November 27, 2008

Shell delays [another] Alberta oil sands project

Reuters

Globe and Mail

November 27, 2008

CALGARY — Royal Dutch Shell Plc is delaying another Canadian oil sands project, saying Thursday it has withdrawn a regulatory application for its 100,000 barrel per day Carmon Creek thermal project as it looks to shave costs by revamping the project.

The delay is the latest blow to what had been an ambitious schedule of projects for Canada's oil sands. The oil sands region of northern Alberta contains the largest oil reserves outside the Middle East, but they are technically challenging and expensive to extract.

Shell, one of the biggest players in the oil sands, last month delayed an expansion of its oil sands mining operation when costs rose and oil prices fell.

Adrienne Lamb, a spokeswoman for the company, said Shell is reviewing and redesigning the Carmon Creek project and plans to submit a new application to regulators. The company hasn't yet decided when that will take place.

“The review is looking at opportunities to reduce costs and improve the profitability of the project,” Ms. Lamb said. “As a result of that we expect there will be some changes ... Rather than update the application we decided the best path forward is to submit a new application.”

Shell had been expected to make an investment decision on Carmon Creek in 2010. However Ms. Lamb said that will now be delayed because of the changes and the company hasn't decided on a new schedule.

Shell had not released a cost estimate for the project, which was to have been built in two 50,000 barrel per day tranches.

Unlike the company's mining operations, Carmon Creek would use thermal techniques to produce the reserves, pumping steam into the ground to liquefy the tar-like bitumen so that it can be pumped to the surface.

Along with Shell, Suncor Energy Inc., Nexen Inc., Petro-Canada, Canadian Natural Resources Ltd. and others have said they'll delay or defer projects in the region because falling oil prices have squeezed profits while costs stay high.

A shortage of skilled labour in the remote region has helped push up costs as companies compete for a small pool of tradesmen and contractors.

See also:

Shell halts Canadian sands development

November 25, 2008

Pipeline unsafety - notes from New Orleans

COMMENT: In 1999, a gasoline pipeline running through a park in Bellingham, blew up, killing three young people. The legal settlement included a court-ordered creation of a $4 million trust, the Pipeline Safety Trust. The Trust concerns itself with improving safety regulations, oversight and performance of pipelines and other methods of moving oil and gas, including liquified natural gas (LNG).

Californian Michael Holmstrom was at the Trust's annual conference in New Orleans last week. His observations are trenchant. While the stats and the data are from the US, there is less transparency, less regulation, and less oversight of pipelines in Canada, and especially in BC.

This builds on data that the pipeline industry finds very convenient, and hides behind at every opportunity: that many incidents ("incident" meaning "unintended loss of contents", and which range from a pinhole corrosion leak to a blast that kills) are caused by third parties. But as Holmstrom's notes reveal, pipeline operators are responsible for a great many incidents themselves. Their hands are far from clean.

But to get industry and government to say, "it'll never happen again" is impossible. Blame avoidance, misdirection, obfuscation, and wheedling sometimes seem like the sole preoccupation of these two after an accident. Who got called first? A first responder? Or a lawyer?

A case in point is Kinder Morgan's Trans Mountain Pipeline oil rupture in Burnaby in 2007. The actual puncture was caused by a machine operator working for Cusano Contracting, hired by the City of Burnaby. Regulations required the operator to hand-dig and expose the pipe if he had any doubt as to the location of the pipeline. He didn't do that. Great alibi for Kinder Morgan. But either Kinder Morgan's maps were incorrect, or the directions the operator received from Kinder Morgan were incorrect or misunderstood. In the finger-pointing, which at last look involves Cusano, Burnaby, and Kinder Morgan, and in the claims for damages from residents, Shell and Chevron, lawyers will enrich themselves, and justice will not be served.

Canada's Transportation Safety Board, whose job it is to determine what did happen and who was at fault, will probably take yet another year before issuing its gently worded report on the cause of the incident and what should be done so it won't happen again.

PPTS = Pipeline Performance Tracking Systems

API/AOPL = American Petroleum Institute / Association of Oil Pipe Lines

A presentation of note from New Orleans

Mike Holmstrom

24 November 2008

I guess I'll start off about New Orleans.

Beyond the beignets & Cajun burgers, I found the info from Cheryl Trench, from Allegro Energy Consulting, to be very interesting. This was Excavation damage info that was mined from API/AOPL reports. This can be found here:

PPTS Operator Advisory: More To Do on Excavation Damage

Excavation Damage Basics

What: Excavation encompasses a range of types of damage resulting from a range of activities, not all of which may strictly be considered to be "excavation." The damage is generally caused by a foreign object such as a backhoe, auger, or plow hitting and damaging the pipeline. It does not include damage caused by earth movement such as subsidence or a landslide.

Who: As used in PPTS, excavation damage can be caused by first, second, or third parties. PPTS defines them as the following:

First Party – Employee(s) of the operator.

Second Party – The operator's contractor.

Third Party – Person or persons not involved with operating or maintaining the pipeline. Third parties can be farmers, landowners, developers, excavators, road crews, other pipeline operators, or utility workers not related to the pipeline, among other types of entities.

OK, seems like routine past info, BUT;

The chart on page 6 shows that 16% of the excavation damage to liquid pipelines is from that pipeline's employees or their contractors!!!

In Medicine I think it's called Malpractice. Sounds like a bunch of refresher training is needed.

Almost as bad is the amount of damage done by other pipelines (!!!), or by other One Call entities, cable, water, phone, etc. Another 27% there.

"Do as we say about One Call, but not as we do"??

-Mike Holmstrom

November 21, 2008

Scientists assail easing of rules for natural gas exploration

Mike De Souza

Vancouver Sun

November 21, 2008

Planned changes cited as path to ecological crisis in boreal forests

OTTAWA -- The Harper government's plans to ease regulations on environmental assessments for natural gas exploration will lead to an ecological crisis in the Canadian Arctic, a group of leading international scientists said Thursday.

The scientists, who are promoting a massive expansion of protected areas in the boreal forest as part of a campaign for Pew Charitable Trusts, compared the proposal to the measures that led to the current global economic crisis.

"The shining example of deregulation is the present free-fall of the world's developed economies," said Jeremy Kerr, a biology professor from the University of Ottawa.

"You can apply exactly the same analogy to natural systems. Deregulating development in natural systems is likely to do ecologically, exactly what deregulation did economically. There is not a defensible position to be made there on any scientific grounds that I'm aware of or have ever heard of."

In its throne speech, the government pledged to "reduce regulatory and other barriers to extend the pipeline network into the North" and increase exploration of natural gas in the north to meet energy needs in southern Canada and the rest of the world.

But the scientists, who are serving as expert advisers for Pew's International Boreal Conservation campaign, said this would put Canada at odds with a new administration in the U.S. led by Barack Obama, that would likely call for more stringent environmental protection and assessments.

They also praised the Ontario and Quebec governments for pledging to protect large areas of the boreal forest, one of the largest intact forests remaining on earth.

"When you're talking about global warming, plants and animals are moving north in the northern hemisphere," said Terry Root, a biology professor from Stanford University in California. "What's up north is going to be this wonderful forest that's going to act as a buffer for all these species in North America."

It's estimated that the boreal forest stores about 27 years worth of global carbon dioxide emissions in its trees and soil across a territory that is estimated to cover 5.7 million square kilometres. The scientists met on Thursday with a senior official from Ontario Premier Dalton McGuinty's office, and they are hoping other jurisdictions in Canada follow up on the measures promised by the two central Canadian provinces.

"It is one of the last places on earth where there remains an opportunity to conserve something that is still really big, and that still works just fine," said Kerr.

The group also noted that development in the Alberta oilsands is a particular danger, not only because of high energy consumption in the oil extraction process, but also because of greenhouse gas emissions generated through land use changes in the forests that are being used for production.

The markets have put an end to the oilsands boom

Gary Lamphier

Vancouver Sun

Thursday, November 20, 2008

Welcome to the oilsands moratorium. No one will call it that, of course. Not officially, anyway. There's been no Alberta government edict, and no sweeping regulatory ruling requiring a slowdown in the pace of new projects around Fort McMurray.

Still, it's a moratorium just the same. Yesterday's oilsands boom is gone. It's not a bust, but the post-boom era has clearly arrived. Last week's announcement by Petro-Canada and its partners that they'll delay a final decision on whether to proceed with the proposed $24-billion Fort Hills oilsands megaproject pretty much seals the deal.

