on Monday evening, it would not change European policy. It would, however, adjust the European Parliament's position on biofuels when it comes to negotiations with the Commission.

"I am absolutely convinced that biofuels can be done right, but there are a number of factors that have to be looked at," Wijkman, who is an MEP from Sweden, says. "The Council seems to be stuck, and hopefully this will get them unstuck."

Judging from the message being sent by the European Commission, Wijkman is likely to be disappointed. At least when it comes to the recent criticism that biofuels are driving up food prices, spokesman Espuny is clear.

"To reach our 10 percent target, we need 4 million tons of agricultural commodities. Total production of cereals, though, is 2.2 billion tons," he said. "I am not an economist, but if you could tell me how 4 million tons could have a large impact on cereal prices at all, I'd be happy to listen."

http://www.spiegel.de/international/europe/0,1518,564409,00.html

Why the Gulf Is Switching to Coal

OIL PRICE SIDE-EFFECT

By Wolfgang Reuter

Der Spiegel

02-Jul-2008

The Persian Gulf may be sitting atop massive oil reserves. But with prices for crude skyrocketing, it makes more sense to sell it than to burn it. Instead, the Gulf is turning to coal for its energy needs -- to the detriment of the climate.

A coal-fired plant belonging to Evonik Steag in Turkey. The company is currently

expanding in the Gulf.

For Alfred Tacke, CEO of the Essen energy giant Evonik Steag, it's the yellowish-brown pall below that tells him the plane he's on is approaching the Persian Gulf. Beneath the haze, he knows, is Kuwait, which has five large-scale gas- and oil-fired power plants in operation. The power they generate provide around-the-clock electricity for Kuwait's gigantic seawater desalination plants and the country's enormous air-conditioning needs.

"Here, you only need to stick your finger in the sand and you're likely to strike oil or gas," says Tacke, whose energy group ranks fifth among Germany's electricity producers. But Tacke has his own ideas about how to make money in the region. And they center on a different kind of black gold: coal-fired power plants. "We're currently in the process of discussing the conditions for projects of this kind," he says.

As odd as the idea may seem, coal power in the gulf is just one more outcome of skyrocketing oil prices. In a world with dramatically disparate ideas on how or even whether to address the risks of global warming, demand for coal plants across the globe is growing rapidly to the detriment of efforts to increase the production of renewable energies such as solar, hydro and wind.

Nowhere is that demand more paradoxical than in the oil-rich Middle East. At the end of April, for example, the state-owned Oman Oil Company signed a memorandum of understanding with two Korean companies on the construction and operation of several coal-fired power plants. Dubai, for its part, is initially planning to build at least four large facilities with a cumulative output of 4,000 megawatts. Abu Dhabi also wants to get into the act. Even Egypt is thinking of constructing its first coal-fired plant on the shores of the Red Sea.

Two-Hundred More Years of Coal

Other regions in the world are fuelling the trend as well. Oil-rich Russia is planning the construction of more than thirty new coal-fired power plants by 2011. In China a new facility is connected to the grid about once every 10 days. Greenpeace estimates that around five thousand coal-fired power plants will be in operation worldwide by 2030.

The economics behind the coal fad are clear. To produce a megawatt hour of electricity using Australian coal, it costs just €11. Using natural gas, on the other hand, ups that price to €26 while oil-fired power plants swallow up €50.50 per megawatt hour of electricity.

Plus, coal is likely to be available for quite some time to come. Global coal reserves will last an estimated 100 more years and possibly even twice that long. As a result, coal is relatively cheap and in some cases can even be gleaned from open pit mines as in Australia, but also in the US, South Africa, China and Russia. The difference between the prices of natural gas and oil on the one hand, and coal on the other is growing increasingly large.

For the Gulf, the development is turning into a highly lucrative business model. They are currently able to sell their oil at record prices on the global market (currently over $140 a barrel). At the same time, they are able to satisfy their own energy needs at a much lower cost with coal shipped in from overseas.

From an environmental standpoint, of course, this trend is devastating. The Gulf states, first and foremost the United Arab Emirates, are among the world's boom regions. It is predicted that by 2015 the population of Dubai will double to a total of 2.6 million. Per capita energy consumption in the Emirates is six times higher than the global average and a third more than even the US average.

Deserts Devoid of Solar Power

Should coal play a major role in satisfying such a growing energy demand in Dubai and elsewhere, prospects for the global climate are dim. Even a modern anthracite-fired power plant emits 750 grams of CO2 per kilowatt hour of electricity produced, twice as much as a gas-fired power plant and around 50 percent more than an oil-fired power plant. The amount of CO2 emitted by lignite-fired power plants is much greater, further aggravating the greenhouse effect.

The situation is one which shows the limitation of climate protection policies developed and implemented on the national rather than the international level. Germany has committed to reduce its CO2 emissions by 20 percent by 2020 relative to 1990 levels and is striving to achieve double that reduction figure. Many Gulf States, on the other hand, including the United Arab Emirates, are classified as developing countries -- meaning that even though they've ratified the Kyoto Protocol, they have no obligation to reduce their CO2 emissions.

A quick look at the potential of solar power in the region shows the absurdity of this situation. In the sun-baked Gulf, one square meter of solar cells produces at least 2,200 kilowatt hours of electricity per year. In Germany annual output for a square meter is less than half that amount. In the Gulf States, though, solar energy is much too expensive when compared with coal. In contrast to Germany, there are no subsidies for those who invest in solar collectors.

