December 30, 2009

Mackenzie pipeline gets a boost

Nathan VanderKlippe

Globe and Mail

30 December 2009

Joint Review Panel concludes northern project should go ahead – but at a deliberate, sustainable pace

A decades-old northern dream has taken a major step ahead after the panel that was assigned to review the Mackenzie Valley natural gaspipeline concluded that it should go forward.

The Joint Review Panel, which has spent the past half-decade assessing the project, has concluded the $16.2-billion project “would deliver valuable and lasting overall benefits and avoid significant adverse environmental impacts.”

But in a 679-page report, the panel lays out a number of measures designed to slow the pace of Arctic development the pipeline could spur, in hopes of avoiding undue ecological and social pressures. In a step that is likely to be controversial, it presses the federal government to keep Canada's natural gas – not solely that flowing from the Arctic – away from projects like the oil sands.

Released Wednesday afternoon, the report does not give formal approval for the pipeline to go ahead – that power lies with the National Energy Board, which is expected to rule in September – but its positive findings are a significant boost to the project. It “is obviously a very positive development,” said Pius Rolheiser, spokesman for project lead backer Imperial Oil Ltd. (IMO-T)

The report includes 176 recommendations aimed at diminishing the pipeline's impact, but concludes that the pipeline will “provide the foundation for a sustainable northern future” – one that would be better with the major project than without it.

One of its major conclusions is that the pace of Arctic development must be tempered in an effort to avoid “cumulative effects” from multiple projects.

An unbridled approach to Arctic gas exploration could be detrimental to the area, the panel found, warning that unless work is carried out at a sustainable pace, the pipeline could bring activity “so large and so rapid as to outstrip the capacities and resilience of northern people, firms and governments.”

The panel found that the Mackenzie line would not adversely affect fish, but says broad regional plans must be created to limit activity that could hurt animals like polar bears, caribou, beluga whales and migratory birds.

It recommended the NWT conclude a revenue-sharing agreement with the federal government, since the territory will shoulder much of the pipeline's infrastructure and related costs but, under current funding structures, “would receive little of the revenue share directly.”

The panel discarded arguments that the pipeline should be blocked on grounds that it would be used to feed clean natural gas to the oil sands.

It did, however, recommend that the federal government establish a “preferential use of natural gas” that would see gas used to replace, rather than boost, “more carbon-intensive and polluting fuels.” That could mean keeping natural gas away from the oil sands, and instead using it to replace coal-fired electrical generation.

“To us that was really the most interesting recommendation there,” said Sierra Club of Canada executive director Stephen Hazell, who called it “a good idea.”

The report's length and complexity kept many of the project's backers from making specific comments Wednesday. Still, Fred Carmichael, the chairman of the Aboriginal Pipeline Group, said it “sounds very, very positive.”

The pipeline group owns a one-third share in the project. The project's corporate backers include Royal Dutch Shell PLC, (RDS.A-N) ConocoPhillips Canada, (COP-N) Exxon Mobil Canada (XOM-N) and Imperial Oil Ltd., which has led the consortium for the past decade. Together, they have proposed a project that would bring a new age of industrialization to one of Canada's most untouched regions.

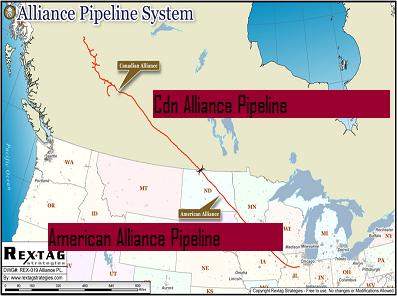

The 1,197-kilometre line would bring up to 1.2 billion cubic feet a day of natural gas from onshore basins near the Arctic coast to the northern edge of Alberta, where it would connect to the province's distribution system.

Though the pipeline dream has stoked fears of cultural and environmental damage, it has also raised hopes among many northerners who yearn for the economic independence it could help to bring.

The seven-member review panel took three years longer than expected to deliver its report, at a total cost of $18.7-million.

Yet in many ways, the most contentious decisions remain to be made. The primary one will come from industry itself, which has to choose whether to build a massive new pipeline whose necessity has been called into question by abundant new North American natural gas supplies from massive shale reservoirs.

