July 29, 2008

Ocean energy adrift in B.C.

Province not taking the initiative to become a world leader

Paul Luke

The Province

Sunday, July 27, 2008

New Energy Corp.'s president and CEO Clayton Bear (left) and business development vice-president

Bob Moll are among those pushing development of ocean energy across Canada.

CREDIT: Gerry Kahrmann, The Province

B.C.'s chance to become a global leader in ocean energy may drift out of reach unless the province decides to help the infant industry stay afloat.

Canada's west coast is blessed with enormous ocean energy resources and a handful of companies with world-beating technology, says Chris Campbell, executive director of Nanaimo-based Ocean Renewable Energy Group.

But unlike several European countries, B.C. has shown little desire to nurture the industry. Campbell predicts B.C. will be generating a significant amount of wave and tidal power in 15 to 20 years, but he worries that it may be using foreign technology.

"We're really at a critical point," says Campbell, whose non-profit organization pushes development of ocean energy across Canada.

"When we put in a wind farm or even a run-of-river project we're buying that technology from somewhere else."

"We've got a B.C.-based wave and tidal technology that could be among the world's leaders but if don't do something soon we may as well just get the box cutters out and open the boxes with the Scottish thistles on them."

Campbell is referring to the United Kingdom's aggressive support for ocean energy research and development over much of the past decade. While there's no clearcut leader in ocean energy technology -- "that's going to be decided over the next four to five years" -- Scotland may emerge as the country to beat, he says.

Vancouver-based Clean Current Power Systems could spoil that for the Scots. Clean Current has developed technology to convert the kinetic energy of tidal currents into electricity.

Clean Current has tested three prototype tidal turbines. One of these, a 65-kilowatt device, was tried out two years ago in the Race Rocks ecological reserve near Victoria.

The company is currently designing and building a commercial-scale turbine with a 17-metre diameter blade to be installed in the Bay of Fundy off Nova Scotia by fall of 2009.

Clean Current CEO Glen Darou says his company's turbines, which work like underwater windmills, are among the few such devices with a proven track record.

"There are something like 46 tidal energy businesses," Darou told last week's meeting of the Pacific NorthWest Economic Region in Vancouver. "There are only about four that have actually been in salt water operating."

B.C.'s other ocean energy companies have yet to go as far towards commercialization. That's one reason the industry was crestfallen when the provincial government bypassed it for funding earlier this month.

No ocean energy initiatives were among the first 15 projects chosen for funding from the government's $25-million Innovative Clean Energy Fund.

Nigel Protter, president of Pemberton-based SyncWave Systems, says B.C. is swimming in a policy vacuum when it comes to ocean energy.

"The possible outcomes of the B.C. government's neglect of the industry is that companies are withering, will wither and may have to leave," Protter told the PNWER meeting.

SyncWave's made-in-B.C. technology targets ocean energy's other stream: wave power. Its system absorbs energy from waves by resonating to the ocean's wave frequencies.

SyncWave hopes to have a demonstration device in the ocean next year. By 2012, it wants to have hybrid wave-diesel systems in place to serve remote communities.

Alberta's New Energy Corp. had, until recently, focused on extracting energy from freshwater streams. The company is developing tidal current applications for its technology by partnering with Campbell River-based Canoe Pass Tidal Energy.

The partners plan to develop tidal-current projects in the channel between Quadra and Maude islands. New Energy hopes to have two 250-kilowatt turbines in the water next year for demonstration purposes, says Bob Moll, New Energy's vice-president of business development.

B.C., the northern tip of Scotland and, perhaps, Chile are among the few areas in the world endowed with immense tidal and wave resources. Mike Tarbotton, head of Vancouver-based Triton Consultants, says B.C. has about 89 tidal energy sites adding up to about 4,015 megawatts of power.

Annual mean wave power off B.C.'s coast totals about 37,000 megawatts, according to a two-year-old inventory by the Canadian Hydraulics Centre.

On paper, that's equivalent to about half of Canada's electricity consumption. In practice only a fraction can be converted into useful power.

Ocean power, which is not affected by changing levels of precipitation, should become part of B.C.'s energy portfolio, Campbell argues.

Ocean energy projects, however, are expensive in their early stages. Venture capitalists after quick payoffs haven't exactly been flinging money at a sector that, like wind energy before it, will need years to test technology and cut costs.

B.C. Hydro, Campbell suggests, could commit to pay for 20 to 50 megawatts of installed ocean power capacity without imposing a heavy burden on ratepayers.

"We need to build an environment that makes it a little easier to attract financial investment," Campbell says. "That isn't simply government writing a cheque, although that helps, but government flying a flag that says we want to see ocean energy as part of the mix for British Columbia."

© The Vancouver Province 2008

July 27, 2008

CRD urged to oppose Texada gas facility

Tanker traffic in strait poses danger: environmentalists

Bill Cleverley

Times Colonist

July 27, 2008

Capital Regional District directors want to hear from both sides before they weigh in on whether a liquefied natural gas plant, with its accompanying tanker traffic on the Inside Passage, should be built on Texada Island.

CRD environment committee members this week heard from representatives from the Georgia Strait Alliance, the Alliance to Stop LNG and Texada Action Now urging them to join the Powell River Regional District in opposing Alberta-based WestPac LNG Corp.'s plans to build a liquefied natural gas facility on Texada.

Saltspring Island director Gary Holman proposed the CRD add its voice to that of Powell River's.

Were the proposal to go ahead, coastal communities would be taking on the health and environmental safety risks associated with a project designed to ship natural gas to the U.S., said Holman.

"I think we should be supporting the Powell River Regional District," he said.

