Will the Electric Car Ever Make It to the Mass Market?

By Christian Wüst

Der Spiegel

September 16, 2009

From internal combustion to electric (Der Spiegel) |

Part 1: Will the Electric Car Ever Make It to the Mass Market?

Not Much Will to Power

Germany's automakers are proudly showing off their concept electric cars at the Frankfurt motor show, which opens to the public Thursday. But the shiny new designs on display are just a pipe dream. It's still not clear when, or even if, viable electric cars will make it onto the mass market.

Amid widespread concerns about global warming, it's practically official policy at the European Commission these days to see electricity consumption as a sin. The bureaucrats in Brussels have recently gone so far as to ban the production of 100-watt incandescent light bulbs.

So far, however, there have been no limits set on a much bigger consumer of electricity -- the automobile. When the 63rd International Motor Show (IAA) opens to the public this Thursday in Frankfurt, visitors can check out designs for electric cars whose power rating will exceed that of the banned bulb by a factor of many thousands.

Mercedes-Benz will be showing a 392-kilowatt concept electric sports car, while Audi is presenting a similarly powerful electric version of its top-of-the-range R8 model. BMW will demonstrate alternative engine systems with its "Vision Efficient Dynamics," a hybrid composed of a three-cylinder diesel engine flanked by two electric motors, which is supposed to have a top speed of 250 kilometers per hour (155 miles per hour). "Economizing is getting sexy!" is the verdict of the German car magazine Auto Bild.

But before environmental organizations show up to point out the real carbon footprint of such energy guzzlers, the manufacturers would do well to point out an important fact up front, namely that such high horsepower electric cars are not market-ready, and not a serious option even in the long run. Even the best batteries would run out within a few minutes of being driven at full power.

Pure Fantasy

And so the first IAA to take place in the age of the electric car proves one thing above all -- that giving up gasoline, which can still provide energy in abundance, won't be easy. The desire to create similarly powerful engines using electricity is, for the time being, pure fantasy.

Nonetheless, a conviction seems to have spread throughout the industry that there will be a mass market for electric cars, and that it will probably happen in the decade between 2020 and 2030. Developers estimate that by then storage capacity will have increased two- or three-fold. That could be enough, at least for a car with a small engine.

Electrochemical parameters still set rather narrow limits on the potential of electric cars. The best lithium-ion batteries currently weigh slightly less than 10 kilograms (22 pounds) per kilowatt hour. The first small-series production cars, such as those from Smart or Mitsubishi, have a capacity of 16 to 20 kilowatt hours. That's the equivalent of the energy content of about two liters (0.5 gallons) of gas.

Manufacturers calculate this can provide a driving distance of 100 kilometers (62 miles) or more. But these consumption measurements use extremely slow standard driving cycles as their basis -- the ideal conditions for an electric motor.

Short Range

In practice, these figures could shrink by as much as half when higher speed driving is combined with further sources of energy consumption such as heating or air conditioning. And who wants to buy a car whose range is so small that even a short trip to the outskirts of town would entail constant worries that the batteries might die? One BMW manager sneers that "people won't be able to think about anything but electrical outlets."

In addition, this extremely limited mobility comes with a very high price tag. Lithium batteries with a capacity of 20 kilowatt hours cost around €20,000 ($29,000). That price should sink by about a third when the batteries one day go into mass production. This is the manufacturers' second big hope -- the batteries eventually need to be three times as good and three times as cheap as those available today. Then things start looking more promising for the electric car.

Until electric cars really do hit the streets en masse, so-called plug-in hybrids present a practical interim solution. These are cars that include a conventional internal combustion engine along with the electric motor. Toyota, the pioneer in hybrid technology, has followed precisely this pragmatic path, and will be showing the plug-in version of its Prius model at the IAA.

This partially electric vehicle has a comparatively small battery pack, which is charged from an electrical outlet and can power the car for about 20 kilometers (12 miles). Once the charge is used up, the gasoline-powered motor kicks in, and the ride continues with an economical hybrid system that continues to switch between the electric and combustion engines.

Daimler too will present an S-Class model with a plug-in hybrid system in Frankfurt. The car's energy consumption, fuelled by both gasoline and the power grid, is supposed to be equivalent to a conventional vehicle with a fuel efficiency of three liters of gas per 100 kilometers (78 miles per gallon). This constellation should be ready for series production with the next generation of the company's luxury model in 2013.

Gradual Evolution

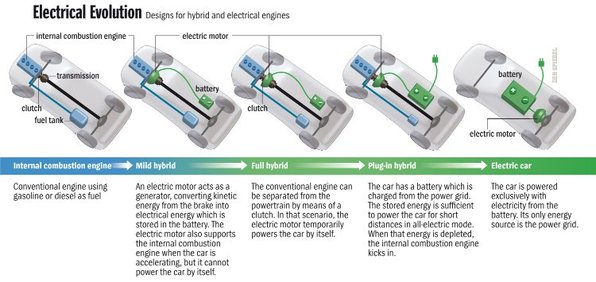

This approach -- using a gradual evolution of hybrid technology to eventually reach purely electric-powered vehicles -- is the only plausible strategy. But Western manufacturers are perceptibly lagging behind. The previous IAA, in September 2005, marked a turning point. At the time, car companies in Europe and the US admitted to having missed the boat. Without exception, they all announced their own hybrid systems.