Another open question surrounds federal funding for the project. Ottawa has spent nearly a year in negotiations with the pipeline's corporate backers on a fiscal support package. Those talks have yet to conclude, raising questions about Ottawa's willingness to commit big dollars to the pipeline at a time it is spending tens of billions on stimulus measures – and raising fears in the North that the pipeline will fail, bringing about an “economic doomsday.”

Environment Minister Jim Prentice, who has overseen the Mackenzie process, was not available for comment Wednesday. An Environment Canada official said the ministry would not respond until it has completed “the necessary analysis and consultation.”

Industry has compared the pipeline to the western railway and the St.

Lawrence Seaway, arguing that federal support has always been needed for such nation-building exercises.

If the federal government steps in to help, “the Mackenzie story is going to be a great story for Canada for a long time,” said Hal Kvisle, chief executive officer of pipeline builder TransCanada Corp.

Review Panel blesses Mackenzie Gas Pipeline

Foundation for a Sustainable Northern Future

Report of the Joint Review Panel for the Mackenzie Gas Project

December 2009

In the Panel’s view, the Mackenzie Gas Project and the associated Northwest Alberta Facilities would provide the foundation for a sustainable northern future.

All documents are available at the CEAA Registry

The Panel is confident in its assessment of the impacts of the Project as Filed and its likely contribution to sustainability. Because of the lack of or unreliability of information about future developments, particularly such developments as would be required to support an increase of throughput on the MVP beyond 1.2 Bcf/d, the Panel has made a number of recommendations specifically directed towards anticipating and allowing for appropriate mitigation of any adverse impacts of those developments. With the full implementation of these recommendations, governments and regulatory authorities responsible for reviewing and approving proposals for future developments would be better informed and would be equipped to ensure that appropriate and effective mitigation measures were in place before such developments were authorized to proceed.

The Panel acknowledges the uncertainty that is inherent in predicting the future and has approached the challenge that this presents as an opportunity/risk matrix. Accordingly, the Panel has given careful attention to means of anticipating and managing cumulative impacts and ensuring a positive legacy from the Project, possible expansions and other future developments. The Panel is confident that, with appropriate policy and regulatory initiatives and responses to manage future developments built on the implementation of the Panel’s recommendations, the MGP, and future developments that might follow from the Project, could proceed in an acceptable manner.

Overall, subject to the full implementation of the following recommendations, the Panel has concluded that the adverse impacts of the Mackenzie Gas Project and the Northwest Alberta Facilities would not likely be significant and that the Project and those Facilities would likely make a positive contribution towards a sustainable northern future.

In the Panel’s view, the Mackenzie Gas Project and the associated Northwest Alberta Facilities would provide the foundation for a sustainable northern future. The challenge to all will be to build on that foundation.

China to buy stake in oilsands

Financial Post

December 30, 2009

Ottawa gives OK for investment by PetroChina

Industry Minister Tony Clement has approved a deal in which a state-owned Chinese company will invest $1.9 billion in Alberta oilsands properties.

The Minister of Industry is giving the go-ahead to one of China's biggest forays into Canada's natural resource sector, PetroChina International Investment Company Ltd.'s $1.9-billion investment in properties owned by Athabasca Oil Sands Corp.

In a statement late yesterday, Tony Clement said he approved the deal to purchase a majority stake in the MacKay and Dover Oil Sands projects "because I am satisfied that the investment is likely to be of net benefit to Canada."

Following its announcement on Aug. 31, the deal was hailed as a major endorsement by foreign investors in the oilsands, as well as a sign that China could be prepared to ramp up its investment in such projects, after lukewarm interest in recent years. At the time, the acquisition was expected to be completed on Oct. 31, and company officials said they did not anticipate much objection from the federal government.

The PetroChina transaction tested guidelines, issued by the Conservatives in 2007, governing takeovers by state-owned enterprises. PetroChina is the publicly traded arm of state-owned China National Petroleum.

Under the guidelines, the department reviewed the "nature and extent" of control by the Chinese government, PetroChina's corporate governance and reporting practices, as well as whether the acquired projects will operate on a "commercial" basis.

But the key determination by the government when it reviews a large foreign takeover is whether the country gains from the investment.

