August 29, 2005

Feds slap local energy company

Tom Fowler

Houston Chronicle

Aug. 26, 2005

In one of largest such orders, Kinder Morgan unit must change how it operates

Kinder Morgan Energy Partners' 3,900-mile-long Pacific Operations system, which supplies six Western states with gasoline, diesel fuel and jet fuel, has been hit by a rash of accidents in the past two years, including:

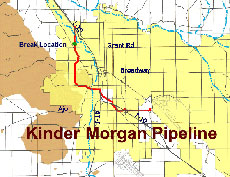

• May 28: Gasoline leaks close to a highway in the Fort Bliss Military Reservation near El Paso. The company concluded the cause was defective pipe.

• April 1: Gasoline and diesel fuel leak into Summit Creek that flows into Donner Lake near a ski resort outside of Truckee, Calif. Company had no additional information.

• Nov. 22, 2004: About 96,000 gallons of gasoline spray the air near San Bernardino, Calif., polluting a portion of the Mojave Desert and shutting down Interstate 15 for hours. Company concluded the line had been damaged by a third party.

• Nov. 9, 20 04: In Walnut Creek, Calif. five contractors were killed when a backhoe used to lay a water main hit a pipeline, sparking a blast.

• April 27, 2004: Corroded pipe leads to about 105,000 gallons of diesel fuel fouling the Suisun Marsh near Fairfield, Calif., killing wildlife.

Source: Company and Transportation Department

Federal pipeline regulators have ordered Houston-based Kinder Morgan Energy Partners to change how it operates more than 3,900 miles of pipelines in six Western states following a recent string of accidents.

In what is being called one of the largest regulatory actions undertaken by the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration, the company must restructure its internal inspection program, get an independent review of its operations and analyze recent incidents, including one that killed five people.

The order didn't come as a surprise to the company — a spokesman said it had been working with regulators on the issues for months and has fixed some already. But it is unusual in its breadth, affecting more than 40 different pipeline segments that carry gasoline, diesel and jet fuel throughout the West.

Most of the recent incidents were due to third parties, such as construction backhoes digging nearby, striking the pipelines. But in its letter to the company, regulators said the recent accidents "indicate a widespread failure to adequately detect and address the effect of outside force damage and corrosion. This failure has systematically affected the integrity of the Pacific Operations unit."

The Kinder Morgan companies operate more than 25,000 miles of pipelines in the nation, carrying crude oil, natural gas and refined products.

While the company has invested in new construction, much of its growth has come through acquisitions. Most of the pipeline system in question came to the company in 1998 when it acquired Santa Fe Pacific Pipeline.

Kinder Morgan said it would spend more than $900 million this year maintaining and operating its pipelines and other assets.

"We share the PHMSA's priorities to operate our pipelines as safely as possible and to protect the public, employees and the environment," company spokesman Larry Pierce said. "These are top priorities at Kinder Morgan."

About 60 percent of accidents along pipelines under Kinder Morgan's Pacific Operations were caused by what is called outside force damage, namely another company or individual damaging the pipeline with equipment, according to the Transportation Department.

One of the worst accidents occurred Nov. 9, 2004, in Walnut Creek, Calif., near San Francisco. Contractors laying a water main are thought to have struck a pipeline with a backhoe, sparking a blast that killed five workers.

But some incidents are due to age and wear and tear. An April 27, 2004, release of 105,000 gallons of diesel into a marsh near Fairfield, Calif., was due to a patch of corrosion almost 14 feet long. The firm paid more than $5 million in fines, penalties and restitution in that case.

Damon Hill, a spokesman with the PHMSA, said the broad scope of the order is due to the large number of incidents in the company's Pacific operations: 44 since Jan. 1, with 14 resulting in the release of more than five barrels of refined petroleum.

"We didn't find any clear-cut violations of integrity management rules, but we did see some weaknesses in the use of their tools to interpret data," said Hill.

For example, the order notes that in some instances Kinder Morgan used internal pipe inspection tools that aren't sufficient to identify certain defects.

The company's organizational structure also expects workers in different departments to identify specific pipeline safety threats, but it does not allow workers from one department easy access to data from another department, the order says.

Kinder Morgan has 120 days to submit a revised integrity management plan to regulators. The company must also provide a list of outside experts it may use to do the independent evaluation within 30 days.

"It's possible, we may choose to appeal certain elements in the order, but we've been working with them on these issues for months," Pierce said.

Copyright 2005 Houston Chronicle

August 25, 2005

Transportation Department Orders Kinder Morgan to Address Rise in Pipeline Incidents

U.S. Department of Transportation

Pipeline and Hazardous Materials Safety Administration

Thursday, August 25, 2005

Contact: James Wiggins/Damon A. Hill

Tel.: (202) 366-4831

The U.S. Department of Transportation’s Pipeline and Hazardous Materials Safety Administration (PHMSA) today announced it ordered Kinder Morgan Energy Partners (KMEP) to address a recent increase in incidents along its hazardous liquids pipeline system. The agency issued a Corrective Action Order requiring KMEP to comprehensively address integrity threats along the entire 3,900-mile Pacific Operations unit.

The order requires a thorough analysis of recent incidents, a third-party independent review of operations and procedural practices, and a restructuring of KMEP’s internal inspection program. KMEP must have a revised integrity management plan approved by PHMSA within 120 days. Failure to comply may result in an assessment of civil penalties of as much as $100,000 per day.

Since January 1, 2003, KMEP has experienced at least 44 accidents with some 14 resulting in the release of more than five barrels of refined petroleum products, some in or near environmentally sensitive areas or major transportation corridors.

“Our investigations into these incidents identified inadequacies in Kinder Morgan’s interpretation of in-line inspection information to evaluate and repair their pipeline systems,” said PHMSA Acting Chief Safety Officer Stacey Gerard. “It is imperative for operators to utilize the most comprehensive set of technologies available to improve their ability to consistently characterize and address every possible threat their systems pose to public safety.”

Recent PHMSA investigations of these accidents, and reviews of KMEP’s operations and procedures, prompted the agency Order requiring KMEP to apply technologies and procedures to help evaluate its pipelines, Gerard said.

PHMSA pipeline engineers and agency State Pipeline Safety Program partners will continue to carefully monitor and scrutinize KMEP’s activities.

-END-

Corrective Action Order - Kinder Morgan Energy Partners, L.P.

August 24, 2005 | News Release

- regarding KM's Pacific Operations - systems in California, Nevada, Arizona, New Mexico and western Texas.

Final Order - Kinder Morgan Energy Partners, L.P.

April 22, 2005

- Rockland CA to Reno NV

Final Order - Kinder Morgan Energy Partners, L.P.

March 23, 2005

- finding of violation and assessing $25,000 fine

Corrective Action Order - Kinder Morgan Energy Partners L.P.

May 1, 2004

- Concord to Sacramento

All pipeline operators at one time or another come under the finger-wagging oversight of OPS, including Terasen, the recent willing takeover subject of Kinder Morgan.

Final Order - Trans Mountain Oil Pipe Line Company (a Terasen company)

June 6, 2005

- regarding adherence to maintenance and inspection standards on the TM pipeline in BC and WA

Kinder Morgan open houses in BC

Kinder Morgan has placed ads in newspapers inviting the public to find out more about them. Open houses in Cranbrook, Prince George, Whistler, Kelowna, and Vancouver are scheduled.

Between 29 Aug - 1Sept, they're on Vancouver Island:

Victoria, 31 Aug, 10am - 1pm, Holiday Inn, Topaz Room.

Nanaimo, 31 Aug, 5-8pm, Coast Bastion Inn, Malaspina Room.

www.terasen.com

www.kindermorgan.com

Terasen gas plant project still alive

Edward Hill

Ladysmith Chronicle

Aug 23 2005

A natural gas storage facility north of Ladysmith is still in the works, says Terasen Gas, despite the demise of the Duke Point power project and Terasen's recent takeover by a Texas energy company.

