June 30, 2008

Loopholes offer sweet deal for big polluters

One columnist making cheap'n'easy journalistic hay (3 columns: like the old Batman show - biff! bam! kapow!) ...

Loopholes offer sweet deal for big polluters

Out-of-province cruise ships, flights, trucks won't pay

Michael Smyth

The Province

Sunday, June 29, 2008

Gordon Campbell says his carbon tax will whallop everyone equally, but read the fine print of the regulations and what do you find?

Loopholes big enough for Arnold Schwarzenegger to drive his fleet of Hummers through! Check out who WON'T be paying the carbon tax come Tuesday:

Cruise ships

Cruise ships with a port of call outside of British Columbia -- pretty much all of them -- won't have to pay the carbon tax. This despite the fact that cruise ships pump out more carbon dioxide on a per-passenger basis than a Boeing 747.

International shipping

Local ships plying our domestic waters must pay the carbon tax, but international ships won't. So if a tugboat hauls a log up the coast to a local sawmill, it gets whacked with the tax. But export a barge of raw logs to the United States or China and those logs travel carbon-tax-free. How is this good for the environment again?

By the way, the shipping and cruising industries fought hard for these carbon-tax exemptions.

"This decision follows discussions between government officials and the Chamber of Shipping members over the previous month," the chamber revealed on its website. "The Chamber of Shipping is pleased the department engaged industry in the regulatory development, listened to the marine carriers' concerns, and decisively took the appropriate action."

Well, bully for them! Now don't you wish there was a Chamber of Barbecuing that could have snagged an exemption for your propane tank?

Out-of-province flights

Aviation fuel used for flights within B.C. get whacked by the carbon tax, but flights in and out of the province do not.

That means if you fly from Vancouver to Prince George to visit your sick mom, or if you hop a floatplane to Victoria on a business trip, get set to pay the carbon-tax man. But when Campbell flies to Hawaii to relax at his vacation property, he flies carbon-tax-free.

Or consider this scenario, which shows the regional unfairness of the carbon tax: A direct flight from Vancouver to Toronto is exempt from the carbon tax. But if you live in the boonies and have to take a connecting flight that touches down at YVR, the connecting flight gets whacked. Take that, B.C. heartlands!

Visiting military forces and diplomats

No carbon tax on American submarines at Nanoose Bay. You're welcome, Dubya.

Fuel used on, or delivered to, native reserves by aboriginal people

That includes the Tsawwassen reserve. They don't start paying taxes under their new treaty for another eight years.

Fuel used to manufacture anodes in an electrolytic process for smelting aluminum

Translation into English, as spoken at the head office of Alcan: "Score!"

Fuel used as a reductant in the production of lead or zinc

Translation into English, as spoken at the head office of Teck-Cominco: "Sweet!"

Cross-border trucking

Truck a load of organic carrots up the road to the local farmers market and you get whacked with the carbon tax. But import a truckload of lettuce across the border from California, and that foreign food enters B.C. carbon-tax-free. Guess Campbell never heard of the 100 Mile Diet.

And many, many others

Including "industrial processes" in the cement and oil-and-gas sectors and "fugitive emissions" from farms and landfills.

Whalloping everyone equally, eh? When it comes to Campbell's carbon tax, some are more equal than others.

E-mail: msmyth@direct.ca

© The Vancouver Province 2008

Carbon tax could be Campbell's undoing

As federal Tories slam Stephane Dion, B.C. premier may face fallout

Michael Smyth

The Province

Friday, June 27, 2008

Saying Gordon Campbell's gas tax is facing a "perfect storm" of public anger has become something of a cliche in B.C., but it's hard to look at the political weather chart and come to a different forecast.

Take a look what happened just yesterday: Oil hit $140 a barrel for the first time ever, triggering triple-digit stock-market plunges in New York and Toronto. Gas prices in Vancouver ticked up another penny a litre, topping out at more than $1.48 in some locations. TransLink said it was considering new highway tolls or vehicle levies to raise money.

In other words, it was another day of terrible news for anyone who has to drive a car or truck to make a living or get on with their lives.

And here comes Campbell with his 2.34-cents-a-litre gas tax to give you another kick in the chops this Tuesday. Campbell's tax could have the dubious distinction of pushing the price at the pump past the psychological barrier of $1.50 a litre.

Happy Canada Day, chump, and enjoy the salt in your wounds.

For the first time ever, meanwhile, public anxiety over soaring energy prices has become the No. 1 concern of British Columbians.

According to the Mustel polling company, worries about energy costs have trumped the environment, the economy, health care, crime and every other worrisome category. Talk about a bad time to raise the anxiety level.

It's starting to take a toll on the Liberals. The governing party has dropped two points to 47-per-cent support in the Mustel poll, while Carole James and the NDP have climbed six points to 37 per cent.

Now that's still a healthy 10-point gap for the Libs. And the thought of Gordon Campbell losing the May election because of his carbon tax is still difficult to imagine, despite the rising tide of anger.

Think about it: The New Democrats would probably jack up your taxes even higher if they ever got back into power. (And don't forget James has said she would bring in a carbon tax, too, but she's awfully shifty about how much it would be and who would pay it.)

But the polls are still going in the wrong direction for Campbell. And now the federal Conservatives are piling on a with a relentless campaign of negative attack ads against federal Liberal Leader Stephane Dion's call for a national carbon tax.

"It's the same old story: The Dion tax trick," say the Tory radio ads burning up the airwaves yesterday. "Everybody sees through it."

Do you think the average ticked-off, taxed-out driver is going to make the distinction between the federal and provincial Liberal parties when he hears those ads? Campbell will get hit with the collateral damage.

Now I'm starting to wonder just how much resolve either Liberal outfit has to weather this perfect storm. The federal Libs hinted this week at special accommodation for coal-dependent Nova Scotia while B.C. Finance Minister Colin Hansen said he was willing to "work with" the B.C. trucking industry, which will get severely hammered by Campbell's gas tax.

If they start cutting special deals -- while the little guy gets whacked -- that could be the last straw for many voters.

E-mail: msmyth@direct.ca

© The Vancouver Province 2008

NDP laughing all the way to the bank

Issue breathes life into Opposition as Libs remain arrogant

Michael Smyth

The Province

Thursday, June 26, 2008

Just five days to go before British Columbians get whacked by Gordon Campbell's gas tax and now the Liberals are suddenly figuring something out:

With gas prices already soaring, people don't like having salt rubbed in their wounds. And unless the Liberals change their tune, this grossly unfair and ineffective carbon tax is going back up on them like a bad burrito.

So Campbell sent his newly minted finance minister out to defend the tax yesterday. With the NDP going to town with an Axe The Gas Tax campaign, Colin Hansen went on the offensive.

"It is totally disingenuous," Hansen railed against the New Democrats. "They profess to be in favour of a carbon tax and then go out and launch a campaign to oppose the carbon tax."

Notice his tricky use of grammar in the above sentence: Yes, the NDP supports "a" carbon tax -- just not his.

Yesterday, NDP critic Shane Simpson said the NDP favoured a system of "carbon pricing" that doesn't include a new tax at the gas pump.

No duh. Even federal Liberal Leader Stephane Dion was smart enough to realize you don't hammer people with gas taxes when the price has gone up 33 per cent in four months.

But Dion's call for a federal carbon tax just means more trouble for Campbell.

Now the federal Conservatives under Prime Minister Stephen Harper are getting set to launch a vicious national campaign of attack ads against Dion's proposed tax.

The Tories will be brutal in their assaults. Harper has already called Dion's carbon tax an "insane" policy that will "screw everybody."

I doubt the approaching attack ads will be as polite.

And Campbell is going to get slimed with the collateral damage. Voters won't make the federal/provincial distinction. They'll just hear "Liberal" and "carbon tax." And then they'll get mad.

So now Hansen is trying to fight back. But his shots yesterday were pathetically weak.