Clement singled out PetroChina's commitment to make capital expenditures of more than $250 million for its share of the projects over the next three years as a key factor in its determination of a "net benefit" to the country.

"In making my determination, I carefully considered the plans, undertakings and other information submitted by PetroChina," Clement said.

He also cited PetroChina's plan to increase employment levels at the projects and to maintain an Alberta head office for its operating companies as contributing factors.

If Clement had ruled against the takeover, it could have had a chilling effect on Chinese investment in Canadian natural resource companies. Such a move would have run counter to the Conservative government's long-standing goal of promoting competition and investment.

Coast Guard runs two probes of grounding

By RICHARD MAUER

Anchorage Daily News

December 29th, 2009

'NORMAL' PATROL: One is to find why tug hit rock; other eyes traffic center.

The last and perhaps final working voyage of the tugboat Pathfinder appeared to have been routine and uneventful until it struck notorious Bligh Reef last week on the way home from an ice-scouting mission, the Coast Guard commander for Alaska said Tuesday.

"They were just out on a normal ice patrol," said Rear Adm. Christopher Colvin.

In a telephone interview from his office in Juneau, Colvin said his agency is conducting two parallel investigations into the Pathfinder's collision with the underwater rock, scene of the 1989 wreck of the Exxon Valdez. The Dec. 23 grounding resulted in a spill of a still-unknown quantity of diesel fuel and the disabling of the tug, but no injuries to its six-member crew.

Colvin said the Coast Guard marine safety office in Valdez was conducting a standard marine casualty investigation to determine why the boat hit the rock. A separate administrative review will look into the vessel traffic center in Valdez.

"Naturally, I have the same questions everybody else has," Colvin said. "I just want to make sure that our folks were doing what they were supposed to do, the way they were supposed to do it."

Colvin said he didn't know how long either investigation would take and wasn't prepared to provide preliminary information as it was learned. He said the crew had all given statements to investigators and were cooperating.

"This appears to be an accident. Nothing more," Colvin said.

Crowley Maritime Corp., the owner of the tug, said the boat's master and second mate have been relieved of duty pending further investigation. Colvin said the Coast Guard has not taken action against any of the crew's licenses.

On Tuesday, crews finished draining the remaining fuel from the boat's undamaged tanks and towed it from the fuel dock at Valdez about a mile to a container dock. The vessel, built in 1970, will remain there until it can be assessed for an ocean voyage to a drydock or shipbreaking facility, said Crowley spokesman Jim Butler.

"We're taking a hard look at the extent of the damage," Butler said. "It is an old vessel."

Butler said gauging specialists have been measuring the fuel unloaded from the tug and squeezed from absorbent boom placed around the vessel when it was still in Prince William Sound. The experts hoped to have an estimate of the missing fuel in a day or two, he said. About 33,500 gallons of fuel was in the two tanks gashed open in the collision, but a large portion was still floating in the tanks when they were emptied.

State officials have said the environmental damage appears to be minimal.

Colvin said the Coast Guard had officially notified the National Transportation Safety Board of the collision. The NTSB, which investigated the Exxon Valdez grounding, has the legal authority to intervene in the Pathfinder investigation but won't, said Keith Holloway, a spokesman at board headquarters in Washington, D.C.

The congressional agency picks its marine accidents carefully, he said, because it only has a handful of experts in the field. All were busy with the Dec. 20 crash in San Diego in which a speeding Coast Guard vessel struck a pleasure boat observing a waterborne parade, killing a child.

While the Pathfinder has human scouts to observe ice, the Coast Guard has special radar to do the same. But Colvin said the ice-tracking radar in Prince William Sound has been inoperable for about two months and won't be restored anytime soon.

The failure is the result of an unanticipated software problem that coincided with the nationwide upgrade of the U.S. vessel tracking system, he said. While the radar isn't officially part of the system, it uses the system to communicate with Coast Guard operations in Valdez. When the improvements were made, the radar went dead and there's no money in the current budget to fix it, Colvin said.

But Colvin said the missing radar didn't cause the Pathfinder to make its journey. That's because whenever the radar fails to pick up ice, a tug must be dispatched to make sure the transit lanes for oil tankers are really clear, he said. Before it wrecked, the Pathfinder had not encountered any ice in the shipping channels, making it likely that even with the radar, it would have been sent on its scouting mission, Colvin said.