Whether the pause lasts 12 months, two years or five years, no one knows. Somewhere, Maude Barlow must be celebrating.

Although former Alberta premier Peter Lougheed has lobbied long and hard for such a slowdown -- his campaign was the subject of a recent cover story in one national business magazine -- he can't take credit for this, either.

With oil prices at $55 US -- $92 below July's peak price of $147 -- and financial markets in turmoil as a global recession hits, producers are heading to the exits en masse, putting their expansion plans on hold.

In just a few weeks, the markets have accomplished what Lougheed, the Pembina Institute and others have demanded for years. Just as the bull market triggered a boom, the bear market has taken it all away.

Let me be clear. I believe this is a good thing, despite the short-term pain that will be inflicted on some as projects are deferred. So do many oil-and-gas industry execs.

As I've said repeatedly, the frenetic pace of expansion in the oilsands over the past five years caused a lot of harm.

Project costs skyrocketed, infrastructure pressures soared, labour shortages were rampant, worker health/safety issues mushroomed, housing costs went through the roof, and overpaid twentysomethings spent like drunken sailors.

Many thought the boom would never end. But booms always end. That's why they're called booms.

Employers outside the oilpatch had to pay big bucks to attract workers, even though they didn't generate the same fat profits as energy firms.

High school kids dropped out to earn big bucks in the 'patch. Real estate speculators flipped condos like hamburgers.

None of this was sustainable, or healthy. Melcor CEO Ralph Young has seen many real estate cycles come and go, and this one had all the earmarks of a classic bubble, he says.

"Looking back, 2006 and especially 2007 were years where very, very foolish decisions were being made. We saw it in the real estate market, and we probably got caught up in it as well," he says.

"Prices -- particularly in the residential markets, for raw land and housing, were just rising at too rapid a rate. There was rampant speculation. It became cocktail circuit talk, how much your house price was rising, and how people were [flipping] condos. That was a pretty clear sign that we'd hit an unsustainable level."

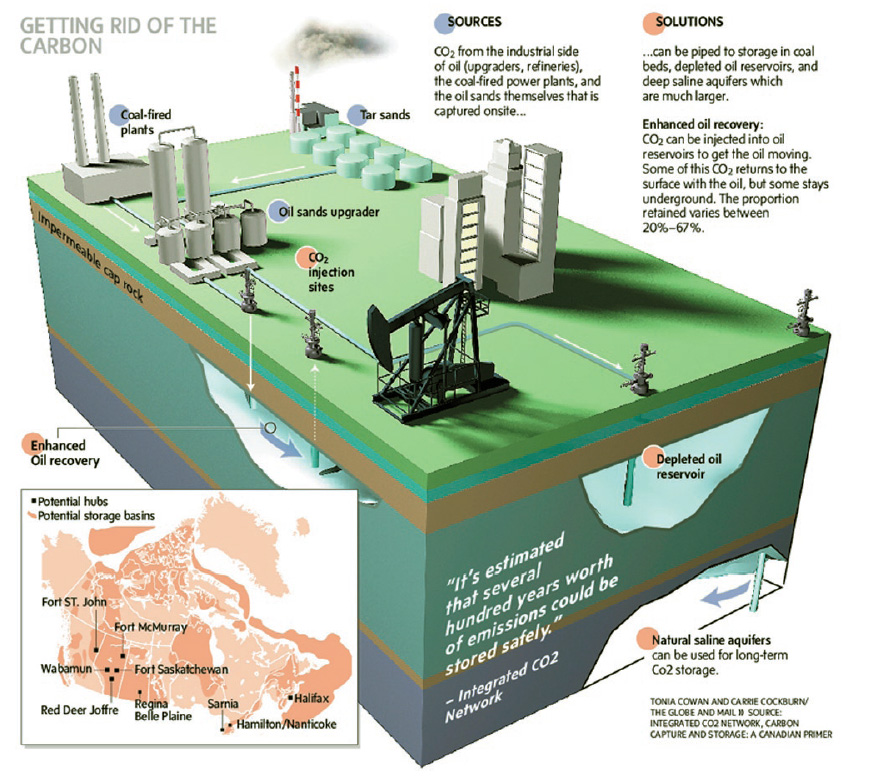

Environmental concerns also mounted. The Stelmach government's $2-billion plan to develop an integrated carbon capture and storage network -- while laudable -- came late in the game, and has been largely ignored outside Alberta.

That's just one reason why the noisy "green" lobby has been so successful in demonizing the oilsands, which generate less than 10 per cent of Canada's carbon emissions, and a fraction of one per cent of global emissions.

Petro-Canada's announcement doesn't come as a surprise, mind you. The Calgary-based integrated oil company and its partners at Fort Hills -- mining giant Teck Cominco, of Vancouver, and UTS Energy, of Calgary -- signalled their growing concerns well in advance.

A few weeks ago, the partners indicated a decision on the upgrader portion of the project might have to wait indefinitely, while they pondered whether to proceed with the mine alone, which accounts for more than half the total cost of the project.

The partners previously revealed that cost estimates for the project had ballooned by more than 50 per cent, from $14 billion to roughly $24 billion.

With oil prices down to $55, and most analysts saying Fort Hills requires $90 oil to be viable, the writing was on the wall. Petro-Canada now joins a growing list of key oilsands producers that have announced project delays in recent weeks, including Suncor, Canadian Natural Resources and Royal Dutch Shell.

The good news? Project costs are already falling rapidly, as costs for steel and other materials sink, and demand for labour eases.

Like other players, Petro-Canada says it will go back to the drawing board and re-examine every aspect of its costs before any final decision on Fort Hills is made.

Ironically, the oilsands giants only have themselves to blame for pushing project costs to sky-high levels. With so many producers trying to squeeze through the same narrow door at once, the result was entirely predictable. The wild speculation that drove oil prices to $147 only made the situation worse.

Now, the pendulum has swung the other way. Sanity is slowly returning, and the seeds of the next up cycle in the oilsands are being sown.

© The Vancouver Sun 2008

November 20, 2008

CBC Centre Stage: Is Alberta's oil dirty?

Wild Rose Country

CBC Edmonton

Thursday, November 20, 2008

Alberta's oilsands: Black gold or black eye?

One in six Albertans are directly and indirectly employed in the energy sector, generating 30% of the province's revenues. But are the oilsands' social, health and environmental impacts giving it a bad name? Wild Rose explores the top five reasons Alberta's oilsands are considered dirty and asks if it's really black gold or just Alberta's black eye. More ...

(Photo: Jeff McIntosh/CP) Alberta's oilsands: Black gold or black eye?

One in six Albertans are directly and indirectly employed in the energy sector, generating 30% of the province's revenues. But are the oilsands' social, health and environmental impacts giving it a bad name? Wild Rose explores the top five reasons Alberta's oilsands are considered dirty and asks if it's really black gold or just Alberta's black eye. More ...

(Photo: Jeff McIntosh/CP) |

"Is Alberta's oil dirty?" To answer that question, we're joined by Andrew Nikiforuk, author of Tar Sands: Dirty Oil and the Future of a Continent, Preston MacEachern, a scientist with Alberta Environment, and Jim Carter, past president of Syncrude.

Click here to download the discussion. (It's a 30 mb MP3 file. If it doesn't stream for you, it's a lengthy download.)

Wild Rose Country is a provincial program heard weekdays from 12:00 to 2:00 p.m. on CBC Radio One (1010 AM in Calgary and 740 AM in Edmonton). Wild Rose Country connects urban and rural Albertans by exploring the environmental, agricultural, educational and political issues affecting everyone from the far north to the deep south of the province.

Wild Rose Dirty Oil series, here.

Nikiforuk's, Tar Sands: Dirty Oil and the Future of a Continent, here.

November 19, 2008

Palin's Pipeline at Risk as Economy Slows

By RUSSELL GOLD

Wall Street Journal

November 19, 2008

The troubled economy that helped sink Alaska Gov. Sarah Palin's hopes of becoming U.S. vice president now is undermining prospects for building the $30 billion natural-gas pipeline she touts as her administration's signal achievement.

The state faces an increasingly gloomy future if construction is delayed, since the majority of the state's unrestricted revenue comes from energy-production taxes and royalties -- a situation unlike any other state. Without a gas pipeline, the annual dividend checks Alaskans get would eventually dwindle and residents could face their first income tax.