"They've got big challenges within their own party," he insisted about the NDP. "They've got people who are ripping up their NDP membership cards."

Ripping up their membership cards? He wishes! The NDP are delighted Campbell is pushing ahead with his gas tax. It's the best issue they've had in a long time.

Now the New Democrats are even encouraging people to donate their $100 climate-change cheques from the government to the NDP so they can fight the gas tax. They're laughing all the way to the bank!

Campbell could stop the bleeding today if he wanted to. He could simply announce the soaring price of gas is doing the job of his carbon tax.

Then he could just cancel or postpone it.

But he's already crossed the Rubicon. The premier's famous stubborn streak will hurt the Liberals this time.

E-mail: msmyth@direct.ca

© The Vancouver Province 2008

June 21, 2008

U.S. utility keen on B.C. power

In a multi-part series, Vancouver Sun reporter Scott Simpson and photographer Ian Lindsay are documenting the new infrastructure and coming challenges involved in B.C.'s massive $5.1-billion effort to create a modern, efficient and reliable electricity transmission grid

Scott Simpson

Vancouver Sun

Saturday, June 21, 2008

In a matter of days, a California energy utility will announce the results of a $14-million US study of B.C.'s vast green electricity potential -- and opportunities to bring that power to the American market.

California wants to be the biggest consumer of green power on the western North American transmission grid, and documents show that B.C. Transmission Corp. and BC Hydro are working in support of that ambition.

The initiative, entirely separate from BCTC's $5.1-billion project to upgrade British Columbia's aging transmission system, has a projected value of $17 billion -- not counting the benefits that would flow to B.C. from heightened electricity trade with utilities in the United States.

BCTC estimates that private-sector investment of $13 billion for development of wind, small hydro and bioenergy resource projects could boost electricity production in the province about 40 per cent above BC Hydro's present annual output by 2015.

The installed, or theoretical, capacity of all that development is more than twice the output of the largest hydroelectricity facility in the province, the Bennett Dam/Shrum Generating Station on the Peace River in northeastern B.C. -- although both wind and small hydro are intermittent energy sources that depend on the variable nature of stream flow and wind.

The power would travel from B.C. to central California on a proposed $4-billion transmission line running south from Selkirk substation in southeastern B.C., through Washington and Oregon to central California.

B.C. already sells power into the U.S. on this route, and since Selkirk substation is only a few kilometres from the U.S. border, its contribution to the new transmission line is nominal.

B.C.'s green energy resources, however, are central to the project.

Pacific Gas and Electric, which serves 15 million customers in north and central California, is leading the effort and is poised to release a $14-million study of B.C.'s potential to feed the state's appetite for green power.

According to Fong Wan, PG&E's vice-president of energy procurement, the shareholder-owned utility has already locked up enough new power development to meet a state-mandated goal of 20-per-cent renewable energy in its portfolio by 2010.

However, Wan noted that legislation developed by the state assembly aimed at curtailing greenhouse gas emissions will push that standard higher. And that's why the utility is looking at B.C.

It will present its findings to the California Public Utilities Commission (CPUC), which regulates utilities in the state in much the same manner that the B.C. Utilities Commission regulates BC Hydro and BCTC.

"We've always been told that B.C. has a vast amount of potential renewable energy," Wan said in a telephone interview earlier this week. "So our desire to explore this possibility is to see what's really there, and how it compares to what else is available in the marketplace."

Early studies have suggested that B.C. power would be affordable for PG&E customers under a variety of economic scenarios.

Wan did not want to discuss the conclusions of the study until it is released.

"We are going to be filing our report with the CPUC in a matter of a week or less. I'm not comfortable with disclosing [its findings] prior to that.

"But I can let you know that I expect in general our comments to be very positive."

Electricity trade has been a boon to British Columbia since then-premier W.A.C. Bennett beat Prime Minister Lester Pearson and U.S. President Lyndon Johnson at the negotiating table for the Columbia River treaty in 1964, and opened the floodgates on a stream of power sales revenue that continues to this day.

The flow of cash was enhanced 20 years ago with the creation of Powerex as a power-trading subsidiary of BC Hydro to market surplus power from hydroelectric facilities across the province.

The trading concept is simple in both theory and execution: Open the dams and export B.C. power when electricity prices south of the border are high, and close the dams and import power when U.S. prices are low.

This arrangement usually works to B.C.'s benefit, but that advantage is eroding due to a lack of major new generation development since the Revelstoke Dam was completed more than two decades ago.

This has prompted the provincial government to order BC Hydro to bring the province back to a net export position through the development of new renewable electricity resources by independent power producers.

Carbon dioxide emission-free power is attractive to traders south of the border as governments move to curtail greenhouse gas emissions that are causing climate change.

Trade can't grow without an improved transmission system. The western grid was never set up to serve a far-flung group of power-trading utilities, and it is frequently running at the limit of its reliability.

Pacific Gas and Electric, BC Transmission Corp. and other utilities along the grid are working on a project to fix it -- the Canada/Pacific Northwest to Northern California Transmission Project, a $4-billion initiative that will complete the first phase of planning in August.

If it goes ahead, it will be the first major expansion of the system in a generation.

"I think the transmission can be built because we built similar infrastructure several decades ago, but it is by no means an easy process," PG&E's Wan said.

B.C. green power resources are one of the keys.

"California and British Columbia have had a long-standing seasonal trading relationship, and that's because down in California we are summer-peaking [in electricity consumption] and you in B.C. are winter-peaking," Wan said.

"We have been able through decades of trading to share our resources on a seasonal basis, and that has gone quite well, in general. From that perspective, we are trading parties ... we share resources."

Doug Little, vice-president of customer service and strategy development at BCTC, said discussions are at "at a very preliminary stage," and while the project looks "promising" from B.C.'s side, "it's too early to say whether it will go ahead or not."

"We can say we have taken a preliminary look at the overall economic feasibility of the line, and concluded it makes sense to go on to the next step and start doing some engineering studies and so on."

There is also an elaborate system of checks and balances to determine whether it's a good deal for B.C.

Little said the project would need approval from both the B.C. Utilities Commission and the National Energy Board before it could go ahead. There would be similar scrutiny in the U.S., he added.

This is not the only project aimed at taking B.C. resources south.

Sea Breeze Power Corp., a Vancouver-based company trading in the 40-cent-a-share range on the TSX Venture Exchange, already has authorization from Canada's National Energy Board and the U.S. Department of Energy to run an undersea cable from the southern tip of Vancouver Island to Port Angeles, Wash., via the Strait of Juan de Fuca.

This link, notes Sea Breeze president Paul Manson, would give power another route to flow between B.C. and the U.S. grid, enhancing the reliability to Vancouver Island's power supply, as well as providing an additional framework -- and an extra market -- for wind power projects on the island.

"There are just vast renewables in the northwest, right up into Alaska. The first of these great renewables is wind. What we need to realize this potential is additional transmission," Manson said in an interview.

The ballpark cost of the full project is about $450 million, and Manson said Sea Breeze is unlikely to attract investment until it has a full roster of engineering studies and other background work to accompany the federal permits.

Nonetheless, the notion of a privately owned transmission line facilitating the delivery of electricity into the U.S. market, without the comfort of public ownership, is drawing critics.

So is the Selkirk-to-California project.

"It's no secret that the U.S. -- particularly western states such as California -- is desperate for additional sources of energy," said Melissa Davis, executive director of B.C. Citizens for Public Power. "And it's no secret that B.C. possesses the natural resources to generate this additional power. But at what cost?

"Hydro power is 'green' only insofar as it generates no greenhouse gas emissions. But there are numerous additional environmental impacts to consider if new projects are required in order to supply power to the U.S. -- logging, road construction, flooding, and threats to numerous aquatic species and wildlife."

Analyst John Calvert -- whose recent book, Liquid Gold, asserts that B.C. is "rapidly losing public control of our electricity system" -- concurred.

