October 28, 2008

A kick in the shins for Gulf states

SONIA VERMA

Globe and Mail

October 28, 2008

Oil-fuelled wealth proves to be only thin insulation against the effects of the global credit crunch

DUBAI — For British soccer fans, it seemed too good to be true: Zabeel Investments, a Dubai-based sovereign wealth fund, was looking to buy Charlton Athletic, a struggling soccer club mired in more than $30-million (U.S.) of debt.

But late last week, Zabeel suddenly pulled out, blaming the toxic economic climate in the West. The company had decided to focus on "domestic opportunities" instead.

If soccer fans in Britain were shattered, the mood in Dubai was shock. The deal's collapse was one of the most striking signs the party in this oil-rich region was over: State-owned investment vehicles had sobered up, suddenly shunning trophy assets like Charlton.

In the past few weeks, Persian Gulf states have been jolted by the realization that they are not immune to the financial turmoil gripping the globe. Oil-fuelled wealth proved to be only thin insulation against the effects of the credit crunch.

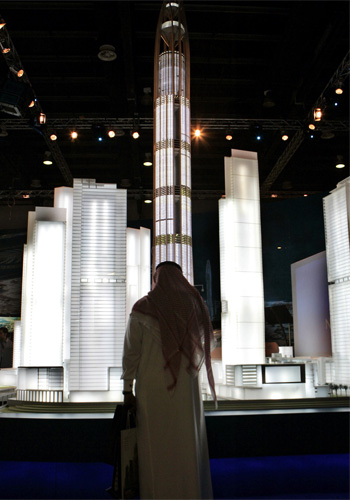

Real estate agents and analysts say demand remains strong for completed projects in Dubai, but interest in those that are incomplete or not yet built is shaky. Here, a man examines a graphic map of Dubai showing new developments.

Photo: Kamran Jebreili/AP

Sources: Reuters, The Associated Press

© Copyright 2008 CTVglobemedia publishing Inc. All Rights Reserved. Real estate agents and analysts say demand remains strong for completed projects in Dubai, but interest in those that are incomplete or not yet built is shaky. Here, a man examines a graphic map of Dubai showing new developments.

Photo: Kamran Jebreili/AP

Sources: Reuters, The Associated Press

© Copyright 2008 CTVglobemedia publishing Inc. All Rights Reserved. |

The Gulf region is being hit by the spreading global crisis. Known for its phenomenal oil wealth, stocks are plunging, governments are moving to support their financial systems and real estate projects are feeling the pinch. Here, a man looks at a model for a kilometer-high tower during a real estate exposition in Dubai's financial district.

Photo: Kamran Jebreili/AP

© Copyright 2008 CTVglobemedia publishing Inc. All Rights Reserved. The Gulf region is being hit by the spreading global crisis. Known for its phenomenal oil wealth, stocks are plunging, governments are moving to support their financial systems and real estate projects are feeling the pinch. Here, a man looks at a model for a kilometer-high tower during a real estate exposition in Dubai's financial district.

Photo: Kamran Jebreili/AP

© Copyright 2008 CTVglobemedia publishing Inc. All Rights Reserved.

|

More than $50-billion of foreign deposits has fled the region's banks in recent weeks as investors pulled back.

The price of oil - this region's main export and source of income - plunged, and local stock markets sank to new lows.

Gulf states have had to retrench, with Kuwait moving to prop up its central bank and Saudi Arabia extending special credit to its neediest citizens over the weekend.

The United Arab Emirates has already acted to guarantee bank deposits, and injected billions of dollars into its domestic money markets to encourage interbank lending. Qatar and Kuwait have used their sovereign wealth to buy up stakes in ailing banks and slumping stock.

"It feels a little like we've all woken up in the Twilight Zone," said Jason Goff, head of treasury sales at Emirates NBD.

"People are scared. Nobody in a million years predicted this would happen here," he added.

Economists are scaling back growth forecasts, and the Gulf's once-giddy property market is showing signs of shakiness, with developers now openly talking about construction delays and cancellations as fear spreads, paralyzing buyers.

Property developers have scaled back recruitment, with some companies imposing unprecedented hiring freezes until the economy stabilizes. Credit Suisse said market turmoil and negative sentiment would likely dent property demand in Dubai and Abu Dhabi, while Morgan Stanley predicts a market downturn of at least 10 per cent by 2010.

"These economies are no longer islands unto themselves," said Dr. Henry Azzam, chief executive officer of Deutsche Bank, Middle East and North Africa, and a former economics professor at Beirut University.

"Economic integration with the West brings with it a level of exposure. It forces a certain degree of reflection on how to move forward."

For the region's rulers, the need to take drastic steps to stabilize markets is unprecedented. Gulf leaders tend to view themselves as mavericks, building skyscrapers in the middle of the desert and man-made islands in the middle of the ocean, all in an effort to attract foreign investment and diversify their economies away from oil wealth.

The strategy has so far worked in countries like the United Arab Emirates, which has boasted double-digit growth in the past five years. Only in the past month have the hidden costs of that progress been revealed.

As Gulf states refocus their resources domestically, there is dwindling interest in acquiring assets in the West, even at fire sale prices.

"Anything in the West is seen as toxic," Dr. Azzam said. "They are not going to be the ones to bail out the banks any more. It's just not worth it," he said.

Foreign assets of Gulf Co-operation Council states were estimated to top $1-trillion last year. Some funds have seen their existing investments suffer massive losses.

The Kuwait Investment Authority's investment in Citigroup last January shows a $270-million loss.

To be sure, Gulf states are in a far better position to survive financial turbulence than the West.

Even though oil prices have dropped, countries including Saudi Arabia, Abu Dhabi and gas-rich Qatar have deep reserves of savings to cushion their countries from any real devastation.

Dubai is still viewed as a refuge for worried professionals, whose jobs are quickly evaporating in Western financial capitals. Some recruitment companies have reported a tenfold jump in applications in the past two months with bankers and estate agents leading the charge.

Gulf leaders and central bankers remain self-assured, arguing that their economies are fundamentally sound and able to withstand the current turmoil.

Echoing the optimistic outlook of other leaders, Sultan Nasser al-Suweidi, the UAE's central bank governor, said yesterday that the liquidity crunch in the region's banking system was easing and soon the region's economies would return to normal. "Things are getting better and stabilizing," he said.

But confidence alone won't calm markets, analysts say, and some suggest a co-ordinated action plan among Gulf states is needed to address the region's problems.

For now, leaders appear to be waiting to see if things get worse.

"If there is a need, we will do more," Mr. al-Suweidi said.

Special to The Globe and Mail

*****

Gimme shelter

As the financial crisis creeps into the Middle East, here's what others countries did yesterday to shore up battered markets.

The U.S. Treasury Department started moving $125-billion (U.S.) to nine major banks by buying ownership stakes, the first big transfer since the $700-billion bailout was passed this month.

Australia's central bank took the rare step of buying Australian dollars twice in the past few days to limit their plunge.

Crisis-hit Iceland said it needs another $4-billion in loans on top of the $2-billion it wants from the IMF .

Japan's Prime Minister Taro Aso told senior officials to draw up steps to calm volatile markets and to fend off further fallout.

News services

Oil price threatens to incinerate jobs

NORVAL SCOTT

Globe and Mail

October 28, 2008

10,000 construction positions at risk as oil sands companies defer projects, look for ways to cut costs

CALGARY -- The plummeting price of oil threatens to derail so many projects in Alberta's oil sands that as many as 10,000 construction jobs could be lost over the next year, stalling the engine that has long driven the province's economy.

Many energy companies are now seeking cheaper ways to build their projects or even deferring their plans altogether. These changes will likely slash the number of construction jobs in the oil sands by almost one-third, industry observers say.

"There's still billions of dollars of expenditure, but the frenzied pace of development is slowing down," said Richard Cooper, leader of Deloitte Inc.'s Canadian energy department. "The pent-up heat that was in the system is being driven out, and things are returning to some sort of equilibrium."