As Gov. Palin returns from the campaign trail, she is finding a very different landscape than when she left Juneau in August. Shortly before she was selected as Sen. John McCain's running mate, the Alaska legislature passed a bill to jump-start preliminary work on the pipeline. Not long afterward, the state began handing out record-high annual checks to every Alaskan, sharing the state's windfall from high oil prices.

Today, the global economic slowdown is making it harder to maintain momentum behind the project. At the same time, the combination of falling oil production and falling oil prices has left state officials wondering if they can balance their budgets in the current or coming fiscal years.

There is growing pessimism in Alaska that the pipeline will be built anytime soon. Mike Chenault, the incoming Republican speaker of the state House of Representatives, said he believes the odds of it moving forward in the next couple of years are less than 50-50. "In the end, it is going to be economics that drive this process and not how much we want it to happen," he said.

The economics of building a pipeline are deteriorating as demand for cleaner-burning natural gas slows and prices fall. "Current economic conditions are not good for the Alaska gas line, and I expect considerable delays in the initiation of its construction," predicts Pedro van Meurs, an energy consultant who worked on the project under previous Alaska governors.

Still, for the time being, preliminary work on two rival pipeline projects is moving ahead. ConocoPhillips and BP PLC have committed $600 million for a detailed assessment of building a pipeline. And in August, the state gave $500 million of incentives to TransCanada Corp. to do similar work on a competing plan. The projects have begun hiring employees and signing engineering contracts. But this work could end abruptly in 2010 if energy producers decide there isn't enough demand for gas to justify the investment.

One big hurdle is the growing success of gas producers in the continental U.S. Either pipeline would bring more than four billion cubic feet of the fuel from northern Alaska down to Chicago to feed an under-supplied market. But booming natural-gas production in the U.S. is outpacing demand. In August, wells produced 5.4 billion cubic feet a day more than a year earlier, according to federal data.

For Alaskans, a pipeline would bring a financial bonanza -- and help replenish dwindling revenue from oil production.

Gov. Palin focused on passing the $500 million incentive package and selecting Calgary-based TransCanada to develop the 1,700-mile pipeline. But TransCanada needs commitments from the three big producers controlling the gas on Alaska's North Slope before it can secure financing for the project. And those companies are balking. Exxon Mobil Corp. has so far refused to participate. BP and ConocoPhillips are backing their own pipeline and have expressed reservations about joining the state-backed pipeline.

If West Coast oil prices average about $60 a barrel from today through the end of the fiscal year in June -- which would require Alaskan North Slope oil to rise above the current $49.89 -- the state would end its budget cycle with a small surplus. But another year of $60 prices would mean a $1 billion deficit, says David Teal, head of Alaska's legislative finance division.

Write to Russell Gold at russell.gold@wsj.com

Obama: A new chapter

President-elect Obama promises “new chapter” on climate change

Change.gov

Tuesday, November 18, 2008

More than 600 climate change leaders from across the country and around the world convened in Los Angeles today for the opening sessions of the Global Climate Summit, a 2-day event arranged by California Governor Arnold Schwarzenegger to break gridlock on the issue ahead of next month's United Nations Climate Change Conference in Poznan, Poland.

In a short video addressed to the Summit's attendees, President-elect Obama emphasized his enthusiasm for the Poznan Conference and promised that his administration would mark a "new chapter in American leadership on climate change."

"Few challenges facing America -- and the world -- are more urgent than combating climate change," he said. "Many of you are working to confront this challenge....but too often, Washington has failed to show the same kind of leadership. That will change when I take office."

President-elect Obama is committed to engaging vigorously with the international community to find solutions and help lead the world toward a new era of global cooperation on climate change.

"Let me also say a special word to the delegates from around the world who will gather in Poland next month: your work is vital to the planet," he said. "While I won’t be President at the time of your meeting and while the United States has only one President at a time, I’ve asked Members of Congress who are attending the conference as observers to report back to me on what they learn there."

Watch the full video of Barack's remarks below, or visit the Global Climate Summit home page to learn more.

COMMENT: The Los Angeles Governors' Summit includes representatives from other national and regional governments around the world. It's an international conference. Canada appears to have sent no-one. British Columbia has sent ... Barry Penner.

Governors' Global Climate Summit, 18-19 Nov 2008

Summit Overview

Summit Agenda

November 17, 2008

Wall Street Journal Editors Put Brakes on BP Story

Corporate Crime Reporter

November 15, 2008

The editors of the Wall Street Journal last week slammed the brakes on a story detailing how the Justice Department shut down a major environmental crimes investigation of BP Alaska.

That's according to Scott West, the now retired lead criminal investigator on the case.

West was leading an 15-month investigation into the March 2006 oil spill on the North Slope when in August 2007 he was told that BP would be allowed to plead to a misdemeanor.

In October 2007, BP did in fact plead guilty to a misdemeanor and was fined $20 million.

West was with the Environmental Protection Agency's Criminal Investigation Division (CID) until he resigned on October 29, 2008.

West says that on October 30, he had a detailed interview with the Journal's Jim Carlton about how the BP investigation was abruptly shut down.

"The agreement I had with Jim Carlton was that the Wall Street Journal was going to publish an article about this case on Monday, November 3, the day before the election," West told Corporate Crime Reporter last week. "I had also spoken with KING5 News, the NBC affiliate here in Seattle. They had me on camera. But I had them under embargo until Monday morning. Then late on Sunday, I was told that the Wall Street Journal editors decided not to go with the story, that they were going to push it off. The Wall Street Journal reneged its promise to me. But KING5 ran it."

Why did Wall Street Journal not run the story?

"I don't know," West said. "I have my suspicions. I understand that the Justice Department was putting a lot of pressure on the Journal. And the Wall Street Journal attorneys were concerned."

During a phone interview with Corporate Crime Reporter last week, West again reiterated that he was told by Karen Loeffler, the lead criminal prosecutor at the U.S. Attorney's office in Alaska, that the prosecutors in Alaska were "just following orders" from Washington to shut down the investigation into BP and to accept the plea to a misdemeanor.

"I hate dragging Karen Loeffler into this," West said. "She is a career prosecutor. A very decent person. Nevertheless, this occurred. Karen took me aside. We were in the hallway at the U.S. Attorney's office. And she directed me into an office off the hallway and she shut the door. And she said look, I'm sympathetic to how you are feeling. And she said you need to know, the decision was made by Ron Tenpas back at Main Justice. And we here are just following orders. I think she said this to try to calm me down. I had no reason to disbelieve Karen. When she told me it was Ron Tenpas, I didn't ask how she knew it was Ron Tenpas. But that's what the woman told me."

Tenpas is the Acting Assistant Attorney General for the Environment and Natural Resources Division at Main Justice.

When West was told last year that his case was being settled for a mere misdemeanor and a $20 million fine, he asked the prosecutors why the rush to settlement?

"Why are we doing this?" he asked. "Look at all of the investment we have in this case. I kept getting back from the senior prosecutors at the Justice Department well, BP wants to wrap this up. We don't want to waste our resources any more. They are willing to plead now. That could save us the expense of a lengthy trial."

"I was screaming bloody murder," West said. "I said I have at least a year to go give me one more year. No, Scott, we are done. Give me six more months. No we are done. Give me three more months, to at least chip away at some of the stuff. No, Scott, BP wants to wrap up this case, Texas City, and the propane trading investigation out of Chicago by October."

West says that BP's lead outside lawyer Vinson & Elkins partner Carol Dinkins tried to get the case dropped altogether, but she was rebuffed early in the negotiations.

When he learned that prosecutors would settle for a misdemeanor plea, West said he called for "an astronomical fine."

He then had a CID lawyer draw up a sentencing memo with three alternative fines topping out at $300 million. But prosecutors opened negotiations with the basement fine $20 million. BP accepted.

[For a complete transcript of the Interview with Scott West, see 22

Corporate Crime Reporter 44(10-16), print edition only

http://www.corporatecrimereporter.com/aboutccr.html

November 16, 2008

Auburn Dam may really be dead this time

By Nancy Vogel

LA Times

November 16, 2008

If California rescinds the water rights it granted to the federal government, the troubled project might never be revived.