"There is a significant environmental impact from these wind farms, and the worst-case scenario is that we get the environmental damage while utility firms in California plus the investors who own these facilities get all the benefits.

"The question is, what's in it for the people of B.C.?"

B.C. Energy Minister Richard Neufeld said the benefits of the Selkirk line are mutual, not exclusive to the United States.

"We are dependent on the U.S. for a big part of our electricity today, and have been for seven of the last 10 years. If it hadn't been for that transmission line, our lights wouldn't be on. We actually need electricity from them to keep going," Neufeld said.

"We need to actually keep increasing the capacity of those transmission lines to meet our own needs. That's what we have to do first. But in the meantime we should be looking at opportunities to actually have green power and export it to the U.S., and make money at it. I don't think there's anything wrong with that."

© The Vancouver Sun 2008

$5-billion fixup a B.C. grid priority

In a multi-part series, Vancouver Sun reporter Scott Simpson and photographer Ian Lindsay are documenting the new infrastructure and coming challenges involved in B.C.'s massive $5.1-billion effort to create a modern, efficient and reliable electricity transmission grid

Scott Simpson

Vancouver Sun

Friday, June 20, 2008

Station C field operations manager Scot Jackson

stands alongside a massive 230-kilovolt transformer,

sealed to contain carbon dioxide emissions, at the

underground substation that keeps the lights burning

in downtown Vancouver.

CREDIT: Ian Lindsay, Vancouver Sun

One of the 230-kilo volt lines supplying the underground

substation comes through the wall before curving

gracefully toward the switching chamber.

Scot Jackson of BC Hydro inspects.

CREDIT: Ian Lindsay, Vancouver Sun

Scot Jackson was on the job a week when the trouble started. Deep in the guts of a $3-million high-voltage transformer buried in an underground electrical substation in downtown Vancouver, swaddled in 50,000 litres of cooling oil, a $50 component had begun to cause an electrical arc.

Acetylene gas was building up in the transformer's oil-filled shell. Unattended, it could elevate the risk of an explosion or fire that would damage the transformer -- a custom-built unit that plays a critical role in keeping the lights on in the heart of Vancouver's business district.

It was, according to BC Transmission Corp. capital programs adviser Gerhard Kehl, "the mother of all problems."

BC Hydro and BC Transmission Corp. maintain a constant vigil on equipment at 291 substations around the province -- but none more intent than Station C, where a minor repair might take weeks but the replacement of a 120-tonne transformer would take 18 months due to the unique location.

The transformers rest on concrete pads six stories below street level, in a compact venue less than half the size of a comparable ground-level substation.

Nobody expected trouble here.

Most of the transmission equipment on the B.C. power grid is 40 to 50 years old, and many of those aging assets -- transmission towers, substations and electrical circuits -- are in "poor or very poor condition," according to a BCTC study.

The most recent estimate to upgrade the system is $5.1 billion over the next decade, but the Crown corporation is warning that the final bill could be billions more.

The transformers at Station C are merely middle-aged and were not considered immediate candidates for replacement.

Jackson took over as field operations manager in July 2007, with his predecessor telling him confidently that he'd done a Station C walk-through the month before and found it to be as robust and stable as ever.

"He said, 'We haven't had a lick of problem with these transformers since they were installed,'" Jackson recalled.

The downtown demand for air conditioning had both transformers -- original equipment dating to the 1984 opening of Station C -- humming.

Either one of the transformers was individually capable of meeting all demand without overheating. But the system would have no backup unit if one failed.

One did. And Jackson had been on the job for less than a week.

The gas monitor inside one of the transformers triggered an emergency shutoff. It took two tanker trucks and a permit from Vancouver city hall just to drain the oil off so that workers could begin to look for the source of the failure.

BC Hydro and BCTC urged downtown building operators to cut back on electricity consumption by tweaking their thermostats up a couple of degrees.

"We were coming into the hottest weather in July," Jackson said.

The sole remaining transformer "was almost at capacity and so we didn't know, with air conditioners set at 20 or 21 degrees, how much more load that would put on the system."

As it turned out, the functioning transformer never got close to overheating as Jackson and his crews worked, for 21 days straight, to find the problem, fix it, and get the failed transformer back in operation.

It was, nevertheless, an anxious time.

"We never did have to move any transformers out. If we did, that would have been a major, major effort to get it up to street level, and out onto the street," said Gerhard Kehl.

Electrical engineers don't like risk.

"When one [transformer] fails, everybody gets antsy because, geez, if the other one fails then the customers served from this station would be without power."

As it turned out, the system functioned smoothly on a single transformer.

If it had needed replacement, however, BCTC would still be scrambling, even now, to install a new one.

With the Olympic Games coming in less than two years, and both residential and commercial construction booming downtown, BCTC is taking no chances of a similar occurrence in the future.

"We have an empty transformer space downstairs, and we will be filling that up in the next year," Jackson said.

"We want that third one so we will always have two transformers to take the load, and be able to take that third one out for servicing."

As a measure of the difficulty associated with squeezing a transformer into an underground bunker, consider this: A new transformer is worth $3 million, but the full cost of putting one into Station C is $13.6 million.

Adding another transformer makes the downtown grid more reliable, but there is also a vast amount of BCTC equipment across British Columbia that's 20 years older than Station C, and considered more likely to fail.

Coming into 2007, BCTC's prevailing estimate was approximately $3.2 billion over 10 years to carry out all the necessary work.

Greater scrutiny revealed far greater problems -- and earlier this year, BCTC announced it would need about $5.1 billion.

That's more than a $1.8-billion price increase just within the past year.

And so, while that increase is about five times the cost overrun of the new Vancouver Convention Centre (which, coincidentally, draws its power from Station C), there is no apparent scandal about runaway costs at BCTC.

The biggest criticism appears to be the Crown corporation's failure, since it was broken off from BC Hydro in 2003, to dare to put a big enough pricetag on the work ahead.

A recent independent appraisal of BCTC's performance in managing its assets found that the corporation, while a "solid asset manager," was not spending enough money to maintain the province's grid.

The system includes a transmission line circuit of 18,336 kilometres, 291 switching, distribution and capacitor stations, and interconnections to Alberta and the U.S. Pacific Northwest.

"The majority of the B.C. transmission system was built between 1960 and 1970, and is now between 40 and 50 years old," according to a BCTC news backgrounder on the $5.1-billion, 10-year project to improve the grid.

BCTC estimates $1.6 billion for "state of the art" replacement equipment that will bring the grid fully into the digital era.

System growth and expansion costs are projected at $3.4 billion, including $1 billion to connect new, clean and renewable energy sources to the grid as B.C. moves toward a stated government objective of being energy self-sufficient by 2016.

BCTC cautions that final cost of some projects could run far higher than estimates.

For example, just two years ago BCTC was predicting it would cost $300 million to construct a new transmission line between the southern Interior and the Lower Mainland.

Today, the project is estimated at $600 million, and BCTC is so concerned about rising costs that it is unwilling to confirm the final price -- in fact, it's asking the BC Utilities Commission to approve it without any firm price guarantee.

BCTC also said the cost of linking independent power producers to the grid jumped $600 million, and needs an extra $700 million to replace assets and keep pace with demand for energy in a growing province.

All of this adds up to a challenge for BCTC, which must transform itself from a low-profile power line utility into a fast-moving, dynamic construction entity with one of the largest public infrastructure budgets in B.C. history.

"When you take a look at a total of $5 billion, there will be hundreds and hundreds of projects," Jane Peverett, BCTC president and CEO, said in an interview.

Peverett is a former senior executive with a western natural gas utility who moved into the top job at BCTC three years ago.

"We're on what I call Phase Three of BCTC.

"Phase One was startup -- getting ourselves established as a separate company, getting our work processes in place, getting the skills to augment the very good talent we got out of BC Hydro.

"Phase Two was being fully operational -- actually conducting all the business we needed to conduct, doing it as a separate stand-alone company, doing it better and better every day.