Just three months ago, record oil prices of $147 (U.S.) a barrel meant it was full speed ahead to develop the oil sands, despite the upward pressure that put on the price of labour, materials and services.

Now, the price of oil is just over $63 a barrel, as fears that the financial panic will cause lower oil demand. But with construction in Alberta continuing and costs still through the roof, only a few new projects will be viable if prices stay at that level.

Oil sands projects that include a mine and an upgrader, which processes the bitumen produced by a mine so that it can be processed by more refineries, need a long-term oil price of $100 a barrel, according to UBS Securities analyst Andrew Potter. Those that use steam injection to extract crude and don't include an upgrader require $70 a barrel.

Without certainty that prices will hit those levels, some companies have already cut back their multibillion-dollar oil sands plans. Suncor Energy Inc., Petro-Canada, Nexen Inc./OPTI Canada Inc. and BA Energy Inc. have already said they'll slow, remodel or postpone their projects, and others could follow.

Those deferrals mean that while the oil sands was expected to need 44,000 construction workers in 2009 and 2010, the region will now need only 26,000, Mr. Potter said. The oil sands now employ about 36,000 construction workers.

Producers are now likely to delay or cancel their Alberta upgraders and instead pursue what appears to be the most cost-effective solution for the oil sands - getting bitumen to an existing refinery in the United States that's been adapted to take heavy crude. That path appears viable at $50 a barrel or over, and has already been taken by EnCana Corp. and Husky Energy Inc.

Oil services companies, many of which have been stretched by the pace of oil sands development, are already feeling the slowdown. Flint Energy Services Inc., a major oil sands contractor, said it has recently scaled back its recruitment efforts as it no longer desperately needs new workers.

"Some of the gold rush mentality has gone," Flint spokesman Guy Cocquyt said. "If one project falls through, there's lots of other work to go around - but we'll see less expense on things like overtime. Some of the pressure [on the sector] will come off."

Even so, wages in the oil sands aren't expected to fall much. Most construction jobs are unionized, and Alberta's unions and employers agreed to a new three-year pay deal last year. Employers instead hope that Alberta's productivity will improve as workers find their jobs are no longer guaranteed.

"Companies know how much they are supposed to pay an [Albertan worker], but they've long missed how productive he'll be," said Neil Earnest, vice-president of Dallas-based energy consultancy Muse Stancil. "Now, some of the boom mentality is being set aside, and that should feed back into the marketplace."

October 27, 2008

Renewable power firms weather the storm

SHAWN MCCARTHY

Globe and Mail

October 27, 2008

Hit hard by the credit crunch and tumbling oil prices, strong green energy companies remain optimistic about growth

VANCOUVER -- Renewable power developer John Keating surveys the credit markets in crisis and heaves a sigh of relief, knowing how close he came to becoming another victim of the financial storm that has raged since early September.

In June, the TSX-listed, Calgary-based Canadian Hydro Developers Inc. closed two debt financings worth more than $700-million, money that is needed to complete construction of three wind energy projects that will add 500 megawatts of capacity to the company's portfolio.

"If I'm not losing sleep now, it's because we moved when we did to get our financing in place," Mr. Keating, Canadian Hydro's chief executive officer, said in an interview. "If we had waited two or three months, we would have had $750-million in projects not proceeding."

The financial crisis is rocking the capital-intensive renewable energy sector, driving up borrowing costs - where credit can be obtained - and threatening project profitability. At the same time, the slumping price for crude oil and natural gas has eroded the competitive position of alternative energy sources, in both the power and transportation sectors.

As a result, the global clean-tech sector has seen its share prices drop even more dramatically than the overall market. Analysts and company executives in the renewable energy industry expect a wholesale consolidation as weaker firms drop by the wayside, and the stronger ones take advantage of strong balance sheets to make acquisitions.

Still, many investors remain optimistic that the renewable energy sector will continue its long-term growth path, driven by public concerns about climate change and energy security, and by oil and natural-gas prices that are expected to climb again when the economic recovery takes hold.

"As the financial markets stabilize, many climate-change sectors should recover early, both in public and private markets, as they have regulatory support and strong long-term growth prospects," Mark Fulton, head of climate-change investment research at Deutsche Bank, said in a report last week.

In the meantime, however, there will be casualties as companies are squeezed by tighter credit or shrinking demand, Mr. Fulton wrote.

Well-established firms are still concluding debt and equity deals, particularly private placements that rely on pension funds, private-equity funds and other financial institutions that have specific allocations for clean-tech investments, said Sasha Jacob, chief executive officer at Jacob & Co. Securities Inc.

But in many cases, the cost of capital has risen sharply, undermining the rates of return expected by the developer, and demanded by their financiers.

However, the Canadian market offers clear advantages to both domestic and international renewable-power companies.

That's because most provincial utilities sign long-term power purchase agreements with developers, while renewable projects in the U.S. - and in Alberta - must compete to sell power to the utilities under a system known as the merchant model. The guarantee of cash flow from a financially solid government agency makes financing easier for companies than it would be if they were operating in a purely competitive marketplace.

Even as credit markets were tightening this summer, Mr. Keating managed to raise financing for wind projects that have guaranteed contracts with the Ontario Power Authority, including the $450-million Wolfe Island development near Kingston, and the $285-million Melancthon II near Shelburne, Ont.

It helped, Mr. Keating said, that the company has a portfolio of some 20 projects generating cash.

Like other industry executives attending the Canadian Wind Energy Association meeting in Vancouver last week, Mr. Keating remains optimistic about the longer-term prospects for the wind industry.

Provincial governments - spurred by commitments to reduce greenhouse gas emissions - are accelerating the expansion of renewable power supply.

Canada has increased its wind power capacity from 137 megawatts in 2000 to the current 2,400 megawatts, with another 1,000 megawatts expected to come online next year.

At last week's meeting in Vancouver, energy ministers from Ontario, British Columbia, New Brunswick and Prince Edward Island re-affirmed their commitments to renewable power - including wind, small-scale hydro and biomass.

However, the provinces have yet to assess the impact that the current economic downturn will have on future electricity demand, and therefore, how much additional power supply they will need.

Increasingly, international giants like French-based GDF Suez, FPL Energy LLC - a division of Florida Power and Light - and General Electric Co. are targeting Canada.

"This is a good market for companies like Suez to participate in," said Jeff Jenner, senior vice-president for the company's North American division. "The opportunities are bountiful and there are fewer potential barriers."

He expects to see a spate of mergers and acquisitions as smaller and medium-sized firms struggle with the capital-market fallout.

October 26, 2008

Canada's nuclear power play

Diane Francis,

Financial Post

October 25, 2008

Ontario must build at least $15-billion worth of nuclear plants to back out of dirty coal and better meet power growth requirements for the next few generations.

This major contract is to be awarded in March and three rivals are in the running: Atomic Energy of Canada Limited (AECL), which is 100% owned by Ottawa, Toshiba (formerly the nuclear division of Westinghouse) and Areva, the world's biggest nuclear company, 90% owned by France.

All three are in the process of responding to a Request for Proposals from Infrastructure Ontario and the decision-making is supposed to be based on technology, price, track record and safety --not politics.

But nuclear power is very political. AECL has built all of Canada's reactors so far and many feel it should get the nod because it's Canadian and really needs this contract. This is not unusual. All 59 reactors in France were built by Areva.

My own bias is that whatever happens, Canada must remain a nuclear industry player. I know nothing about the technology but I do know that Canadians deserve to have two policy goals met: a) creation of nuclear power that is the most efficient and safe in the world and b) participation in the world's nuclear industry by Canadians.

Since the 1950s, AECL has built 29 reactors worldwide and 14 reactors in Canada (12 in Ontario). Its designs have been incorporated into other reactors and it also produces valuable byproducts such as radioisotopes used in medical diagnostic procedures and cancer treatments, with a 60% worldwide market share.

Areva has become the world's largest nuclear player. It has built 98 plants worldwide, has two under construction and three more ordered and provides 20% of all nuclear power generated in the United States.