The Auburn Dam may never be built at this site on the American River, 35 miles northeast of Sacramento. Construction has been a local issue since Congress authorized it in 1965. (Auburn Journal) The Auburn Dam may never be built at this site on the American River, 35 miles northeast of Sacramento. Construction has been a local issue since Congress authorized it in 1965. (Auburn Journal) |

Reporting from Sacramento -- Use it or lose it is the rule of California water rights, and after 43 years, the would-be Auburn Dam -- subject of one of the state's bitterest water feuds -- is about to lose it.

The proposed plug on the gold-sprinkled American River northeast of Sacramento has been declared dead many times since Congress authorized it in 1965, and there may be no reviving it now. The state is poised to take back the legal right it granted to the federal government to store water behind the dam. Without that right, the federal government cannot build a reservoir, and the state has never been inclined to build one itself.

|

"Auburn Dam" are fighting words in Northern California, pitting river rafters and other nature lovers against those who say that California's thirst and the Sacramento area's vulnerability to floods demand the trapping and storing of more Sierra snowmelt.

Money is at the heart of the fight. Dam opponents argue that the multibillion-dollar price of an Auburn Dam would outweigh its benefits, while backers say a dam would eventually pay for itself and save untold lives. The struggle has played out for decades in Congress and in the halls of Sacramento and Placer County governments.

The nation's taxpayers have sunk $325 million into the project, with little to show beyond stacks of reports and a scarred canyon where construction was halted in 1975. So the state Water Resources Control Board is expected soon to finalize a draft decision to revoke the federal government's rights.

At the same time, the Auburn Dam's most powerful advocate prepares to retire from Congress. Republican Rep. John T. Doolittle of Roseville, who garnered tens of millions of federal dollars for study of a big dam at Auburn during his 18-year congressional career, decided this year not to run for reelection. He faces federal scrutiny of his ties to convicted lobbyist Jack Abramoff.

Doolittle will leave Congress in January. The race to replace him was so tight that elections officials aren't sure yet whether the winner is Republican state Sen. Tom McClintock, who vows to keep pushing for a dam, or Democrat and Air Force veteran Charlie Brown, who opposes it.

If McClintock wins, his quest for construction of an Auburn Dam would face steep odds that would be even higher after a revocation of water rights. The project would have to be reauthorized by Congress, because costs have grown tremendously since 1965, and the agencies most likely to buy water and power from the dam project have shown little interest in sharing construction costs. And the federal government would have to apply anew for state water rights.

"You'll never get the water rights back" once they are revoked, Doolittle said in a recent interview.

He predicted that an Auburn dam would be built some day, but not the kind he sought, with a big lake to provide water, electricity, recreation and flood control.

Sacramento will eventually require a dam to guard against floods, Doolittle said. But without water rights, the federal government would be limited to building a "dry" dam -- a concrete wall with a big hole in it to let the American River flow unimpeded most of the time and hold back water temporarily only in the event of a gigantic flood.

Dry dams were proposed by Sacramento flood-control officials twice in the 1990s but not funded by Congress.

"For heaven's sake, we ought to be storing water," said Doolittle. "We're the ones who supply Southern California with their water."

A dam at Auburn was long planned as part of the U.S. Bureau of Reclamation's Central Valley Project, an audacious network of dams and canals that provides subsidized water to farmers from Redding to Bakersfield. But construction at Auburn stalled after an earthquake made federal engineers rethink the seismic safety of a thin-arch concrete dam.

Work was not resumed amid concerns about cost and the submersion of nearly 50 miles of river canyon.

Various incarnations of the dam have been touted by federal dam builders, valley farmers and Sacramento flood control officials for decades, all of them attacked by local river enthusiasts and national environmental groups.

Doolittle faulted "conniving environmentalists" for persuading the State Water Resources Board last month to revoke the Auburn Dam water rights under a state law that requires rights holders to exercise "due diligence" in putting their water to good use.

Last month, in the draft revocation order, the water board noted that the federal government was supposed to finish the dam by 1975 and put all the water to "beneficial use" by 2000.

"Reclamation has failed to meet these deadlines and subsequently failed to diligently pursue a request for an extension of time," the board wrote. "Accordingly, cause for revocation exists."

The water board rejected the federal argument that California should let Washington keep the water rights out of deference to Congress, which has not undone its 1965 dam authorization.

Still, dam backers do not concede defeat.

Earlier this month, 18 persistent members of the Auburn Dam Council met, as they do the first Monday of every month, at a Coco's coffee shop in suburban Sacramento. Mostly white-haired retired engineers and water board directors, they resumed an ongoing discussion about winning over reluctant city and county officials to the merits of the dam.

"They should have this right on the wall in [Sacramento] City Hall," said Joe Sullivan, who held up a newspaper graphic showing where hundreds of people perished in the 2005 Hurricane Katrina flooding of New Orleans.

After the meeting, Sullivan, president of the Sacramento County Taxpayers League, called the expected water rights revocation "temporarily the end."

"They'll build Auburn Dam," he said, "right after Sacramento is flooded to 7 feet and people have died."

And defenders of the North Fork of the American River are not claiming victory. They figure the fight will continue as long as inundation threatens Sacramento and Southern California needs water.

Ron Stork has argued against the dam for 21 years at the nonprofit group Friends of the River. The controversy, he said, "will never go away."

Vogel is a Times staff writer.

Nancy.vogel@latimes.com

November 15, 2008

Has the sun set on clean tech?

ERIC REGULY

Globe and Mail

November 13, 2008

Once a booming industry thanks to sky-high oil prices, the feel-good trend, carbon reduction and subsidies, the financial crisis has pushed investors to give up on green energies, and like the dot-com bubble of 2000, some analysts say it's about to burst

ROME - The executives of Canadian solar-energy company Arise Technologies knew hours before yesterday's conference call that their shares were probably doomed. They could thank Germany's Solon, one of their two biggest customers, for the dark forewarning.

As they were preparing for the call, their Solon counterparts in Berlin - six hours ahead - shocked investors with the news that expected growth rates would fall by about half. The shares of Solon, the first solar-equipment company to list on the German stock market, closed down 18.3-per-cent, taking the decline to more than 75 per cent since January and not far above the 1998 initial public offering price.

In Toronto, Arise's already depressed shares slumped by 33 per cent, to close at 49 cents. The announcement of relatively minor technical problems at its new German photovoltaic (PV) factory, near Dresden, and lower-than-expected PV cell shipments in the second half of this year didn't help.

There is no longer any doubt: As far as investors are concerned, the sun has set on solar power, one of the hottest growth industries of the past decade.

"We are trading below book value even though we're quite pleased with what we've built," said Arise founder and vice-chairman Ian MacLellan. "This market is numbing."

Jim Buckee, the former CEO of Canada's Talisman Energy, thinks the clean-tech industry will revert to fringe status because it can't seem to thrive without government subsidies and because the wind doesn't always blow and the sun doesn't always shine, meaning the technologies can never fully replace coal, oil and nuclear plants.

"I think economic reality will kill the green industry," said Mr. Buckee, who now lives in Britain and lectures on climate change.

Solar energy isn't alone in its woes. Wind, biomass, biofuel and other "clean-tech" companies are getting pasted too as the financial crisis sends investors fleeing from technology names, dries up credit and freezes the IPO market. The moribund equity markets are especially bad news for the green-energy players, who depend on a steady stream of equity from growth-obsessed investors to keep moving.

"We are very fast growing companies and we need a lot of financings," said Therese Raatz, Solon's investor relations manager. "We can't turn to the capital markets now."

The price collapse has been so brutal that industry and corporate finance executives predict a shake-out as some of the weaker clean-tech companies burn through precious cash. "Bankruptcies are a real risk," said Brent Goldman, a corporate finance partner in London at BDO Stoy Hayward.

They have already started. Two weeks ago, VeraSun Energy, the second-biggest ethanol producer in the United States, filed for Chapter 11 bankruptcy protection. While no solar or wind company has gone under, failures are inevitable, Mr. Goldman and others said.

But the picture isn't entirely bleak. While the shredded share prices make comparisons to the bursting of the dot-com bubble in 2000 inevitable, some clean-tech newbies are still attracting venture-capital money, and the green agendas of president-elect Barack Obama and European Union governments offer some hope. But no one is willing to say the worst is over.

The clean-tech industry was propelled by soaring oil prices, the feel-good investment trend, Kyoto-inspired carbon-reduction efforts and a stream of government subsidies. Its growth has been phenomenal.