But committee members said they wanted to give proponents of the plant an opportunity to present their case before making a decision. Representatives from WestPac will now be invited to speak to the CRD board.

If the plant were built, LNG tankers the size of three football fields would travel up or down the Strait of Georgia every five days, Deborah Conner, executive director of the Georgia Strait Alliance and Arthur Caldicott, of the Alliance to Stop LNG and Texada Action Now told directors.

"Anything that's plying down the strait is of concern to us to us if it does have an environmental impact on the marine environment," Conner said.

The project could also feed LNG to the Lower Mainland and to Vancouver Island via existing pipelines.

Caldicott said the Texada proposal is designed to move natural gas into the high-demand U.S. market.

"B.C. produces far more natural gas than we use domestically. So any new gas coming in to Texada would net out with the same amount moving out of British Columbia elsewhere," Caldicott said.

"So in effect it's an import scheme to move more gas into the high-demand U.S. market. The other reason for Texada is that it's right on the B.C. Hydro transmission grid. It's the main line for Vancouver Island and with the gas-fired generation plant they have an easy connection to the grid."

He said tankers would travel through the Juan de Fuca Strait, up Haro Strait and then up the Strait of Georgia to Texada Island.

"This is one of the most densely travelled waterways in North America," Caldicott said.

The Powell River Regional District has passed a resolution calling on the federal government to implement a ban on LNG tanker traffic in the Strait of Georgia.

July 25, 2008

Oil and gas commissioner: no problems with Shell yet

COMMENT: A comment worth highlighting here is this, from OGC Commissioner Alex Ferguson:

"Ferguson said the commission prefers dealing with large companies who already know the rules and regulations. "They have pretty sophisticated planning. At least we know they've got the ability. It's a matter of reminding them of that," he said."

This statement confirms the concerns that other communities have had where small, ad hoc companies show up to develop coalbed methane. Companies in which it's clear they have no expertise, no financial capacity. Yet the OGC gives them drilling permits, too.

Terrace Standard

July 22, 2008

THE PROVINCIAL government's oil and gas regulator so far hasn't had any issues with Shell's plans to drill for coalbed methane natural gas in the Klappan area, its representatives say.

Approvals for three wells drilled in 2004 and approvals to drill up to 14 more starting this fall in the area north and to the east of here all met guidelines, says Alex Ferguson, the commissioner with the provincial regulator known simply as the Oil and Gas Commission.

"There's no hydrogen sulphide here, which is extremely dangerous, and there's no high pressure gas issues here," he said.

"The equipment footprint here is smaller [than with other drilling] and it's the same drilling equipment that you would use to drill a water well with," Ferguson added.

Shell's plans, so far, haven't come close to triggering more comprehensive environmental assessments that would be required by, for example, mining companies or other resource users.

As for Shell itself, Ferguson said the commission prefers dealing with large companies who already know the rules and regulations.

"They have pretty sophisticated planning. At least we know they've got the ability. It's a matter of reminding them of that," he said.

Ferguson and another commission official, Steve Simons, were in Terrace July 14 at the invitation of Terrace city council to explain how the commission works.

That was the first day of a two-day Shell open house here explaining its Klappan plans and the day before a anti-Klappan drilling rally was held here.

Environmental groups, individuals and some Tahltan whose traditional territory takes in the Klappan say the prospects of environmental damage from drilling aren't worth the risk.

Ferguson and Simons said the timing of their meeting with council was a coincidence.

And, they said, the commission has no part in the discussions or approvals as to whether Shell should be in the Klappan or not.

"That tenure's been sold," said Ferguson of the deal struck back in 2004 in which Shell bought drilling rights from the provincial government. "We get involved after tenure's been sold."

Simons said the commission makes sure the applications are technically sound and working within the laws of the province, as well as ensuring that oil and gas exploration are done in a safe manner.

"We act on the public's behalf," Simons said.

Ferguson said the commission's level of involvement will increase if and when Shell's drilling turns up enough information for it to think it could have a commercially viable venture on its hands.

If Shell does find enough natural gas to justify a large-scale project, that means it'll need to build a pipeline south.

That'll trigger another response by the commission since it has the responsibility for pipelines that start and end in B.C.

Pipelines that cross provincial borders generally fall under the jurisdiction of the federal National Energy Board.

There are about 300 companies involved with oil and gas exploration operating in the province.

Offshore debate heats up as talks continue

By Shaun Thomas

The Northern View

July 22, 2009

The debate over offshore oil and gas development off the B.C. coast heated up last week with North Coast MLA Gary Coons saying that drilling in the Queen Charlotte Basin would not be tolerated by the people of the North Coast.

"We want a living ecosystem; even if everyone else in the world thinks that money is more important than life, we don't. This is our home. We won't let anyone wreck it, not for money, not for oil," said Coons in response to a statement by Finance Minister Colin Hansen that the province continues to work with the Federal Government to open offshore oil and gas development.

"We don't care who says it is safe, we don't care who says that the risk is worth the money. We don't need it."

Calling offshore development "a huge economic opportunity" for the province, Minister of Energy and Mines Richard Neufeld said the province is continuing its push to lift the moratorium, but that any development would still be a long way off.

"I know some people say we would just jump in there, but that's not quite so."

"Let me be very clear, even if you lifted the ban you would not start drilling on the coast for a long time after that because there first has to come some consultation and some work on that front, you have to update the seismic that is there and you have to develop the final agreements between the federal and provincial government on responsibilities and regulations."

And when it comes to the economics of drilling, the two share very different views on the role oil and gas development play in the operation of the province.

Drill logs show Shell struck water

By Quinn Bender

Smithers Interior News

July 23, 2008

Royal Dutch Shell's claim that no water is being produced by coalbed methane test wells is being refuted by the company's own drill logs.