Carol Greaves, Terasen's community relations manager, said the company will re-start the approval process with the B.C. Utilities Commission within the next several months. The BCUC previously gave the go-ahead in February, predicated on supplying gas to a 252-megawatt power plant, which BC Hydro abandoned in June.

Greaves said Terasen is still calculating the economics of building a $100-million liquid natural gas (LNG) facility, but suggested its construction is likely.

"It depends on projected use. The facility will offer a flexible source to store gas. We will buy it in the summer when prices are lower, and draw from it in the winter when demand is greater," Greaves said. "It will contribute to stabilizing prices."

Houston-based Kinder Morgan, which operates pipelines within North America, took control of Terasen Aug. 1 for $6.9 billion. Kinder Morgan was primarily interested in Terasen's Alberta oilsands pipeline network.

Greaves said for B.C. customers and projects, "it's business as usual. Nothing is going to change."

LNG storage is slated for construction about six kilometres northwest of Ladysmith near Mt. Hayes, on 12 hectares of a 42-hectare parcel owned by Terasen. The Cowichan Valley Regional District granted the LNG storage environmental certification and zoning approval last year.

The tank will be massive, 60 metres in diameter and 55 metres high, holding up to 30 million cubic metres of LNG. Natural gas is stored in a liquid state at -162 degrees Celsius, which reduces its gaseous volume by a factor of 600, but makes it a dangerous substance to humans.

Should the tank ever rupture, from an earthquake or otherwise, the plan calls for an earthen dike that holds the same volume as the tank.

In June, at about the same time the Duke Point project died, Terasen entered into an agreement with the with the Chemainus First Nation and Cowichan Tribes' Khowutzun Development Corporation.

"The project might affect [Chemainus First Nation] land," Greaves said. "We want them to help with site prep work."

If the project gets the nod from the BCUC, Chemainus members have been guaranteed contracts for site road construction, land clearing and pipeline installation, among other jobs.

August 24, 2005

The wind blows for free, advocate argues

Guy Dauncey

Guest Commentary

Victoria News

Aug 24 2005

They are spinning on the windswept hills of southern Alberta, and on a hill outside Whitehorse, in the Yukon.

They are spinning in downtown Toronto and along the shores of the St. Lawrence, in Quebec. But there are no wind turbines spinning in British Columbia - yet.

The production of electricity from the wind is making rapid progress around the world. By the end of 2003, wind turbines had 39,000 megawatts of global capacity. By the end of 2004, it had risen to 47,000 MW. In Quebec, the government has just given approval for the construction of a further 2,000 MW.

In Calgary, the public light rail system is powered by 12 wind turbines in the southern prairies, near Pincher Creek. The program is called "Ride the Wind," and moves the Calgary C Trains while producing no greenhouse gas emissions at all. Wind-generated electricity is also powering many Calgary households, which purchase green electricity credits to show that their power has come from Alberta's turbines.

Overall, in Canada, wind turbines have 570 MW of capacity. The Canadian Wind Energy Association believes that Canada could have 10,000 MW of wind power capacity by 2010.

But don't wind turbines kill birds? Aren't they ugly, and noisy?

And what happens when the wind is not blowing?

These are all important questions.

The first generation of turbines with latticed frames were certainly no friends of birds, especially if they were inappropriately located.

But the new turbines have smooth tubular stems, with nowhere for a bird to rest. Studies show that on average they kill no more than one or two birds per turbine per year. If we want to protect the birds, we should look after our cats. [and cars, and pesticide use ...]

To some people, wind turbines are ugly. But many people like their sleek designs and see them as an emblem of the future. If you live very close, they will sometimes produce a background noise, but most of Canada's wind farms are in remote areas where few people live.

What happens when the wind is not blowing?

The answer is simple: they stop turning. This is why it will never be possible for a community to get all its energy from the wind. Here in B.C., however, we are blessed with a hydro system which can be used like a battery. When the wind is blowing, and the turbines are putting energy into the grid, the hydro engineers can hold back the water in the dams. When the wind stops, the dams can do their part. This eliminates the problem and allows them to contribute consistent

power to the grid.

How much power could wind turbines in B.C. produce?

A recent study done for BC Hydro suggested we have potential for 5,000 MW, enough to power almost a million homes. The best locations are in the Peace River country, on the northern end of Vancouver Island, and along B.C.'s mid-coast off Haida Gwaii.

How much will it cost?

The cost varies according to the wind, ranging from 6 to 12 cents a kilowatt hour. The owners of a 58.5 MW project that was recently scrapped at Holberg, on northern Vancouver Island, negotiated a low-price contract with BC Hydro before they knew how much wind there was, and had to back out when the numbers didn't work.

Power from natural gas, for comparison, costs 9 cents a kilowatt hour, which is guaranteed to increase since North America has only enough gas left for 10 more years, after which it must be shipped in as liquefied natural gas from unstable countries like Russia, Algeria, and Iran.

Coal-fired power is still cheap, but coal is the dirtiest of all fuels, and "clean coal" technologies which will not produce greenhouse gas emissions are still years off. Wind energy, by contrast, is a gift from the sun (since it's the sun's heat that causes the wind to blow).

It is renewable, clean, and goes on forever.

In Denmark, where the modern wind energy movement began, farmers, teachers, and other people have formed wind energy cooperatives, and own their own turbines. Globally, a study from Stanford University has suggested that the world could harvest five times more power from the wind than we are currently using for all purposes - if we wanted to.

The BC Sustainable Energy Association believes that wind energy has a big future in B.C., as long as policies and rules are put in place to encourage it.

Let's hope we don't have to wait much longer!

- Guy Dauncey is president of the BC Sustainable Energy Association,

www.bcsea.org, and author of the book Stormy Weather: 101 Solutions to Global Climate Change. He lives in Victoria.

August 23, 2005

The EUB’s ‘men without chests’

Andrew Nikiforuk

Calgary Herald

August 23, 2005

In one of his most famous essays, the Christian philosopher C.S. Lewis once described bureaucrats who banished all magnanimity and heart from their decisions as “men without chests.”

The Energy and Utility Board’s recent decision to grant Compton Petroleum another 21 /2-month extension on its plans to drill sour gas wells in the city’s southeast corner illustrates just how advanced this organic atrophy has become among the agency’s faceless directors.

By now almost every Calgarian knows the direction of this sad narrative. A company, whose president wouldn’t live near a sour gas well, gleefully declares its intent to put nearly 250,000 citizens as well as a future hospital, in harm’s way so it can enrich itself. All because the oil and gas regulator has no plan, no policy and no heart.

I can’t name a world-class city that would allow active production of a highly hazardous gas and well known chemical warfare agent in its backyard. Or that would entrust the safety of its citizens to an agency so chronically understaffed that it openly expects ordinary Albertans to do its own police work. Or that would relinquish its sovereignty to a board so morally captive to provincial cash flows that it even rubber stamps wells for companies in steady “noncompliance” mode without so much as demanding a $100,000 reclamation bond.

It gets worse. By the board’s own reluctant calculations and that of rural economist Peter Boxall, the health risks of sour gas devalue properties anywhere between five and 10 per cent. Any rural house in an emergency response zone, for example, loses $6,000 in value.

So Compton’s project will sour property values in the city by at least $15 million.

Men without chests, however, don’t bat an eyelash when it comes to expropriating property rights or the security of ordinary citizens.

After giving Compton two months to produce a coherent emergency response plan, the EUB has now rewarded the company’s insouciance by giving it another delay so that Compton can, in all likelihood, work harder at convincing taxpayers and other agencies to help foot the bill.

Fortunately the Calgary Regional Health Authority has challenged this insanity with a damning legal appeal of the board’s chestless actions.

The CRHA’s motion of appeal says everything the mayor should have said. It accuses the board of not considering the potential social and economic costs of the project; and it accuses the EUB of failing to establish the costs of evacuating, sheltering and providing medical care to persons affected by an accidental release of sour gas.

The CHRA repeatedly accuses the board of erring, ignoring or misinterpreting so much evidence that “the board could not properly carry out its mandate to determine the public interest and weigh the social and economic effects of the proposed project.”