Take solar energy. The end product requires an expensive process that uses highly-refined silicon to make PV cells which, in turn, form part of the solar-module systems that generate electricity when the sun shines (Arise makes both silicon and PV cells; Solon buys Arise's cells to make the modules).

In the mid-1990s the solar industry was pretty much non-existent. But since 1996 or so, the compound annual industry growth has been 40 per cent. Last year PV cells collectively capable of generating 4 gigawatts (or 4 billion watts) of electricity were delivered. That's the equivalent of a couple of nuclear plants.

Solar-industry sales last year were about $30-billion (U.S.) globally, up from $2-billion in 2000, Mr. MacLellan said. Wind power experienced even greater growth rates, though solar growth is now outpacing it. When you drive along the highways in Germany, which has created 250,000 alternative-energy jobs, you're almost never out of sight of a wind turbine. Solar- and wind-power sales are still climbing, though the growth curve is going from the near vertical to the gently sloping. The fear that companies will be incapable of raising money while the financial crisis persists has accelerated the investor exodus.

There are other problems. Ms. Raatz, of Solon, said falling government subsidies are rattling investors. Germany had been cutting its "feed-in" tariff - the highly inflated price it pays to generators of clean energy - by about 5 per cent a year. But a new law lifts the phase-out rate to 8 to 10 per cent a year. Spain, whose feed-in tariffs were more generous than Germany's, is also taking the axe to subsidies. "Spain's support led to enormous developments and they had the best [clean-tech] returns in the world," she said.

Growth rates and project developments are now crumbling everywhere. Earlier this year, T. Boone Pickens, the Texas oilman turned green-energy guru, announced plans to build the world's biggest wind farm. He has since put the plans on hold because oil prices have declined by well more than half since their July peak of $147 a barrel.

Solon cut its growth forecast rate next year to about 25 per cent from 50 per cent. The prices of PV cells are expected to fall between 7 and 11 per cent next year and shares of almost all clean-tech companies are sinking. Vestas Wind Systems of Denmark is off two-thirds from its peak. The same is true of Gamesa, a Spanish wind turbine maker. The major solar companies have had similar declines, though Arise's fall - more than 80 per cent from its April high - has been harder than most.

Mr. Goldman, the BDO corporate finance partner, said the number of renewable energy initial public offerings on London's junior Alternative Investment Market (AIM) has fallen off a cliff. There has been exactly one - an Irish company called Kedco, in October - this year compared to 13 in 2007 and 21 the year before. The pace of mergers and acquisitions has also declined.

Mr. MacLellan and Mr. Goldman buy the doomsday scenario outlined by Mr. Buckee, the former Talisman chief. Mr. Obama has promised to "strategically invest" some $150-billion over 10 years to develop a clean-energy economy. The United Nations and governments in many developed countries are calling for "green deals" to reduce carbon dioxide output and create tech jobs. Germany's goal is to generate 20 per cent of its electricity from renewable energy sources by 2020 and it's already halfway there. "It's going through a hard time now, but clean tech will bounce back," Mr. Goldman said.

ARISE TECHNOLOGIES (APV)

Close: 49 cents, down 24 cents

*****

Clean energy

ARISE TECHNOLOGIES (APV-TSX)

Company based in Waterloo, Ont., makes photovoltaic cells, which produce solar energy. Recently opened a plant in Bischofswerda, Germany. Stock has fallen 84 per cent from its 52-week high in April.

VESTAS WIND SYSTEMS (VWS-Copenhagen)

Wind turbine maker, based in Randers, Denmark, is the world's No. 1 manufacturer of wind power systems. Operates in a dozen countries and has annual revenue of more than $5-billion. Stock has fallen 62 per cent from its 52-week high.

GAMESA (GAM-MADRID)

Spanish wind-energy firm, based in Vitoria-Gasteiz, is the second-largest company in the sector. Also involved in the construction of photovoltaic power stations. Stock has fallen 33 per cent from its 52-week high.

WATERFURNACE RENEWABLE ENERGY (WFI-TORONTO)

Makes heating systems using geothermal energy, based in Fort Wayne, Ind. Stock has fallen 14 per cent from its 52-week high in September.

November 14, 2008

Nuclear deal would allow AECL to renew Indian business ties

SHAWN MCCARTHY

Globe and Mail

November 14, 2008

OTTAWA — Federally owned AECL Ltd. is looking to re-enter the Indian market some 35 years after the south Asian giant shocked the world and brought about its own nuclear isolation by using Candu technology to build a bomb.

The federal government is currently negotiating a nuclear co-operation agreement with India that would allow AECL to re-establish business ties, despite concerns that India has not signed the international nuclear Non-Proliferation Treaty.

The negotiations come after Canada backed a decision by the international Nuclear Suppliers Group to provide an exemption for India that would allow it to develop civilian nuclear power even as it maintains its right to develop weapons without international scrutiny.

The United States lobbied hard to exempt India from the kinds of sanctions it imposes on Iran and North Korea, and has concluded its own nuclear co-operation agreement with India. France has also completed a nuclear co-operation agreement, and both countries are now openly competing with Russia to sell reactors there.

Critics complain that the West's special treatment of India will spark a new arms race with Pakistan and undermine the Non-Proliferation Treaty, and argue Canada should hold out for stringent conditions in any bilateral accord.

In an interview from India, AECL chief executive Hugh MacDiarmid said the Crown-owned company is hopeful of getting major service work on the country's aging fleet of heavy-water reactors, and potentially even the sale of a new reactor.

The AECL group met with senior officials from India's Department of Atomic Energy, and from the Nuclear Power Corporation of India Ltd., which has said it intends to build or buy up to 20 reactors over the next 12 years.

"We've been greeted very warmly," Mr. MacDiarmid said, concluding a six-day visit to India and China. He said Indian heavy-water reactor technology has not kept pace with Western companies, and AECL - one of the few companies that also deal in heavy-water reactors - could help modernize it.

"They feel there is a mutual benefit to be had. We do believe there is potential for us to be marketing our reactor technology in this country," he said.

AECL's own future remains very much in doubt as the federal government is reviewing its ownership and considering selling off the 60-year-old Crown corporation, either entirely or to a minority partner. Yesterday, Finance Minister Jim Flaherty said the government is looking at selling some Crown corporations - without mentioning names - in order to balance the federal books.

Whether it sells AECL or keeps it, Ottawa is keen to put the company on a stronger commercial footing, and that means ensuring it has access to growing emerging markets such as India's.

In addition to AECL's interest, Canada's broader nuclear industry is eager to see the Indian market open up to them, as is Cameco Corp., the Saskatchewan-based uranium producer that has been prevented from selling fuel to India.

Activist Ernie Regehr of Project Ploughshares said the Indian exemptions undermine the international Non-Proliferation Treaty by sending the message that countries can flout the rules and still co-operate on civilian nuclear uses. He worries the decision by the Nuclear Suppliers Group in September may reignite an arms race with Pakistan, which has reacted angrily to the move.

A spokeswoman for Foreign Affairs confirmed the two sides had "informal" discussions last month and expect to schedule formal sessions soon. She said Canada signalled its support for India's re-engagement with the broader nuclear-energy community when it backed the suppliers' group decision.

"India is a responsible democracy that shares with Canada the fundamental values of freedom, democracy, human rights and respect for the rule of law," government spokesman Lisa Monette said. "India has made substantial non-proliferation and disarmament commitments to achieve the trust of the Nuclear Suppliers Group, which were reiterated in a political statement on Sept. 5."

Mr. Regehr said India has made political commitments, such as agreeing not to test nuclear weapons, but has refused to sign the Comprehensive Nuclear Test Ban Treaty. It has also insisted on the right to stockpile uranium, which Mr. Regehr says would provide it with an assured fuel supply should it again run afoul of the international suppliers group.

Australia, which along with Canada is one of the world's major uranium miners, is refusing to sell the fuel to India unless it signs the Non-Proliferation Treaty. Mr. Regehr said Canada should do likewise.

November 13, 2008

BURIED SECRETS -

is natural gas drilling endangering US water supplies

by Abrahm Lustgarten

Pro Publica

November 13, 2008

A drill rig near the town of Pinedale, Wyo. (Credit: Abrahm Lustgarten/ProPublica) |

In July, a hydrologist dropped a plastic sampling pipe 300 feet down a water well in rural Sublette County, Wyo., and pulled up a load of brown oily water with a foul smell. Tests showed it contained benzene, a chemical believed to cause aplastic anemia and leukemia, in a concentration 1,500 times the level safe for people.

