Oregon exceptionally generous with green-energy subsidies

COMMENT: European countries are ahead of the pack in encouraging renewable energy. They are doing it for two reasons - to reduce their dependency on coal fired generation and other fossil fuels, and to establish industries so that they become global leaders. Denmark is notable in this respect with wind energy. The UK is doing it with wave and tidal energy.

BC has missed the boat completely. The consequence of BC's clean energy policies has been to drive investment into small hydro and biomass, where the technologies are mature and there is no opportunity to become a manufacturer or technology leader.

The few wind projects in BC are too little, too late. There might have been an opportunity in 2000, when the GSX Pipeline and gas-fired generation were the sorry best that could come out of the cloistered musty minds in BC Hydro and the BC Government.

There still may be an opportunity with tidal and wave energy, but without policy and fiscal encouragement (read, feed-in tariffs), any development of these awesome energy resources, will similarly leave BC a consumer of technologies and knowledge developed elsewhere, most likely the UK, instead of a global leader.

Some places in North America get it. In the US, Oregon is something of a leader, as this article describes (with caveats). In Canada, Nova Scotia is establishing itself with tidal energy.

There is no indication that the BC government appreciates the opportunities that exist, or has any interest in developing them. With its head lost in Pacific Gateway transportation infrastructure and the 2010 Olympic party, the BC government reveals itself to be lost in the thinking of yesterday.

Rivers of Riches, from the January-February 2007 Watershed Sentinel (on small hydro)

Here Be Dragons, from the June-July 2008 Watershed Sentinel (on tide and wave energy)

by Harry Esteve

The Oregonian

Friday January 02, 2009

Klondike Wind Power spins electricity from its north-central Oregon turbines, which stand 214 feet tall and have 120-foot-long blades. The company receives an $11 million energy tax credit from the state. (MARV BONDAROWICZ/THE OREGONIAN/2003) |

Oregon taxpayers are shelling out tens of millions of dollars to subsidize green energy projects, making the state a magnet for solar and wind companies.

But an investigation by The Oregonian shows that the money also is going to risky ventures with questionable environmental benefits and to prosperous companies that need no incentives but are cashing in anyway.

When the Legislature convenes next week, Gov. Ted Kulongoski will call on lawmakers to raise taxes and fees as the state plunges deeper into recession.

At the same time, he will push to expand tax breaks for businesses -- tax breaks that will cost the state at least $140 million over the next two years, a cost he says is necessary to make Oregon a sustainability model for the nation.

The governor likes to credit these subsidies for luring SolarWorld to develop a $440 million factory in Hillsboro. But records show that the state also has given away millions to keep long-haul truckers comfortable in their cabs overnight without running their diesel engines, to timber companies for wood-burning steam boilers, to buy bus passes for well-paid employees at Nike and the city of Portland, to build a state-of-the-art bicycle garage for a Hillsboro sportswear company and to help a car rental company add hybrids to its Portland fleet.

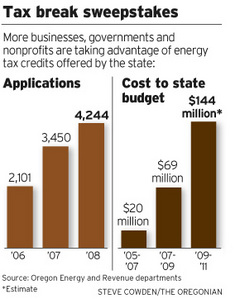

The handouts come from Oregon's Business Energy Tax Credit program -- the state's fastest growing tax shelter. The credits are so easy to obtain that more than 4,000 applicants have lined up to get them whether they need them or not. Klondike Wind Farms, for example, seeks $44 million in state tax breaks even though eastern Oregon's wind-blown geography has proved a profitable turbine location, subsidies or no.

"It's gotten out of hand," says Chuck Sheketoff, director of the Oregon Center for Public Policy, which studies the impact of state tax policies on low-income residents. "It's being scammed. It's not serving its purpose."

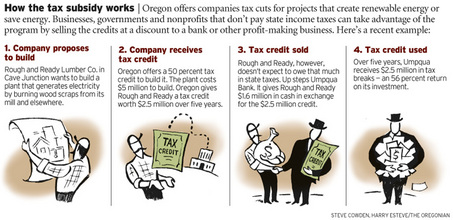

Even banks and big corporations that have nothing to do with renewable energy are grabbing the tax breaks. Under the state's generous incentives, groups and companies that qualify for tax credits can turn around and sell them. Most do. Standard Insurance, for example, paid $2.5 million to Flakeboard, an Albany mill that makes composite wood. In exchange, Standard gets to use $3.5 million in tax credits the mill received for building a wood-burning boiler that can generate electricity.

Lawmakers alarmed

The energy credit is just one of hundreds of tax breaks allowed by Oregon -- a list that includes popular deductions such as home mortgages and medical expenses for the elderly. Unlike tax deductions, however, tax credits are far more attractive because they directly reduce a tax bill -- every dollar of credit is a dollar saved on taxes.

Rapid growth in the amount and size of the tax credits has alarmed some lawmakers and advocacy groups that see the state reducing services to the poor while handing out huge sums to often wealthy businesses. Furthermore, they say, the state is using its precious general fund dollars to pay private companies for projects that help them make a bigger profit.

|

"My concern is, it's going to be loved to death," says state Sen. Ginny Burdick, D-Portland, who chairs the Senate Revenue Committee. "Are we getting our money's worth as taxpayers? Or are we simply doling out money to people who would be doing what they're doing anyway?"