The oil giant has repeatedly claimed that three test wells drilled in 2004 exploring for coalbed methane did not produce any water, but drill logs obtained by The Interior News show that, in fact, the testing at one well site has on four instances caused artesian flow at depths from 179 to 311 metres.

Opponents to proposed coalbed methane exploration and extraction in the Klappan Valley, known colloquially as the Sacred Headwaters, said the drill logs conclusively prove Royal Dutch Shell is not forthcoming with their findings

"[The drill log] defeats Shell's mantra that they haven't found any water up there," said Shannon McPhail, executive director of the Skeena Watershed Conservation Coalition (SWCC).

As a result of the artesian activity, Shell suspended drilling at the site and has since capped the well and reclaimed the surrounding area, according to a company spokesperson. Shell also stressed the water was not produced from a coal seam, but found at random depths in fresh ground-water tables.

"What's in this document is actually not produced water [from the coal seam], it's water that you would experience as you drill through different layers of rock," said Shell spokesperson Larry Lalonde. "What we're drilling for, where we would get the gas from the coal, is much deeper than the water that was experienced."

Whether or not the water was the dreaded flow from the coal seam, toxic to above- ground ecosystems, the SWCC is concerned the potential for such water threatens to mix with groundwater, and enter the environment through natural aquifers.

Lalonde insists produced water from the coal seam could not penetrate their well structure, four layers each of steel and concrete, to mix with subterranean fresh water.

Shell faced a battery of protests last week, during a series of public information sessions attended by a Royal Dutch Shell representative from the company's head office in the Netherlands.

The SWCC hand delivered a large box containing 1,730 letters from North Americans opposing Shell's project in the so-called Sacred Headwaters, the ecologically sensitive watershed where three of the province's major salmon-bearing rivers begin. The package was handed to Barnaby Briggs, from Shell International's Social Performance Management Unit, to hand deliver to Royal Dutch Shell CEO Jeroen van der Veer.

The handoff occurred amidst one of several protests outside Elks Hall, with representatives from several community and First Nations groups shouting anti-Shell slogans.

Despite the protests, Shell said the open house was well attended with approximately 80 people dropping in over the two-day period.

The protests fell on the heels of an official letter of opposition released by Wet'suwet'en Hereditary Chiefs.

"The Wet'suwet'en are in full support of the Tahl'tan in their fight against [Royal Dutch Shell] and have passed an agreement in principle to support the Friends of Wild Salmon Declaration."

That declaration was signed by the councils and board of directors of several Northwest towns and their districts, including the Town of Smithers. The Regional District of Bulkley-Nechako is awaiting a presentation from Shell Canada before voting on their endorsement of the declaration.

Having routinely promised the most environmentally sensitive operation possible, Shell is asking the public to await data from this season's test drilling before they pass judgement on the project. The company said it plans to drill six wells to determine whether the gas will flow, if those wells will produce the potentially toxic waste water and what scale of an operation will be needed if the project is green lit.

During an information session delivered to the Chamber of Commerce Thursday, the company hinted that the government permitting process would eventually require them to file an application for at least 1,000 wells total in the Klappan, Prudential and Nass Valleys.

"You want a company like Shell doing this," said spokesperson Kathy Penney. "Not five or six separate companies who will all do it their own way."

http://www.bclocalnews.com/bc_north/interior-news/news/25764174.html

July 24, 2008

What went wrong? Still no answers

One year ago this week, an accident ruptured a pipeline in North Burnaby and sent nearly a quarter of a million litres of crude oil spurting over homes and into Burrard Inlet. Below, in the first part of a special report, reporter Brooke Larsen looks at the impact of the spill a year later.

Brooke Larsen

Burnaby Now

Wednesday, July 23, 2008

The aftermath: Workers begin the task of cleaning

the shoreline after last summer's oil spill.

CREDIT: File photos/BURNABY NOW

A year after a massive oil spill wreaked havoc on Inlet Drive, investigators aren't saying what went wrong.

Art Nordholm, lead investigator for the Transportation Safety Board, said it will be three or four months before the board releases its findings on the oil pipeline rupture.

Nordholm said the board's investigation focused on the cause of the break, which is also under investigation by the National Energy Board and Environment Canada.

Nearly a quarter of a million litres of oil spurted onto Inlet Drive on July 24, 2007 after a city-hired contractor struck an underground pipeline owned by Kinder Morgan Canada.

The spill caused millions of dollars of damage to homes and city property and launched a large cleanup of Burnaby's shoreline.

Nordholm said a draft report is finished and must be sent out to interested parties for review.

"So it would be a while yet before it's going to be released," Nordholm said, adding he hasn't seen a copy of the report.

National Energy Board spokesperson Sarah Kiley said the National Energy Board's report won't be released until the Transportation Safety Board report is released because the two agencies work together.

Kiley said the energy board is looking at whether there were any violations of the National Energy Board Act, which governs the operation of oil pipelines and carries maximum fines of $1 million.

A spokesperson from Environment Canada declined the NOW's request for an interview.

Headed for the courtroom?

The outcome of the investigations could play a role in the various lawsuits stemming from the spill, city solicitor Bruce Rose said in an interview.

"Potentially, they could be used as evidence," Rose said, adding it's up to the courts to decide who is liable for the spill.

Rose said residents whose homes were damaged have launched "at least a dozen" lawsuits. The suits have not progressed past the initial statements of claim.

"They were filed, but I mean there's been no examinations for discovery," Rose said.

In 2007, Shell Canada filed the first lawsuit stemming from the spill, naming Kinder Morgan Canada, the City of Burnaby and the city's contractor, Cusano Contracting.