It is also vertically integrated and involved in uranium mining, processing and waste management. So why has France's national corporation done so much better than AECL?

One reason is that AECL cannot get leverage from its government, like U. S., Japanese or French players do, by promising and delivering geopolitical and other offsets to customer-countries.

But what Canada can do now is leverage the fact that Ontario is going to buy $15-billion worth of nuclear technology, plus possibly more in the oil sands. Canadians should want their industry to prosper as well as to get the cheapest and safest power for the future. There are currently 435 reactors worldwide and another 100 to be built within a decade or so. Canada should get a slice of this industrial activity.

Best solution is a joint venture, or a publicly listed merged entity, so I asked both AECL and world giant Areva about this idea.

Areva Canada President Armand Laferrere said in a telephone interview yesterday: "Canada should protect the industry, rather than the [AECL] technology, and pick a solution which will give more jobs to Canadians. We do a lot of joint ventures, with Mitsubishi, in the U. S., in China. We are very flexible in adapting to local markets."

AECL's CEO, Hugh MacDiarmid, when asked yesterday about a partnership, said: "Our mandate at AECL is to be a top-tier global competitor in the nuclear business and we believe we have the knowledge and skills to do that. We believe we can compete with the best in the world."

October 25, 2008

Palin pipeline terms curbed bids

By JUSTIN PRITCHARD and GARANCE BURKE

Associated Press

Washington Post

26 October 2008

AP INVESTIGATION

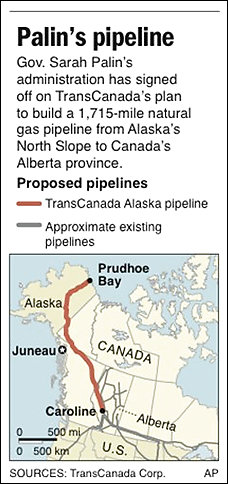

ADVANCE FOR OCTOBER 26; map locates TransCanada proposed pipeline project that will run from Alaska to Alberta, Canada;

(Siobhan Dooley - AP)

ADVANCE FOR OCTOBER 26; map locates TransCanada proposed pipeline project that will run from Alaska to Alberta, Canada;

(Siobhan Dooley - AP) |

Beginning at the Republican National Convention in August, the McCain-Palin ticket has touted the pipeline as an example of how it would help America achieve energy independence.

"We're building a nearly $40 billion natural gas pipeline, which is North America's largest and most expensive infrastructure project ever, to flow those sources of energy into hungry markets," Palin said during the Oct. 2 vice presidential debate.

Despite Palin's boast of a smart and fair bidding process, the AP found that her team crafted terms that favored only a few independent pipeline companies and ultimately benefited the winner, TransCanada Corp.

And contrary to the ballyhoo, there's no guarantee the pipeline will ever be built; at a minimum, any project is years away, as TransCanada must first overcome major financial and regulatory hurdles.

In interviews and a review of records, the AP found:

-Instead of creating a process that would attract many potential builders, Palin slanted the terms away from an important group - the global energy giants that own the rights to the gas.

-Despite promises and legal guidance not to talk directly with potential bidders, Palin had meetings or phone calls with nearly every major candidate, including TransCanada.

-The leader of Palin's pipeline team had been a partner at a lobbying firm where she worked on behalf of a TransCanada subsidiary. Also, that woman's former business partner at the lobbying firm was TransCanada's lead private lobbyist on the pipeline deal, interacting with legislators in the weeks before the vote to grant TransCanada the contract. Plus, a former TransCanada executive served as an outside consultant to Palin's pipeline team.

-Under a different set of rules four years earlier, TransCanada had offered to build the pipeline without a state subsidy; under Palin, the company could receive a maximum $500 million.

"Governor Palin held firmly to her fundamental belief that Alaska could best serve Alaskans and the nation's interests by pursuing a competitive approach to building a natural gas pipeline," said McCain-Palin spokesman Taylor Griffin. "There was an open and transparent process that subjected the decision to extensive public scrutiny and due diligence."

ONLY ONE VIABLE BIDDER

There were never more than a few players that could execute such a complex undertaking - at least a million tons of steel stretching across some of Earth's most hostile and remote terrain.

TransCanada estimates it will cost $26 billion; Palin's consultants estimate nearly $40 billion.

The pipeline would run from Alaska's North Slope to Alberta in Canada; secondary supply lines would take the gas to various points in the United States and Canada. The pipeline would carry 4.5 billion cubic feet of natural gas daily, about 8 percent of the present U.S. market.

Building such a pipeline had been a dream for decades. The rising cost and demand for energy injected new urgency into the proposal.

So too did the depletion of Alaska's long-reliable reserves of oil, which are trapped in the same Arctic Circle reservoirs as clean-burning natural gas. Not only does that oil provide jobs, it pays for an annual dividend check to nearly every Alaska resident. This year's payment was $2,069, 25 percent higher than 2007 - plus a $1,200 bonus rebate to help offset higher energy costs.

Palin was elected as governor two years ago in part because of her populist appeal. Promising "New Energy for Alaska," she vowed to take on Exxon Mobil Corp., ConocoPhillips and BP, the multinational energy companies that long dominated the state's biggest industry.

Oil interests were particularly unpopular at that moment: Federal agents had recently raided the offices of six lawmakers in a Justice Department investigation into whether an Alaska oil services company paid bribes in exchange for promoting a new taxing formula that would ultimately further the multinationals' pipeline plans.

Palin ousted fellow Republican Gov. Frank Murkowski, who pushed a pipeline deal he negotiated in secret with the "Big Three" energy companies. That deal went nowhere.

With Alaskans eager for progress and sour on Big Oil, Palin tackled the pipeline issue with gusto, meeting with representatives from all sides and assembling her own team of experts to draw up terms.

Palin invited bidders to submit applications and offered the multimillion-dollar subsidy. Members of Palin's team say that without the incentive, it might not have received any bids for the risky undertaking.

TIES THAT BIND

Palin's team was led by Marty Rutherford, a widely respected energy specialist who entered the upper levels of state government nearly 20 years ago. Rutherford solidified her status when, in 2005, she joined an exodus of Department of Natural Resources staff who felt Murkowski was selling out to the oil giants.

What the Palin administration didn't tell legislators - and neglected to mention in its announcement of Rutherford's appointment - was that in 2003, Rutherford left public service and worked for 10 months at the Anchorage-based Jade North lobbying firm. There she did $40,200 worth of work for Foothills Pipe Lines Alaska, Inc., a subsidiary of TransCanada.

Foothills Pipe Lines Alaska Inc. paid Rutherford for expertise on topics including state legislation and funding related to gas commercialization, according to her 2003 lobbyist registration statement.

Palin has said she wasn't bothered by that past work because it had occurred several years before. But Rutherford wouldn't have passed her new boss' own standards: Under ethics reforms the governor pushed through, Rutherford would have had to wait a year to jump from government service to a lobbying firm.

Rutherford also has downplayed her work for Foothills.

"I did a couple of projects for them, small projects," she told a state Senate committee examining the TransCanada bid earlier this year. While a partner, Rutherford said, she "realized that my heart was not in the private sector, it was in the public sector, and I sold out for the same amount of money I bought in for."

At one point, Palin's pipeline team debated Rutherford's role, but concluded there was no problem.

"We were looking at it in terms of is this an actual conflict or is there the appearance of impropriety of Marty's participation," said Pat Galvin, the commissioner of the Revenue Department and another top team member. "It was determined that there was none, and so we moved forward."

Patricia Bielawski, Rutherford's former partner at Jade North, spent last summer in Juneau, the state capital, serving as TransCanada's lead private lobbyist on the pipeline deal. While the Legislature debated - and ultimately approved - the TransCanada deal, Bielawski met with lawmakers and sat in on the public proceedings, several legislators said.

Bielawski told AP earlier this month that Rutherford's employment at her firm was irrelevant. She said Rutherford never directly lobbied the Legislature for Foothills, and that Rutherford broke no rules based on 2003 state ethics guidelines.

"There's no statutory or regulatory prohibition that extends to things that many years ago," Bielawski said. "So there's no issue."