"Phase Three is where we are right now. In addition to being a fully operational company, we are a huge growth and construction company.

"When we were setting up BCTC, we did not anticipate that."

Nor is BCTC confident that its current working price tag is enough to fix the system.

"There are projects we know of today that are either in the works or are well-planned. But then there are a number of projects that are future projects and they really need further study," BCTC chief financial officer Janet Woodruff said in an interview.

Julius Pataky, BCTC vice-president for system planning and asset management, said that trend is pushing up costs in a "very real" way.

"We are talking about a single transformer costing $2 million [in 2006] that is now costing us $3 million," Pataky said in an interview.

"The suppliers of our equipment are running flat out. The lead times have gone from eight months to 24 months, and in some cases to 48 months. We are basically reserving factory space to get some of this equipment manufactured."

B.C. energy sector commentator David Austin said the biggest reason for the $1.8-billion jump isn't skyrocketing equipment prices, or demand growth. It's the fact that British Columbia's transmission assets were taken for granted through the 1990s, and not enough was spent to maintain them.

The former NDP government, he said, diverted potential grid maintenance funds to support other political priorities, and the long-term cost of that decision has finally begun to manifest itself.

"When you look at BC Hydro's accounts during the 1990s, they weren't even investing enough money to cover off the depreciation of their equipment, let alone the requirement to expand the electrical transmission system," Austin said in an interview.

"The electric utility business is like investing in your RRSP. You have to keep up with investment on an annual basis. If you defer it, you get caught by the inevitable ups and downs of the market -- including equipment, availability, inflation, currency exchange rates, and interest rates.

"Because the utility business is such a long-term business, investment should be made on an incremental basis and not on a stop-start basis.

"It's a long-term, boring business, where the winner is inevitably the tortoise and not the hare."

© The Vancouver Sun 2008

Bad mix

Rachel Pulfer

Canadian Business Online

June 18, 2008

Spectra Energy (NYSE: SE) builds pipeline infrastructure for natural gas. Based in Houston and valued at US$17.5 billion by market cap, the company boasts networks that span North America. These include a series of new developments in Fort Nelson, near the Horn River area of British Columbia.

As Alex Mlynek reported in her Briefcase blog earlier this year on Canadian Business Online, sales of oil and gas rights in the Horn River region have hit record highs in recent months. On June 16, Randy Eresman, the CEO of EnCana (TSX: ECA) announced the company had secured the rights to drill on 220,000 acres of gas shale deposits in the Horn River area. Eresman says Horn River holds the potential to eventually become among the largest resource plays in North America — comparable in size and scope to the Barnett Shale in north central Texas, which produces 3 billion cubic feet of natural gas a day.

So far this fiscal year, the province of British Columbia has derived more than $480 million from these sales of rights. Yet curiously (for a province where the oil and gas sector is so rapidly expanding) British Columbia is also among the first jurisdictions in North America to introduce a tax on carbon. That tax, announced in the February provincial budget, is set to go into effect July 1. It will tax carbon at a low “starter” rate of $10 a tonne. By 2012, that will ramp up to $30 a tonne. (Lest you think British Columbia is alone in this effort, on Thursday June 19, Liberal leader Stéphane Dion proposes his own version.)

Environmentalists applauded B.C.’s decision, and many economists agree that putting a price on carbon is the most immediate way to reduce emissions. People respond to price signals, and a tax is the strongest policy lever a government has to price the environmental cost in to carbon-intensive activity — thus encouraging low-carbon alternatives. Or so the theory goes.

But B.C.’s odd mix of policies — allowing record sales of rights to develop oil and gas, the sectors that generate the most greenhouse gas emissions in Canada, while taxing carbon — presents an interesting conundrum. On the one hand, the government is encouraging a mushrooming oil and gas sector; on the other, it’s proposing to tax emissions (much of which will come from that sector) to the hilt.

This situation may help explain why the B.C. government put $3.4 million towards Spectra Energy’s effort to test whether the Horn River area is ready for the magic of carbon capture and sequestration (CCS). That’s the technological alchemy whereby greenhouse gas emissions are removed from the atmosphere and pumped deep underground for permanent storage.

Like Alberta, B.C. faces the dilemma of how to grow an expanding resource sector while bringing emissions under control. CCS is seen by many as Canada’s best hope for reducing the carbon footprint of a fossil fuel-intensive economy. So on May 26, Spectra Energy announced it is conducting a $12 million feasibility study of CCS at Fort Nelson near Horn River, together with the support of the provincial government and the good wishes of the U.S. Department of Energy. (The DOE will study whether it is possible to sequester natural gas this way — and develop a manual of best practices.)

Spectra Energy’s Western Canadian initiative is headed by Doug Bloom. In a conference call with Gary Weilinger, another Spectra VP, and Canadian Business, he said CCS is a “safe, proven technology.” (Spectra already operates seven other CCS projects elsewhere in Canada.) For Bloom, “Fort Nelson is simply a good opportunity to try it out on a larger scale.” The goal is to pump 1 million tonnes of carbon dioxide and other greenhouse gases underground each year. The feasibility study will test the geology of the region and ensure the cavity in question can store that amount of gas, leak free.

Some, such as Ian Bruce, a climate change expert with the David Suzuki Foundation, have questioned whether public money should be going towards such projects, particularly at a time when commodity prices — and in particular those for natural gas — are through the roof. But Bloom says the public spend is justified by the public benefit. Spectra literature claims that sequestering 1 million tonnes of carbon a year is the equivalent of taking 250,000 cars off the road.

More of a concern is the economic and environmental impact of this provincial government’s decision to implement two policies at direct cross-purposes — at the same time.

By taxing carbon, the Gordon Campbell government earned kudos from an environmentally-aware electorate. Yet by allowing drilling activity to expand, the government is filling its coffers with rights revenues and encouraging the emissions-intensive activities its carbon tax is supposed to discourage.

Attempting to square this circle by putting public money into carbon capture isn’t going to make the problem go away anytime soon. Assuming the geology is leak free, the Fort Nelson CCS project won’t be in operation for several years; drilling on one well for the feasibility study starts later this year, and the other in 2009. Meanwhile, emissions from new drilling activity in Horn River will rise, and the government will collect additional revenue from the carbon tax on those emissions.

A government that allows its oil and gas sector to expand — while simultaneously introducing a carbon tax — undermines, at least in the short term, the point of having the tax in the first place. Meanwhile, Bloom says the company’s strategy for coping with its carbon tax liability will be to pass the costs on to shippers, who will eventually have to pass those costs on to consumers. That means higher energy costs, at a time when consumers are already hurting.

If the B.C. government really wants to encourage green growth, a smarter approach might be to let industry test out and implement a CCS strategy first, before auctioning off rights. As it is, all this mix of policies will achieve for certain is increased revenue for the government. That may be a great for government finances, but it’s a lousy way to promote an economically savvy green policy. Too bad consumers and taxpayers end up paying a disproportionate amount of the price.

Rachel Pulfer is the U.S. correspondent for Canadian Business. A journalist since 1999, and features editor of Canadian Business from 2005 to 2007, she has been nominated for three National Magazine Awards. In Letter from America, her online column, Rachel comments on economic and cultural developments in the U.S. and their significance for Canada.

Spectra Energy to Pursue Feasibility of Large-Scale Carbon Capture and Storage Project in British Columbia

News Release

Spectra Energy

May 26, 2008

VICTORIA, BC – Spectra Energy (NYSE: SE) today announced plans to pursue a large-scale integrated carbon capture and storage (CCS) project near its existing Fort Nelson natural gas plant in northeast British Columbia (BC).

The project represents a partnership between Spectra Energy and the provincial government in BC which has provided a $3.4 million grant to help fund an initial feasibility phase, intended to determine whether deep underground saline reservoirs and associated infrastructure in the area are appropriate for CCS.