In Germany last year, solar power facilities with an output of 1,300 megawatts were installed. In Saudi Arabia the other Gulf States, it was just 36 megawatts. Even if only a fraction of the solar electricity subsidies available in Germany were available in the Gulf, the positive effect for the global climate would be many times greater.

For the moment, though, there is currently not enough political support for solutions of this kind, neither in the oil-producing countries nor in the industrialized nations. Which means that Alfred Tacke of Evonik Steag is hoping for tidy profits in the future. "The Gulf," he says hopefully, "is a growth region for us."

Translated from the German by Larry Fischer

http://www.spiegel.de/international/business/0,1518,563502,00.html

Skyward oil stokes a coal-fired future

NEIL REYNOLDS

Globe and Mail

July 18, 2008

Der Spiegel, the German newsmagazine, explained earlier this month why the Persian Gulf states are switching to coal. “[They] may be sitting atop massive oil reserves,” the magazine said. “But with prices for crude skyrocketing, it makes more sense to sell it than to use it. Instead, the Gulf states are turning to coal for their own energy needs – to the detriment of the climate.” And these states are not alone. “Demand for coal plants,” the magazine says, “is growing rapidly across the globe.”

Abu Dhabi (largest of the seven UAE emirates) has announced that it will switch to coal-fired power plants. Dubai (the second largest) is already building four of them – with a combined output of 4,000 megawatts – as a first-phase investment in coal. Apart from the United Arab Emirates, Oman (widely regarded as “the next Dubai”) has signed a contract with South Korea for the construction of several coal-fired plants. Beyond the Gulf, Egypt proposes to build its first coal-fired plant on the shores of the Red Sea. Russia has announced plans to build more than 30 coal-fired plants by 2011.

As almost everyone now knows, China connects a new coal-fired plant to its electrical grid every 10 days – and intends to keep doing so for several years. Less known is China's decision to construct a massive coal-fired plant in Inner Mongolia that will convert the region's vast coal reserves into oil. With 10,000 people now engaged in the construction, the plant will be completed by the end of the year. The coal-to-liquid process used by this plant will consume twice as much coal and produce twice the CO{-2} emissions as the simple burning of coal in a conventional power plant.

The Kyoto Protocol, incidentally, classifies the Gulf states as developing countries – meaning that they are under no obligation, oil revenues notwithstanding, to reduce CO{-2} emissions. They have opted for coal for a single compelling reason: cost. They can produce a megawatt-hour of electricity using Australian coal, Der Spiegel calculates, for $17.49 (U.S.). Using natural gas, the cost rises to $41.34. Using oil, the cost rises further to $79.50. At the same time, they can sell their oil on the global market for something approaching (or occasionally exceeding) $140 a barrel.

One of the ironic differences between Germany and the Gulf states, Der Spiegel observes, is the absence of solar energy investment “in the sun-baked Gulf states.” Germany produced 1,300 megawatts from solar installations in 2007; the Gulf states combined produced 36 megawatts. As impressive as its commitment to solar power appears, though, Germany has its work cut out. It has promised to generate most of its electricity by renewable energies (largely wind and solar) by 2020 – when it will phase out its nuclear power. Germany has thus opted for the world's most expensive electrical power even as other countries simultaneously opt for the cheapest.

For an assessment of Germany's chances, check out CanadianEnergyIssues.com, the website of Steve Aplin, the perceptive Ottawa-based energy and environment consultant. “Germany must bring at least 12,000 megawatts of base-load electricity into service by 2020, the year in which the nuclear phase-out will begin,” Mr. Aplin writes. “German politicians are beginning to realize the difficulty, if not the impossibility, of plugging the gap left by the departure of nuclear.”

It appears that German environmentalists are making it harder for the country to reach its aggressive objective – and are driving up the country's CO{-2} emissions, too. Some German Greens are blocking construction of power lines needed to connect wind power to the grid in a bid to prevent despoiling of the countryside. Mr. Aplin notes that emissions from German power generation rose by 12 million tonnes between 2005 and 2007. “In their zeal to admonish the rest of the world,” he says, “German Greens are making sure that their own emissions will continue to rise.”

Other German Greens are championing – you are ready for this, right? – coal. “The more strident of the anti-nuclear politicians in Germany are now advocating new coal and gas plants to ward off a certain electricity supply crisis,” Mr. Aplin says. “Why is coal in this mix? It is cheap and domestically available.”

Cheap, reliable power apparently still has its practical uses – and its political appeal. The Germans are now operating a showcase 40-megawatt solar power plant near Leipzig (which, in its experimental startup phase, will operate as a 24-megawatt plant). But 40 megawatts are a long way from 12,000 megawatts. “Hence,” Mr. Aplin says, “the new enthusiasm [in Germany] for coal and gas.”

The bizarre debate still rages on here and there in the developed countries. What limits on carbon emissions must be imposed? What taxes levied? Two days ago, though, Germany's Finance Ministry issued a remarkably candid public statement. It conceded that Europe's proposals for reductions in greenhouse gases – without the participation of all major contributors worldwide – will be pointless.

Precisely.

http://www.theglobeandmail.com/servlet/story/RTGAM.20080717.wreynolds0718/BNStory/Business/

Suncor's coke solution? Ahoy, Port Alberta

PATRICK BRETHOUR

Globe and Mail

July 25, 2008

PRINCE RUPERT -- The massive pyramids of coal on Prince Rupert's Ridley Island are anonymous, but one has a story to tell.