The results sent shockwaves through the energy industry and state and federal regulatory agencies.

Sublette County is the home of one of the nation's largest natural gas fields, and many of its 6,000 wells have undergone a process pioneered by Halliburton called hydraulic fracturing, which shoots vast amounts of water, sand and chemicals several miles underground to break apart rock and release the gas. The process has been considered safe since a 2004 study (PDF) by the Environmental Protection Agency found that it posed no risk to drinking water. After that study, Congress even exempted hydraulic fracturing from the Safe Drinking Water Act. Today fracturing is used in nine out of 10 natural gas wells in the United States.

Over the last few years, however, a series of contamination incidents have raised questions about that EPA study and ignited a debate over whether the chemicals used in hydraulic fracturing may threaten the nation's increasingly precious drinking water supply.

An investigation by ProPublica, which visited Sublette County and six other contamination sites, found that water contamination in drilling areas around the country is far more prevalent than the EPA asserts. Our investigation also found that the 2004 EPA study was not as conclusive as it claimed to be. A close review shows that the body of the study contains damaging information that wasn't mentioned in the conclusion. In fact, the study foreshadowed many of the problems now being reported across the country.

The contamination in Sublette County is significant because it is the first to be documented by a federal agency, the U.S. Bureau of Land Management. But more than 1,000 other cases of contamination have been documented by courts and state and local governments in Colorado, New Mexico, Alabama, Ohio and Pennsylvania. In one case, a house exploded after hydraulic fracturing created underground passageways and methane seeped into the residential water supply. In other cases, the contamination occurred not from actual drilling below ground, but on the surface, where accidental spills and leaky tanks, trucks and waste pits allowed benzene and other chemicals to leach into streams, springs and water wells

It is difficult to pinpoint the exact cause of each contamination, or measure its spread across the environment accurately, because the precise nature and concentrations of the chemicals used by industry are considered trade secrets. Not even the EPA knows exactly what's in the drilling fluids. And that, EPA scientists say, makes it impossible to vouch for the safety of the drilling process or precisely track its effects.

"I am looking more and more at water quality issues…because of a growing concern," said Joyel Dhieux, a drilling field inspector who handles environmental review at the EPA’s regional offices in Denver. “But if you don't know what's in it I don't think it’s possible."

Of the 300-odd compounds that private researchers and the Bureau of Land Management suspect are being used, 65 are listed as hazardous by the federal government. Many of the rest are unstudied and unregulated, leaving a gaping hole in the nation's scientific understanding of how widespread drilling might affect water resources.

Abrahm Lustgarten/ProPublica |

"Halliburton's proprietary fluids are the result of years of extensive research, development testing," said Diana Gabriel, a company spokeswoman, in an e-mail response. "We have gone to great lengths to ensure that we are able to protect the fruits of the company's research…. We could lose our competitive advantage."

"It is like Coke protecting its syrup formula for many of these service companies," said Scott Rotruck, vice president of corporate development at Chesapeake Energy, the nation’s largest gas driller, which has been asked by New York State regulators to disclose the chemicals it uses.

Thanks in large part to hydraulic fracturing, natural gas drilling has vastly expanded across the United States. In 2007, there were 449,000 gas wells in 32 states, thirty percent more than in 2000. By 2012 the nation could be drilling 32,000 new wells a year, including some in the watershed that provides drinking water to New York City and Philadelphia, some five percent of the nation's population.

The rush to drill comes in part because newly identified gas reserves offer the nation an opportunity to wean itself from oil.

Natural gas, as T. Boone Pickens said recently, is "cleaner, cheaper… abundant, and ours." Burning gas, used primarily to heat homes and make electricity, emits 23 percent less carbon dioxide than burning oil. Gas is the country's second-largest domestic energy resource, after coal.

The debate over water arises at a critical time. In his last days in office President George W. Bush has pushed through lease sales and permits for new drilling on thousands of acres of federal land. President-elect Barak Obama has identified the leasing rush as one of his first pressing matters and is already examining whether to try to reverse Bush's expansion of drilling in Utah.

State regulators and environmentalists have also begun pressing the gas industry to disclose the chemicals they use and urging Congress to revisit the environmental exemptions hydraulic fracturing currently enjoys.

But in the meantime, the drilling continues.

In September, the Bureau of Land Management approved plans for 4,400 new wells in Sublette County, despite the unresolved water issues. Tests there showed contamination in 88 of the 220 wells examined, and the plume stretched over 28 miles. When researchers returned to take more samples, they couldn’t even open the water wells; monitors showed they contained so much flammable gas that they were likely to explode.

'Big Wyoming'

News that water in Sublette County was contaminated was especially shocking because the area is so rural that until a few years ago cattle were still run down Main Street in Pinedale, the nearest town to the gas field. The county is roughly the size of the state of Connecticut but has fewer people than many New York City blocks. With so little industry, there was little besides drilling that people could blame for the contamination.

"When you just look at the data…the aerial extent of the benzene contamination, you just say...This is huge,” says Oberley, who is charged with water study in the area. “You’ve got benzene in a usable aquifer and nobody is able to verbalize well, using factual information, how the benzene got there.”

Sublette County, Wyo. (Credit: Abrahm Lustgarten/ProPublica) |

"We need the gas now more than ever," says Fred Sanchez, whose water well is among those with high levels of fluoride. But gazing off his deck at the prized trout waters of the New Fork River, he wonders whether drilling has gone too far. "You just can't helter skelter go drilling just because you have the right to do it. It's not morally right to do it. There should be some checks and balances."

Further east, in the town of Clark, the Wyoming Department of Environmental Quality found benzene in a residential well after an underground well casing cracked. In Pavilion, another small town, a series of drinking water wells began running with dark, smelly water, a problem a state official speculated might be linked to drilling nearby.

"There is no direct evidence that the gas drilling has impacted it," says Mark Thiesse, a groundwater supervisor for the Wyoming DEQ. "But it sure makes you wonder. It just seems pretty circumstantial that it’s happening."

On federal land, which is where most of the Sublette County wells are located, the BLM governs leasing and permitting for gas development, with secondary oversight from the state and only advisory input from the EPA. When the contaminated water results were first reported, both the BLM and the state downplayed their significance.

The EPA’s regional office in Denver sharply disagreed. But because it has only an advisory role in the federal review process, and hydraulic fracturing is exempted from the Safe Drinking Water Act, there was little the EPA could do. It rebuked the BLM in a strongly worded letter and gave the development plans in Sublette County a rare "unsatisfactory" rating. It also recommended that the project be stopped until further scientific study could be done.

The BLM, backed by a powerful business lobby, ignored that recommendation. Why do a study if you can’t prove something is wrong, industry argued.

Drilling operators said the benzene came from leaky equipment on the trucks that haul water and waste to and from the drill sites -- and in one or two cases, EPA scientists say that was likely. One theory put forth by the BLM blamed the benzene contamination on malicious environmentalists "hostile to gas production," an accusation the agency later said it had no evidence of.

Thiesse, the DEQ supervisor, recounted a meeting where the debate dwindled down to semantics: "I called it contamination, and somebody said is it really contamination? What if it's naturally occurring?"

Leaky equipment on trucks was one reason put forth by drilling operators for benzene contamination. Above, trucks are seen hauling water and waste to and from drilling sites. (Credit: Abrahm Lustgarten/ProPublica) |

"You have intervening rock in between the area that you are fracturing and the areas that provide water supplies. The notion that fractures are going to migrate up to those shallow formations -- there is just no evidence of that happening," says Ken Wonstolen, an attorney representing the Colorado Oil and Gas Association who has worked with the petroleum industry for two decades. "I think fracturing has been given a clean bill of health."

A flurry of mail from industry representatives to the BLM said the sort of study the EPA wanted would needlessly slow production. "BLM's restrictions on drilling in the Intermountain west have seriously reduced the supply of natural gas reaching consumers," wrote the American Gas Association.

Washington leaned down on Pinedale too. The message, according to Chuck Otto, field manager for the BLM: Make this happen by November. The 4,400 new wells were approved in September without any deadline for cleaning up the contamination or further research. State regulators told ProPublica that hydraulic fracturing was not even considered as a possible cause.