“Addressing the challenge of climate change requires a commitment of both government and the private sector to innovation and deploying new technologies,” said Doug Bloom, president, Spectra Energy Transmission West. “We believe carbon capture and storage technology holds real promise in providing a safe and effective means of reducing greenhouse gases and addressing climate change.”

“We’re excited to work in partnership with the Province to build on Spectra Energy’s existing experience with CCS and to explore the feasibility of a large-scale project at our Fort Nelson plant,” said Bloom.

"As part of the BC Energy Plan, we said our government will explore new technologies for safe, underground sequestration of carbon dioxide from oil and gas facilities – or CCS – which is exactly what Spectra Energy proposes to do,” said the Honourable Richard Neufeld, Minister of Energy, Mines and Petroleum Resources. “If the exploratory drilling program achieves good results, Spectra Energy’s project has the potential to deliver major CO2 reductions for BC."

During the initial phase of the project – which will evaluate geological, technical and economic feasibility – Spectra Energy will drill two test wells to determine whether surrounding geology is suitable for the permanent storage of carbon dioxide (CO2) and hydrogen sulphide (H2S). These compounds are present in the raw natural gas produced in the area and removed during processing at the company’s Fort Nelson gas plant.

“While there is a significant amount of research and development required, our initial work has identified two potentially suitable saline reservoirs – over two kilometers underground – which may be suitable for large-scale CCS,” said Gary Weilinger, vice president, strategic development and external affairs, Spectra Energy Transmission West. “If proven viable, we believe the project has the potential to capture and store in the range of one million tonnes of CO2 emissions annually — the equivalent of taking 250,000 cars off the road each year.”

Spectra Energy has been recognized by the UN Intergovernmental Panel on Climate Change as a world leader in CCS technology. Currently, four of Spectra Energy’s gas processing facilities in BC, and four in Alberta, are equipped with CCS technology. Together, these facilities remove about 200,000 tonnes of greenhouse gases from the atmosphere each year.

Spectra Energy Corp (NYSE:SE) is one of North America’s premier natural gas infrastructure companies serving three key links in the natural gas value chain: gathering and processing; transmission and storage; and distribution. For close to a century, Spectra Energy and its predecessor companies have developed critically important pipelines and related energy infrastructure connecting natural gas supply sources to premium markets. Based in Houston, Texas, the company operates in the United States and Canada approximately 18,000 miles of transmission pipeline, 265 billion cubic feet of storage, natural gas gathering and processing, natural gas liquids operations and local distribution assets. Spectra Energy Corp also has a 50-percent ownership in DCP Midstream, one of the largest natural gas gatherers and processors in the United States. Visit www.spectraenergy.com for more information.

Forward-Looking Statement

This release includes "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events. This release includes forward-looking statements concerning future developments at our facilities, including the anticipated timing and amount of planned capital expansions. Such statements are subject to risks, uncertainties and other factors, many of which are outside our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. Those factors include: the timing and success of efforts to develop infrastructure projects; the timing and receipt of required regulatory approvals. These factors, as well as additional factors that could affect our forward-looking statements, are described in our Form 10-K, filed with the Securities and Exchange Commission, and other filings that we make with the SEC, which are available at the SEC’s website at www.sec.gov. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Media Contact:

Lise-Ann Jackson

(403) 699-1506

(403) 483-0822 (cell)

Analyst Contact:

John Arensdorf

(713) 627-4600

June 17, 2008

B.C. Hydro plan alarms air-quality officials

Bid to boost electricity output at aging thermal plant in Port Moody would greatly increase greenhouse-gas emissions, regulators say

JUSTINE HUNTER

Globe and Mail

June 16, 2008

VICTORIA -- Metro Vancouver's air-quality officials are prepared to rewrite B.C. Hydro's pollution licence if it goes ahead with a plan to dramatically increase operations at its Burrard thermal generating plant in Port Moody.

A plan filed last week with Hydro's regulators seeks approval to boost the aging gas-fired power plant's annual output of electricity - along with the cocktail of pollutants it spews into Metro Vancouver's air - to six times the current level.

Company officials immediately played down their own 2008 long-term acquisition plan. Hydro wants the plan approved only to keep its options open in case the power is needed at any time over the next 11 years, the officials said.

However Ray Robb, air-quality district director for Metro Vancouver, is concerned because the plan suggests the Burrard Generating Station, which now operates only in periods of peak demand, would once again become a base source of Hydro's electricity production.

Print Edition - Section Front

Section S Front Enlarge Image

The Globe and Mail

At full capacity, the thermal plant is the largest single source of greenhouse-gas emissions in British Columbia, with a measurable impact on Metro Vancouver's air quality.

"Nothing in B.C. Hydro's permit now would prevent them from doing this. We'll have to consider whether something should prevent them," Mr. Robb said in an interview. As the official who hands out air-pollution permits for Metro Vancouver, he will be asking for a meeting with the authors of the plan to find out what they really mean.

Any increase from current levels would flow against Metro Vancouver's - and British Columbia's - greenhouse-gas emission targets.

Hydro's director of energy planning, Cam Matheson, said his report - which has been filed with the B.C. Utilities Commission for approval - does not spell any change in the Burrard plant's current operations.

Hydro is asking the commission to approve a plan to rely on the plant, for planning purposes, for 3,000 gigawatt hours a year of firm energy.

"B.C. Hydro's current plan is that Burrard must be capable of reliably providing its capacity and energy capability at least through 2019," it says.

Although the document describes changing the station's status from a "swing plant" for occasional peak use to a "base load plant" that would churn out a steady supply of energy, Mr. Matheson said that's not the intention.

"There's no intention of making Burrard thermal a base load plant," he said. "Burrard is essentially an insurance policy."

Mr. Matheson said Hydro is adopting one scenario of the four that were drafted by consultants. It's the "compromise" option that would run the facility at half of its full capacity, which can produce 6,000 gigawatt hours of energy per year. It's still enough that the Crown corporation anticipates it will have to buy carbon offsets starting in 2010 when the province's greenhouse-gas reduction targets come into force.

The Burrard plant has attracted many opponents over the years, including Premier Gordon Campbell, who vowed, during the 2001 election campaign, to mothball it. Instead Hydro has lowered its dependence on the facility since 2001, using it only as a "swing plant" for peak demand that has produced an average of 500 gigawatt hours of power annually.

The public might accept increased production to 3,000 gigawatt hours per year - a measure Hydro calls its social licence - because it has operated at that level as recently as 2001, the plan states.

In 2001, just months before he became Premier, Mr. Campbell said the health risks posed by the plant's operations were unacceptable.

"Burrard Thermal plant is one of the largest single-point producers of pollution in the Lower Mainland's air shed that exists. It creates health problems for people in the province. ... One of our objectives should be to have Burrard Thermal shut down."

June 14, 2008

B.C.'s power pitch: You take the risk, we'll take the gravy

COMMENT: "But prospective investors should take this new demand for what it is: A warning sign that British Columbia is growing cool on the notion of private ownership of power generation." Whooh! I wouldn't go that far!

PATRICK BRETHOUR

Globe and Mail

June 13, 2008

VANCOUVER -- Try pitching this one to the board of directors: Let's invest billions in a capital-hungry power plant, in a risky construction environment. If all goes well, we'll earn single-digit returns.

And then, when the capital costs are accounted for, and decades of higher profits beckon - let's sell.

Such is the predicament of investors in British Columbia's power sector today, now that B.C. Hydro has given itself a pry bar to buy out any power project that seems particularly profitable. The utility has just issued a call for proposals from the private sector to build a whopping 5,000 gigawatt-hours a year of power, equal to about 10 per cent of the province's current generating output. All of it is to be clean power: hydro, geo-thermal or wind, for the most part.