But others say it's a legitimate question.

"I'm not saying someone's getting paid off for a sweetheart contract, but it's very hard to ignore that this is your former partner and your former client standing there before you," said Republican Sen. Lyda Green, a Palin critic who in August was among the handful of lawmakers who voted against awarding TransCanada the license. "Every time it was mentioned to the governor or to the commission, it was like, 'How could you question such a wonderful person?'"

Tony Palmer, the TransCanada vice president who leads the company's Alaska gas pipeline effort, rejects the suggestion that his company benefited.

"We have gained clearly no advantage from anything that Ms. Rutherford did for Foothills some five years ago on a very much unrelated topic," he said.

Rutherford did not respond to interview requests made directly to her and through the governor's office. But Griffin, the spokesman for the McCain-Palin campaign, said Rutherford "had no decision-making role or authority," and contended that such matters were handled by others on the Palin pipeline team.

TransCanada also had a connection to the team hired by the Palin administration to analyze the bid. Patrick Anderson, a former TransCanada executive, served as an outside consultant and ultimately helped the state conclude that TransCanada's technical solution for shipping gas through freezing temperatures would work.

NARROW SET OF RULES

In January 2007, Palin spoke the first of at least two times to Vice President Dick Cheney, the Bush administration's point person on energy issues, according to calendars obtained by the AP through a public records request. Cheney's staff pressed the Palin administration to draw in the energy companies, said current and former state officials involved in those discussions.

As the governor's approach unfolded in the spring of 2007, there were signs it was skewed in a different direction.

Palin said she saw problems if the firms that own the gas also owned the pipeline. They could manipulate the market or charge prohibitive fees to smaller exploration firms, discouraging competition.

Several important requirements in the legislation were unpalatable to the big oil companies. In the talks under Murkowski, the firms asked that the rates for the gas production tax and royalties be fixed for 45 years; Palin refused to consider setting rates for that long.

Under the Palin process, the pipeline firms had an advantage because they simply pass along taxes paid by oil and gas producers.

Oil company officials warned lawmakers they wouldn't participate under those terms. Still, in a near unanimous vote, the Legislature passed the Alaska Gasline Inducement Act in May 2007, generally as written by Palin's pipeline team.

Once the state issued its request for proposals on July 2, 2007, the level of communication between the government and potential bidders was supposed to decrease drastically, so that no one would be accused of gaining unfair advantage. State lawyers advised public officials to keep their distance, and bidders were told to submit questions on a Web site where answers could be seen by all.

Several of the state's gas line team members interviewed by AP said they had no contact with possible bidders. But Palin had conversations with executives at most of the major potential bidders during that period, according to her calendars.

While the calendars don't detail what was discussed, the documents indicate that the pipeline was the subject of the discussions, or that the conversations occurred immediately after a briefing with Palin's pipeline team.

When she was in Michigan for a National Governors Association summit in late July 2007, Palin and her team met executives from Williams Co., a pipeline builder that ended up not bidding.

"The purpose of the meeting was to more fully understand the details of the project, which we were still evaluating at the time," company spokeswoman Julie Gentz said in a statement.

TransCanada's Palmer described communication with state officials as nonexistent.

According to the governor's official schedule, however, Palin called TransCanada President and CEO Hal Kvisle on Aug. 8, 2007. Asked about that call, Palmer said it was to clarify the bidding process.

Griffin said that in keeping with legal guidance, Palin never spoke in any of the meetings about the competitive bidding process.

By the Nov. 30 submission deadline, there were five applications. But the state disqualified four for failing to satisfy the bill's requirements.

That left TransCanada.

The Canadian giant had been pursuing an Alaska pipeline since at least 2004, when the company negotiated a deal with Rutherford that the state ended up shelving. While the details remain confidential, six people familiar with the terms told the AP that TransCanada was willing to do the work then without the large state subsidy.

In testimony this July before the state Senate, Rutherford herself confirmed such a willingness, but described the 2004 deal as presenting a different set of trade-offs. A state lawyer warned her not to say more, lest she violate a confidentiality agreement.

Others who reviewed the deal think much of the $500 million will be wasted money.

"Most definitely TransCanada got a sweetheart deal this time," said Republican Sen. Bert Stedman, who voted against the TransCanada license. "Where else could you get a $500 million reimbursement when you don't even have the financing to build the pipeline?"

Associated Press writer Brett J. Blackledge contributed to this report.

October 24, 2008

Warning issued on carbon capture

Scott Simpson

Vancouver Sun

October 24, 2008

Underground storage of carbon dioxide has been hailed as the ultimate solution to climate change, but there's no evidence it can actually avert a global warming disaster.

Across the world, the private sector and governments are spending "nowhere near" the amount of time and resources necessary to develop technology for capturing and disposing of carbon emissions, the International Energy Agency is warning in a new report.

The IEA warns of "major impacts on the environment and human activity" unless there is a massive surge in research and development of clean coal technology and carbon capture and storage.

Almost 70 per cent of all carbon dioxide emissions globally are energy-related, and the IEA warns that they will increase 130 per cent by 2050 in the absence of new technology and policies to curtail them.

The IEA says the next 20 years are critical to development of technology to capture the carbon dioxide emitted by energy generation and industrial processes and pipe it underground.

The IEA notes that the G8 group earlier this year endorsed an IEA proposal to embark on at least 20 large-scale carbon capture and storage research projects by 2010. Missing that deadline could be devastating. A failure to curtail emissions from the energy sector in particular could double the pace of global warming in this century, it says, citing a 2007 report from the Intergovernmental Panel on Climate Change.

Without those projects to lead the way, it's unlikely a target of 10,000 carbon capture and clean coal projects will be in place by 2050.

"Current spending and activity levels are nowhere near enough to achieve these deployment goals," the IEA says, noting rapid escalation of technology costs over the past five years, lack of public and private funding for demonstration projects, and an absence of regulatory support and incentives.

Canada is home to one of the world's largest carbon storage projects, in Weyburn, Sask., while Spectra Energy is in the early stages of another world-class project at the Fort Nelson gas processing plant in northeast British Columbia.

Gary Weilinger, Spectra's vice-president for strategic development and external affairs, said in a telephone interview that many of the delays for large-scale projects relate to an absence of government policy.

Spectra is proceeding with its project, the proposed containment of 1.2 million tonnes per year of carbon dioxide emissions at Fort Nelson in a deep underground saline reservoir.

Weilinger noted that the storage project, when realized, will add significantly to the production costs of natural gas at the plant -- but if governments make it cheaper for a less-motivated producer to buy carbon credits and just keep polluting the atmosphere, then there's no incentive for investing in the new technology.

As well, there are unresolved issues about long-term liability for stored carbon. If an unrelated gas exploration company breaches the periphery of an underground containment field, it's not clear who would be at fault, Weilinger said.

Nor are there any specific government policies in place around carbon containment infrastructure such as pipelines, access to Crown and private land and aboriginal rights and title.

Weilinger compared the development of a carbon capture sector to the development of any large-scale public infrastructure project, the latter typically requiring several years worth of regulatory work before any substantial development takes place.

ssimpson@vancouversun.com

Cap-and-trade, carbon tax not much different, report says

James Cowan

Vancouver Sun

October 24, 2008

TORONTO -- Canadian politicians overstate the differences between carbon taxes and cap-and-trade programs as tools to reduce greenhouse gases, a new report suggests.

A study prepared by the Pembina Institute, an energy think-tank suggests neither approach will effectively cut emissions on its own. Furthermore, the two have more in common than politicians in the recent election would admit.

Both the Conservatives and the NDP advocated variations of the cap-and-trade model, which imposes a limit on the emissions that a company can produce and then allows corporations that do not meet the targets to buy further credits.

The Liberals' much-maligned Green Shift proposed a tax on fossil fuels that would fund cuts to income and corporate taxes.

Either method would result in price hikes for consumers, according to Don Drummond, TD's chief economist. "The ones supporting a cap-and-trade never mentioned the impact on households, pretending, I guess, that there wasn't going to be any impact, which of course is not true."