"The BLM looks at it more as a business-driven process," Otto said. "It's not like I have Vice President Cheney calling me up and saying you need to get this done. But there definitely is that unspoken pressure…mostly from the companies, to develop their resources as they'd like to see fit…to get things done and get them done pretty fast."

A Compromised Study

The 2004 EPA study (PDF) is routinely used to dismiss complaints that hydraulic fracturing fluids might be responsible for the water problems in places like Pinedale. The study concluded that hydraulic fracturing posed "no threat" to underground drinking water because fracturing fluids aren't necessarily hazardous, can’t travel far underground, and that there is "no unequivocal evidence" of a health risk.

But documents obtained by ProPublica show that the EPA negotiated directly with the gas industry before finalizing those conclusions, and then ignored evidence that fracking might cause exactly the kinds of water problems now being recorded in drilling states.

Buried deep within the 424-page report are statements explaining that fluids migrated unpredictably -- through different rock layers, and to greater distances than previously thought -- in as many as half the cases studied in the United States. The EPA identified some of the chemicals as biocides and lubricants that “can cause kidney, liver, heart, blood, and brain damage through prolonged or repeated exposure." It found that as much as a third of injected fluids, benzene in particular, remains in the ground after drilling and is “likely to be transported by groundwater."

The EPA began preparing its report on hydraulic fracturing in 2000, after an Alabama court forced the agency to investigate fracturing-related water contamination there under the Safe Drinking Water Act. Political pressures were also mounting for the agency to clarify its position on fracturing. The 2001 Energy Policy, drafted in part by the office of Vice President Dick Cheney, a former Halliburton CEO, noted that “the gas flow rate may be increased as much as 20-fold by hydraulic fracturing.” While the EPA was still working on its report, legislation was being crafted to exempt hydraulic fracturing from the Safe Drinking Water Act.

Before that happened, however, the EPA sought an agreement with the three largest hydraulic fracturing companies, including Halliburton, to stop using diesel fuel in fracturing fluids. Diesel fuel contains benzene, and such a move would help justify the report’s conclusion that no further studies were needed.

Signs put in all directions to drilling sites in Wyoming. (Credit: Abrahm Lustgarten) |

In a subsequent meeting, an EPA official’s handwritten notes show that a Halliburton attorney asked federal officials, "Are we willing to entertain regulatory relief in other areas; eg: fewer inspections?"

"Willing…," was the reply from Tracy Mehan, then the EPA’s assistant administrator for water.

A Halliburton spokesperson declined to comment on this exchange.

The diesel agreement (PDF) was signed. But according to the EPA, it isn't legally enforceable and the agency hasn't checked to see if diesel is still being used. Furthermore, the agreement applies only to fluids used in a specific kind of gas drilling, not all drilling across the United States.

Mehan did not return calls for comment about his negotiations. Roy Simon, associate chief of the Drinking Water Protection Division's Prevention Branch at EPA headquarters in Washington says the "EPA still stands by the findings outlined in the (2004) report."

But one of the report’s three main authors, Jeffrey Jollie, an EPA hydrogeologist, now cautions that the research has been misconstrued by industry. The study focused solely on the effect hydraulic fracturing has on drinking water in coal bed methane deposits, typically shallow formations where gas is embedded in coal. It didn’t consider the impact of above-ground drilling or of drilling in geologic formations deep underground, where many of the large new gas reserves are being developed today.

"It was never intended to be a broad, sweeping study," Jollie says. "I don’t think we ever characterized it that way."

Nevertheless, a few months after the report’s release, the sweeping 2005 Energy Policy Act was passed. Almost no attention was paid to the three paragraphs that stripped the federal government of most of its authority to monitor and regulate hydraulic fracturing’s impact on the environment. By default, that responsibility would now fall to the states.

“That pretty much closed the door,” said Greg Oberley, an EPA groundwater specialist working in the western drilling states. “So we absolutely do not look at fracking...under the Safe Drinking Water Act. It’s not done.”

Waste Hazards

On April 30, 2001 a small drilling company now owned by the Canadian gas company Encana fractured a well at the top of Dry Hollow, a burgeoning field in western Colorado that has seen one of the fastest rates of energy development in the nation.

The well sat at the end of a dirt drive among pinion pines and juniper at the crest of a small mesa overlooking the Colorado River. It was also less than 1,000 feet from the log farmhouse where Larry and Laura Amos lived.

As usual that day, water trucks lined up like toy soldiers on the three acre dirt pad cleared for drilling just across the Amos’ property line. They pumped 82,000 gallons of fluids at 3,600 pounds of pressure thousands of feet into the drill hole.

Suddenly the Amos' drinking water well exploded like a Yellowstone geyser, firing its lid into the air and spewing mud and gray fizzing water high into the sky. State inspectors tested the Amos well for methane and found lots of it. They did not find benzene or gasoline derivatives and they did not test fracking fluids, state records show, because they didn't know what to test for.

The Amoses were told that methane occurs naturally and is harmless. Inspectors warned them to keep the windows open and vent the basement, but they were never advised to protect themselves or their infant daughter from the water. It wasn't until three years later, when Laura Amos was diagnosed with a rare adrenal tumor, that she started challenging the state about the mysterious chemicals that might have been in her well.

Misted waste fluid rises from waste pits at a Wyoming well site. (Credit: Abrahm Lustgarten/ProPublica) |

Spurred by reports of water contamination in Colorado, Colborn painstakingly gathered the names of chemicals from shipping manifests that trucks must carry when they haul hazardous materials for oil and gas servicing companies. Whenever an accident occurred -- a well spill in Colorado, or an explosion at a drilling site in Wyoming – she took water and soil samples and tested them for contaminants, adding the results to her list.

Industry officials say they use such tiny amounts of chemicals in the drilling – of the million or so gallons of liquid pumped into a well, only a fraction of one percent are chemicals – that they are diluted beyond harmful levels. But on some fracturing sites that tiny percentage translates to more than 10,000 gallons of chemicals, and Colborn believes even very low doses of some of the compounds can damage kidney and immune systems and affect reproductive development.

In Garfield County, there were signs this was already happening. Animals that had produced offspring like clockwork each spring stopped delivering healthy calves, according to Liz Chandler, a veterinarian in Rifle, Co. A bull went sterile, and a herd of beef cows stopped going into heat, as did pigs. In the most striking case, sheep bred on an organic dairy farm had a rash of inexplicable still births -- all in close proximity to drilling waste pits, where wastewater that includes fracturing fluids is misted into the air for evaporation.

Among Colborn’s list of nearly 300 chemicals -- some known to be cancer-causing -- is a clear, odorless surfactant called 2-BE, used in foaming agents to lubricate the flow of fracking fluids down in the well. Colborn told Congress in 2007 that it can cause adrenal tumors.

Laura Amos, who suffered from such a tumor, pressed Encana on whether the compound had been used to fracture the well near her house. For months the company denied 2-BE had been used. But Amos persisted, arguing her case on TV and radio. In January 2005, her lawyers obtained documents from Encana showing that 2-BE had, in fact, been used in at least one adjacent well.

"Our daughter was only six months old when fracturing blew up our water well," Amos wrote in a letter to the Oil and Gas Accountability Project, an anti-drilling group. "I bathed her in that water every day. I also continued breast-feeding her for 18 more months...If there was a chemical in my body causing my tumor, she was exposed to it as well."

In 2006, Amos stopped talking to the media after she accepted a reported multi-million settlement from Encana. The company was fined $266,000 for "failure to protect water-bearing formations and…to contain a release of (gas production) waste." Yet investigators also concluded, without further explanation, that hydraulic fracturing was not to blame.

Asked about the Amos case and the rash of complaints in the area, an Encana spokesman said the company disagreed with the state's judgment on the Amos case and emphasized that there was no proof that fracturing had caused the explosion. Environmentalists had created a climate of fear in the community, he added.

"The concerns residents have expressed -- and some of them are legitimate and heartfelt concerns -- a lot of them are out of misinformation," said Doug Hock. "Just because chemicals are used at a site does not create risk. We have a proven process that helps us ensure that there are no pathways."

'The Tipping Point'

In the past 12 months a flurry of documented incidents has made such reports harder to dismiss.

"We've kind of reached the tipping point," says Dhieux, the EPA inspector in Denver. "The impacts are there."