Shell wants to recover costs from 11 days of lost production after the spill.

Trans Mountain Pipeline, owned by Kinder Morgan, has also launched a lawsuit, claiming Burnaby failed to locate the company's underground pipeline before it started sewer work on Inlet Drive.

Among the damages in its statement of claim, the company lists loss of reputation, lost oil and the cost of repairing private properties.

The City of Burnaby, meanwhile, maintains that Kinder Morgan supplied the city with inaccurate maps of the pipeline's location.

A pipeline map signed by Kinder Morgan early last year was off by several metres, a City of Burnaby engineer says.

The map, viewed by the Burnaby NOW last week, is part of a crossing agreement prepared by consultant R.F. Binnie and Associates. The city hired R.F. Binnie to prepare the crossing agreement between Burnaby and Terasen Pipelines, operated by Kinder Morgan Canada, for sewer work the city planned to do, Geoff Tsuyuki said,

The agreement, dated Feb. 9, 2007, gave Burnaby permission to carry out sewer work near the company's pipeline.

Tsuyuki, who is manager of contracts and inspections in Burnaby's engineering department, said R.F. Binnie mapped the pipeline's location using information supplied by Kinder Morgan.

"They (R.F. Binnie) have to prepare these drawings based on information they receive from the utilities," Tsuyuki said.

The map was then sent to Kinder Morgan for approval, he said.

The map, which was initialled by two Kinder Morgan employees, bears a stamp that reads, "All information is subject to field verification by a Kinder Morgan inspector."

Tsuyuki said that, while the initials relate to the location of the crossings, it's common for utilities to say at that stage whether they have an "issue" with the maps or the project.

"If they think there's an issue with it, they may say, 'That's too close,'" Tsuyuki said.

He added, "I'm not sure what their (Kinder Morgan's) process is."

Tsuyuki said the map shows the pipeline's location as running a few metres south of where the pipeline rupture occurred.

"According to the map, it's just under three metres," Tsuyuki said.

A spokesperson for Kinder Morgan Canada did not return phone calls before Burnaby NOW deadlines.

© Burnaby Now 2008

July 22, 2008

Risks escalating on maxed-out BC hydro grid

Power so tight that Hydro will pay industrial users to shut down on peak winter days

Scott Simpson

Vancouver Sun

Saturday, July 19, 2008

Our electricity supply is so tight that BC Hydro is asking permission to pay industrial customers to shut down operations on peak winter days when the system gets close to capacity.

B.C. will be in that situation "for the next several years" according to documents recently submitted to the B.C. Utilities Commission.

This situation illustrates how the flaws and risks of failure in BC Hydro's aging electricity system don't stop with the faulty cable splices that blacked out downtown Vancouver this week.

The entire system, every bit of it, from the dams that capture water to generate power, to the wires distributing electricity to people's homes, is maxed out.

Or, in the words of the Crown corporation itself, "BC Hydro is facing capacity constraints in all parts of its system."

Recent Hydro filings with BCUC state that the B.C. electricity grid is "significantly exposed" to the risk that Hydro won't have enough power in the system when four million residents flick on lights, furnaces and other appliances on the coldest, darkest days of the winters ahead.

So far, there's no indication that Hydro's overall ability to deliver electricity is fading to black.

In spite of a blackout in Vancouver's core business and tourism district for up to three days this week, the reliability of service is comparable to other North American jurisdictions, according to internationally established performance measures.

Nonetheless, it's clear from the documents that the Crown corporation's dedicated corps of electrical engineers and linemen will be holding their breath when the mercury drops, and counting on steady performance from hydroelectric facilities that are already showing signs of age.

Remedies are years away. Hydro and its critics acknowledge that chronic under-spending on the system in the 1990s, and a lack of recruitment of electrical line workers and engineers all the way back to the early 1980s, make it difficult to catch up.

Last year, for example, "inadequate long-term planning" left BC Hydro with a "skill shortage" that forced it to forego $105 million worth of system improvement projects because it didn't have enough workers to carry out of all the work it planned.

New independent power facilities are not the answer. They offer intermittent production that is not reliable enough to serve baseline needs in crucial situations.

Other potential sources such as Burrard Thermal and Columbia Treaty power require advance scheduling and force Hydro into an iffy situation where it must bet, in advance, how much power people will use the following day.

Reliance on market-priced power imports from the U.S. isn't just expensive, it's also in conflict with orders from the provincial government to make B.C. self-sufficient in electricity by 2016. Moreover, Hydro notes, the power lines themselves already run at capacity in winter, particularly along border connections.

Hydro is proposing to spend $3.4 billion by 2010 -- paid for by customers through a 15-per-cent rate increase over two years -- to begin to "renew and upgrade" its dams, generating stations and the complex system of wires that distribute power to customers. That won't be enough to overcome the strains on a system that has not had a major expansion since 1984.

Hydro thinks paying big industrial users to shut down will leave enough room in the system to meet sudden spikes in demand. Documents show that without the industrial "load curtailment" program, there is only a 55-to-60-per-cent likelihood that Hydro will have electricity to spare at peak times this winter.

That means 40 to 45 per cent of the time, the system will run flat out.

That is far from Hydro's ideal. Its "operational planning criteria" target is to have surplus power at least 90 per cent of the time.

The industrial program already exists in a scaled-down version on Vancouver Island, where the possibility of blackouts has already been raised in the absence of new high-voltage cables to bring more power from the mainland.

The new cable route is mostly built, save for a controversial section through Tsawwassen that continues to meet vigorous opposition from some residents.