These accusations have been echoed across the province. In Drayton Valley, where the board has abused rural Albertans by putting some households in as many as 52 emergency response zones (and thereby eliminated all value), people are getting fed up.

Citizens there have actually brought industry’s high-density sour gas drilling to a standstill by objecting to every sour gas well. “The companies came in and said, ‘We will do what we want,’ ” says 56-year-old local Louis Mastre, and “we are fighting back.”

The residents of Drayton Valley, of course, support a vigorous oil and gas industry, but one run and regulated by men with chests.

They want what southeast Calgarians want: a commitment to public health and safety first.

They want priority land use zoning that keeps sour gas wells and high-density drilling away from schools, hospitals and grandmothers like Mastre. They want full cost accounting and industry to pay for property devaluation as well as full health-risk insurance for the residents of sour gas zones.

And they want the regulator to responsibly act on industry’s appalling $9-billion deficit in unreclaimed wells and facilities.

Calgarians will know when sour gas developments in cities and towns are safe when their leaders practise what they preach.

So when Premier Ralph Klein and Energy minister Greg Melchin make the ultimate sacrifice, and devalue their homes and that of their neighbours, by sticking sour gas wells in their backyards and all without improper health and economic assessments, and then submit to monitoring by an understaffed agency directed by men without chests and no cleanup fund, then we’ll know that sour gas is good for us.

Until that distant time, Compton’s rude proposal will remain a bad business supported by men without chests. “Do as you would be done by” remains a mighty measure of men, said Lewis. Even in an oil and gas town.

ANDREW NIKIFORUK IS A PROUD CALGARIAN, WON THE GOVERNOR’S GENERAL AWARD IN 2002 FOR SABOTEURS: WIEBO LUDWIG’S WAR AGAINST BIG OIL.

Kinder Morgan Marked by Spills

Jeremy J. Nuttall

TheTyee.ca

August 23, 2005

Trouble in Tuscon

Terasen suitor's many pipelines figure in several

U.S. disasters, including a very deadly one.

Kinder Morgan, the company that hopes to take over the B.C. gas utility Terasen, is “the poster child for pipeline problems,” according to Carl Weimer, executive director of the Bellingham, Washington--based Pipeline Safety Trust.

Weimer says Kinder Morgan has a poor safety record, which he attributes to the company taking over a huge network of pipelines in a short time frame. “They’ve expanded rapidly and a lot of the pipelines they took over are older pipelines. And that has undercut some of the safety,” he says.

Weimer, whose trust is funded by a court-ordered endowment created after an Olympic Pipe Line Co. pipeline in Bellingham burst and then exploded in 1999, killing three and destroying Whatcom Creek, says ongoing internal inspection is the best way to stay on top of pipeline maintenance. Weimer adds that Terasen has a good record on this front. “Hopefully the personnel won’t go through a dramatic change” during the takeover, he says, given Terasen staff’s credible record.

According to Terasen, many of their pipelines are approaching 50 years of age, and some, particularly under Vancouver, are as old as 70 years. Many of the lines Kinder Morgan took over in the U.S. are around 50 years old, says Weimer, which has resulted in several failures on its network.

Explosion killed five

The most dramatic and deadly incident had another cause, however. Five people were killed last November in Walnut Creek, California, after an excavator ruptured a high-pressure petroleum line. Gasoline filled the pipe trench and was ignited by a welding torch.

Kinder Morgan spokesman Rick Rainey told The Tyee that the incident had nothing to do with the company’s practices. “It was a backhoe operator that ruptured our pipeline, so that had nothing to do with integrity,” he says.

However, the California Department of Industrial Relations didn’t see it exactly that way. In its 20-page report on the Walnut Creek explosion, the department said the main contributing factor was that the pipeline was not properly marked: “The primary cause of the incident was that the location of the petroleum line was not known to employees working in the area.”

Negligence cited

In the end, Kinder Morgan was cited for two counts of “serious willful” and fined a total of $140,000. In the report, “willful” is defined as a situation “where evidence shows that the employer committed an intentional and knowing violation -- as distinguished from inadvertent or accidental or ordinarily negligent -- and the employer is conscious of the fact that what they are doing constitutes a violation, or is aware that a hazardous condition exists and no reasonable effort was made to eliminate the hazard.”

Right underneath that violation “serious” is defined as “cited where there is substantial probability that death or serious physical harm could result from a condition which exists -- or from practices, operations or processes at the workplace.”

The fines to the three other companies involved amounted to $51,750, less than half of what Kinder Morgan was fined for its part in the accident, even though Kinder Morgan insists the accident was not really its fault.

Another blemish on Kinder Morgan’s environmental record is a 2004 70,000-gallon diesel spill into a Northern California marsh from an old, corroded pipeline. However, according to Rainey, the company had wanted to replace the very pipeline that leaked into the marsh, and would have done so, except that California’s “cumbersome permitting process” held up the company’s attempts to change the line.

“It took us three years to even get permits. Had it been done a little more timely,” says Rainey, “we wouldn’t have had the issue of the rupture.”

Still, Kinder Morgan pled guilty in the case and paid about $3 million in penalties and restitution. The company didn’t notify the California government about the spill until 18 hours after it had occurred, a failure for which it was cited. Kinder Morgan attributed the delay to the time it took them to identify the leak and be certain there was a one.

Houses sprayed with gas

Not all of the leaks have been hard to locate. In 2003 in Tuscon, Arizona, 19,000 gallons of gasoline spilled out of another Kinder Morgan pipeline, spraying a housing development and flooding nearby streets. The resulting pipeline closure caused major gas shortages in the state.

In December 2004, a Kinder Morgan pipeline burst in the Mojave Desert in California. For 12 hours, it spewed diesel more than 70 feet into the air. The fuel seeped an estimated 50 feet below the surface and the clean up involved removing 7,500 tons of dirt from the site.

Rainey defends Kinder Morgan’s history and says that overall, “despite a couple of recent high-profile incidents,” the company has a clean record. “We have a very aggressive integrity management program, and that will be applied,” he says of the standards the company will promote in B.C.

Safety commitment lauded

According to Rainey, since the company was formed in 1997 it has increased its pipelines by 6.5 times yet spends 10.5 times more on safety and maintenence. He says the incidents have little to do with negligence. “It’s certainly not for lack of dedicating financial resources to make sure [pipelines] are safe,” he says.

Rainey says Kinder Morgan’s record is considered better than the industry average -- according to his company’s records. That sentiment is echoed by Terasen’s director of public affairs, Cam Avery. “In most quarters they’ve got above-industry-standard record,” says Avery, adding that B.C. standards would apply if Kinder Morgan succeeds in its takeover bid. “Terasen gas is regulated in British Columbia according to British Columbia standards.”

Rainey also stresses the company is actively trying to improve its practices. “Commitment to safety is our top priority,” he says.

However, Kinder Morgan has been cited for not complying with government safety standards, and for not performing emergency training. In December 2004, Kinder Morgan was fined $26,630 and promised to buy emergency equipment for a California town after failing to conduct the minimum 10 emergency drills at a Nevada oil-holding facility and for neglecting to conduct two oil-spill response drills. The safety drills were required by the Environmental Protection Agency.

Out of Enron

Kinder Morgan was formed by Richard Kinder and Bill Morgan, both former executives of the infamous energy giant Enron Corporation. Richard Kinder was the president of Enron until 1997, when he handed the reins over to Kenneth Lay, who now faces fraud charges related to the collapse of the company.

As with Lay, Kinder and his family are strong supporters of George W. Bush. Kinder’s wife raised more than $200,000 for Bush during the 2004 election, and had pledged $100,000 to the Bush campaign in 2001. According to Mother Jones, during that 2001 campaign Kinder and his wife served as regional co-chairs for Bush’s Presidential Exploratory Committee, and Kinder has given $379,745 US to the Republican party.

Terasen stockholders will vote on the sale of Terasen to Kinder Morgan in late October. If the deal is approved, Terasen could be under Kinder Morgan control by December.

Scott Webb, a Terasen gas utility spokesperson, says there is some nervousness within Terasen about the deal. There’s “a little bit of uncertainty,” he says. “This all happened very fast.” Webb added that some Terasen employees are excited that Terasen may be acquired by a company that really wants to own it.