While either system could increase the cost of living, either is also a viable way to cut emissions, according to Matthew Bramley of the Pembina Institute.

"The debate we've seen publicly between carbon taxes and cap-and-trade has exaggerated the differences between the two ways to do things," said Matthew Bramley, one of the report's authors. "The more you look at them, the more similar they appear."

Both systems can be designed to offer flexibility for different industries, to minimize administrative complexity and to conform with the Kyoto Protocol and other international reduction regimes, according to the report.

"From an environmental perspective, the more important question is how stringent is the policy," Bramley said. "Those questions are more fundamental than the ones we've been hearing about one versus the other."

Choosing Greenhouse Gas Emission Reduction Policies in Canada

Pembina Institute, 24-Oct-2008

October 23, 2008

Canada needs to kick its dirty-oil habit

Tar Sands: Dirty Oil and the Future of a Continent

by Andrew Nikiforuk

Declaration of a Political Emergency, an excerpt.

Canada needs to kick its dirty-oil habit

Barbara YaffeVancouver Sun

November 11, 2008

Canada has become an oil junkie, hooked on the tarsands and in desperate need of detox.

That's a perspective put forward in a new book by Alberta journalist Andrew Nikiforuk in Tar Sands: Dirty Oil and the Future of a Continent.

The book is likely to be lauded by environmentalists and pilloried by folks in Canada's oil patch.

The author argues for a reopening of the North American Free Trade Agreement to enable Canada to reclaim its resource from a ravenous customer and partner in crime, the U.S.

Writes Nikiforuk: "Canada has adopted a new geodestiny: Providing the U.S. with bitumen."

He notes that while Canada furnishes the Americans with 20 to 30 per cent of their oil, half of this country's own citizens, in Quebec and Atlantic Canada, continue to rely on insecure supplies from the Middle East.

Accordingly, a vast network of north-south pipelines and electricity corridors are being built across the continent -- to serve U.S. interests.

Nikiforuk disapprovingly cites NAFTA provisions that guarantee the U.S. unlimited access to Canadian oil and natural gas, and reasonable access during times of shortages.

These guarantees, he says, need to be renegotiated to allow Canadians to safeguard their domestic energy security.

Canada's official policy, of course, is quite different. Alberta's government regularly lobbies Washington to ensure its oil exports remain unimpeded.

When the U.S. Energy Independence and Security Act became law last December, limiting dirty oil imports, Edmonton and Ottawa immediately began lobbying for a tarsands exemption.

The Harper government has signalled it hopes to use American reliance on tarsands oil as a way of conveying to the new Obama administration Canada's strategic importance.

Nikiforuk believes the tarsands should be developed gradually and with far greater environmental sensitivity, a view that has been supported by former Alberta premier Peter Lougheed.

Nikiforuk paints a picture of the current development as an environmental cesspool.

In fact, every barrel of bitumen from the tarsands produces on average three times more C02 emissions than a regular barrel of oil.

The tarsands are Canada's single largest growing source of carbon dioxide, and by 2020 will account for no less than 16 per cent of the nation's total emissions.

Meanwhile, "no comprehensive assessment of the megaproject's environmental, economic or social impact has been done."

Approvals are granted enthusiastically as part of a process that seeks to maximize potential profit, says the author.

And there's where the rubber hits the road; the tarsands have been wildly profitable. How can we realistically expect the politicians to voluntarily turn off the spigot?

Between 2000 and 2020, it's estimated that corporate taxes from the tarsands will yield $44 billion for Alberta and $51 billion for Ottawa.

The Alberta Energy Department website describes the tarsands -- which it more benignly refers to as 'oil sands' -- as "a triumph of technological innovation," covering an area the size of the state of Florida and accounting for nearly half Canada's oil output and 62 per cent of Alberta's output.

Just as impressively, some 145,000 Albertans are employed in the mining and oil and gas extraction industry. And thousands more work in the services sector that supports energy exploration and production. Jobs are going to people as far away as Newfoundland.

In the face of such facts, it would run counter to human nature to curtail the tarsands or even scale back development.

Nikiforuk argues convincingly that we have been both quick and somewhat reckless when it comes to the tarry goo, but democracies are run according to the wishes of their people.

And the main overseer of the tar sands, Alberta's Conservative governments, keep getting re-elected with hearty mandates.

Meanwhile, the feds are thrilled by the revenue take from the tarsands and other provinces are grateful for the job opportunities.

As much as scientists keep predicting global doom resulting from greenhouse gases, Canadians still love their cars and continue running their dishwashers.

The tarsands has a lifespan of about 40 years and to date only about two per cent of the resource has been produced. This is a topic that will continue to fuel heated debate.

byaffe@vancouversun.com

Author Andrew Nikiforuk fears tar sands undermine democracy

By Charlie SmithGeorgia Straight

23-Oct-2008

A Calgary author and journalist says most Canadians don’t understand that we’re living in a “petrostate” that could undermine our democracy. Andrew Nikiforuk, author of Tar Sands: Dirty Oil and the Future of a Continent (Greystone Books, $20), told the Georgia Straight in a phone interview that Canada needs a national debate on the topic. “I think the tar sands has created a political emergency for the country,” he said.

In his book, Nikiforuk describes the Alberta tar-sands developments as the world’s largest construction project, the world’s largest capital project, and the world’s largest energy project—one that uses as much water in a year as a city with a population of two million.

“We need reporters from our national daily newspapers living in Fort McMurray and writing about this nation-changing event,” Nikiforuk said. “This is an event much greater than the building of the national railway. This is an event much greater than the Apollo moon project.”

Canada, which has approximately 175 billion barrels of recoverable oil, is the largest supplier of oil to the United States, having surpassed Saudi Arabia. “We have become a petrostate without any of the safeguards that a petrostate should have,” Nikiforuk said.

He noted that there is a vast amount of political-science research demonstrating that oil wealth hinders democracy. He said this is true regardless of whether the petrostate is in the Middle East, and whether it’s a large or small country.

Nikiforuk pointed out that Canada has ignored recommendations from the International Monetary Fund and the Organisation for Economic Co-operation and Development calling on countries that generate a great deal of oil wealth to put those revenues into a separate fund that cannot be touched by politicians.

“Canadians need to start thinking of themselves as a petrostate, and they need to start thinking of the kinds of controls needed to protect the country from the excesses of oil,” he said. “We also need to think about the pace, and where we want to go with it. It is out of control.”

He said that oil wealth undermines democracy in several ways. Governments enriched by petroleum revenues reduce taxes, which makes the public feel good about politicians who make these decisions. Oil money is also used to buy votes, he alleged.

“Then, those parties tend to stay in power for long periods of time,” Nikiforuk said, noting that Conservatives have governed Alberta for 37 years. “Parties that stay in power for long, long periods of time tend to become more authoritarian in nature.”

Alberta has the lowest provincial voter turnout in the country. Nikiforuk said governments that remain in power for decades tend to make more appointments based on patronage rather than merit.

“So you end up with all kinds of people being appointed to positions they should not be in,” he claimed.

He estimated that $200 billion has been spent developing the Alberta tar sands if the cost of pipelines, refinery expansions, and upgraders is included.

“It has brought 700,000 people into Alberta since 1996,” Nikiforuk said. “It is almost like the invasion of Iraq, but in this case, it’s a petroboom.”

According to the Alberta-based Pembina Institute, two tonnes of the bituminous sands, otherwise known as tar sands, and two tonnes of overburden must be excavated to create a single barrel of oil. Nikiforuk writes that producing each barrel generates three times as much greenhouse gas as a barrel of conventional oil because of the work involved.

He noted that the tar-sands developments are playing a role in preventing Canada from meeting its climate-change goals. But the impact goes beyond that, affecting cross-Canada labour mobility and causing politicians to amend immigration legislation to allow more temporary foreign workers. “The tar sands has changed Canada in the same way the fur trade has changed Canada,” Nikiforuk said.