A spokesman for industrial users said in an interview he sees no problem in his members striking accords with Hydro. But even so, there are substantial challenges. In March 2008 for example, one of the turbines at Shrum Generating Station on the Peace River -- the largest hydroelectric station in the province -- suffered what engineers describe as a "catastrophic failure" and is out of commission for a year. Four others on the same bank of turbines are showing similar symptoms of stress, and all have been in service since the 1960s.

"Aging infrastructure, if not adequately maintained or replaced when conditions warrant, can have a profound effect on the safety and reliability of the electric system," Hydro states in its revenue requirements application to the BCUC.

Hydro president and CEO Bob Elton said in an interview this week the Shrum unit failure "is not going to affect our reliability" and he says Hydro is "accelerating" its expenditures on the system.

"If you see the condition of [Hydro assets] deteriorating, and you see the demands on them increasing, which is what we see, then we know we need to invest."

Elton noted that Hydro is preparing to add almost 2,000 megawatts of new generating capacity, almost 20 per cent more than what Hydro has at present.

Hydro looks to add two additional generators at Revelstoke and two at Mica, the second- and third-largest hydroelectric facilities in the province.

"We feel strongly that these are necessary investments," Elton said. "We need to pass on to the next generation a system that's better equipped for the demands of our modern life."

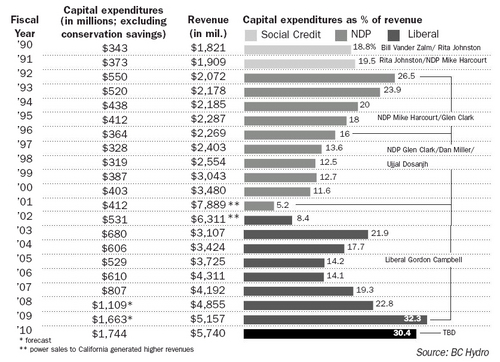

By 2010, Hydro proposes to spend $1.7 billion in a single year, compared to $412 million in 2001, the year the BC Liberal Party took power.

The construction of new generating assets, as well as new high voltage transmission and lower voltage distribution lines, is projected to alleviate the current squeeze.

But Hydro warns that in the meantime, "the system remains significantly exposed to risks" including delays in construction at Revelstoke and Mica, and delays in maintenance work on broken units, such as the failed turbine at Shrum.

B.C. energy sector commentator David Austin, who expressed alarm in 2000 about Hydro's apparent failure to spend enough money to maintain its system, said one of the largest challenges is simply getting the refurbishment of the system underway.

The lead time to purchase a new turbine is measured in years, not weeks or months, for example.

"There was under-spending in the 1990s, but you can't suddenly turn the tap on and correct the problem overnight," Austin said.

"It's like jump-starting a car. It takes a while to get it moving."

Dan Potts, executive director of the Joint Industry Electricity Steering Committee, which represents the interests of large industrial customers of BC Hydro, said he doesn't perceive this week's three-day blackout in downtown Vancouver as a symptom of any looming system failure.

"We're not dissatisfied with the level of reliability we typically receive from BC Hydro," Potts said. "Now, if I was in downtown Vancouver and lost a freezer full of food, I don't know what I'd think.

"BC Hydro does need to build some new infrastructure, without question."

Gwenne Farrell, president of Canadian Office and Professional Employees Local 378, representing Hydro inside workers, said her members remain concerned that the provincial government's priority remains the expansion of private-sector power rather than fixing the grid.

"If you look at BC Hydro's own application to the BCUC for their revenue requirement, the largest amount of the rate increase they are going for is energy purchases from private producers, not the maintenance of the infrastructure. You have to question how that is appropriate," Farrell said in an interview.

ssimpson@png.canwest.com

© The Vancouver Sun 2008

July 16, 2008

Canada's Kitimat LNG hopes to start terminal construction Q3 2009

COMMENT: There are a set of interdependencies here. It's a variation on "for want of a button ..."

- No dirt will be dug until the capital to build the Kitimat LNG (KLNG) import terminal (estimated in 2005 as $500 million, likely substantially higher today) has been secured.

- No capital will be secured for the LNG terminal, until the capital to build the Kitimat-Summit Lake expansion (KSL) of the Pacific Natural Gas pipeline (estimated also since 2005 as costing $1 billion) has been secured, because without the KSL, the gas from KLNG is as locked in as if it were still in the ground in Deeper Petrostan. The two projects, KLNG and KSL are for each, a sine qua non. That is, it's neither or both.

- No capital for either project will secured until KLNG can demonstrate to lenders or investors that the project(s) will safely provide a return on the investment.

- That means, KLNG has to secure customers who want gas from its operation, and KSL has to secure shippers who will utilize the pipeline. And we're not talking a token, here - the ROI will only be secured by a high utilization rate of both the terminal and the pipeline - which again, mean the same thing, really.

- The exception to this equation is if KLNG can persuade anyone (including itself) to build a honking big gas-fired generation plant in Kitimat. Hello, BC Hydro. Kitimat LNG has pondered this possibility.

- No customer will commit to either project unless it knows gas will be forthcoming. At best, customers might sign contingency agreements, or take options, requiring KLNG to show them the money, that is, show that it has long term LNG supply contracts.

- Securing long term contracts for LNG may be the biggest challenge KLNG and other importers face. There may be enough gas in the world, but there isn't enough liquifying capacity to meet demand. Japan, Korea, China - these are the global price setters. Not North America. Also, the price of LNG, like the price of natural gas, follows the price of oil. LNG suppliers have no incentive at present to sign long term supply contracts. The oft-repeated wisdom is that carriers are rerouted at sea, as the shippers, or owners of the contents, discover better spot pricing. Not good when you are depending on gas for your tar sands cooker, need to know your pipeline is full and flowing, and are depending on ships arriving at your terminal.