The B.C. Ministry of Energy and Mines and the Ministry of the Environment were approached for comment on safety and regulatory issues in B.C. but were not available by press time.

Jeremy Nuttall is a Penticton radio reporter and freelance writer.

August 22, 2005

Activists, companies split over Kyoto panel

Bill Curry

Globe and Mail

22-Aug-2005

OTTAWA

Environment Canada's hope of bringing together industry executives, environmentalists and senior public servants to craft policies might not get off the ground as boycotts are threatened over who gets to run the meetings.

Some environmental critics are questioning why EnCana, a company that has been one of the most vocal critics of the Kyoto Protocol, has been asked to fill a leadership role as co-chair of a panel that will propose energy policies.

But Gerry Protti, the EnCana executive vice-president who has been named to the post, said he is proud of his company's environmental record and is looking forward to taking part in the policy sessions.

He noted that EnCana has invested in tidal-power technology, as well as research into ways to capture carbon dioxide emissions and inject them back into Earth.

"We still think [Kyoto's] a huge challenge and I think the entire energy sector recognizes that. Having said that, I think we're taking a leadership role in terms of reduction of greenhouse gas emissions.".

In July, 21 environmental groups said they would boycott the first of four such policy tables after it was announced that a vice-president of Imperial Oil had been named co-chair of the meetings dealing with chemicals.

There will also be tables dealing with the mining and forestry sectors.

Each table is co-chaired by both an industry representative and a senior public servant.

John Bennett, senior policy adviser for the Sierra Club, said that if the government wants to get industry involved, it should invite companies, such as Shell and Suncor, that have been more supportive of Kyoto and the government's environmental plan.

Mr. Bennett said environmental groups are giving Environment Canada a bit more time to convince them environmental concerns will not be sidelined by the views of industry at the four tables. "If they don't, there will be a boycott of all the tables," he added.

"The companies that fought the hardest against doing the right thing end up with the most influence with the government. It might have been some crackerjack's idea that this would be a smart way to get them in the house, but they weren't thinking what that communicated to Canadians."

Rick Smith of the Environmental Defence Fund expressed similar concerns, saying: "It's another bizarre decision by the government. It's yet another fox-in-the-henhouse scenario."

But not all environmentalists are ready to give up on the tables, or think industry representatives should be rejected out of hand.

Marlo Raynolds of the Pembina Institute, a not-for-profit environmental-policy research and education organization, took part in one of the planning meetings for the energy table. He said that while he has some concerns, he is still hopeful the meetings can be positive.

Mr. Raynolds said he is pushing for the volunteer co-chair positions to rotate and include environmentalists. EnCana deserves some credit for getting involved in the project, he added.

"It creates an opportunity for EnCana to show and demonstrate some leadership and I think we'll have to see how they use that opportunity."

Environment Canada spokesman Sebastien Bois said the co-chairs are expected to be neutral and will not be representing the positions of their companies or departments. Mr. Protti's experience in government and with outside policy groups makes him "very qualified" for the position, Mr. Bois added.

Mr. Protti, a former public servant with the Alberta government, said he received a personal invitation from Alex Himelfarb, Clerk of the Privy Council, to take part in the meetings.

Mr. Protti said he and the other energy co-chair, fisheries deputy minister Larry Murray, have been working on a list of members for the table. He predicted it will involve between 25 and 30 people.

August 21, 2005

The Breaking Point

Peter Maass

New York Times

August 21, 2005

The largest oil terminal in the world, Ras Tanura, is located on the eastern coast of Saudi Arabia, along the Persian Gulf. From Ras Tanura's control tower, you can see the classic totems of oil's dominion -- supertankers coming and going, row upon row of storage tanks and miles and miles of pipes. Ras Tanura, which I visited in June, is the funnel through which nearly 10 percent of the world's daily supply of petroleum flows. Standing in the control tower, you are surrounded by more than 50 million barrels of oil, yet not a drop can be seen.

The oil is there, of course. In a technological sleight of hand, oil can be extracted from the deserts of Arabia, processed to get rid of water and gas, sent through pipelines to a terminal on the gulf, loaded onto a supertanker and shipped to a port thousands of miles away, then run through a refinery and poured into a tanker truck that delivers it to a suburban gas station, where it is pumped into an S.U.V. -- all without anyone's actually glimpsing the stuff. So long as there is enough oil to fuel the global economy, it is not only out of sight but also out of mind, at least for consumers.

I visited Ras Tanura because oil is no longer out of mind, thanks to record prices caused by refinery shortages and surging demand -- most notably in the United States and China -- which has strained the capacity of oil producers and especially Saudi Arabia, the largest exporter of all. Unlike the 1973 crisis, when the embargo by the Arab members of the Organization of Petroleum Exporting Countries created an artificial shortfall, today's shortage, or near-shortage, is real. If demand surges even more, or if a producer goes offline because of unrest or terrorism, there may suddenly not be enough oil to go around.

As Aref al-Ali, my escort from Saudi Aramco, the giant state-owned oil company, pointed out, ''One mistake at Ras Tanura today, and the price of oil will go up.'' This has turned the port into a fortress; its entrances have an array of gates and bomb barriers to prevent terrorists from cutting off the black oxygen that the modern world depends on. Yet the problem is far greater than the brief havoc that could be wrought by a speeding zealot with 50 pounds of TNT in the trunk of his car. Concerns are being voiced by some oil experts that Saudi Arabia and other producers may, in the near future, be unable to meet rising world demand. The producers are not running out of oil, not yet, but their decades-old reservoirs are not as full and geologically spry as they used to be, and they may be incapable of producing, on a daily basis, the increasing volumes of oil that the world requires. ''One thing is clear,'' warns Chevron, the second-largest American oil company, in a series of new advertisements, ''the era of easy oil is over.''

In the past several years, the gap between demand and supply, once considerable, has steadily narrowed, and today is almost negligible. The consequences of an actual shortfall of supply would be immense. If consumption begins to exceed production by even a small amount, the price of a barrel of oil could soar to triple-digit levels. This, in turn, could bring on a global recession, a result of exorbitant prices for transport fuels and for products that rely on petrochemicals -- which is to say, almost every product on the market. The impact on the American way of life would be profound: cars cannot be propelled by roof-borne windmills. The suburban and exurban lifestyles, hinged to two-car families and constant trips to work, school and Wal-Mart, might become unaffordable or, if gas rationing is imposed, impossible. Carpools would be the least imposing of many inconveniences; the cost of home heating would soar -- assuming, of course, that climate-controlled habitats do not become just a fond memory.

But will such a situation really come to pass? That depends on Saudi Arabia. To know the answer, you need to know whether the Saudis, who possess 22 percent of the world's oil reserves, can increase their country's output beyond its current limit of 10.5 million barrels a day, and even beyond the 12.5-million-barrel target it has set for 2009. (World consumption is about 84 million barrels a day.) Saudi Arabia is the sole oil superpower. No other producer possesses reserves close to its 263 billion barrels, which is almost twice as much as the runner-up, Iran, with 133 billion barrels. New fields in other countries are discovered now and then, but they tend to offer only small increments. For example, the much-contested and as-yet-unexploited reserves in the Alaska National Wildlife Refuge are believed to amount to about 10 billion barrels, or just a fraction of what the Saudis possess.

But the truth about Saudi oil is hard to figure out. Oil reservoirs cannot be inventoried like wood in a wilderness: the oil is underground, unseen by geologists and engineers, who can, at best, make highly educated guesses about how much is underfoot and how much can be extracted in the future. And there is a further obstacle: the Saudis will not let outsiders audit their confidential data on reserves and production. Oil is an industry in which not only is the product hidden from sight but so is reliable information about it. And because we do not know when a supply-demand shortfall might arrive, we do not know when to begin preparing for it, so as to soften its impact; the economic blow may come as a sledgehammer from the darkness.