The coal pile in question belongs to oil sands giant Suncor Energy Inc., which is already shipping a half-million tonnes a year through Prince Rupert to Asian and Mexican ports. Suncor hasn't decided to branch out into the coal mining business. The coal - to be more precise, petroleum coke - comes from its upgrading operations in Fort McMurray, Alta.

Although it looks and feels like coal, petroleum coke is literally the dregs of the (oil) barrel, the leftovers after crude oil and other liquids have been extracted from gooey bitumen. Until recently, petroleum coke has been something only a step above industrial waste: worth little, but a potentially big environmental headache for oil sands firms that are far from any sizable market.

Suncor alone stockpiles three million tonnes of the stuff in a year; it burns a million tonnes to power its upgrading operations, but that amount is not likely to rise because of coke's heavy carbon footprint. So, every year, the stockpile in Fort McMurray grows ever bigger, with just a trickle dribbling out to the West Coast. Without an outlet, the best use of petroleum coke will be as landfill - far from an ideal material, if the seemingly eternal underground coal fires of West Virginia are any guide.

But a confluence of tectonic shifts in the energy market, and a somewhat obscure short-line railway, are radically altering the economics of petroleum coke. Oil sands production, propelled by soaring prices, is on a rocket ride. That will drive up the volume of petroleum coke, particularly at Suncor, which will be producing close to nine million tonnes by 2012, making it one of the largest sources of coal in Canada.

Rising coal prices are key. Even though petroleum coke sells at a discount to thermal coal, its price increased fivefold in the middle part of this decade, and has continued to rise since. What had been a problem for the oil sands could now be transformed into profits - if it can be brought to market.

And that is where Prince Rupert, and a little heralded acquisition by Canadian National Railway Co., come in. Last December, just before Christmas, CN issued a press release detailing its purchase of the line running from Fort McMurray to Boyle, Alta., a dilapidated line bought for a bargain $25-million, plus a vow to spend more than five times that amount on upgrades. Long-term volume guarantees from Suncor, and two other oil sands producers, OPTI Canada Inc. and Nexen Inc., were a cornerstone of that acquisition, according to CN.

By the time Suncor is pumping out nine million tonnes of petroleum coke in 2012, those upgrades will be long completed, opening the path for the export of an enormous volume of petroleum coke from Fort McMurray, through the Rocky Mountains, to Prince Rupert and Ridley Island - and on to Asia. At today's prices, that amount of petroleum coke would top $1-billion a year - even for an oil sands company, that is serious money.

For Don Krusel, chief executive officer of the Prince Rupert Port Authority, the prospect of handling mass volumes of petroleum coke, along with other Prairies commodities, is part of his vision of turning the shipping route in northern B.C. waters into a transit corridor snaking back into the middle of Canada. He's hoping that the upgrades to the port, including the new container ship facility, will shift the mindset in landlocked provinces, opening their eyes to the possibility of Asian exports, and to thinking of Edmonton, Lloydminster and Fort McMurray as part of one export system that leads to the open waters of the Pacific. Mr. Krusel has a phrase that sums up that shift in thinking: Port Alberta.

Petroleum coke is part of Port Alberta. Sulphur - another formerly unwanted byproduct of the oil sands - could be as well, if Ridley Terminals is successful in finally getting its specialized facility up and running. Canpotex's recent announcement that it will build a potash facility on Ridley Island is also part of the picture. Mr. Krusel sees a day, not too far away, when grain, sulphur, even beef and poultry, are flowing from the Prairies through to Asia.

Ahoy, Port Alberta.

July 24, 2008

Natural gas, oil abound in the Arctic, study says

Northern countries vie for control of areas that contain vast deposits

Andrew Mayeda

Canwest News Service

July 24, 2008

OTTAWA -- Nearly a quarter of the world's undiscovered petroleum resources lie in the Arctic, confirms a U.S. study that should only intensify pressure on countries such as Canada to stake their claims to the Far North.

The U.S. Geological Survey has previously offered a rough estimate of the Arctic's vast oil and gas resources. On Wednesday, the state-funded agency released a study that refines its estimates for the entire Arctic region.

According to the new assessment, the Arctic holds an estimated 90 billion barrels of undiscovered oil. That accounts for 13 per cent of the world's total undiscovered reserves. By comparison, the Alberta oilsands are estimated to hold about 173 billion barrels that can be extracted economically.

The Arctic actually appears to be far richer in natural gas than oil. There are about 1,670 trillion cubic feet of natural gas in the Arctic, according to the U.S. assessment. That accounts for about 30 per cent of the world's untapped reserves, and is nearly as much as the proven reserves of the world's most natural-gas endowed country, Russia. Combined, oil and gas account for 22 per cent of the world's undiscovered petroleum resources.

"For a number of reasons, the possibility of oil and gas exploration in the Arctic has become a subject that's much less hypothetical than it once was," said U.S. Geological Survey geologist Don Gautier.

The new assessment comes as Canada jockeys with other Arctic nations to determine how far their national boundaries extend --and who will cash in on the oil and gas that experts expect to become increasingly enticing as climate change accelerates the rate of ice melt.

In a summary of the results, the U.S. Geological Survey says the "extensive Arctic continental shelves may constitute the geographically largest unexplored prospective area for petroleum remaining on Earth."

Under a U.N. treaty called the Convention on the Law of the Sea, countries can claim offshore territory to the edge of their continental shelf.