This article confirms that Kitimat LNG still does not have customers, and that it has made no headway with the only possible supplier mentioned (and the nearest source), Russia's Gazprom. My take is, this is a bad news article for KLNG and KSL, not good news. My track record with predictions? Ah, did you have to ask?

Platts

www.platts.com

15-Jul-2008

Tokyo (Platts)--15Jul2008

Calgary-based Kitimat LNG expects to start construction of its proposed LNG import terminal in British Columbia, Canada in the third quarter of 2009, if it finalizes commercial agreements in the next six months, Kitimat LNG president Rosemary Boulton said Tuesday.

"We are working closely with potential customers, and if we can finalize commercial arrangement in the next six months, we will start construction in the fall of 2009, in the third quarter," Boulton told the 3rd Annual LNG World conference in Tokyo.

That would fit in with the environmental assessment issues, she added.

Kitimat LNG plans to commission its 1 Bcf/d LNG import and regasification terminal near the port of Kitimat in 2012-2013, Boulton said, adding that 2013 was the "most likely" start-up timeline.

The facility can be further expanded to 1.6 Bcf/d, "once we get commercial certainty, contracts," she said.

Boulton declined to name the customers Kitimat LNG was in talks with, saying the company was "in the middle of discussions."

With Russian gas giant Gazprom, which has been increasingly looking at North American terminal capacity for its future LNG, Boulton said Kitimat LNG has not progressed towards any commercial agreement with the company.

"We had preliminary discussions with them, but we have not really been able to progress [anywhere] towards commercial arrangements with Gazprom," she said on the sidelines of the conference.

The terminal will be able to handle LNG carriers of up to 266,000 cubic meters and is permitted to have three LNG storage tanks with a capacity of 160,000 cu m each.

A gas transmission system, Pacific Trail Pipelines, is to be built from the LNG import terminal to Summit Lake in British Columbia, from where the gas can further access key North American markets, including California, through a number of existing pipelines.

PTP has already received provincial environmental approval in June, and expects to receive federal approval in the third quarter of 2008, Boulton said.

PTP, a $1 billion, 470 kilometer pipeline will provide the terminal with a direct connection to the existing Spectra Energy Transmission pipeline system on the West Coast, which is linked with other major pipelines running to a number of Canadian and US destinations.

If the LNG terminal is later expanded to 1.6 Bcf/d, more compressors will be added to PTP, Boulton said.

PTP is a 50:50 partnership between Canada's privately-owned Galveston LNG, which is Kitimat LNG's sole parent, and Pacific Northern Gas, which owns and operates gas transmission and distribution systems.

--Anna Shiryaevskaya, anna_shiryaevskaya@platts.com>anna_shiryaevskaya@platts.com

--Takeo Kumagai, takeo_kumagai@platts.com

First Nations support green run-of-river power projects

Ken Brown, Walter Paul and Darren Blaney

Vancouver Sun

Wednesday, July 16, 2008

Over the past few months the NDP Opposition, union leaders and organizations formed and backed by these political groups have implemented a campaign of public meetings and media misinformation on run-of-river power projects.

Seemingly lost in this disturbingly paternalistic and blatantly ideological campaign against run-of-river green energy projects are the interests of first nations communities partnering with independent power producers.

The majority of these green projects -- whether they are run-of-river, wind, tidal or biomass -- exist in the core traditional territories of first nations across this province. For many years first nations have been working to put what we believe are the appropriate environmental, economic and social decision-making processes in place to assess whether an individual project(s) should receive the consent.

Despite what the anti-IPP movement would have you believe, first nations are the front line environmental and economic stewards of our territories. These are the lands and waters that must sustain our nations in perpetuity. We participate in the environmental assessment process and often augment it with our own traditional use studies and archaeological studies. To suggest these studies are not done is blatantly untrue and is disrespectful. In many cases, these IPP projects are directly helping to re-build a sustainable economic base to replace what has been lost.

While there are undoubtedly projects and developers that have no business coming into our traditional territories, the suggestion that the entire IPP sector should be shut down is nothing more than self serving, politically inspired rhetoric. In our view there is a very welcome place for private sector partnerships, direct first nation equity ownership and better agreements with BC Hydro for our nations involved in the power production business. To eliminate any of these options, when our province clearly needs renewable energy to stop importing dirty power from foreign jurisdictions, is foolhardy and runs contrary to all of our interests.

For too many years first nations in this province have been purposely shutout of economic activities on the land base and therefore stuck in a negative and destructive framework of economic dependency. Despite its relatively short history, we believe strongly the IPP sector is resulting in more jobs, steady revenue streams, and capacity building for our nations. By working together, we believe this positive start can continue to mature and will become an even more important foundation for many of our nations.

The anti-IPP movement would be wise to tone down the rhetoric, get their facts straight and work positively with us to build a better industry.

Chief Ken Brown is with the Klahoose First Nation; Chief Walter Paul is with the Sliammon First Nation; Chief Darren Blaney is with the Homalco First Nation.

© The Vancouver Sun 2008

July 12, 2008

Bechtel Gains $200-Million (U.S.) Contract For Kitimat Project

Nickle's Energy Analects

11 July 2008

Bechtel Corporation says it has signed a $200-million (U.S.) contract to provide engineering, procurement and construction management for the Rio Tinto Alcan Inc. modernization project at the smelter complex in Kitimat, British Columbia.

The proposed $2.5 billion Kitimat Modernization Project would increase production capacity at the smelter by 40%, taking it up to 400,000 tons per year and increase Rio Tinto annual global primary aluminum production capability by more than three per cent.

This will make Kitimat one of the largest Rio Tinto smelters in the world.