The gap, however, is still enormous. Toyota has already sold more than a million hybrid cars. Volkswagen dealerships, meanwhile, have yet to see a single one. It's the same with Opel, Peugeot, Fiat and Renault. Mercedes is currently producing a very limited number of S-Class hybrids, about 40 a day. They have a so-called "mild hybrid" engine -- a simpler variation following Honda's example, in which the electric engine can only act as support, not power the car alone.

The far more ambitious full hybrid system has been presenting developers with formidable hurdles. Mercedes, BMW and General Motors spent four years on a project called "Two Mode." It outdid Toyota's system considerably in terms of complexity -- and also ended up being far too expensive. The elaborate electromechanical systems created in the project will be used in a few hefty sport utility vehicles and then disappear off the market again. All the participating companies have agreed not to continuing developing the system.

Volkswagen together with its new subsidiary Porsche wanted to present the hybrid versions of their Touareg and Cayenne models at this year's Frankfurt motor show, but they still haven't got the project under control. Integrating a full hybrid system into a traditional powertrain requires a very complicated control system. Both vehicles won't be released until next year, and they'll also be sold at a very high price -- to which the manufacturers are apparently still adding. "We can congratulate any customer who decides against the Touareg hybrid," one VW manager admits.

There is a certain bitter humor in the fact that the same companies which are delivering such pitiful results when it comes to relatively basic electric car technology also want to make IAA visitors believe they already have electric sports cars in the works.

Part 2: German Companies Play Catch-Up

In any case, the arduous pursuit of the electric car has created centers of expertise, albeit less with the car manufacturers than with their suppliers. While Toyota develops nearly all its electrical motor components in house, down to semiconductors and batteries, its Western counterparts outsource this area.

Many car companies and suppliers have now forged relationships with battery manufacturers. The field is largely dominated by Japanese and South Korean producers. German auto parts producer Bosch relies on Samsung, VW gets components from Toshiba, among others, while Opel works with LG Chem in South Korea. Only Daimler gets its electronics locally, from an Evonic subsidiary in eastern Germany called Li-Tec.

"Three to four major battery producers will prevail in the end," estimates Bernd Bohr, the head of Bosch's automotive group. He believes that large system suppliers like Bosch will dominate the market when it comes to the integration of electric engine components, especially the development of the power electronics that control the flow of electrical current.

Stuttgart-based Bosch was long considered Germany's champion as far as automobile electronics were concerned -- even if the focus was previously on the combustion engine. After all, the company logo even features an armature from a magneto ignition.

However Bohr admits that Bosch underestimated the hybrid and electric engine business for too long and entered the field too late. But he believes his company is catching up. "Bosch has always had considerable stamina when it has to sprint," he says. He adds that order volume for hybrid and electric engines is now looking good.

Bold Plans

Noticeably better positioned is a competitor usually associated more with rubber tires, although more recently it gained a doleful prominence as the object of a corporate takeover which ended in tears. Continental, of all companies, is Germany's pivotal technology company in the field of hybrid and electric engines.

The company was already producing the first hybrid components for GM five years ago, and so far Continental has invested more than €500 million in the segment. About 800 employees -- around twice as many as Bosch employs in the sector -- work here on more than 20 projects related to electric motors, including Mercedes' S-Class hybrid, the electric Smart, and the Opel Ampera.

The most spectacular electric car project to be announced so far will apparently also take to the streets with Continental technology. The French-Japanese alliance of Renault and Nissan has signaled that it will soon be manufacturing 100,000 electric cars a year -- a bold plan.

In the run-up to the IAA, Continental was planning to reveal that it has started to develop the central engine components for an electric vehicle which will be launched on the market in large-scale production in 2011. The supplier isn't at liberty to say which manufacturer is involved in this project, but in this case the point is moot -- aside from Renault/Nissan, no other company has comparable plans.

Revolutionary Concept?

The mass-produced electric car is supposed to help Shai Agassi's "Better Place" project to get off the ground. A former board member at the software giant SAP, Agassi was a shooting star in the IT industry and now seems to be taking over the media role that the entrepreneur Nicolas Hayek, a co-founder of the watch company Swatch, occupied in the 1990's. Hayek seduced the industry's major players with his vision of an ultra-ecological "Swatch car," ultimately winning over VW and later Daimler as partners. The end result was the Smart car, a purely Daimler product with some memorable birth defects.

A similar development is foreseeable with Renault and Better Place. Agassi has taken on the role of the virtuoso public speaker, calling his company "the leading electric vehicle services provider," without much substance to show for it. The battery switch stations that are supposed to be Better Place's great idea will for the time being only be available in limited numbers in Agassi's native Israel. And the project's revolutionary concept still relies on the time-tested electrical outlet.

In the end, all car companies are going to have to tackle this problem. It's not the infrastructure for electric cars that's missing, but practical and affordable storage technology.

Renault and Nissan are risking the leap to series production using batteries from the Japanese manufacturer NEC. The goal is an impressive capacity of 24 kilowatt hours. But the prototypes shown so far have had little over half of that.

Posted by Arthur Caldicott on 28 Sep 2009