Those kinds of projects are desperately needed if B.C. Hydro is to meet its own goals for clean power and energy self-sufficiency, not to mention the strictures imposed by the province's push to reduce greenhouse gas emissions. Although opponents of private power will deny this strenuously, outside investment capital is needed to make this happen. That is the foundation of the B.C. government's policy of allowing private firms to turn a profit while they help to fulfill the public interest.

The foundation has just gotten shaky, however. Buried in the depths of the document asking for proposals is a paragraph that will give B.C. Hydro the ability to buy the "residual rights" to a power project once the term of the initial electricity-purchase agreement expires.

Even though some of the agreements are for 40 years, the power plants being proposed are expected to be generating electricity for decades beyond that point, just as much of B.C. Hydro's generating capacity comes from projects built, and paid for, decades ago. Because of that, the utility's cost for producing electricity is lower than for new projects (whether it or the private sector builds them).

The turbines in NaiKun Wind Energy Group Inc.'s proposed offshore wind power project, for instance, will work just fine for 40 years.

Until now, investors have had an entirely reasonable expectation that if they shouldered the risk of construction, and operation, they would be the ones allowed to reap the benefits when their projects saw their costs drop, and profits rise.

However, B.C. Hydro is, in effect, expropriating those profits and demanding that any bidder spell out, now, how much it will be willing to sell for two, three or even four decades down the line. (In a similar vein, B.C. Hydro is requiring bidders to commit to construction costs in November for their proposed projects, while waiting until mid-2009 to actually award contracts. If, or more precisely when, costs spike in the meantime, it will be the bidders who pay the price for the utility's languid pace of decision making.)

Of course, B.C. Hydro is not so crass as to label its demand as such, or to articulate why the clause is necessary. Instead, it "invites" proponents to include a sidecar proposal on residual rights - and later spells out that the presence of such a proposal will form part of the calculus used to decide which bids will be accepted. Hint taken.

Firms preparing bids for the latest call for proposals are being circumspect - why snap at the hand you hope will feed you, after all? While the call for bids is generating enthusiasm, it's clear that those warm feelings don't extend to the prospect of having to hand over an asset just as its returns start to rise.

Bruce Ripley, president of Plutonic Power Corp., zeroes in on one practical difficulty: How exactly do you price a power plant for a sale in, say, 2048, a period in which climate change, greenhouse gas policies and energy technology are going to warp the economics of electricity. "They're going to be fascinating discussions," he says. Mr. Ripley, while measured in his critique, does allow that the residual-rights clause will make power projects less attractive for financial investors.

If one goes strictly by the numbers, the residual-rights clause might not seem like such a big deal. As Nick Hann at MacQuarie Capital Markets Canada points out, the current value of profits 40 years in the future is negligible. And firms were always going to need to renegotiate deals with B.C. Hydro, even without an explicit residual-rights clause.

But prospective investors should take this new demand for what it is: A warning sign that British Columbia is growing cool on the notion of private ownership of power generation.

B.C. Hydro evaluating gas-fired power plants

Charlie Smith

Georgia Straight

June 12, 2008

As B.C. Hydro prepares to release its long-term energy strategy, a document suggests that the Crown utility is considering securing electricity from natural-gas-fired power plants. According to a presentation from a B.C. Hydro workshop held on April 25 at the Sutton Place Hotel in Vancouver, there is a 24.8 percent “relative likelihood” that three natural-gas-fired plants will be built: a 494-megawatt plant at Kelly Lake near Clinton scheduled in 2016; a 243-megawatt plant at the same location in 2024; and a 243-megawatt plant somewhere on Vancouver Island in 2025.

However, B.C. Hydro spokesperson Susan Danard told the Georgia Straight that no new electricity will be generated in natural-gas-fired plants in B.C. “In no way is B.C. Hydro even contemplating any new gas-fired generation,” she claimed. “That’s not us.”

These types of plants emit millions of tonnes of greenhouse gases, which have been linked to climate change. When asked if B.C. Hydro might buy electricity from independent power producers who burn natural gas, Danard replied, “I don’t believe that’s correct either because just today, actually, coincidentally we launched our clean call [for electricity from independent power producers].…That is the direction we’re going in…we’re looking at clean power projects: hydro, wind, solar, geothermal energy—proven technologies that have to meet the provincial guidelines for cleaner renewable energy. We’re not looking at purchasing or building gas-fired generation at this point.”

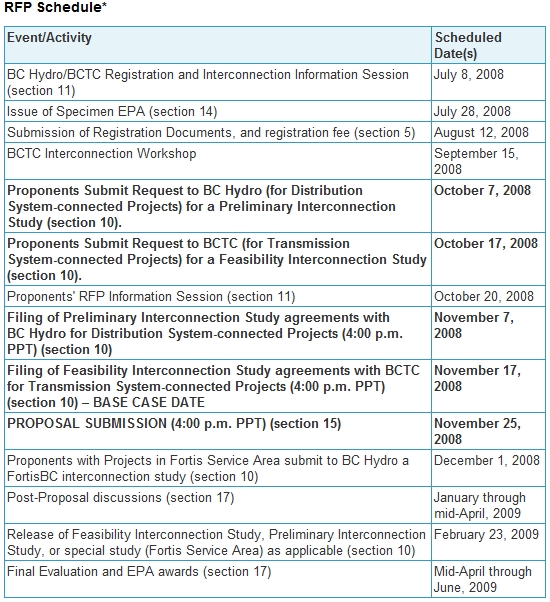

The Clean Power Call complements the Standing Offer Program that was launched in April 2008, and the two-phase Bioenergy Call for Power, which released its Phase I RFP in February 2008. The Standing Offer Program targets smaller clean projects that generate up to 10 megawatts of power, while the Bioenergy Call for Power targets projects that utilize wood infected by the mountain pine beetle as well as other wood fibre fuel sources. The design of the Clean Power Call RFP reflects stakeholder and First Nations engagement held in 2007. Contact: Note: BC Hydro/BCTC Information Session, July 8, 2008

Susan Danard

Media Relations

Phone: (604) 623-4220

June 13, 2008

Vital power route faces epic hurdles

In a multi-part series, Vancouver Sun reporter Scott Simpson and photographer Ian Lindsay are documenting the new infrastructure and coming challenges involved in B.C.'s massive $5.1-billion effort to create a modern, efficient and reliable electricity transmission grid

Scott Simpson

Vancouver Sun

Friday, June 13, 2008

Photos from a helicopter survey of the main

transmission line between Vancouver and Kamloops

where the BCTC wants to undertake a project to

twin the line as part of a $5 billion system upgrade.

CREDIT: Ian Lindsay/Vancouver Sun

In a province of violent geography that demands great ingenuity of its engineers, we are in a helicopter, scrutinizing one of their greatest feats.

We pick it up near Westwood Plateau Golf and Country Club in Coquitlam, follow it 246 kilometres northeast, and end up at another grass-covered plateau - one where cattle, not golfers, are scattered.

"It" is a 500-kilovolt transmission line that carries electricity on the final segment of its journey from distant generating stations in northern and eastern B.C. to the southwestern corner of the province where 70 per cent of electricity is consumed.

British Columbia Transmission Corp. calls it the Interior-to-Lower Mainland line, or ILM, "the most critical transmission path in B.C."

It is also emerging as the most controversial, and challenging, pathway in the province.

Documents on file with the B.C. Utilities Commission indicated that failure to get an additional line on this route by the winter of 2014 could lead to something that electrical engineers call "load shedding" - or what newspaper headline writers call "blackouts."

The documents also indicate that BCTC does not want to commit to a firm cost estimate for the project - the working figure is $600 million - and is instead asking that the final cost be scrutinized in a formal review once the project is complete.

Part of the uncertainty arises from issues that go beyond the actual installation of transmission towers and electrical cable.

There are spotted-owl and grizzly-bear habitats to skirt, and fish-bearing streams to avoid. There are 60 first nations with territorial interests along the route, and part of accommodating them involves the largest archeological-impact assessment ever undertaken in this province.