Plans call for the Kitimat aluminum production capacity to increase by 125,000 tons by using hydroelectric power from the generating station at the complex. The modernization and green power usage is expected to reduce greenhouse gas emissions by more than 40% per year.

First metal from the modernized smelter is expected in 2011.

In January, the British Columbia Utilities Commission (BCUC) accepted the approach and objectives proposed by BC Hydro and Power Authority in a long-term electricity purchase agreement (EPA) reached with Alcan Inc for supply from the Kemano hydroelectric facility.

The term of the EPA was retroactive from Oct. 1, 2007 and extends to Dec. 31, 2034.

Subsequent to submitting the proposed EPA, Alcan was acquired in November 2007 and renamed Rio Tinto Canada Holding Inc. (RTCH).

The commission concluded the net benefits to ratepayers, calculated by comparing the cost of the 2007 EPA to other resource alternatives, would still be positive under most reasonable scenarios and likely range between $65 million and $120 million under a natural gas price forecast by by the Energy Information Administration in the United States.

July 08, 2008

Power line needs mining money, says energy minister

Terrace Standard

July 08, 2008

MINING COMPANIES can forget about any government effort to build a power line up Hwy37 North unless one or more of them has a project ready to go and money on the table, says provincial energy minister Richard Neufeld.

He's rejected even reviving technical and environmental studies on what's commonly called the Northwest Transmission Line until that happens.

The multi-million dollar line was to run from Terrace to Bob Quinn Lake and was announced last fall by Premier Gordon Campbell as a partnership between the province and mining companies.

The province was to pay nearly $250 million and NovaGold Resources and TeckCominco, partners in the Galore Creek copper and gold mine construction project, another $158 million for the $400 million line.

Galore Creek was going to get the power it needed by building a feeder line to connect to the larger line at Bob Quinn Lake and other power would be available to other mining companies who needed it when their own projects began.

But when work on Galore Creek stopped last fall as costs far outran the construction budget, the province also stopped any and all work on the line.

Since then, mining companies, companies which serve the mining industry and local and regional governments, have amassed a $300,000-warchest to finance a lobbying campaign to keep the Northwest Transmission Line alive.

But even requests to do all of the paperwork, including reaching agreements with area First Nations, so the line is construction-ready when mining companies themselves are ready have been rebuffed by Neufeld, who said taxpayers would blast the province for spending tax monies in that fashion.

"What would Fred and Martha say to the government if it wanted to spend $400 million on a line and there's nothing there. Are there any projects? We had one and that was Galore Creek," said Neufeld.

Even doing all of the paperwork in advance of there being an actual mining project wouldn't fly because it might be outdated by the time a mining company had its permits and financing, the minister added.

"I guarantee you we can get a line there in the same time frame. I'm confident we can do it in parallel," said Neufeld of a company building a mine while the province constructed a power line. "That makes sense."

"What if Galore Creek was five years away? You'd be back to Square One," he said of environmental and other approvals needed for a line's construction.

Mining companies - and the public - shouldn't doubt the province's commitment to build a power line once conditions warrant it.

As proof, Neufeld said the province provided the Galore Creek partnership a guarantee as part of the Northwest Transmission Line agreement.

"They wanted assurances the line would be there. What we said was that if we could not get power to them by 2009, then BC Hydro would have put in diesel generators," he said.

Neufeld also questioned the contrast between companies wanting the province to move ahead with the power line compared to the money they'd make from operating mines.

"I had one company say they'd recover the $2.5 billion it would cost them [in mine construction costs] in three years. So if they can do that, what's the hold up with $158 million for a line? Why are they asking the taxpayers to fund the whole line?" he said.

"We're as committed as we ever were but we're looking for partners," he added.

July 03, 2008

Kinder Morgan ramping up pipeline plans

Dormant northern leg being revived

Jon Harding

Canwest News Service

July 02, 2008

CALGARY -- A second large shipper of oil from Canada to the United States has confirmed interest is heating up between Canadian producers and refining customers in Asia and along the United States' West Coast.

As a result, Kinder Morgan Canada began two months ago to ramp up internal planning work on a long-talked-about -- but basically dormant -- northern leg concept for the company's Trans Mountain pipeline expansion project, according to chief executive Ian Anderson.

The proposed northern leg, a concept Kinder Morgan has had in the wings for years, would stretch in British Columbia from Valemont to a deep-water port at Kitimat on the West Coast, passing by Prince George on the way.

Kinder Morgan is in the midst of expanding its system between Edmonton and Vancouver, and will have completed the looping of its anchor line by the end of the year to boost capacity between Edmonton and Valemont to 300,000 barrels of oil a day.

In an interview this week, Anderson said interest in a West Coast crude outlet is growing. Anderson also talked about progress being made in Alberta around carbon capture and storage and the movement of carbon dioxide, via pipeline, from large emitters to either storage locales or to companies ready to use the CO2 for enhanced oil recovery.

American parent Kinder Morgan Inc. is the largest transporter of CO2 in the U.S.

Q: So what's your take the "dirty oil" talk emanating from the United States and does it pose a threat to the Canadian oilsands industry?

A: Our views are that ultimately producers will look for optional markets

. . . . The political rhetoric coming out of the U.S. is just that, largely posturing (around a U.S. presidential election) and the right conclusions will be reached. I think it's important for the producers, the Alberta and Canadian governments to have their eyes on it and be responsive to it, though.

Calmer heads will ultimately prevail. In the long run, it's the largest market in the world and (Canada's oilsands) are right next door to it.

Q: Has the mood at all changed on either side of the border about doing business together, with Canadian oilsands producers on one side and refiners based in the United States on the other?