He said that Canadian provincial and federal governments have generated $60 billion from tar-sands development, but claimed that Canadians have little to show for it. In his book, he notes that Ottawa will have collected at least $50 billion from tar-sands developments by 2020. “True to the First Law of Petropolitics,” Nikiforuk writes, “government has used this windfall so far to reduce corporate taxes and slash 2 per cent off the federal sales tax. While Norway has kept the resource curse largely at bay with clear accounting and its dedicated oil/pension fund, Ottawa has spent the cash to win friends and influence elections.”

Nikiforuk said that Canada has no strategy for ensuring self-sufficiency in energy over the long term, even though it appears that conventional oil production has peaked around the world. He also said that no Alberta politician ever expected that environmentally concerned Americans would start asking questions about degradation wrought by tar-sands developments. “What we’re seeing is a complete vacuum here in terms of political direction, political policy, political strategy,” he claimed. “It’s dangerous for Alberta. It’s dangerous for Canada. It’s dangerous for North America.”

Refinery expansion, pipeline to be good for area

By Scott Cousins

Granite City Press-Record

Sunday, October 19, 2008

Rotary talk centers on energy, oil

A multi-billion dollar expansion of ConocoPhillips' Wood River Refinery will be a major benefit for the entire region, according to a company official speaking in Granite City Wednesday.

Tim Peterson, manager of technical services at the plant, was the speaker at this month's Granite City Rotary Action Prayer Breakfast.

Although the formal presentation was about energy security and climate change, much of the group's interest centered on the development.

The company recently received the final environmental permits for a $3 billion expansion coupled with the construction of a pipeline from Alberta, Canada, to deliver oil for processing.

He said the pipeline is expected to be finished in 2010, with the refinery expansion coming on line in 2011.

The refinery, originally built in 1917, is the 10th largest in the U.S., according to Peterson.

It processes about 300,000 barrels of oil per day. Of that, 160,000 barrels is turned into gasoline, 90,000 into diesel or jet fuel, and the remainder into asphalt and other petroleum products.

When completed, the expansion will allow the refinery to produce an addition 70,000 barrels of crude oil per day.

In addition, the expansion will double the amount of heavy crude oil the refinery is able to process.

The oil coming from Albert is primarily heavy crude oil.

"You need some special facilities in your plant (to process the heavier oil)," Peterson said.

The refinery expansion and construction of the pipeline will employ between 2,000-3,000 workers in this area, and when completed will add between 50-100 permanent jobs in the refinery.

"It's a great project for the (economic) security of the refinery," he said.

In talking about the general subject of oil, gasoline and the environment, he said there are "significant challenges" in producing energy and dealing with climate and environmental issues.

"They're very interrelated," he said. "You can't solve one without the other."

Peterson noted that current projections call for energy use to 25 percent over the next 20 years or so, and that oil, natural gas and coal will provide about 80 percent of U.S. energy at least through 2030.

For future energy demands, he said there needs to be energy diversity, including ethanol, nuclear and other sources.

"We basically need it all to keep up with the demand," he said.

There also needs to be an increased emphasis on energy efficiency, along with a concern for the environment

October 21, 2008

Requiem for a moratorium

Big Oil and enviros agree:

Surging prices were nail in coffin for offshore-drilling ban

Grist

20-Oct-2008

The 110th Congress achieved some notable victories for the environmental community. The Democratic majorities secured the first major increase in automobile fuel-economy standards in nearly three decades, along with tougher efficiency rules for household appliances. They extended tax credits for solar and other renewable energy sources. Serious discussion of climate legislation got underway in the Senate, while the House approved an energy bill with the first national renewable electricity standard (though the Senate didn't pass it). Democratic leaders set an example for the nation with a plan to green the U.S. Capitol.

But for many enviros, the legacy of the 110th Congress will be its failure to renew the 27-year-old moratorium on drilling for oil and gas on the outer continental shelf (OCS) -- one of the largest concessions on environmental protection in decades.

Republican leaders and former elected officials like Newt Gingrich spent the summer of 2008 demanding that the country "drill here, drill now." In the waning hours of Congress, they finally got at least a partial win on the issue: The moratorium expired on Oct. 1, opening more than 600 million acres of coastal waters to leasing and potentially allowing oil and gas drilling as close as three miles to shore. The expiration clearly demonstrated the persistent power of the fossil-fuel lobby in Washington.

"This is the biggest reversal of conservation and protection in the history of this country," said Richard Charter, a government relations consultant for Defenders of Wildlife Action Fund and a long-time opponent of offshore drilling. "This could be just the first step to losing what people in this country who are now alive took for granted as they were growing up ... If anything is going to be fair game to be destroyed in the quest for oil, then this is probably not the end. This is probably just the first step."

For the moratorium on offshore drilling to expire under a Democratic Congress might strike some observers as ironic, given the party's longtime ties to various environmental groups. But that would overlook the fact that the moratorium has for decades had backing from both sides of the aisle, with particularly vocal support from Republican leaders in key states like Florida and California.

"The moratorium has always been a bipartisan product, and could not have survived as many years as it did without Republican support," Charter said.

But that all changed when the price of oil went soaring.

"It's safe to say the whole country went crazy when gas hit $4 a gallon," said Athan Manuel, Sierra Club public lands program director. "At that point you saw people across the country calling for immediate action. Congress tried to do everything they could on energy -- do more efficiency, do more renewables, do more nukes, and do more drilling. Whether it was the right solution or not, people just started calling for action, and you saw people like Newt Gingrich and the Republican leadership really exploiting that."

The nearly three-decades-old bipartisan coalition built to support the moratorium was simply no match for oil selling during the peak summer months at well over $100 a barrel, say enviros.

"People vote with their right foot, on the gas pedal," Charter said. "There is no more powerful lobbying tool, in the environmental movement or anywhere else, than that little dial spinning around on a gas pump."

A captive audience

Representatives of the oil industry, who have long campaigned for the end of the OCS moratorium, confirmed that it was the high price of gasoline this year that helped them finally get their wish.

"I think that people were listening this summer when they saw gas prices going higher, so that had a lot to do with the public sentiment," said Denise McCourt, industry relations director for the American Petroleum Institute. "We're pleased to see that, because people are recognizing that we have some tremendous opportunities out here and that Congress needed to act."

McCourt said API ramped up its advertising and outreach campaigns on the issue, in part because the high price of gasoline had more people tuned in on the issue.

Lee Fuller, vice president of government relations for the Independent Petroleum Association of America, said national security concerns also helped change public opinion on drilling, but high prices were the main factor.

"We were looking at the impacts of the price of oil moving U.S. money into the hands of foreign countries, which in many cases weren't that supportive of the United States," said Fuller -- echoing a point made by both Barack Obama and John McCain during the presidential campaign. But Fuller said it was the spike in oil prices that "drove energy into the front line debate" for much of the summer.

Even though new offshore drilling wouldn't lower prices for at least a decade, according to everyone from the Energy Information Administration to API, the oil industry and its friends in Congress were able to convince the American public otherwise. Through expanded marketing tactics and sheer repetition, they drove home the notion that drilling could be done in a "safe, environmentally friendly" way, and gave the impression that it would only be "deep-sea" drilling -- far from the public's favorite beaches.

In the first six months of 2008, Big Oil spent $289.6 million on political contributions, lobbying expenditures, and paid media, according to a recent report [PDF] from the campaign finance watchdog group Public Campaign Action Fund. The Center for Responsive Politics reports that Gingrich's 527 group, American Solutions for Winning the Future, has on its own spent $15.6 million this year, most of it on pushing the "drill here, drill now" message.

"Big Oil has just been able to wage a major effort to convince both the public and decision makers that there's merit to drilling," said Margie Alt, executive director of Environment America.

The P.R. effort had an impact, as the summer saw growing public demand for drilling, which in turn put pressure on lawmakers to do something. The demand for drilling came despite the fact that, according to other survey data, there is far more public support for investing in renewable energy sources as a way to bring down energy prices.

And as poll numbers in favor of drilling crept up, so did congressional support, even among lawmakers who recognize that it isn't a real solution to energy concerns.