BC Transmission Corp. vice-president of major projects Bruce Barrett describes First Nations and aboriginal issues as the Crown corporation's foremost consideration - taking precedence over the construction of the line, and even the cost of the project.

"As engineers, we can build something almost anywhere," Barrett explains. "It's a matter of compromising our technical and cost aspects to accommodate environmental and first nations considerations.

"There are other things as well, including visibility along the Trans Canada Highway. There are places along the highway where the existing lines feel as if they're right in your face. We want to find places to cross where the lines will be less visible."

Power first flowed to the Lower Mainland along this line in 1968.

From a kilometre in the air, it looks delicate, a few strands of wire strung across tidal marsh and plunging river valley, over snowy mountain peak and bone-dry high country ranchland.

There are concrete pads to keep the transmission towers bearing the high-voltage lines from sinking into the tidal mud flats of the Lower Pitt River, just north of the Lougheed Highway in Pitt Meadows.

Ten minutes' flight east and we see towers clinging to the side of a mountain, with exposed beds of gravel revealing spots where November rains have beaten away the surface soil and triggered landslides - some directly above the towers, forcing the installation of concrete berms to deflect away any potential debris flow in future.

In the most spectacular circumstances, the towers perch on granite outcroppings barely large enough to sink footings into, or the lines themselves hang unsupported in downward arcs for distances up to a kilometre in length as they span the valley of the Harrison River, and the Fraser River canyon.

Only about half of the existing right-of-way route is suitable for the installation of additional towers. On the other half, a new route must be developed because squeezing more towers onto the existing path would expose them to the same risks as the original set - increasing, rather than reducing, the threat of a major blackout during a wind or ice storm.

"You don't want to put a [new] 500-kilovolt line right next to [an existing] 500-kilovolt line in an area where there are geotechnical risks," explained Melissa Holland, BCTC's senior project manager - and The Vancouver Sun's tour guide on the helicopter trip.

"If there was a landslide, and it takes two lines out, then you are going to be in trouble."

In historic terms, the most difficult area on the entire route is on the outskirts of the Lower Mainland, at Cascade Creek ridge on the east side of Stave Lake near Mission.

"The Cascade ridge is where we have probably some of the biggest challenges for the lines in terms of weather," said Holland.

True to form, the helicopter had to skirt the top of the 3,250-foot ridge, and the sturdy tower perched at its western edge, on the morning of the tour because they were shrouded by clouds.

"The cloud ceiling is low here, and you get icing and loading during the winter months. Even though it's very close to the Lower Mainland, it's one of the most challenging spots to build the towers so that they can withstand the weather systems that move through here."

A hundred kilometers northeast, in the richly forested Anderson River drainage east of the Fraser River canyon, the issue is wildlife, not weather.

"There is a challenge here with spotted-owl habitat and grizzly-bear habitat," Holland explained. "We're trying to find a route alignment that will by-pass these. There's a nice little window between the two habitat areas and we will try to thread the needle, if you will.

"It's about a 500-metre corridor between the two habitats that we are going to try to scoot through. It's not a lot of room when you are trying to site a transmission line."

Gwen Barlee, policy director for the Western Canada Wilderness Committee, said the project means B.C. will lose less electricity through transmission line losses, "and there are efficiencies there that lead to conservation."

"But on the other hand, when you look at the potential impact of that project on all the wildlife habitat along that 274-kilometre route, there are concerns," Barlee said in an interview.

"The main concerns are because we don't have adequate protections in this province to protect species at risk - so groups like the Wilderness Committee have to look at projects like this very, very closely to make sure there aren't undue impacts on spotted-owl habitat, or what this project means for the north Cascade grizzly-bear population."

It will be several months before the transmission corporation is ready to submit its final route plans to the province's Environmental Assessment office.

Preliminary discussions on the project are already under way before the B.C. Utilities Commission, which regulates BCTC, BC Hydro, ICBC, and Terasen Gas.

Documents submitted to the commission indicate no one is disputing the need for the route.

But all are expressing alarm over BCTC's request to avoid binding itself to any hard cost estimates, but to instead submit to what it calls a "prudency review" after the project is done and the money is spent.

If BCTC fails to keep a lid on project costs, the overrun would not be recovered through higher electricity rates - it would fall to taxpayers as a whole to make up the shortfall.

"It is beyond debate that after-the-fact prudency review is an inadequate mechanism to hold utilities accountable for the wisdom of their capital projects," said Jim Quail, executive director of the BC Public Interest Advocacy Centre, in a letter filed recently with the utilities commission.

"But even more to the point, the opportunity will be long gone to ensure that the course that is selected is in fact the best one for ratepayers and the people of the province as a whole."

The Joint Industry Electricity Steering Committee, which represents all of British Columbia's large industrial consumers of electricity, thinks the transmission corporation should be leashed with a "cost collar" for the project.

"The JIESC has strong reservations about the effectiveness of an 'after-the-fact prudence review', and accordingly is supporting a cost collar mechanism with incentives and penalties to encourage cost-effective performance by BCTC," the committee says in a letter to the utilities commission.

The Independent Power Producers association of BC says in a submission to the BCUC that post-project reviews "do not create an environment of cost discipline." The association notes that private electricity project developers "are subject to the same cost pressures and uncertainty", but are expected to shoulder all the economic "risks" when they contract to sell their power to BC Hydro.

Not everyone shares that apprehension, or believes it's appropriate to focus on costs to the exclusion of other considerations.

Gordon Mohs, heritage resource advisor for the Chehalis First Nation, ranks the transmission corporation's involvement with the Fraser Valley aboriginal group as "fabulous."

"I think they've been extremely good about everything," Mohs said in an interview. "The consultation has been excellent. They want to do what they can in terms of accommodation on the project."

The corporation is paying for consultants to work on behalf of first nations along the route, including a 30-kilometre strip through traditional Chehalis territory.

"It's a very good opportunity to do some very good science and investigations into prehistory as part of the project to bring power and security of power to the Lower Mainland.

"There has been one fabulous little discovery made just north of the Chehalis Indian Reserve," Mohs said. "It's the Oregon spotted frog, and it's only one of three places in all of British Columbia where these little critters are found.

"They've made alterations to their power line alignment to make sure there are no severe environmental impacts to the frogs."

Mohs said the corporation is showing similar sensitivity toward cultural and archeological sites.

"The idea is that you don't want to impact them - avoid them if you possibly can. Move the tower 50 feet to the left or the right, or north or south just to avoid that impact, because it gets very expensive when you have to excavate."

Meanwhile, BCTC's Barrett suggests that the route is starting to get tight because of all the competing interests along it.

The next step will probably be to rewire the existing transmission towers with lines capable of carrying much higher voltages.

"I don't know if we'd ever put another line in this corridor."

Instead, he says, "We will look at new adjustments that allow us to get more power out of existing corridors."

© Vancouver Sun

June 12, 2008

The money rolls in for the Liberals as natural gas prices take off again

Vaughn Palmer

Vancouver Sun

June 12, 2008

VICTORIA - While surging oil prices will hurt consumers and business alike, they likely mean good news for the balance sheet of the B.C. Liberal government.

B.C. is not a big oil producer. It is a much more significant player in natural gas, which as a substitute for oil has racked up major price increases as well.

That means a windfall for the provincial treasury, because the price is already considerably higher than forecast in this year's provincial budget.

The lowballing wasn't deliberate. The finance ministry compiles natural gas forecasts from two dozen internationally respected sources and averages them into a comparable price in Canadian dollars.

The process, while independent, doesn't always produce flattering results on the bottom line. Last year gas prices ran about 20 per cent lower than forecast, producing a half-billion-dollar hit on provincial revenues.

This year the results are running in the opposite direction.

The budget forecast for natural gas royalties was predicated on a price of $5.65 Cdn per gigajoule "at plant inlet." That last bit refers to the base price used to calculate provincial royalties.

Currently, at-plant-inlet prices are running well ahead of the forecast. About $3.50 higher according to the most recent reckoning.