A: I think there is increasing interest in the West Coast. I don't know if that is only or directly attached to the "dirty oil" conversations in the U.S. We're in the midst of expanding to the West Coast (Vancouver) today, we have our rout to Kitimat as well, just like Enbridge does. By this fall, we'll be looped right through those parks (Jasper National Park and Mount Robson Provincial Park) to Valemont and Valemont is the takeoff point to go to Kitimat. That infrastructure is to serve a northern route as well, so we'll have pipe in the ground if that's where the market wants to go.

Q: Why, from your standpoint, did the West Coast pipeline option turn quiet two years ago?

A: Supply contracts couldn't reached and they (producers and customers) still aren't underpinning it. It's in the business development phase. What we saw in the last 12 months was a more concerted attention looking at the U.S. Gulf Coast and the pipelines responded. Now it's reverting back to the West Coast again, which is where it was a couple of years ago.

Q: How can a deep-water port be developed at Kitimat when there is an oil development moratorium in place that some believe includes a ban on oil supertanker traffic off the West Coast of Canada?

A: That's debatable. Whether the offshore moratorium on development includes, as it does in some people's minds, tankers. It's a political debate. We have an Aframax (a type of smaller oil tanker) -sized facility in Vancouver that, given the economics today on oil, after transportation is facilitating producer business developments overseas.

Q: Why then have you been working with the B.C. government, First Nations communities and talking with Alberta producers about the TMX's northern leg in the last two months?

A: With all the Gulf Coast alternatives out there for consideration, what market access is the next wave? I think the West Coast is it and I think we're very well-positioned with existing assets and relationships to advance expansion to the West Coast.

Q: How large and how expensive would a northern leg pipeline be?

A: It would carry 400,000 barrels a day. We did a cost estimate 18 months ago, but I wouldn't want to speculate now.

We've seen pipeline construction costs, steel costs probably go up by 20 to 25 per cent in the last year to 18 months.

© The Vancouver Sun 2008

July 01, 2008

Water expert raises alarm about coal-bed mining in salmon rivers

MARK HUME

Globe and Mail

July 1, 2008

VANCOUVER -- When John Stockner talks about water, people listen.

Dr. Stockner, now retired from the Department of Fisheries and Oceans, is one of Canada's most eminent scientists in the field of limnology, the study of lakes and other fresh water.

More than 30 years ago, he did groundbreaking research that allowed DFO to boost sockeye productivity by fertilizing nutrient-starved lakes in British Columbia.

Dr. Stockner was among a small group of scientists who first realized that the harvesting of adult salmon on the West Coast was robbing lakes and rivers of annual injections of marine nutrients.

Instead of decomposing after spawning and thereby releasing phosphorous and other valuable nutrients into the water, the bodies of the salmon were going off to market.

As the level of nutrients fell, stocks declined even more because young salmon feed on plankton, and the plankton crops were failing because of a lack of fertilizer.

When Dr. Stockner looks at a watershed in B.C. then, this is what he sees: an intricate web of life that involves everything from the top predators down to the tiniest algae.

And all of that, he knows, has to be in balance if salmon are to flourish.

So it is significant that Dr. Stockner is now raising alarms about the threat coal-bed methane mining holds for salmon rivers in northern B.C.

Dr. Stockner raised his concerns recently in an e-mail letter to Premier Gordon Campbell.

"I have studied and written about lakes and reservoirs in this province for over 35 years, including studies on lakes of the Nass, Skeena, Fraser, and Nechako rivers and lakes of the north and central coast, Queen Charlotte and Vancouver islands," he wrote.

"I have also studied lakes in Montana, Idaho and Washington states and collectively written about the productive capacities of Pacific Northwest lakes to support wild sockeye salmon; offering, where possible, effective means of enhancement and run restoration. I have read and talked with colleagues in the Pacific Northwest about the implications of coal-bed methane extraction on lakes and rivers and seen pictures of the effects of their operations in Wyoming on aquatic biota and their habitat.

"I strongly object to this province even contemplating the extraction of methane and allowing a multi-national company to enter a pristine region of B.C. - wherein lies the birthing-place [source] of three of B.C.'s major northern rivers. To use a medical analogy, the environmental damage from coal-bed methane extraction operations are not as some would like to believe - 'benign,' rather they are 'malignant' and of long-term duration. Effluents once in the ground then entering groundwater and eventually surface flows can severely impact the physico-chemical balances of rivers and streams for several decades!"

It is not like Dr. Stockner to use an exclamation mark in his writings.

But he is deeply worried about the threat coal-bed methane mining poses in an area known as the Sacred Headwaters, where three of B.C.'s greatest rivers - the Skeena, Nass and Stikine - are born.

"In my vision as an aquatic scientist, I firmly believe that this Province cannot afford to play with any exploration or production of coal-bed methane in the headwaters of these major salmon bearing systems," Dr. Stockner wrote.

"Please carefully consider the options before you - to preserve the sanctity of these three major northern rivers and their wild salmon or continue the madness of pursuing coal-bed methane in their headwaters. In my eyes, your legacy as a forward-thinking 'green' premier is at stake with my three children and six grandchildren."

The Premier's office gets flooded with e-mails every year and it is likely that Dr. Stockner's letter was probably never put in front of Mr. Campbell to be read.

If that's the case, the Premier's staff should dig it out of the pile now and make sure he gets it.

Dr. Stockner knows water better than just about anybody in Canada.

And if he's this worried about coal-bed methane mining, Mr. Campbell should know about it.

Shell Canada Ltd. has been granted tenure to drill on 412,000 hectares of land about 150 kilometres northwest of Smithers, where the Skeena, Nass and Stikine all have headwaters.

Shell's project is in the early exploratory stages, but the plans call for more than 1,000 wells to be dug to extract methane.