"I don't think the [congressional] leadership was as strong as they should have been," said Corry Westbrook, legislative director for the National Wildlife Federation. "I don't think they were good about messaging and getting out to the public that there is a better solution than drilling."

A long time coming

The demise of the moratorium on offshore drilling didn't happen suddenly. It has had opponents throughout its history, and the legislation to support its continuation, which usually came as part of the regular Interior Department spending legislation, was seeing its support in the key appropriations committees slide year after year.

But it was John McCain who kick-started this year's big political debate over the issue. For years he had supported the federal OCS drilling ban, but in June he reversed course and called for lifting it. President Bush quickly jumped on board, calling on Congress to lift its ban and then repealing the executive ban, which had originally been imposed by his father in 1990. In order for drilling to proceed, both the congressional and executive bans needed to be ended.

While the drilling debate was still raging in Congress, the Bush administration started putting together a new five-year plan that would allow OCS lease sales as soon as 2010.

"Areas that were considered too expensive to develop a year ago are no longer necessarily out of reach based on improvements to technology and safety," Interior Secretary Dirk Kempthorne said in July. "The American people and [President Bush] want action and this initiative can accelerate an offshore exploration and development program that can increase production from additional domestic energy resources."

Though Kempthorne won't be able to complete the new plan before the end of this administration, he will have set in motion a plan that the next president could carry out.

"It just happened to take almost to the end of the administration, but you know that the White House will get it as far down the runway as they can before they leave," said Charter.

Green around the gills?

Lawmakers and groups committed to preserving protections for the outer continental shelf were also thwarted by the enormity of the financial crisis that confronted Congress in its final weeks. The House managed to pass an energy bill that included at least some protections for the OCS, but with all attention turned to the Wall Street bailout plan, the protections were never considered in the Senate. Many assume that the Senate wouldn't have been able to pass them anyway, and Bush made clear he would veto any bill that included them.

But some believe the financial crisis could have given the Democratic leadership some bargaining power to force the president's hand on a measure to protect the coasts.

"[The Bush administration] came, hat in hand, asking for the $700 billion bailout, so you would presume that Democrats would have some leverage," said Charter. "I think the reason that the Democrats blinked in this giant game of cataclysmic chicken ... is they didn't want to further complicate the Bush economic crisis."

Others think the financial crisis simply sucked all the air out of the room in the final weeks of Congress. "With everything else going on in Congress, and with Big Oil putting all their weight behind this idea that we need to drill more, the environmental perspective just wasn't able to prevail," said Alt.

Some in Congress fault environmental groups for not doing enough to help keep the moratorium in place. Rep. George Miller (D-Calif.), speaking at a public forum on "The Politics of Green" at the Democratic National Convention in August, accused the environmental community of being "entirely absent" during this summer's debate over drilling. "Nobody heard from them in their district office, nobody heard from them during that discussion," said Miller.

Environmentalists, of course, buck at that suggestion, pointing to a litany of advertisements, email campaigns, phone calls, op-eds, and press releases from the summer.

Sierra Club's Manuel is a bit sick of people asking where enviros were during the heated drilling debate. "I have answered that question millions of times on the Hill," said. "They asked us why we were so silent. We weren't. We were yelling like crazy, but we weren't yelling as loud as the other guys because they had a bigger bullhorn than we did."

But even if they were drowned out by the oil industry and their allies in Congress, Manuel acknowledged that some things could have been done better this year. He said there is a definite need to reactivate the long-standing coalitions between enviros, tourism organizations, and the fishing industry that have previously stepped up to protect the coasts.

"We just need to do a better job of making those voices louder, because those voices were definitely crowded out," he said. "We need to get those guys reactivated again. That's always been an important part of this fight, and we didn't do as good of a job activating that crowd."

NWF's Westbrook also noted that while green groups could have improved their messaging on the OCS issue, they were in fact very active on Capitol Hill over the summer, focusing a lot of their efforts on the Lieberman-Warner Climate Security Act and the seemingly never-ending battle to extend the renewable-energy tax credits.

"Most of the community was very focused on the Climate Security Act, and that is completely tied to investments in more fuel-efficient cars and more fuel-efficient buildings, and getting global warming and carbon dioxide gases down," said Westbrook. But still, she added, "I wish that we had articulated our message and our concerns more clearly to the public about the fact that [drilling] is just a short-term, and not a real, solution."

The victors aren't feeling victorious

While the outcome this year was far from ideal for environmentalists, it wasn't exactly what Big Oil was asking for either.

The industry wanted a bill explicitly endorsing offshore drilling (like the "All of the Above" bill from the House Republicans), but all it got was a passive expiration of the ban. Drilling advocates wanted a portion of the revenues from leasing to be given to states, in order to give them more incentive to allow drilling off their coasts. They wanted to open up more areas of the Gulf Coast (which are currently protected by legislation separate from the OCS moratorium), and they wanted to include language to significantly limit lawsuits challenging new leasing. Sen. Jim DeMint (R-S.C.) tried to slip these provisions into other legislation in the final hours of Congress, to no avail.

So Oct. 1, though it was dubbed Energy Freedom Day by the pro-drilling contingent, did not represent a dramatic change in energy policy. Instead, it marked a draw on offshore drilling. Drilling supporters will keep pressing their agenda next year, and opponents will push to have the ban reinstated.

"While today we celebrate the offshore drilling ban being lifted, remember there is still a lot more work to be done to move America toward energy independence," said a post on the American Solutions blog on Oct. 1.

API's McCourt said the industry needs more assurance that Congress won't reinstate the moratorium before it can move forward on plans to drill offshore.

"There's talk about what's going to happen in 2009, so of course nobody can make any sort of commitment to look for more resources, even to try to look for more resources, unless there's some kind of long-term assurance from Congress that this moratorium will remain lifted," she said. "I think we all have to see how this all plays out in 2009."

Said Charter, "The outcome this year is not an outcome. I think that leaves the issue unresolved and ripe for resolution next year. Even states that were relatively amenable to drilling, this outcome is not something they're going to want to leave to stand."

And while some coastal states are more favorable to drilling than others, many are outright opposed, and state legislators, governors, and congressional representatives in those states will use every tool at their disposal to fight it.

Rep. Ed Markey (D-Mass.) has already introduced legislation [PDF] to protect Georges Bank, an area off the Massachusetts coast that may be targeted for new drilling. Other anti-drilling lawmakers are likely to follow suit and try to protect their states' coastlines.

Now what?

It's pretty much inevitable that the offshore drilling debate will resurface early in 2009.

"Congress will revisit the OCS issue in March with a new president," Drew Hammill, spokesperson for House Speaker Nancy Pelosi (D-Calif.), told Grist. March is when the continuing resolution that's currently funding the government is set to expire.

"Democrats know that the Republican 'drill only' policy will not make our country energy independent," Hammill said. "The speaker will continue to promote comprehensive energy policies that create green jobs, protect our environment, and make our nation more secure."

But if environmental champions in the House and Senate are to press aggressively for a renewal of the ban or for other offshore protections, they'll need to hear stronger support from greens, congressional insiders say. "Congress is going to need a push come March," said one Democratic aide. "Democrats have lots of great ideas, but they weren't being heard among the 'drill here, drill now,' 'drill, baby, drill.'"

Enviros say they recognize they'll need to put out a strong message to both the public and politicians on energy issues -- not just lobbying against drilling, but lobbying for better alternatives. "We've got to engage the public on our positive message early on in the process," said Manuel. "Probably the most important thing is to go out and sell the public on what we are for -- economy, efficiency, clean energy solutions."

But the real determining factor on offshore drilling may be the nation's choice of its next president. John McCain now wholeheartedly supports drilling on the OCS. Barack Obama maintained his opposition for much of the summer, but in August said he'd be "willing to consider" offshore drilling if it could help get a comprehensive and otherwise good energy bill passed. Still, Obama repeatedly stresses that the nation can't drill its way out of its energy problems.