"That's the weird thing about the ice radar -- if you don't detect anything on the ice radar, you probably have to send somebody out to make sure that there's no ice there," he said.

All Coast Guard navigation aids were working properly at the time, Colvin said.

As it headed out of Valdez, the Pathfinder called the Coast Guard vessel tracking center to say it was leaving the shipping lanes for ice patrol. It skirted Bligh Reef on its left, or port, side and headed west toward Columbia Glacier, the local source of ice floes and bergs. From there, it went to the east to the Bligh Reef side of the lanes, where windblown ice sometimes accumulates.

"They operate near the reef pretty routinely -- that's the challenge," Colvin said. "They were probably a mile south of the reef when they headed north, and apparently it's normal for them to head up on this course."

The Pathfinder crew called back to the Coast Guard vessel center in Valdez that their scouting was done, no ice was found, and they were heading home. They reported the grounding at 6:15 p.m., not long after it happened, Colvin said.

December 26, 2009

Crews abandon efforts to skim oil

By RICHARD MAUER and ELIZABETH BLUEMINK

Anchorage Daily News

December 25th, 2009

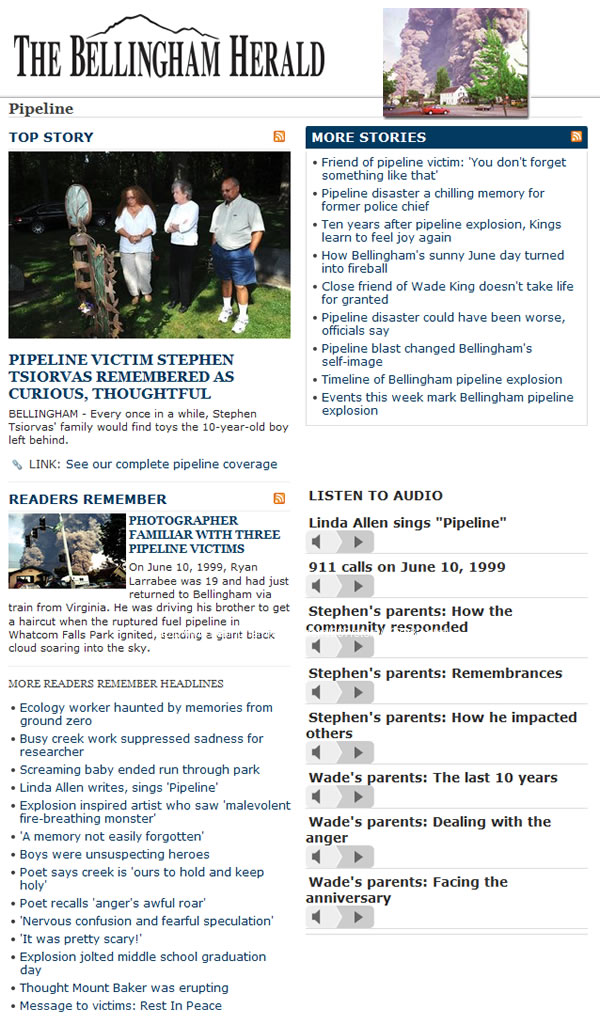

Rock made infamous by Exxon Valdez is site of another spill

The tug Pathfinder is surrounded by a spill containment boom on Thursday, December 24, 2009, in Prince William Sound. It is the left of the two boats at the bottom right of photo.The Pathfinder, a 136-foot tug scouting for ice along Prince William Sound's oil shipping lanes near Valdez, Alaska, grounded on Bligh Reef. (Marc Lester / Anchorage Daily News). Click here for slideshow. |

The owner of the disabled tugboat Pathfinder gained approval Thursday evening to begin pumping the remaining diesel fuel from the tug's two tanks that were slashed open on the unforgiving rock of Bligh Reef the night before.

|

Depending on how much of the original 33,500 gallons of fuel in those tanks spilled into Prince William Sound in the hours following the Wednesday grounding, the emergency pumping operation could last up to eight hours and continue into Christmas morning, according to the Coast Guard and a spokesman for Crowley Maritime Services, owner of the tug.