Of course the Saudis do have something to say about this prospect. Before journeying to the kingdom, I went to Washington to hear the Saudi oil minister, Ali al-Naimi, speak at an energy conference in the mammoth Ronald Reagan Building and International Trade Center, not far from the White House. Naimi was the star attraction at a gathering of the American petro-political nexus. Samuel Bodman, the U.S. energy secretary, was on the dais next to him. David O'Reilly, chairman and C.E.O. of Chevron, was waiting in the wings. The moderator was an éminence grise of the oil world, James Schlesinger, a former energy secretary, defense secretary and C.I.A. director.

''I want to assure you here today that Saudi Arabia's reserves are plentiful, and we stand ready to increase output as the market dictates,'' said Naimi, dressed in a gray business suit and speaking with only a slight Arabic accent. He addressed skeptics who contend that Saudi reservoirs cannot be tapped for larger amounts of oil. ''I am quite bullish on technology as the key to our energy future,'' he said. ''Technological innovation will allow us to find and extract more oil around the world.'' He described the task of increasing output as just ''a question of investment'' in new wells and pipelines, and he noted that consuming nations urgently need to build new refineries to process increased supplies of crude. ''There is absolutely no lack of resources worldwide,'' he repeated.

His assurances did not assure. A barrel of oil cost $55 at the time of his speech; less than three months later, the price had jumped by 20 percent. The truth of the matter -- whether the world will really have enough petroleum in the years ahead -- was as well concealed as the millions of barrels of oil I couldn't see at Ras Tanura.

or 31 years, Matthew Simmons has prospered as the head of his own firm, Simmons & Company International, which advises energy companies on mergers and acquisitions. A member of the Council on Foreign Relations, a graduate of the Harvard Business School and an unpaid adviser on energy policy to the 2000 presidential campaign of George W. Bush, he would be a card-carrying member of the global oil nomenclatura, if cards were issued for such things. Yet he is one of the principal reasons the oil world is beginning to ask hard questions of itself.

Two years ago, Simmons went to Saudi Arabia on a government tour for business executives. The group was presented with the usual dog-and-pony show, but instead of being impressed, as most visitors tend to be, with the size and expertise of the Saudi oil industry, Simmons became perplexed. As he recalls in his somewhat heretical new book, ''Twilight in the Desert: The Coming Saudi Oil Shock and the World Economy,'' a senior manager at Aramco told the visitors that ''fuzzy logic'' would be used to estimate the amount of oil that could be recovered. Simmons had never heard of fuzzy logic. What could be fuzzy about an oil reservoir? He suspected that Aramco, despite its promises of endless supplies, might in fact not know how much oil remained to be recovered.

Simmons returned home with an itch to scratch. Saudi Arabia was one of the charter members of OPEC, founded in 1960 in Baghdad to coordinate the policies of oil producers. Like every OPEC country, Saudi Arabia provides only general numbers about its output and reserves; it does not release details about how much oil is extracted from each reservoir and what methods are used to extract that oil, and it does not permit audits by outsiders. The condition of Saudi fields, and those of other OPEC nations, is a closely guarded secret. That's largely because OPEC quotas, which were first imposed in 1983 to limit the output of member countries, were based on overall reserves; the higher an OPEC member's reserves, the higher its quota. It is widely believed that most, if not all, OPEC members exaggerated the sizes of their reserves in order to have the largest possible quota -- and thus the largest possible revenue stream.

In the days of excess supply, bankers like Simmons did not know, or care, about the fudging; whether or not reserves were hyped, there was plenty of oil coming out of the ground. Through the 1970's, 80's and 90's, the capacity of OPEC and non-OPEC countries exceeded demand, and that's why OPEC imposed a quota system -- to keep some product off the market (although many OPEC members, seeking as much revenue as possible, quietly sold more oil than they were supposed to). Until quite recently, the only reason to fear a shortage was if a boycott, war or strike were to halt supplies. Few people imagined a time when supply would dry up because of demand alone. But a steady surge in demand in recent years -- led by China's emergence as a voracious importer of oil -- has changed that.

This demand-driven scarcity has prompted the emergence of a cottage industry of experts who predict an impending crisis that will dwarf anything seen before. Their point is not that we are running out of oil, per se; although as much as half of the world's recoverable reserves are estimated to have been consumed, about a trillion barrels remain underground. Rather, they are concerned with what is called ''capacity'' -- the amount of oil that can be pumped to the surface on a daily basis. These experts -- still a minority in the oil world -- contend that because of the peculiarities of geology and the limits of modern technology, it will soon be impossible for the world's reservoirs to surrender enough oil to meet daily demand.

One of the starkest warnings came in a February report commissioned by the United States Department of Energy's National Energy Technology Laboratory. ''Because oil prices have been relatively high for the past decade, oil companies have conducted extensive exploration over that period, but their results have been disappointing,'' stated the report, assembled by Science Applications International, a research company that works on security and energy issues. ''If recent trends hold, there is little reason to expect that exploration success will dramatically improve in the future. . . . The image is one of a world moving from a long period in which reserves additions were much greater than consumption to an era in which annual additions are falling increasingly short of annual consumption. This is but one of a number of trends that suggest the world is fast approaching the inevitable peaking of conventional world oil production.''

The reference to ''peaking'' is not a haphazard word choice -- ''peaking'' is a term used in oil geology to define the critical point at which reservoirs can no longer produce increasing amounts of oil. (This tends to happen when reservoirs are about half-empty.) ''Peak oil'' is the point at which maximum production is reached; afterward, no matter how many wells are drilled in a country, production begins to de cline.SaudiArabia and other OPEC members may have enough oil to last for generations, but that is no longer the issue. The eventual and painful shift to different sources of energy -- the start of the post-oil age -- does not begin when the last drop of oil is sucked from under the Arabian desert. It begins when producers are unable to continue increasing their output to meet rising demand. Crunch time comes long before the last drop.

''The world has never faced a problem like this,'' the report for the Energy Department concluded. ''Without massive mitigation more than a decade before the fact, the problem will be pervasive and will not be temporary. Previous energy transitions (wood to coal and coal to oil) were gradual and evolutionary; oil peaking will be abrupt and revolutionary.''

Most experts do not share Simmons's concerns about the imminence of peak oil. One of the industry's most prominent consultants, Daniel Yergin, author of a Pulitzer Prize-winning book about petroleum, dismisses the doomsday visions. ''This is not the first time that the world has 'run out of oil,''' he wrote in a recent Washington Post opinion essay. ''It's more like the fifth. Cycles of shortage and surplus characterize the entire history of the oil industry.'' Yergin says that a number of oil projects that are under construction will increase the supply by 20 percent in five years and that technological advances will increase the amount of oil that can be recovered from existing reservoirs. (Typically, with today's technology, only about 40 percent of a reservoir's oil can be pumped to the surface.)

Yergin's bullish view has something in common with the views of the pessimists -- it rests on unknowns. Will the new projects that are under way yield as much oil as their financial backers hope? Will new technologies increase recovery rates as much as he expects? These questions are next to impossible to answer because coaxing oil out of the ground is an extraordinarily complex undertaking. The popular notion of reservoirs as underground lakes, from which wells extract oil like straws sucking a milkshake from a glass, is incorrect. Oil exists in drops between and inside porous rocks. A new reservoir may contain sufficient pressure to make these drops of oil flow to the surface in a gusher, but after a while -- usually within a few years and often sooner than that -- natural pressure lets up and is no longer sufficient to push oil to the surface. At that point, ''secondary'' recovery efforts are begun, like pumping water or gas into the reservoirs to increase the pressure.

This process is unpredictable; reservoirs are extremely temperamental. If too much oil is extracted too quickly or if the wrong types or amounts of secondary efforts are employed, the amount of oil that can be recovered from a field can be greatly reduced; this is known in the oil world as ''damaging a reservoir.'' A widely cited example is Oman: in 2001, its daily production reached more than 960,000 barrels, but then suddenly declined, despite the use of advanced technologies. Today, Oman produces 785,000 barrels of oil a day. Herman Franssen, a consultant who worked in Oman for a decade, sees that country's experience as a possible lesson in the limits of technology for other producers that try to increase or maintain high levels of output. ''They reached a million barrels a day, and then a few years later production collapsed,'' Franssen said in a phone interview. ''They used all these new technologies, but they haven't been able to stop the decline yet.''