All of the big green groups that endorse presidential candidates have endorsed Obama: Sierra Club, the League of Conservation Voters, Friends of the Earth Action, Environment America, and Defenders of Wildlife Action Fund.

But if Obama doesn't win, then what?

"Maybe [McCain will] flip-flop back to where he was before when he understood that drilling wasn't the solution," Manuel said. "But it's hard to assume that would happen with Sarah Palin as his vice president ... That would be a terrible step backward for the country on energy policy if it was McCain and Palin in the White House."

Grist: Environmental News and Commentary

©2007. Grist Magazine, Inc. All rights reserved.

Gloom and doom with a sense of humor®.

October 18, 2008

20bn barrel oil discovery puts Cuba in the big league

• Self-reliance beckons for communist state

• Estimate means reserves are on a par with US

Rory Carroll, Latin America correspondent

The Guardian,

Saturday October 18 2008

A worker walks at an oil rig in Havana, Cuba.

Photograph: Enrique De La Osa/Reuters

A worker walks at an oil rig in Havana, Cuba.

Photograph: Enrique De La Osa/Reuters |

Friends and foes have called Cuba many things - a progressive beacon, a quixotic underdog, an oppressive tyranny - but no one has called it lucky, until now .

Mother nature, it emerged this week, appears to have blessed the island with enough oil reserves to vault it into the ranks of energy powers. The government announced there may be more than 20bn barrels of recoverable oil in offshore fields in Cuba's share of the Gulf of Mexico, more than twice the previous estimate.

If confirmed, it puts Cuba's reserves on par with those of the US and into the world's top 20. Drilling is expected to start next year by Cuba's state oil company Cubapetroleo, or Cupet.

"It would change their whole equation. The government would have more money and no longer be dependent on foreign oil," said Kirby Jones, founder of the Washington-based US-Cuba Trade Association. "It could join the club of oil exporting nations."

"We have more data. I'm almost certain that if they ask for all the data we have, (their estimate) is going to grow considerably," said Cupet's exploration manager, Rafael Tenreyro Perez.

Havana based its dramatically higher estimate mainly on comparisons with oil output from similar geological structures off the coasts of Mexico and the US. Cuba's undersea geology was "very similar" to Mexico's giant Cantarell oil field in the Bay of Campeche, said Tenreyro.

A consortium of companies led by Spain's Repsol had tested wells and were expected to begin drilling the first production well in mid-2009, and possibly several more later in the year, he said.

Cuba currently produces about 60,000 barrels of oil daily, covering almost half of its needs, and imports the rest from Venezuela in return for Cuban doctors and sports instructors. Even that barter system puts a strain on an impoverished economy in which Cubans earn an average monthly salary of $20.

Subsidised grocery staples, health care and education help make ends meet but an old joke - that the three biggest failings of the revolution are breakfast, lunch and dinner - still does the rounds. Last month hardships were compounded by tropical storms that shredded crops and devastated coastal towns.

"This news about the oil reserves could not have come at a better time for the regime," said Jonathan Benjamin-Alvarado, a Cuba energy specialist at the University of Nebraska.

However there is little prospect of Cuba becoming a communist version of Kuwait. Its oil is more than a mile deep under the ocean and difficult and expensive to extract. The four-decade-old US economic embargo prevents several of Cuba's potential oil partners - notably Brazil, Norway and Spain - from using valuable first-generation technology.

"You're looking at three to five years minimum before any meaningful returns," said Benjamin-Alvarado.

Even so, Cuba is a master at stretching resources. President Raul Castro, who took over from brother Fidel, has promised to deliver improvements to daily life to shore up the legitimacy of the revolution as it approaches its 50th anniversary.

Cuba's unexpected arrival into the big oil league could increase pressure on the next administration to loosen the embargo to let US oil companies participate in the bonanza and reduce US dependency on the middle east, said Jones. "Up until now the embargo did not really impact on us in a substantive, strategic way. Oil is different. It's something we need and want."

guardian.co.uk © Guardian News and Media Limited 2008

October 15, 2008

Lineup for LNG project adds a competitor

by Ted Sickinger

The Oregonian

Monday October 13, 2008

Peter Hansen, chief executive of Oregon LNG, has spent nearly five years pushing a proposal to build a liquefied natural gas terminal on the Skipanon peninsula, just west of Astoria (in background). His company filed a formal application Friday with federal energy regulators. |

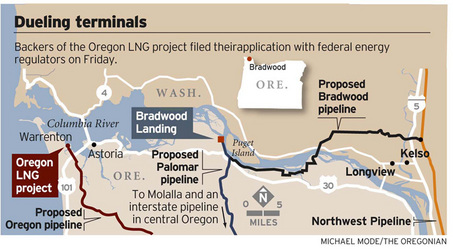

Most controversy over liquefied natural gas in Oregon has focused on proposals to build an import terminal 20 miles east of Astoria on the Columbia River and on a competing project in Coos Bay.

With little fanfare Friday, however, backers of a third LNG project delivered 21 binders to federal energy regulators containing their application to build a terminal on a spit of sand and blackberry brambles that juts into the Columbia River from Warrenton.

Oregon LNG, as the company is called, isn't exactly new. The project was launched in 2004 by Calpine Corp., which went into bankruptcy a year later. Managers of the project kept pushing local land-use approvals for the terminal, and later bought out Calpine with backing from a New York-based holding company, Leucadia National Corp., that specializes in distressed investments.

Their plan is to erect three mammoth gas-storage tanks on the Skipanon peninsula, each 17 stories tall, almost as wide as a football field and highly visible from Astoria, which is directly across Young's Bay from the project site.

The gas-receiving terminal would be coupled to a pier sticking 2,100 feet into the Columbia, where a new generation of LNG supertankers would dock in a dredged basin to unload their cargoes.

|

The $1 billion terminal would be capable of importing a billion cubic feet of natural gas a day - almost twice Oregon's daily consumption. The gas would be shipped to markets throughout the Northwest and California via "the Oregon pipeline." The 36-inch, high-pressure line is slated to arc through 121 miles of farm- and forestland in Clatsop, Tillamook, Washington, Yamhill, Marion and Clackamas counties to a gas hub in Molalla.

Oregon LNG's application comes as the U.S. market for gas appears to have temporarily collapsed. Domestically produced gas is cheap and abundant. Asian countries are willing to pay such eye-popping premiums for LNG cargoes that many industry experts doubt it makes sense to import LNG to the United States.

Industry giants are sending the same message. British Petroleum recently backed out of a proposed terminal on the Delaware River, citing lousy industry conditions, while several terminals are applying for permission to export U.S. and Canadian gas to take advantage of the Asian bonanza.

Moreover, just as the Houston-based backers of the Bradwood Landing LNG proposal have met vehement opposition, local landowners, environmentalists and tribal groups could put up a stiff fight against Oregon LNG.

"We're opposed," said Brent Foster, executive director of Columbia Riverkeeper. "It would have a massive impact on the Columbia estuary. It comes with a significant pipeline that would impact farms, forestlands and rivers. And it's right in the middle of the flight path to the Astoria airport.

"There's no way you can call this a good site."

Oregon LNG executives obviously disagree. They figure their chances of commercial success are good enough to justify investing tens of millions of dollars in a labyrinthine permitting process.

Oregon LNG Chief Executive Peter Hansen said his aim is to build collaborative relationships and open dialogues - even with his opponents. The approach has built credibility and some good will among state regulators, tribal groups and environmental opponents.

Julie Carter, a lawyer with the Columbia River Intertribal Fish Commission, said the jury is still out on how the tribes will react to the project, which they still consider a huge industrial development on the river. But she said the company's approach has been refreshing.

"We've been pleased with the way they've been treating our interests and concerns, and how they've carried on this process," Carter said.

Hansen said Oregon LNG has spent $20 million and will continue spending $1.5 million a month to resolve myriad environmental, engineering and safety questions. This summer, for example, the company had biologists in the Tillamook forest hooting like spotted owls to determine whether its pipeline would harm owl habitat. It has done similar surveys for marbled murrelets and rare native plants.