Canadian scientists have been mapping the seabed in preparation for Canada's claim, which must be submitted by 2013.

Some of the oil and gas deposits are believed to be located in territory under dispute between Canada and its Arctic neighbours.

For example, Canada and the United States disagree over who controls a portion of the Beaufort Sea. According to the new estimate, the biggest undiscovered Arctic oil reserves are off the coast of Alaska.

Imperial Oil, a subsidiary of energy giant Exxon Mobil, has earmarked more than half a billion dollars to explore for offshore petroleum in the Beaufort Sea, and the federal government recently closed a call for bids to explore five more offshore parcels.

Another big potential source of oil and gas are the waters between Greenland and the northeast Canadian Arctic. However, Canada and Denmark have clashed over control of Hans Island, a speck on the map between Greenland and Ellesmere Island.

Because conventional seismic and drilling data is not available, the U.S. Geological Survey used a probability model based on factors such the composition and age of rock samples.

Industry experts believe the price of oil and gas would have to increase considerably before it would be cost-effective to recover much of the Arctic reserves --84 per cent of which are offshore, according to the assessment.

July 23, 2008

Canadian energy policy "Made in USA"

The window may be closing on what's left of Canadian decision-making power over our own energy.

by Linda McQuaig

www.StraightGoods.ca

July 22, 2008

When Americans want something that lies in another country, the consequences for that other country can be severe.

Even if they don't actually invade, they put a lot of pressure on lesser countries to behave as they want.

The future of the oil sands is one of the most important and contentious issues facing Canada.

Canada, for instance, hasn't been invaded by the United States since 1812, but Ottawa has proved highly co-operative with Washington's desire to have access to our oil. We are America's Number 1 supplier.

Pressure for Canadian acquiescence in servicing America's apparently bottomless energy appetite is only going to get more intense, as fresh panic sweeps across America over skyrocketing oil prices and supply insecurity. Oddly, the Bush administration continues to flirt with the idea of making oil supplies even more insecure by launching a military strike against Iran.

All this turns the spotlight ever more on Canada as America's energy dream, nestled conveniently on top of the homeland, far from the roiling waters of the Persian Gulf.

Typical was a commentary on CNN's American Morning last week in which business correspondent Ali Velshi gushed about how Alberta's oil sands have more oil than Saudi Arabia, and most of it goes to the US. Velshi said that if daily oil-sands production were to rise from 1.5 million barrels to 4 or 5 million barrels, that would amount to "about a third of all the oil that the US imports."

He noted that this Canadian treasure trove of oil could service US needs for the next 70 years, possibly the next 150.

As American audiences are increasingly titillated by the idea that the oil sands could solve their energy dilemma, the window may be closing on what's left of Canadian decision-making power over our own energy.

Noticeably absent from the CNN report was any mention of the fact that the oil sands produce extraordinarily large greenhouse gas emissions, and plans to triple current output would be environmentally disastrous.

The future of the oil sands is one of the most important and contentious issues facing Canada, pitting concerns over global warming and the need to meet our international Kyoto obligations against the desire to make huge profits selling oil and to accommodate American interests.

There's an acute need for some sort of coherent national policy to deal with all this, to avert the looming environmental disaster while minimizing regional divisions and tensions with the United States.

Canada's policy vacuum only encourages the Americans to assume they can count on Canadian acquiescence to their energy dreams.

Of course, for years Ottawa has stubbornly refused to develop any sort of national energy policy, after Pierre Trudeau's efforts to increase Canadian energy independence and self-sufficiency were soundly defeated by US oil companies and the Alberta government.

(Trudeau also created a publicly owned oil company in 1975, but unfortunately Petro-Canada was privatized in 1991. Imagine if we had the option as consumers today of directing the exorbitant amounts we're obliged to spend on gas into the public treasury, rather than the coffers of Exxon or Shell.)

Now, with the urgent new realities of global warming, a strong government in Ottawa might have worked up the courage to take another run at developing a national energy policy. Sadly, however, at the helm these days is the Harper government, which clearly won't do anything that might annoy its base in Alberta or Washington.

Actually, the truth is we do have a national energy policy - it's just that Canada isn't the nation that designed it.

Journalist and best-selling author Linda McQuaig has developed a reputation for challenging the establishment. As a reporter for The Globe and Mail, she won a National Newspaper Award in 1989 for writing a series of articles, which sparked a public inquiry into the activities of Ontario political lobbyist Patti Starr, and eventually led to Starr's imprisonment.

In 1991, she was awarded an Atkinson Fellowship for Journalism in Public Policy to study the social welfare systems in Europe and North America.

She is author of seven books on politics and economics - all national bestsellers - including Shooting the Hippo (short-listed for the Governor General's Award for Non-Fiction), The Cult of Impotence, All You Can Eat and It's the Crude, Dude: War, Big Oil and the Fight for the Planet. Her most recent book is Holding the Bully's Coat: Canada and the US Empire.

Since 2002, McQuaig has written an op-ed column for the Toronto Star. This article, which appears here with permission, previously appeared in The Star.

Email: lmcquaig@sympatico.ca

Website: http://www.lindamcquaig.com

http://www.straightgoods.ca/ViewFeature8.cfm?REF=406

Calgary upstart to turn coal into liquid fuel

COMMENT: What kind of bunkum is this? "... the project would produce carbon dioxide that could be used in mature oil fields to increase production." Carbon dioxide rebranded from global warming pariah to a useful byproduct of coal gasification!