The vague production and reserve data that gets published does not begin to tell the whole story of an oil field's health, production potential or even its size. For a clear-as-possible picture of a country's oil situation, you need to know what is happening in each field -- how many wells it has, how much oil each well is producing, what recovery methods are being used and how long they've been used and the trend line since the field went into production. Data of that sort are typically not released by state-owned companies like Saudi Aramco.

As Matthew Simmons searched for clues to the truth of the Saudi situation, he immersed himself in the minutiae of oil geology. He realized that data about Saudi fields might be found in the files of the Society of Petroleum Engineers. Oil engineers, like most professional groups, have regular conferences at which they discuss papers that delve into the work they do. The papers, which focus on particular wells that highlight a problem or a solution to a problem, are presented and debated at the conferences and published by the S.P.E. -- and then forgotten.

Before Simmons poked around, no one had taken the time to pull together the S.P.E. papers that involved Saudi oil fields and review them en masse. Simmons found more than 200 such papers and studied them carefully. Although the papers cover only a portion of the kingdom's wells and date back, in some cases, several decades, they constitute perhaps the best public data about the condition and prospects of Saudi reservoirs.

Ghawar is the treasure of the Saudi treasure chest. It is the largest oil field in the world and has produced, in the past 50 years, about 55 billion barrels of oil, which amounts to more than half of Saudi production in that period. The field currently produces more than five million barrels a day, which is about half of the kingdom's output. If Ghawar is facing problems, then so is Saudi Arabia and, indeed, the entire world.

Simmons found that the Saudis are using increasingly large amounts of water to force oil out of Ghawar. Most of the wells are concentrated in the northern portion of the 174-mile-long field. That might seem like good news -- when the north runs low, the Saudis need only to drill wells in the south. But in fact it is bad news, Simmons concluded, because the southern portions of Ghawar are geologically more difficult to draw oil from. ''Someday (and perhaps that day will be soon), the remarkably high well flow rates at Ghawar's northern end will fade, as reservoir pressures finally plummet,'' Simmons writes in his book. ''Then, Saudi Arabian oil output will clearly have peaked. The death of this great king'' -- meaning Ghawar -- ''leaves no field of vaguely comparable stature in the line of succession. Twilight at Ghawar is fast approaching.'' He goes on: ''The geological phenomena and natural driving forces that created the Saudi oil miracle are conspiring now in normal and predictable ways to bring it to its conclusion, in a time frame potentially far shorter than officialdom would have us believe.'' Simmons concludes, ''Saudi Arabia clearly seems to be nearing or at its peak output and cannot materially grow its oil production.''

Saudi officials belittle Simmons's work. Nansen Saleri, a senior Aramco official, has described Simmons as a banker ''trying to come across as a scientist.'' In a speech last year, Saleri wryly said, ''I can read 200 papers on neurology, but you wouldn't want me to operate on your relatives.'' I caught up with Simmons in June, during a trip he made to Manhattan to talk with a group of oil-shipping executives. The impression he gives is of an enthusiastic inventor sharing a discovery that took him by surprise. He has a certain wide-eyed wonder in his regard, as if a bit of mystery can be found in everything that catches his eye. And he has a rumpled aspect -- thinning hair slightly askew, shirt sleeves a fraction too long. Though he delivers a bracing message, his discourse can wander. He is a successful businessman, and it is clear that he did not achieve his position by being a man of impeccable convention. He certainly has not lost sight of the rule that people who shout ''the end is nigh'' do not tend to be favorably reviewed by historians, let alone by their peers. He notes in his book that way back in 1979, The New York Times published an investigative story by Seymour Hersh under the headline ''Saudi Oil Capacity Questioned.'' He knows that in past decades the Cassandras failed to foresee new technologies, like deep-water and horizontal drilling, that provided new sources of oil and raised the amount of oil that can be recovered from reservoirs.

But Simmons says that there are only so many rabbits technology can pull out of its petro-hat. He impishly notes that if the Saudis really wanted to, they could easily prove him wrong. ''If they want to satisfy people, they should issue field-by-field production reports and reserve data and have it audited,'' he told me. ''It would then take anybody less than a week to say, 'Gosh, Matt is totally wrong,' or 'Matt actually might be too optimistic.'''

Simmons has a lot riding on his campaign -- not only his name but also his business, which would not be rewarded if he is proved to be a fool. What, I asked, if the data show that the Saudis will be able to sustain production of not only 12.5 million barrels a day -- their target for 2009 -- but 15 million barrels, which global demand is expected to require of them in the not-too-distant future? ''The odds of them sustaining 12 million barrels a day is very low,'' Simmons replied. ''The odds of them getting to 15 million for 50 years -- there's a better chance of me having Bill Gates's net worth, and I wouldn't bet a dime on that forecast.''

The gathering of executives took place in a restaurant at Chelsea Piers; about 35 men sat around a set of tables as the host introduced Simmons. He rambled a bit but hit his talking points, and the executives listened raptly; at one point, the man on my right broke into a soft whistle, of the sort that means ''Holy cow.''

Simmons didn't let up. ''We're going to look back at history and say $55 a barrel was cheap,'' he said, recalling a TV interview in which he predicted that a barrel might hit triple digits.

He said that the anchor scoffed, in disbelief, ''A hundred dollars?''

Simmons replied, ''I wasn't talking about low triple digits.''

he onset of triple-digit prices might seem a blessing for the Saudis -- they would receive greater amounts of money for their increasingly scarce oil. But one popular misunderstanding about the Saudis -- and about OPEC in general -- is that high prices, no matter how high, are to their benefit.

Although oil costing more than $60 a barrel hasn't caused a global recession, that could still happen: it can take a while for high prices to have their ruinous impact. And the higher above $60 that prices rise, the more likely a recession will become. High oil prices are inflationary; they raise the cost of virtually everything -- from gasoline to jet fuel to plastics and fertilizers -- and that means people buy less and travel less, which means a drop-off in economic activity. So after a brief windfall for producers, oil prices would slide as recession sets in and once-voracious economies slow down, using less oil. Prices have collapsed before, and not so long ago: in 1998, oil fell to $10 a barrel after an untimely increase in OPEC production and a reduction in demand from Asia, which was suffering through a financial crash. Saudi Arabia and the other members of OPEC entered crisis mode back then; adjusted for inflation, oil was at its lowest price since the cartel's creation, threatening to feed unrest among the ranks of jobless citizens in OPEC states.

''The Saudis are very happy with oil at $55 per barrel, but they're also nervous,'' a Western diplomat in Riyadh told me in May, referring to the price that prevailed then. (Like all the diplomats I spoke to, he insisted on speaking anonymously because of the sensitivities of relations with Saudi Arabia.) ''They don't know where this magic line has moved to. Is it now $65? Is it $75? Is it $80? They don't want to find out, because if you did have oil move that far north . . . the chain reaction can come back to a price collapse again.''

High prices can have another unfortunate effect for producers. When crude costs $10 a barrel or even $30 a barrel, alternative fuels are prohibitively expensive. For example, Canada has vast amounts of tar sands that can be rendered into heavy oil, but the cost of doing so is quite high. Yet those tar sands and other alternatives, like bioethanol, hydrogen fuel cells and liquid fuel from natural gas or coal, become economically viable as the going rate for a barrel rises past, say, $40 or more, especially if consuming governments choose to offer their own incentives or subsidies. So even if high prices don't cause a recession, the Saudis risk losing market share to rivals into whose nonfundamentalist hands Americans would much prefer to channel their energy dollars. A concerted push for greater energy conservation in the United States, which consumes one-quarter of the world's oil (mostly to fuel our cars, as gasoline), would hurt producing nations, too. Basically, any significant reduction in the demand for oil would be ruinous for OPEC members, who have little to offer the world but oil; if a substitute can be found, their future is bleak. Another Western diplomat explained the problem facing the Saudis: ''You want to have the price as high as possible without sending the consuming nations into a recession and at the same time not have the price so high that it encourages alternative technologies.''