If natural gas prices remain high -- or go even higher as some analysts suggest -- then the province can look forward to collecting much more in the way of royalties over the year.

The finance ministry calculates that for each $1 rise in the price of natural gas over the forecast, the treasury collects an additional $300 million in royalties.

So if -- note the "if" -- the average price for the entire budget year were to be the current roughly $9.15 instead of the predicted $5.65, then the provincial treasury could look forward to a $1 billion top-up.

Nor is that the end of the potential revenue windfalls.

The treasury is also enriched by the sale of drilling rights, essentially up-front cash payments for the option to explore for natural gas.

Those sales have been running ahead of expectations as well. Better prices for the product means more interest in exploration, particularly where drilling involves greater financial risk.

B.C. benefits especially because some of its potential is locked up in shale gas deposits, which are more expensive to develop.

Expectations of a "land rush" were borne out in a May 21 press release from the energy ministry: "$441-million monthly rights sale largest ever."

Some 40 parcels of land covering 46,284 hectares fetched an average of $9,538 per hectare, three times the previous mark.

The record may not stand for long. When I mentioned the May sale to Energy Richard Neufeld recently, he said there's every expectation those returns will be exceeded in the next round.

B.C. is regarded as having the greatest untapped potential for gas exploration on the continent. Six of the 10 best sales of drilling rights in provincial history have been recorded in the past 12 months.

Accordingly, Neufeld's ministry has put up 99 parcels totalling 61,482 hectares for the June sale. If the bids are in the same range as last time, the take will exceed half a billion dollars.

The finance ministry, in its prudence, would ask me to note that not all of the benefit from increased sale of drilling rights will be registered in the current financial year.

The rights are a form of tenure. Companies buy in for a fixed period, usually five to 10 years.

Though the buyers commit cash up front, provincial accounting rules demand that the payments be apportioned over the length of the tenure, averaging eight years.

If the province collects $1 billion now -- as it may well do from the combined May and June sales -- only about $125 million will show up on the bottom line for the current year.

Still a tidy sum, and Neufeld notes a further benefit of the tenure system. "If they don't exercise those rights within the specified period of time, they revert to the Crown and we can sell them again."

Yes, as with the fabled hucksters of swampland, the government can sell the same plot of land -- or rather the drilling rights under it -- more than once.

All this good news from the gas sector has political implications.

With the forest industry battered, the tourism sector anxious and an election year approaching, the Liberals have good reason to worry about the health of provincial finances.

Any windfall in gas revenues will come in handy as they are squaring up the books and rolling out the goodies for a spring election campaign.

June 10, 2008

Municipality challenges BCTC authority

Utility told to provide proof of its right to access civic properties without consulting local government

Scott Simpson

Vancouver Sun

June 10, 2008

DELTA - The corporation of Delta is challenging the BC Transmission Corp.'s authority to carry out a planned upgrade of a high voltage power line through Tsawwassen.

BCTC is accessing civic properties that are outside its power line's right-of-way, and Delta is demanding proof that it can go onto those properties without consulting the local government, Delta municipal solicitor Greg Vanstone said Monday in a telephone interview.

Vanstone said Delta is also concerned that BCTC is refusing to provide a work schedule for the project to enable area residents to plan their way around traffic and property disruptions that will occur during construction.

BCTC spokeswoman Thoren Hudyma responded that Delta had never previously indicated a concern about access for construction of the line.

Tsawwassen is one of the final incomplete sections of a $280-million, 67-kilometre power line upgrade between the B.C. mainland and Vancouver Island.

Thousands of Delta residents have voiced opposition to the project, which will put new overhead high-voltage lines along an existing 3.7-kilometre transmission right-of-way that runs through backyards of 137 Tsawwassen homes.

Work crews began arriving in the community last week to commence work on the publicly owned sections of the route, with several residents threatened with injunctions after refusing access to their property.

"We have not issued any permits, approvals, licences, any formal authorization for them to do what they're doing," Vanstone said.

"In addition to going onto private property they are going onto some municipal property, some dedicated roads and lanes and this sort of thing. Those are properties that do not have a right-of-way dedicated against them.

"So, because we haven't given them any approval and because they don't have a right-of-way, we've asked them what their authority is to enter the right-of- way for this purpose. They've not yet told me what their authority is."

In addition, Vanstone said Delta also believes BCTC should respect the municipality's customary practice of announcing in advance any civic works likely to cause a local disturbance to traffic or the community in general.

"We'd like to be able to tell the residents, you can be expecting this to happen on 12th Avenue on these days, and this to be happening on this street on these days, so you can decide whether you go get your milk today at this store, or whether you go somewhere else, those sorts of things," Vanstone said.

He said Delta expects BCTC to post signs on affected streets, or publish or mail public notices to inform residents how their movement around the community, or the enjoyment of their backyards, will be affected on a day-to-day basis during construction of the new lines.

"When we have a road project or a waterworks project, if we are going to block a road, we put up signs. We say this road is going to be affected for these days. We'd like to be able to tell our citizens that sort of information, [but] we don't have it." He said Delta has no plans "at this time" to take the issue to court.

Hudyma said BCTC "has the legal right to construct this line. The right-of-way agreements include the provision allowing us to pass and repass over the land for the purposes of ingress and egress to and from the right-of-way."

She noted that Delta opposed the project at hearings before the B.C. Utilities Commission, but said "at no time did they ever indicate that they took the position that BCTC did not have the right to use municipal streets or other infrastructure in constructing the BCTC has been in "ongoing contact" with Delta, and with residents, about construction in and around the lines

"As for receiving copies of individual property owner construction management plans, these are confidential documents and we are speaking about these to individual property owners," Hudyma said.

A tentative date has been set for Wednesday in B.C. Supreme Court to hear BCTC's application for an injunction against four Tsawwassen residents who have refused work crews access to their properties.

"We expect some kind of answer by the end of the week, very shortly after the hearing," Hudyma said. "We know that we do have the legal right as per the right-of-way agreements that have been in place since the '50s. So the idea of going to the courts is to have those rights reaffirmed," Hudyma said.

"We know we have them, but if people are more comfortable hearing that kind of reaffirmation from the courts then that's fine too."

June 09, 2008

Spilled gov't gravy proof of questionable lobbying

'Insiders' insiders' net clients big deals in Campbell controversy

Michael Smyth

The Province

Sunday, June 08, 2008

The decision by B.C. Hydro to contract out much of its functions to giant multinational corporation Accenture for $1.4 billion is one of the biggest controversies surrounding Premier Gordon Campbell's privatization agenda.

But, until now, British Columbians only knew part of the story. Now we discover a Vancouver company led by senior Liberal political organizers Patrick Kinsella and Mark Jiles was helping the deal along behind the scenes.

That was just one of last week's revelations contained in an amazing series of documents obtained by hard-digging Internet blogger Sean Holman.

Kinsella co-chaired the Liberal election campaign in 2001 and 2005. Jiles was Campbell's personal campaign manager in Vancouver-Point Grey.

Apparently this situated them perfectly to land lucrative government deals for their clients, Accenture being only one on a long list.

The Progressive Group -- the company operated by Kinsella and Jiles -- also helped Alcan land a sweet deal to expand its Kitimat smelter. It helped the B.C. Motion Picture Production Industry Association bag $65 million in provincial tax breaks. And on and on.

B.C. lobbyist registrar David Loukidelis is now investigating whether Kinsella and Jiles broke the rules by failing to publicly register as lobbyists while delivering all this government gravy to their undoubtedly delighted clients.

After several days of silence, the Progressive Group on Friday issued a written statement saying its activities did not constitute "lobbying" under the law in B.C.

Hmm. The dynamic duo brag in their resume that they were hired by the motion-picture association "to convince the provincial government to extend the foreign tax credits" to their clients.

If that's not lobbying I'd like to know what is. I look forward to Loukidelis's report.