Alter NRG plans to build $4.5-billion coal-to-liquids plant that would produce 40,000 barrels a day of fuel by 2014

NORVAL SCOTT

Globe and Mail

July 23, 2008

CALGARY - For most energy companies, figuring how to best turn Alberta's vast oil sands into lucrative gasoline is challenging enough. But Alter NRG Corp. is looking to go one better.

The Calgary-based upstart said yesterday that it's seeking to develop a project in Alberta that would turn coal into liquid petroleum fuels. The $4.5-billion plant, which will produce 40,000 barrels a day of fuel by 2014, would be the first of its kind in Canada.

"Local market conditions make producing diesel and naphtha [from coal] most attractive," Alter NRG chief executive officer Mark Montemurro said in an interview. "We'd be producing a very high-quality product."

Alter NRG, which is listed on the TSX Venture Exchange, plans to build its plant at the coal reserves it owns near Fox Creek, northwest of Edmonton.

In addition to producing diesel and naphtha - a heavy oil product used for paving roads, as well as for diluting bitumen from the oil sands - the project would produce carbon dioxide that could be used in mature oil fields to increase production.

Turning coal into liquid fuel is a technology that was first developed in the 1920s, and was used by coal-rich Germany to produce synthetic diesel during the Second World War.

South Africa, shunned during its apartheid years by potential trading partners, has also long used coal-to-liquids methods (CTL) to produce domestic fuel.

Although the technology, which involves gasifying the coal and then turning that product into a liquid, produces both a low level of emissions and a product that's effectively sulphur-free, the capital costs of development are expensive.

Each flowing barrel of CTL production would cost Alter NRG $110,000 to bring on stream, an amount comparable to the most expensive oil sands projects.

While Mr. Montemurro acknowledged that the upfront construction costs are steep, the operating costs of the CTL plant would be one-quarter of an oil sands mine and upgrader, creating a project with strong cash flows, he said, adding that the company expects to make announcements on operating and financial partners later this year.

ALTER NRG CORP. (NRG) Close: $4.68, up 29Ct

www.theglobeandmail.com

www.alternrg.ca

July 22, 2008

Unimak Pass rescue vessels far in future

SPILLS: First comes a study of ways to cut risks.

By ELIZABETH BLUEMINK

Anchorage Daily News

July 18, 2008

Click here for larger map

Ship traffic through the Aleutian Islands is growing significantly and, along with it, the risk of accidents, according to a scientific report published Thursday.

Carrying cargo from Toyotas to sneakers, thousands of ships pass through the remote, stormy archipelago each year, transiting the Great Circle shipping route between Asian and U.S. ports.

The traffic through Unimak Pass, a 28-mile-long corridor through the Aleutian chain, is roughly double the amount of vessel traffic to all Alaska ports combined, according to the 185-page report, published by the Washington, D.C.-based Transportation Research Board, an arm of the National Research Council.

Unlike the boats that arrive in Alaska ports, many of the ships traveling through the Aleutians are minimally regulated. In recent years, thousands of gallons of fuel have spilled near Unalaska Island, one of the country's top seafood ports, the report said.

In 20 years of Aleutian spills, almost no oil has been recovered, and in many cases, bad weather and other problems have prevented any response at all, according to the report.

Federal and state decisions about big steps that might be taken to reduce harm from a shipping accident or spill in the Aleutians are some years off. The report published Thursday is a precursor to a two-year, joint state and federal study of how to reduce those risks.

That seems like too long for some people who live in the region.

"I have some impatience," said Pete Hendrickson, an Unalaska fisherman who says he lost fishing time due to the massive fuel oil spill from a Malaysian cargo ship that broke apart near the island in 2004.

The Selendang Ayu accident led to six deaths when a Coast Guard rescue helicopter went down. Fuel from the ship contaminated 34 miles of beach and cost roughly $100 million to clean up.

Last March, Hendrickson said, he and other Unalaska residents were petrified when a 443-foot freighter, the Spanish-flagged Salica Frigo, temporarily lost power and drifted within 500 yards of Unalaska Island.

"We need to get something in place so we don't lose another ship," he said.

Rick Steiner, a marine activist and University of Alaska Anchorage professor, spoke at a meeting held Thursday in downtown Anchorage to present the report's findings to the public.

Government officials need to deploy an "interim" rescue tug in the Aleutians now, instead of waiting for the end of the study, Steiner said.

If it takes five years to fund any rescue vessels, there will be "40,000 possible disasters out there," he said.

"We understand the sense of urgency," said Keith Michel, one of the authors of the report.

He said deploying a rescue tug requires an extensive review -- what kind and how big a tug, for example. "We were not prepared to make a recommendation on that," he said.

"I think everyone would like to have a rescue tug out there," said Gary Folley, an on-scene spill coordinator for the Alaska Department of Environmental Conservation.

Yet rescue tugs are costly to operate and funding is a sticking point, according to Coast Guard officials at Thursday's meeting.

A rescue tug recently deployed to the Juan de Fuca Strait in Washington state has a $3 million annual budget, said Coast Guard Cmdr. James Robertson, the 17th District's Juneau-based chief of inspections and investigations.

A rescue tug deployed in the remote Aleutians could cost three times that amount, Robertson said.

The Coast Guard is not closed to the idea of deploying a rescue tug, he added. The study will figure out the pros and cons, he said.

The report suggested that the Coast Guard and the state should investigate funding levels for a rescue tug stationed in the Aleutian chain while the two-year study is in progress.