A case in point is Enterprise Rent-A-Car, the St. Louis-based chain that has shifted large numbers of its rental fleet to hybrids. Enterprise has received more than $100,000 in Oregon tax credits, mostly for new Toyota Priuses, which run on a combination of electricity and gasoline.

Yet the company would have bought the cars even without the tax credit, says Meghan Maguire, an Enterprise spokeswoman.

"We buy hybrids because it's a reaction to customer demand," Maguire said. "It's a nice thing that (the tax credits) are available, but it certainly doesn't impact our decision to buy hybrids."

Oregon is generous

Oregon's energy credits are uniquely generous and simple to get.

Zipcar, a car-sharing company based in Cambridge, Mass., received approval for $1.7 million in Oregon tax credits simply for doing what it does -- offering use of cars for a monthly or hourly fee. Zipcar offers its service in at least 10 other states, none of which give it the kind of tax breaks that Oregon does.

"That's money we're not putting to children," says Jody Wiser of Tax Fairness Oregon, a group that looks at how state tax dollars get divvied up. "That's money we're not using for health care."

Kulongoski, however, remains a big believer in the program. He argues it has brought hundreds of jobs to the state and kick-started the green energy industry. In fact, he wants to offer even more lucrative tax breaks to companies that construct energy-efficient buildings.

"It's about moving to a greener, cleaner economy," said Kulongoski's spokeswoman, Anna Richter Taylor. "Any time you have a tax incentive program, there's always going to be a debate about what's the best use of public dollars."

In some cases, however, Oregon energy tax credits have been used as startup money for projects that aren't proven energy savers. One is Reklaim Technologies, a Bellevue, Wash., company that erected a tire recycling plant in Boardman.

Reklaim got $3.4 million in tax credits from Oregon. The company says the plant will extract usable oil from the tires and sell it as industrial grade fuel.

The problem, says Michael Blumenthal, a national expert on scrap tires, is that the process Reklaim plans to use, called pyrolysis, has never been proved as an economically viable way to recycle tires. It is possible to get oil from the tires, but it is prohibitively expensive, and the markets for the end products often aren't there, he says.

"The road is littered with the carnage of previous companies that have tried it and the investors who have gone down with them," says Blumenthal, a vice president of the Rubber Manufacturers Association in Washington, D.C.

Renee Gastineau, a spokeswoman for Reklaim, says the company studied past failures "and made modifications. There's always someone who can come along and find a better process, and that's what Reklaim is doing."

Construction ended last summer. Initially, company officials said the plant would be operational in October and capable of processing 5.5 million tires a year. Now, the company says the plant won't be up and running until after March.

Push from Kulongoski

Oregon's energy tax credits began as a small, targeted program aimed at conservation and efficiency. It kicked into high gear after the 2007 legislative session, when Kulongoski pushed for some of the biggest tax breaks offered anywhere in the nation.

Under the 2007 rules, companies could apply for up to 50 percent of the cost of the project, up to a limit of $20 million, as long as they could show the project would save energy or produce renewable energy or fuel alternatives.

The governor saw what he considered to be two golden opportunities. One, green tech companies would move to Oregon to take advantage of the tax savings, bringing jobs with them. And two, the state would make progress on its goal of drawing 25 percent of its energy from renewable sources by 2025.

|

At the time, state officials projected the changes would add $2 million to a projected $23 million hit on the state's two-year budget. They were wrong. Less than two years later, the program is costing taxpayers $78 million. And that figure easily could triple again. State records show more than 4,400 applications pending for the credits, for projects worth $716 million.

To give an indication of the program's attraction, one of the world's most successful solar companies, Maryland-based Sun Edison, recently applied for $14 million in tax breaks to build more than 50 plants, mostly in the Portland area.

"The governor went into the program with his eyes open," says Lynn Frank, former director of the state Department of Energy, which oversees the credits. "The program has been very successful in bringing renewable resource manufacturing plants to Oregon."

Unnecessary break

Even bicycles get tax breaks.

Susan Otcenas, owner of Team Estrogen, a company that makes athletic wear for women, used the tax credits to help pay for construction of what she considers Oregon's nicest bicycle parking facility at the company's Hillsboro plant. It features lockers, places to hang bikes, heat and other comforts for employees who bike to work.

The tax credits helped, she says, but "yeah, we would have done it anyway. I hate to say that."

Burdick, the Senate Revenue chairwoman, says the Legislature may consider capping the amount of money that can be spent on the tax credits. Her counterpart in the House, Rep. Phil Barnhart, says he needs more facts about how the program has operated.

So far, Barnhart says, the credits have helped bring needed commerce to Oregon, but that doesn't mean all the credits make sense.

"Lately, questions have been raised about subsidies for wind power," says the Eugene Democrat. "Is it at the stage now where it no longer needs a subsidy? I don't know the answer to that. Those are the kinds of questions we'll be asking."

-- Harry Esteve: harryesteve@news.oregonian.com

www.oregonlive.com/politics