From the American standpoint, one argument in favor of conservation and a switch to alternative fuels is that by limiting oil imports, the United States and its Western allies would reduce their dependence on a potentially unstable region. (In fact, in an effort to offset the risks of relying on the Saudis, America's top oil suppliers are Canada and Mexico.) In addition, sending less money to Saudi Arabia would mean less money in the hands of a regime that has spent the past few decades doling out huge amounts of its oil revenue to mosques, madrassas and other institutions that have fanned the fires of Islamic radicalism. The oil money has been dispensed not just by the Saudi royal family but by private individuals who benefited from the oil boom -- like Osama bin Laden, whose ample funds, probably eroded now, came from his father, a construction magnate. Without its oil windfall, Saudi Arabia would have had a hard time financing radical Islamists across the globe.

For the Saudis, the political ramifications of reduced demand for its oil would not be negligible. The royal family has amassed vast personal wealth from the country's oil revenues. If, suddenly, Saudis became aware that the royal family had also failed to protect the value of the country's treasured resource, the response could be severe. The mere admission that Saudi reserves are not as impressively inexhaustible as the royal family has claimed could lead to hard questions about why the country, and the world, had been misled. With the death earlier this month of the long-ailing King Fahd, the royal family is undergoing another period of scrutiny; the new king, Abdullah, is in his 80's, and the crown prince, his half-brother Sultan, is in his 70's, so the issue of generational change remains to be settled. As long as the country is swimming in petro-dollars -- even as it is paying off debt accrued during its lean years -- everyone is relatively happy, but that can change. One diplomat I spoke to recalled a comment from Sheik Ahmed Zaki Yamani, the larger-than-life Saudi oil minister during the 1970's: ''The Stone Age didn't end for lack of stone, and the oil age will end long before the world runs out of oil.''

Until now, the Saudis had an excess of production capacity that allowed them, when necessary, to flood the market to drive prices down. They did that in 1990, when the Iraqi invasion of Kuwait eliminated not only Kuwait's supply of oil but also Iraq's. The Saudis functioned, as they always had, as the central bank of oil, releasing supply to the market when it was needed and withdrawing supply to keep prices from going lower than the cartel would have liked. In other words, they controlled not only the price of oil but their own destiny as well.

''That is what the world has called on them to do before -- turn on the taps to produce more and get prices down,'' a senior Western diplomat in Riyadh told me recently. ''Decreasing prices used to keep out alternative fuels. I don't see how they're able to do that anymore. This is a huge change, and it is a big step in the move to whatever is coming next. That's what's really happening.''

Without the ability to flood the markets with oil, the Saudis are resorting to flooding the market with promises; it is a sort of petro-jawboning. That's why Ali al-Naimi, the oil minister, told his Washington audience that Saudi Arabia has embarked on a crash program to raise its capacity to 12.5 million barrels a day by 2009 and even higher in the years after that. Naimi is not unlike a factory manager who needs to promise the moon to his valuable clients, for fear of losing or alarming them. He has no choice. The moment he says anything bracing, the touchy energy markets will probably panic, pushing prices even higher and thereby hastening the onset of recession, a switch to alternative fuels or new conservation efforts -- or all three. Just a few words of honest caution could move the markets; Naimi's speeches are followed nearly as closely in the financial world as those of Alan Greenspan.

I journeyed to Saudi Arabia to interview Naimi and other senior officials, to get as far beyond their prepared remarks as might be possible. Although I was allowed to see Ras Tanura, my interview requests were denied. I was invited to visit Aramco's oil museum in Dhahran, but that is something a Saudi schoolchild can do on a field trip. It was a ''show but don't tell'' policy. I was able to speak about production issues only with Ibrahim al-Muhanna, the oil ministry spokesman, who reluctantly met me over coffee in the lobby of my hotel in Riyadh. He defended Saudi Arabia's refusal to share more data, noting that the Saudis are no different from most oil producers.

''They will not tell you,'' he said. ''Nobody will. And that is not going to change.'' Referring to the fact that Saudi Arabia is often called the central bank of oil, he added: ''If an outsider goes to the Fed and asks, 'How much money do you have?' they will tell you. If you say, 'Can I come and count it?' they will not let you. This applies to oil companies and oil countries.'' I mentioned to Muhanna that many people think his government's ''trust us'' stance is not convincing in light of the cheating that has gone on within OPEC and in the industry as a whole; even Royal Dutch/Shell, a publicly listed oil company that undergoes regular audits, has admitted that it overstated its 2002 reserves by 23 percent.

''There is no reason for any country or company to lie,'' Muhanna replied. ''There is a lot of oil around.'' I didn't need to ask about Simmons and his peak-oil theory; when I met Muhanna at the conference in Washington, he nearly broke off our conversation at the mention of Simmons's name. ''He does not know anything,'' Muhanna said. ''The only thing he has is a big mouth. We should not pay attention to him. Either you believe us or you don't.''

o whom to believe? Before leaving New York for Saudi Arabia, I was advised by several oil experts to try to interview Sadad al-Husseini, who retired last year after serving as Aramco's top executive for exploration and production. I faxed him in Dhahran and received a surprisingly quick reply; he agreed to meet me. A week later, after I arrived in Riyadh, Husseini e-mailed me, asking when I would come to Dhahran; in a follow-up phone call, he offered to pick me up at the airport. He was, it seemed, eager to talk.

It can be argued that in a nation devoted to oil, Husseini knows more about it than anyone else. Born in Syria, Husseini was raised in Saudi Arabia, where his father was a government official whose family took on Saudi citizenship. Husseini earned a Ph.D. in geological sciences from Brown University in 1973 and went to work in Aramco's exploration department, eventually rising to the highest position. Until his retirement last year -- said to have been caused by a top-level dispute, the nature of which is the source of many rumors -- Husseini was a member of the company's board and its management committee. He is one of the most respected and accomplished oilmen in the world.

After meeting me at the cavernous airport that serves Dhahran, he drove me in his luxury sedan to the villa that houses his private office. As we entered, he pointed to an armoire that displayed a dozen or so vials of black liquid. ''These are samples from oil fields I discovered,'' he explained. Upstairs, there were even more vials, and he would have possessed more than that except, as he said, laughing, ''I didn't start collecting early enough.''

We spoke for several hours. The message he delivered was clear: the world is heading for an oil shortage. His warning is quite different from the calming speeches that Naimi and other Saudis, along with senior American officials, deliver on an almost daily basis. Husseini explained that the need to produce more oil is coming from two directions. Most obviously, demand is rising; in recent years, global demand has increased by two million barrels a day. (Current daily consumption, remember, is about 84 million barrels a day.) Less obviously, oil producers deplete their reserves every time they pump out a barrel of oil. This means that merely to maintain their reserve base, they have to replace the oil they extract from declining fields. It's the geological equivalent of running to stay in place. Husseini acknowledged that new fields are coming online, like offshore West Africa and the Caspian basin, but he said that their output isn't big enough to offset this growing need.

''You look at the globe and ask, 'Where are the big increments?' and there's hardly anything but Saudi Arabia,'' he said. ''The kingdom and Ghawar field are not the problem. That misses the whole point. The problem is that you go from 79 million barrels a day in 2002 to 82.5 in 2003 to 84.5 in 2004. You're leaping by two million to three million a year, and if you have to cover declines, that's another four to five million.'' In other words, if demand and depletion patterns continue, every year the world will need to open enough fields or wells to pump an additional six to eight million barrels a day -- at least two million new barrels a day to meet the rising demand and at least four million to compensate for the declining production of existing fields. ''That's like a whole new Saudi Arabia every couple of years,'' Husseini said. ''It can't be done indefinitely. It's not sustainable.''