The $3 million study will begin this year. State and federal officials said Thursday they soon will start appointing people to serve on the study's advisory panel.

The study is being paid for by the operator of the Selendang Ayu as part of its $10 million plea agreement in federal court in 2007.

Find Elizabeth Bluemink online at adn.com/contact/ebluemink or call 257-4317.

July 16, 2008

Matt Simmons and the Five Psychological Stage of Grief

CNBC Fast Money

June 30, 2008

Watch the Fast Money show on YouTube

http://www.youtube.com/watch?v=rkzETN8qfzw

This is a wonderful clip. Matt Simmons is the author of ‘Twighlight in the Desert’, is a leading US investment banker, and a long-term advocate of the peak oil argument. When he was asked to go on CNBC’s ‘Fast Money’ to discuss the high oil prices, he clearly stunned the presenters with his forthright analysis of society’s current perilous situation. When asked if $147 a barrel is a ‘wake up call’ he replied “yes, but we’re not having a wake up call, we’re having a witch hunt for who got us here”, a succinct analysis of the current world situation. What was especially fascinating to watch was when he was asked for his prognosis of the near future.

The nub of his argument is that oil is still actually very cheap, and that the biggest danger the world faces at the moment is those people who argue that the current high prices are a blip, a bubble, a speculators spike. When asked for his scenario of the next year or two, he replied that the US would keep dropping its inventories (of oil) and feeling good about it, which would be followed by a shortage, which would, in turn, lead to “a run on the banks so fast your eyes would spin. This is when everyone tops up their tank. We haven’t run out of oil, but we could literally run out of usable diesel and gasoline and then we would have the Great American Disaster, because within a week we’d have run out of food”.

At this point the looks on the faces of the presenters is priceless. Yet Simmons isn’t finished yet. What can we do now, he is asked. We need to retreat from our oil addiction, “start living in villages again, eliminate long distance communiting by liberating the workforce and paying by productivity and growing food locally, and starting to embrace an enormous amount of R&D into things we’re not really doing anything about today, likek ocean energy, geothermal, then within 5-7 we could get ourselves out of a very deep hole, but we have to do it real quick”.

The programme’s oil analyst then quickly goes straight off back into business-as-usual, and the discomfort evident in those in the studio subsides. In Richard Heinberg’s ‘Peak Everything’, he cites Elizabeth Kubler-Ross’s five psychological stages people go through when told they have a terminal illness, denial, anger, bargaining, depression, acceptance. I am increasingly finding these a useful scale by which to measure where people are at in the peak oil debate. While Simmons appears to have moved, in this piece, to acceptance, the presenters are still in the bargaining phase, as if we can somehow haggle and trade our way out of this.

When I look around at UK society today, we see the denial about peak oil in the tabloids arguing that high oil prices are all the governments fault, and in the conspiracy loons who argue there is still hundreds of years worth of supplies which some mythical ‘they’ are hiding from us, the anger in the striking hauliers and other fuel protesters, the denial in government circles who still argue that oil will cost $67 a barrel in 2020, the bargaining in the debates around the 2p duty on fuel, the depression about it seems to be pretty common in writers on the subject, and then the acceptance, which I guess is what Transition work is trying to do, to look at the practicalities of where to go once people accept what is happening. It is fascinating to see what happens as people move through these stages, and I see lots of people moving through them quite quickly these days!

What is so fascinating about this clip, is that it is somehow a microcosm of what happens when people in denial and in bargaining meet someone from the acceptance stage. Now all we need is for Simmons (and others) to really integrate climate change into his thinking, and then that acceptance would be even more powerful! These exchanges are happening more and more these days, and what is important, I think, is not to take any of these 5 stages as being somehow superior to any of the others, there is no moral high ground here, rather they are all perfectly natural responses to a bewildering situation, although ultimately, the faster we can move towards acceptance, the faster we can actually start in earnest our preparations for life after oil.

http://transitionculture.org/2008/07/15/matt-simmons-and-the-five-psychological-stage-of-grief/

Undersea volcanic rocks offer vast repository for GHGs

Public Release

Earth Institute at Columbia University

14-Jul-2008

Drilling, experiments, target huge formations off West Coast

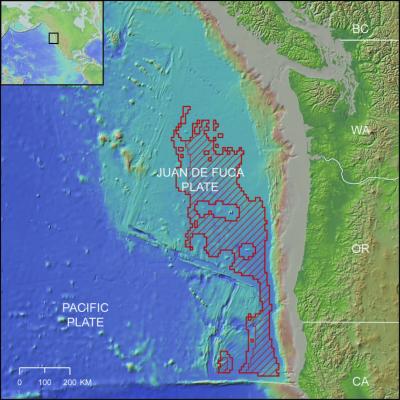

Deep-sea basalt region for CO2 burial. Red outline shows where water depth

exceeds 2,700 meters and sediment thickness exceeds 200 meters; hatched

areas show where sediment thickness exceeds 300 meters....

Palisades, N.Y., July 14, 2008—A group of scientists has used deep ocean-floor drilling and experiments to show that volcanic rocks off the West Coast and elsewhere might be used to securely imprison huge amounts of globe-warming carbon dioxide captured from power plants or other sources. In particular, they say that natural chemical reactions under 78,000 square kilometers (30,000 square miles) of ocean floor off California, Oregon, Washington and British Columbia could lock in as much as 150 years of U.S. CO2 production. The findings are published today in the Proceedings of the National Academy of Sciences.