In December 2007, a house in Bainbridge, Ohio exploded in a fiery ball. Investigators discovered that the neighborhood’s tap water contained so much methane that the house ignited. A study released this month concluded that pressure caused by hydraulic fracturing pushed the gas, which is found naturally thousands of feet below, through a system of cracks into the groundwater aquifer.

The raised platform used by Encana at some of its drill sites helps to protect the underlying landscape. (Credit: Abrahm Lustgarten/ProPublica) |

As more contamination cases are documented, state governments and Washington are being pressured to toughen oversight. One aim is to institutionalize the precautionary measures some companies are already experimenting with.

When ProPublica visited an Encana drilling operation in Pinedale, for example, the company was placing its drill rigs on raised platforms to protect the underlying landscape and using rubber pools to catch spilled fluids before they could seep into the soil. Drilling companies in New Mexico have begun storing waste in enclosed steel tanks rather than open pits.

Such efforts can add 10 percent to drilling costs, but they also dramatically lessen the environmental risks, an Encana employee said.

State regulators and Washington lawmakers though are increasingly impatient with voluntary measures and are seeking to toughen their oversight. In September, U.S. Congresswoman Diana DeGette and Congressman John Salazar, from Colorado, and Congressman Maurice Hinchey, from New York, introduced a bill that would undo the exemptions in the 2005 Energy Policy Act. Wyoming, widely known for supporting energy development, has begun updating its regulations at a local level, as have parts of Texas.

New Mexico has placed a one-year moratorium on drilling around Santa Fe, after a survey found hundreds of cases of water contamination from unlined pits where fracking fluids and other drilling wastes are stored. "Every rule that we have improved...industry has taken us to court on," said Joanna Prukop, New Mexico’s cabinet secretary for Energy Minerals and Natural Resources. "It’s industry that is fighting us on every front as we try to improve our government enforcement, protection, and compliance…We wear Kevlar these days.”

The most stringent reforms are being pursued in Colorado. Last year it began a top-to-bottom re-write of its regulations, including a proposal to require companies to disclose the exact makeup of their fracking fluids -- the toughest such rule in the nation.

Cathy Behr (Credit: Abrahm Lustgarten/ProPublica) |

Her doctors searched for details that could save their patient. The substance was a drill stimulation fluid called ZetaFlow, but the only information the rig workers provided was a vague Material Safety Data Sheet, a form required by OSHA. Doctors wanted to know precisely what chemicals make up ZetaFlow and in what concentration. But the MSDS listed that information as proprietary. Behr’s doctor learned, weeks later, after Behr had begun to recuperate, what ZetaFlow was made of, but he was sworn to secrecy by the chemical’s manufacturer and couldn’t even share the information with his patient.

News of Behr’s case spread to New York and Pennsylvania, amplifying the cry for disclosure of drilling fluids. The energy industry braced for a fight.

"A disclosure to members of the public of detailed information…would result in an unconstitutional taking of [Halliburton’s] property," the company told Colorado’s Oil and Gas Conservation Commission. "A number of studies have concluded there are no confirmed incidents of contamination of drinking water aquifers due to stimulation operations…EPA reached precisely this conclusion after undertaking an extensive study."

Then Halliburton fired a major salvo: If lawmakers forced the company to disclose its recipes, the letter stated, it "will have little choice but to pull its proprietary products out of Colorado." The company’s attorneys warned that if the three big fracking companies left, they would take some $29 billion in future gas-related tax and royalty revenue with them over the next decade.

In August, the industry struck a compromise by agreeing to reveal the chemicals in fracturing fluids to health officials and regulators -- but the agreement applies only to chemicals stored in 50 gallon drums or larger. As a practical matter, drilling workers in Colorado and Wyoming said in interviews that the fluids are often kept in smaller quantities. That means at least some of the ingredients won’t be disclosed.

"They’ll never get it," says Bruce Baizel, a Colorado attorney with the Oil and Gas Accountability Project, about the states’ quest for information. "Not unless they are willing to go through a lawsuit. When push comes to shove, Halliburton is there with its attorneys."

Asked for comment, Halliburton would only say that its business depended on protecting such information. Schlumberger and BJ Services, the two other largest fracturing companies, did not return calls for comment.

Lee Fuller, vice-president for government relations at The Independent Petroleum Association of America, said the oil and gas industry’s reluctance to release information about drilling chemicals is to be expected. "These operations are ones where companies have spent millions of dollars," he says. "They are not going to want to give up that competitive advantage. So I would fully expect that they will try to protect that right as long as they possibly can."

Allison Battey, Kristin Jones and Jonathan Sidhu contributed to this report.

A version of this story first appeared on Business Week's Web site and is included in the magazine's print edition.

Investigation: Natural Gas Rush

Fractured Relations -- New York City Sees Drilling as Threat to Its Water Supply

by Abrahm Lustgarten - Aug. 6, 2008 8:30 am

Despite New York's Order for Environmental Review, Gas Drilling May Proceed

by Abrahm Lustgarten - July 24, 2008 11:02 am

Governor Signs Drilling Bill But Orders Environmental Update

by Abrahm Lustgarten - July 23, 2008 5:57 pm

New York's Gas Rush Poses Environmental Threat

by Abrahm Lustgarten - July 22, 2008 2:42 pm

Graphics

Graphic: What is Hydraulic Fracturing?

Other Gas Drilling Coverage

"A Toxic Spew? Officials Worry About Impact of 'Fracking' of Oil and Gas"

by Jim Moscou, Newsweek, Aug. 20, 2008

"Natural Gas Could Transform Sullivan County"

by Ilya Marritz, WNYC, April 9, 2008

Chemical Used in Natural Gas Development and Delivery, The Endocrine Disruption Exchange

Document Dive

Halliburton Celebrates 50-Year Anniversary of Process That 'Energized' Oil and Gas Industry (PDF)

Halliburton's Web site, June 21, 1999

Elimination of Diesel Fuel in Hydraulic Fracturing Fluids Injected into Underground Sources of Drinking Water During Hydraulic Fracturing of Coalbed Methane Wells (PDF),

A Memorandum of Agreement Between the United States Environmental Protection Agency and BJ Services Company, Halliburton Energy Services, Inc., and Schlumberger Technology Corporation, Dec. 12, 2003

A White Paper Describing Produced Water from Production of Crude Oil, Natural Gas, and Coal Bed Methane (PDF),

prepared by the Argonne National Laboratory, January 2004

Evaluation of Impacts to Underground Sources of Drinking Water by Hydraulic Fracturing of Coalbed Methane Reservoirs (PDF),

Environmental Protection Agency, June 2004

New Mexico Gas Pit Sampling Results (PDF),

May 23, 2007

Written Testimony by Theo Colburn, Ph.D. (PDF),

before the House Committee on Oversight and Government Reform, Oct. 25, 2007

Report on the Investigation of the Natural Gas Invasion of Aquifers in Bainbridge Township of Geauga County, Ohio (PDF),

Ohio Department of Natural Resources, Division of Mineral Resources Management, Sept. 1, 2008

© Copyright 2008 Pro Publica Inc. The original content on this site is licensed under

a Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 United States License.

November 12, 2008

From credit crunch to energy crisis?

SHAWN MCCARTHY

Globe and Mail

November 12, 2008

OTTAWA — Global oil companies are sowing the seeds of a new supply crisis and a return to record-high prices by cutting back on current investments in response to the global slowdown, the International Energy Agency warns.

Four months ago, economists warned of “demand destruction” as record prices and a slumping economy slowed the growth of global crude consumption. But now, the IEA is worried about “supply destruction” as producers delay expensive projects, including some in Canada's oil sands, that would bring much-needed supplies to market.

“We think that the investment decisions that are being made now are of crucial importance, not only to meet future growth in demand, but to compensate for the decline in existing fields,” the agency's chief economist, Fatih Birol, said in an interview.

“If the investments are postponed, which is happening now, [then] when the demand rebounds we will see a supply crunch which may exceed the situation we saw this summer.”

Mr. Birol noted that producers across the globe – from multinationals tapping Canada's oil sands to national oil companies operating in the Middle East – have been cutting back their capital budgets as oil prices slumped from record highs this summer to a 20-month low Tuesday of $59.33 (U.S.) a barrel.

In a report released Wednesday, the Paris-based agency – which advises rich countries on energy policies – warned that the world's energy system is on an unsustainable path that could lead to both oil shortages and, eventually, in “catastrophic and irreversible damage” to the planet's climate.