Husseini speaks patiently, like a teacher who hopes someone is listening. He is in the enviable position of knowing what he talks about while having the freedom to speak openly about it. He did not disclose precise information about Saudi reserves or production -- which remain the equivalent of state secrets -- but he felt free to speak in generalities that were forthright, even when they conflicted with the reassuring statements of current Aramco officials. When I asked why he was willing to be so frank, he said it was because he sees a shortage ahead and wants to do what he can to avert it. I assumed that he would not be particularly distressed if his rivals in the Saudi oil establishment were embarrassed by his frankness.

Although Matthew Simmons says it is unlikely that the Saudis will be able to produce 12.5 million barrels a day or sustain output at that level for a significant period of time, Husseini says the target is realistic; he says that Simmons is wrong to state that Saudi Arabia has reached its peak. But 12.5 million is just an interim marker, as far as consuming nations are concerned, on the way to 15 million barrels a day and beyond -- and that is the point at which Husseini says problems will arise.

At the conference in Washington in May, James Schlesinger, the moderator, conducted a question-and-answer session with Naimi at the conclusion of the minister's speech. One of the first questions involved peak oil: might it be true that Saudi Arabia, which has relied on the same reservoirs, and especially Ghawar, for more than five decades, is nearing the geological limit of its output?

Naimi wouldn't hear of it.

''I can assure you that we haven't peaked,'' he responded. ''If we peaked, we would not be going to 12.5 and we would not be visualizing a 15-million-barrel-per-day production capacity. . . . We can maintain 12.5 or 15 million for the next 30 to 50 years.''

Experts like Husseini are very concerned by the prospect of trying to produce 15 million barrels a day. Even if production can be ramped up that high, geology may not be forgiving. Fields that are overproduced can drop off, in terms of output, quite sharply and suddenly, leaving behind large amounts of oil that cannot be coaxed out with existing technology. This is called trapped oil, because the rocks or sediment around it prevent it from escaping to the surface. Unless new technologies are developed, that oil will never be extracted. In other words, the haste to recover oil can lead to less oil being recovered.

''You could go to 15, but that's when the questions of depletion rate, reservoir management and damaging the fields come into play,'' says Nawaf Obaid, a Saudi oil and security analyst who is regarded as being exceptionally well connected to key Saudi leaders. ''There is an understanding across the board within the kingdom, in the highest spheres, that if you're going to 15, you'll hit 15, but there will be considerable risks . . . of a steep decline curve that Aramco will not be able to do anything about.''

Even if the Saudis are willing to risk damaging their fields, or even if the risk is overstated, Husseini points out a practical problem. To produce and sustain 15 million barrels a day, Saudi Arabia will have to drill a lot more wells and build a lot more pipelines and processing facilities. Currently, the global oil industry suffers a deficit of qualified engineers to oversee such projects and the equipment and the raw materials -- for example, rigs and steel -- to build them. These things cannot be wished from thin air or developed quickly enough to meet the demand.

''If we had two dozen Texas A&M's producing a thousand new engineers a year and the industrial infrastructure in the kingdom, with the drilling rigs and power plants, we would have a better chance, but you cannot put that into place overnight,'' Husseini said. ''Capacity is not just a function of reserves. It is a function of reserves plus know-how plus a commercial economic system that is designed to increase the resource exploitation. For example, in the U.S. you have infrastructure -- there must be tens of thousands of miles of pipelines. If we, in Saudi Arabia, evolve to that level of commercial maturity, we could probably produce a heck of a lot more oil. But to get there is a very tedious, slow process.''

He worries that the rising global demand for oil will lead to the petroleum equivalent of running an engine at ever-increasing speeds without stopping to cool it down or change the oil. Husseini does not want to see the fragile and irreplaceable reservoirs of the Middle East become damaged through wanton overproduction.

''If you are ramping up production so fast and jump from high to higher to highest, and you're not having enough time to do what needs to be done, to understand what needs to be done, then you can damage reservoirs,'' he said. ''Systematic development is not just a matter of money. It's a matter of reservoir dynamics, understanding what's there, analyzing and understanding information. That's where people come in, experience comes in. These are not universally available resources.''

The most worrisome part of the crisis ahead revolves around a set of statistics from the Energy Information Administration, which is part of the U.S. Department of Energy. The E.I.A. forecast in 2004 that by 2020 Saudi Arabia would produce 18.2 million barrels of oil a day, and that by 2025 it would produce 22.5 million barrels a day. Those estimates were unusual, though. They were not based on secret information about Saudi capacity, but on the projected needs of energy consumers. The figures simply assumed that Saudi Arabia would be able to produce whatever the United States needed it to produce. Just last month, the E.I.A. suddenly revised those figures downward -- not because of startling new information about world demand or Saudi supply but because the figures had given so much ammunition to critics. Husseini, for example, described the 2004 forecast as unrealistic.

''That's not how you would manage a national, let alone an international, economy,'' he explained. ''That's the part that is scary. You draw some assumptions and then say, 'O.K., based on these assumptions, let's go forward and consume like hell and burn like hell.''' When I asked whether the kingdom could produce 20 million barrels a day -- about twice what it is producing today from fields that may be past their prime -- Husseini paused for a second or two. It wasn't clear if he was taking a moment to figure out the answer or if he needed a moment to decide if he should utter it. He finally replied with a single word: No.

''It's becoming unrealistic,'' he said. ''The expectations are beyond what is achievable. This is a global problem . . . that is not going to be solved by tinkering with the Saudi industry.''

It would be unfair to blame the Saudis alone for failing to warn of whatever shortages or catastrophes might lie ahead.

In the political and corporate realms of the oil world, there are few incentives to be forthright. Executives of major oil companies have been reluctant to raise alarms; the mere mention of scarce supplies could alienate the governments that hand out lucrative exploration contracts and also send a message to investors that oil companies, though wildly profitable at the moment, have a Malthusian long-term future. Fortunately, that attitude seems to be beginning to chang e.Chevron's''easyoilisover'' advertising campaign is an indication that even the boosters of an oil-drenched future are not as bullish as they once were.

Politicians remain in the dark. During the 2004 presidential campaign, which occurred as gas prices were rising to record levels, the debate on energy policy was all but nonexistent. The Bush campaign produced an advertisement that concluded: ''Some people have wacky ideas. Like taxing gasoline more so people drive less. That's John Kerry.'' Although many environmentalists would have been delighted if Kerry had proposed that during the campaign, in fact the ad was referring to a 50-cents-a-gallon tax that Kerry supported 11 years ago as part of a package of measures to reduce the deficit. (The gas tax never made it to a vote in the Senate.) Kerry made no mention of taxing gasoline during the campaign; his proposal for doing something about high gas prices was to pressure OPEC to increase supplies.

Husseini, for one, doesn't buy that approach. ''Everybody is looking at the producers to pull the chestnuts out of the fire, as if it's our job to fix everybody's problems,'' he told me. ''It's not our problem to tell a democratically elected government that you have to do something about your runaway consumers. If your government can't do the job, you can't expect other governments to do it for them.'' Back in the 70's, President Carter called for the moral equivalent of war to reduce our dependence on foreign oil; he was not re-elected. Since then, few politicians have spoken of an energy crisis or suggested that major policy changes are necessary to avert one. The energy bill signed earlier this month by President Bush did not even raise fuel-efficiency standards for passenger cars. When a crisis comes -- whether in a year or 2 or 10 -- it will be all the more painful because we will have done little or nothing to prepare for it.

Peter Maass is a contributing writer. He is writing a book about oil.

Copyright 2005 The New York Times Company

Cogen up and running 95 per cent of the time

Grant Warkentin

Campbell River Mirror

Aug 17 2005

The Island Cogen power plant beside the Elk Falls paper mill has had minimal downtime this year.

During the second quarter of 2005, the natural gas-fired power plant was capable of generating electricity 95 per cent of the time, or 496,025 megawatt-hours. During the same time last year, the plant was only capable of generating electricity 46 per cent of the time, or 191,482 megawatt-hours of electricity.

The Island Cogen facility was shut down for four days in the second quarter of 2005 for maintenance compared to 63 days for the same period 2004. That's because in spring 2004, the plant was undergoing a major upgrade to increase its capacity to generate electricity. The plant's owners, Calpine Power Income Fund, are happy with the performance of all its power plants.