Interest in so-called carbon sequestration is growing worldwide. However, no large-scale projects are yet off the ground, and other geological settings could be problematic. For instance, the petroleum industry has been pumping CO2 into voids left by old oil wells on a small scale, but some fear that these might eventually leak, putting gas back into the air and possibly endangering people nearby.

Basalts on seafloor near Juan de Fuca Ridge. Image shows about 3 by 4.5 feet.

Lead author David Goldberg, a geophysicist at Columbia University's Lamont-Doherty Earth Observatory, called the study "the first good evidence that this kind of carbon burial is feasible."

"We are convinced that the sub-ocean floor is a significant part of the solution to the global climate problem," said Goldberg. "Basalt reservoirs are understudied. They are immense, accessible and well sealed--a huge prize in the search for viable options." One of the main advantages, he said, is a chemical process between basalt and pumped-in CO2 that would convert the carbon into a solid mineral.

In their paper, Goldberg and his colleagues Taro Takahashi and Angela Slagle used previous deep-ocean drilling studies of the Juan de Fuca plate, some 100 miles off the Pacific coast, to chart a vast basalt formation that they say could be suitable for such pumping. Basalt, the basic stuff of the ocean floors, is hardened lava erupted from undersea fissures and volcanoes. In this region, much of it lies under some 2,700 meters (8,850 feet) of water, and 200 meters (650 feet) or more of overlying fine-grained sediment. Drilling by the Integrated Ocean Drilling Program has shown the rock is honeycombed with watery channels and pores that would provide room for pressurized CO2. The scientists have mapped out specific areas that they say are isolated from earthquakes, hydrothermal vents or other factors that might upset the system.

Ongoing experiments by Lamont scientists on land have shown that when CO2 is combined with basalt, the gas and components of the rock naturally react to create a solid carbonate—basically, chalk. Later this year, a separate team headed by Lamont geochemist Juerg Matter will begin pumping CO2 into a landbound basalt formation at a power plant near Reykjavik, Iceland—the first such large-scale demonstration. Basalts lie at or near the surfaces of other land areas including the northeast United States; the Caribbean; north and south Africa; and southeast Asia.

Goldberg says that undersea basalts, which are widespread, may be bigger, and better, than ones on land. At the depths studied, any CO2 that does not react with the rock will be heavier than seawater, and thus unable to rise. And in places like the Juan de Fuca, even if some did escape the rock, it would hit the overlying impermeable cap of clayey sediment.

Skeptics point out that getting the CO2 to such sites could be expensive and tricky. But Goldberg says the West Coast formations should be close enough to the land for delivery by pipelines or tankers. He called on government to study the details of how the idea might work, and whether it would be economically feasible. The United States currently spends about $40 million a year studying carbon sequestration, but nearly all of that goes to land-based research. "Forty million is about the opening-day box office for Finding Nemo," said Goldberg. We need policy change now, to energize research beyond our coastlines."

###

Art or advance copies of the paper, "Carbon dioxide sequestration in deep-sea basalt," are available from the authors, PNAS, or The Earth Institute. It is now downloadable as an Earth Institute Open Access Article, from here.

Authors: David Goldberg (lead) Goldberg@ldeo.columbia.edu 845-365-8674

Taro Takahashi taka@ldeo.columbia.edu 845-365-8537

Angela Slagle aslagle@ldeo.colubmia.edu 845-365-8339

Earth Institute press office: Kevin Krajick kkrajick@ei.columbia.edu

212-854-9729 Mobile: 917-361-7766

PNAS press office: pnasnews@nas.edu 202-334-1310

The Earth Institute at Columbia University mobilizes the sciences, education and public policy to achieve a sustainable earth. Through interdisciplinary research among more than 500 scientists in diverse fields, it is adding to the knowledge necessary for addressing the challenges of the 21st century and beyond. With over two dozen associated degree curricula and a vibrant fellowship program, the Earth Institute is educating new leaders to become professionals and scholars in the growing field of sustainable development. We work alongside governments, businesses, nonprofit organizations and individuals to devise innovative strategies to protect the future of our planet. Lamont-Doherty Earth Observatory, a member of The Earth Institute, is one of the world's leading research centers seeking fundamental knowledge about the origin, evolution and future of the natural world. More than 300 research scientists study the planet from its deepest interior to the outer reaches of its atmosphere, on every continent and in every ocean. From global climate change to earthquakes, volcanoes, nonrenewable resources, environmental hazards and beyond, Observatory scientists provide a rational basis for the difficult choices facing humankind in the planet's stewardship.

http://www.eurekalert.org/pub_releases/2008-07/teia-uvr071108.php

Scientists tout Pacific floor for massive carbon capture project

Margaret Munro

Canwest News Service

Monday, July 14, 2008

Vast amounts of greenhouse gases could be stashed under the ocean floor from British Columbia to California say scientists, who have ambitious plans to start testing deep-sea disposal.

The geological formations off the Pacific Northwest coast "offer promising locations to securely accommodate more than a century of future U.S. emissions," the team, led by geophysicist David Goldberg at Columbia University, reported Monday in the U.S. Proceedings of the National Academy of Sciences. [Download report here]

The researchers hope to begin a pilot project as early as next year injecting liquefied carbon dioxide below the ocean floor, Goldberg said in an interview. He says the project, which would cost about $50 million, still needs to be approved by U.S. National Science Foundation and the Integrated Ocean Drilling Program.