The fuel transfer from the Pathfinder to the oil-spill response ship Valdez Star was expected to begin before midnight Thursday.

The 136-foot tug had been scouting the Valdez shipping lanes for ice Wednesday when it struck one of the most infamous maritime hazards in the world, 20 years and nine months after the Exxon Valdez came up hard aground on the same charted rock.

The six-member Pathfinder crew reported running aground on Bligh Reef at 6:15 p.m. Wednesday, though the Coast Guard didn't make the incident public until about 3:30 a.m. Thursday.

A still unknown amount of diesel fuel bubbled from the vessel into the sea. Off the reef 30 minutes later, the tug limped under its own power to a sheltered cove on the south side of nearby Busby Island, where it remained, surrounded by oil-spill containment boom.

Divers who inspected the hull of the Pathfinder in the predawn darkness Thursday morning discovered major damage to the vessel. A 4- to 5-foot section of the keel was missing, and three fuel tanks were breached.

The Coast Guard sent a Jayhawk helicopter and C-130 plane over the area in the morning and discovered a silvery sheen three miles long and 30-feet wide about a mile east of Glacier Island.

The Valdez Star with its skimmers was sent out in early afternoon to try to recover the fuel, but the effort came up empty-handed.

"There's no recoverable sheen," said Jim Butler, a spokesman for Crowley. "That was based on overflight and equipment operating in the area."

While diesel fuel is toxic, it gets diluted relatively quickly through dispersion and evaporation, Butler said. Though it doesn't just "go away," it doesn't persist like crude oil, which globs up on beaches and tidal pools and can continue to pollute for years. The Exxon Valdez spilled an estimated 11 million gallons of North Slope crude, and its effects are still being felt in the Sound.

The Coast Guard reported that marine forecasters didn't believe the fuel sheen would touch Glacier Island, at least for the next 24 to 36 hours, and they expected it to dissipate rapidly.

After the failed skimming operation, the Valdez Star turned back to Busby Island at mid-afternoon to be on hand for the fuel transfer. Two of the three breached tanks contained fuel, while the third was empty. Secure tanks holding another 65,000 gallons of fuel will not be emptied, officials said.

Once the remaining fuel is removed, officials said they will be able to estimate how much of the 33,500 gallons originally in those tanks spilled into the water.

The Alaska Department of Environmental Conservation reported that the main engine of the Pathfinder is inoperable. The federal on-scene coordinator, Coast Guard Lt. Erin Christensen, said Thursday night that a marine towing company, Titan Marine, was drawing up plans to tow the Pathfinder to Valdez for further assessment.

Butler said the journey could begin Christmas Day and take roughly five hours to cover the 17 miles from Busby to the port.

The Coast Guard announced Thursday afternoon that a unified command made up of officials from the Coast Guard, the Alaska Department of Environmental Conservation and Crowley had been established to manage the after-effects of the disaster. Unified commands are used when agencies and companies with different jurisdictions and responsibilities need to respond to a large-scale incident.

Butler said he had no information about how the ship ran into the reef, a question that had some people responding with disbelief.

"How did it hit the most famous rock in Prince William Sound?" asked Stan Jones, spokesman for the Prince William Sound Regional Citizens' Advisory Council, a watchdog group funded by the oil industry after the oil spill.

Coast Guard officials said Thursday they were also trying to find out why the tug hit the reef. A Coast Guard inspector from Valdez talked to the crew, but Christensen couldn't say when the information from the interviews would be made public.

The Exxon Valdez captain, Joe Hazelwood, had been seen drinking before the wreck, but he was cleared of drunken navigation charges in part because it took hours to measure the alcohol content in his blood after the disaster.

Tests administered to the Pathfinder crew before 10 p.m. turned up no alcohol, the Coast Guard said. Results of drug tests would be available in three or four days, Christensen said.

Crowley, based in Seattle, is a marine services contractor for Alyeska Pipeline Service Co., which runs the trans-Alaska pipeline for its oil-company owners.