A handout graphic shows the location of undersea

volcanic rocks which scientists say could be used

as a vast repository for greenhouse gases.

They would pump the CO2 into test wells on the Juan De Fuca Plate, an enormous basalt formation that runs from Vancouver Island to California about 150 kilometres off shore. The researchers say the plate, made of hardened lava, is honeycombed with watery channels and pores that could hold plenty of pressurized CO2.

While the region is famous for earthquakes and seismic activity, Goldberg and his colleagues have mapped out a 68,000-square-kilometre area they say would be isolated from quakes, hydro thermal vents or other factors that might upset a CO2 storage system. The region is in international waters, just south of B.C. and off the coast of Washington, Oregon and California.

"It is very large and very secure," says Goldberg, noting that "big solutions" are needed for the planet's greenhouse gas emission problems.

The proposed disposal area is in under more than two kilometres of seawater and more than 200 metres of clayey sea floor sediments. Both the water and the sediments would help keep the CO2 in place even in the event of a massive quake, says Goldberg.

Deep ocean drilling experiments have revealed spots around the globe, that might be used to "securely imprison" carbon dioxide captured from power plants or other sources. The potential storage capacity is huge, say Goldberg and his colleagues, who estimate that Juan de Fuca formation "could lock in as much as 150 years of U.S. CO2 production."

The big attraction is that over time the CO2 would become locked into the rock. This is because CO2 and basalt naturally react to create a solid carbonate, which Goldberg says is "basically chalk."

Part of the pilot project would be to assess how long it would take CO2 to react with the rocks - a process that might take anywhere from "decades to a century," he says.

There is plenty of talk about carbon capture and sequestration, but no large-scale projects are yet off the ground because of the cost, technical challenges, and environmental concerns.

Goldberg says the deep-ocean disposal has some clear advantages over plans, popular in Canada, to pump CO2 into old oil wells. There is concern that the CO2 might eventually leak out and drift into the atmosphere.

Goldberg says while ocean disposal would be more expensive, the advantage is that the carbon would eventually be locked up as a solid compound.

While "convinced" sub-ocean disposal can be a significant part of climate change solution, Goldberg says it will take several years to evaluate the feasibility. The proposed pilot would entail pumping a few thousands tonnes of liquefied CO2 into wells that have been previously drilled in the Juan de Fuca plate. Then the researchers would monitor the CO2 and how quickly it reacts with the basalt.

Goldberg team says the West Coast formations should be close enough to the land for delivery by pipelines or tankers.

© Canwest News Service 2008

July 10, 2008

Alberta Pledges $2 Billion For CCS

By Paul Wells

Nickle's Daily Oil Bulletin

10 July 2008

The Alberta government will ante up $2 billion for three to five large-scale carbon capture and storage (CCS) projects that it says will store up to five million tonnes of cabon dioxide (CO2) by 2015 -- a move lauded by industry.

"With this announcement we will continue to demonstrate leadership and encourage the federal government and Alberta industries to make real investments in carbon capture and storage (CCS)," Premier Ed Stelmach said in a statement.

With the potential to reduce emissions at facilities such as coal-fired electricity plants and oilsands extraction sites and upgraders, the $2-billion fund will support CCS projects that are expected to reduce emissions by up to five million tonnes annually."

Dave Pryce, vice-president of Western Canada operations for the Canadian Association of Petroleum Producers (CAPP), says the funding will spur on industry investment for CCS.

"Absolutely, I'm sure it will. It's a significant amount and I don't think we've seen any government come across with a strategy that's this large in dollars," he said.

"I think it's a significant signal of (the province's) commitment. They've now gone down the path, they've put a process in place to engage industry to go forward on this and it's intended to bring investment into putting steel in the ground. It's for project development."

Stephen Kaufman, a Suncor Energy Inc. official and chair of the industry-led Integrated CO2 Network (ICO2N), said the province's financial pledge is a "very positive signal."

"We think it shows the leadership in helping to deploy the early stage CCS projects," he said.

"The ICO2N group has indicated all along that CCS is not going to be able to proceed strictly on a market-based approach and that an approach that includes a partnership with government and industry is going to be needed to get initial projects up and running."

Steve Snyder, TransAlta Corporation's president and chief executive officer, also applauded the province's funding announcement, saying CCS is vital if Canada is to achieve its goal of reducing carbon emissions by 20% from current levels by 2020.

"CCS has the potential to contribute to Canada's economic prosperity and dramatically reduce our environmental footprint at the same time," he said.

"Given its thermal assets, storage potential and access to world leading energy expertise, Alberta is an ideal location to demonstrate the benefits of this technology, which can then be applied elsewhere in Canada, the U.S. and around the world."

Longer term, Alberta's new climate change plan targets a 200 megatonne reduction (from business as usual forecasts) in greenhouse gas emissions by 2050, or 14% below actual 2005 levels. The province said CCS will account for 70% of the total.

The provincial announcement virtually mirrors the recommendations made by the joint federal-provincial ecoEnergy Carbon Capture and Storage Task Force in a report released in January of this year.

"The report (laid) out a pathway to move CCS from talk to action. It shows how industry and government could work together to get several large CCS facilities operational by 2015, cutting emissions by five million tonnes per year at a cost of about $2 billion," said David Keith, the University of Calgary's Canada Research Chair on Energy and the Environment and the only academic on the task force.

"Investment in CCS now is vital to ensure Canada has the option of using CCS to make the very large absolute emissions reductions required over the coming decades," he added.