When it struck the reef, the Pathfinder was scouting the shipping route from Valdez to Hinchinbrook Entrance, a passage between two islands through which oil tankers enter and exit the Gulf of Alaska, the Coast Guard said

The National Weather Service said that seas were as high as 6 feet near Bligh Reef on Wednesday. Thursday morning, seas were at 2 feet and winds were blowing from the northeast at 10 to 15 knots. Winds could increase to 25 knots Thursday night, said Andy Brown, a lead forecaster for the National Weather Service in Anchorage.

December 19, 2009

Accord reached on global warming

COMMENT: After all that hoopla ... this? It wasn't worth the greenhouse gases it took to get it.

KELLY CRYDERMAN

Vancouver Sun

December 19, 2009

The deal: Rich countries hammer out a general agreement to reduce emissions

An international deal on global warming was reached late Friday, a last-minute breakthrough that was described as only a first step and insufficient to fight climate change.

"We have much farther to go," U.S. President Barack Obama said, adding that more trust would have to be built between rich and poor nations to reach a legally binding pact.

The talks went into overtime Friday, bolstered by hopeful discussions between the U.S. and China, but muddled by numerous confusing drafts of a new United Nations agreement swirling through the conference centre.

Obama reportedly reached a "meaningful agreement" with Chinese Premier Wen Jiabao, Indian Prime Minister Manmohan Singh and South Africa's President Jacob Zuma after a day of deep divisions between leaders of rich and developing nations.

A key compromise was an allowance for poor or developing countries that don't take international financing to avoid international monitoring of their emissions. The move was a pointed concession to China, which has fought such strict controls.

The so-called "Copenhagen Accord" lays out a general agreement for reducing greenhouse gas emissions. Under its guidance, countries would strive to keep temperature change below two degrees Celsius. Rich countries would reduce their emissions by 80 per cent by 2050 -- brought to fruition with various country commitments to be written into an annex at some future date.

The document said "nationally appropriate mitigation measures" will be laid out for developing countries.

In a concession to developing nations and small island states most vulnerable to climate change, it said a rise in world temperatures should be limited to two degrees Celsius, with a review in 2016 that would also consider a tougher limit of 1.5 Celsius.

"The preponderance of scientific evidence and opinion is that climate change is a very real challenge. The science continues to evolve -- we've had some controversy recently because the science is not uniform, not every scientist agrees on every detail, but we are guided by the preponderance of the evidence and that is absolutely clear," Prime Minister Stephen Harper, one of 120 world leaders at the climate summit, said Friday night.

"I know there will be people running out there saying targets are not hard enough but let me assure you what we and others are committed to do over the next decade will have real impacts and real challenges on players in the Canadian economy."

Harper also spoke of the oilsands-- often and loudly targeted by environmental activists on the streets of Copenhagen throughout the summit.

"The oilsands are I think, about four per cent of Canada's greenhouse gas emissions. They are a rapidly growing percentage," said Harper.

The proceedings were a day behind schedule and rumours swirled of talks going well into the weekend. Earlier in the day, Obama chastised world leaders for allowing squabbling to leave the United Nations pact in limbo so late in the process.

"I have to be honest, as the world watches us today, our ability to take collective action is in doubt right now," the U.S. president said.

Saskatchewan: Nuclear? Not Now

By Angela Hall

with files from James Wood

Leader-Post

December 18, 2009

Decision day

Saskatchewan residents won't see a nuclear power plant on the horizon in the next decade but a reactor might still make sense in the future, the provincial government said Thursday.

Energy and Resources Minister Bill Boyd said the decision means the government doesn't support Ontario-based Bruce Power's study that a nuclear power plant could add 1,000 megawatts to the Saskatchewan grid by 2020.

Boyd said worries about the impact of nuclear power generation on consumers' power bills was a chief factor in the Saskatchewan Party government's decision. There was also concern about the need to appropriately match power supply with demand, he said.

"When you look at all of those kinds of things -- cost drivers, demand, all of those things -- we are of the view that this is simply not something that meets with the needs of Saskatchewan at this particular time," Boyd said.

"When you look at beyond 2020, we still think it should be in the basket of options that SaskPower has to take a look at."

The comments came as Boyd held a news conference to respond to the findings of the Uranium Development Partnership (UDP), a government-appointed panel that in the spring recommended the province pursue nuclear power.

As well, a feasibility study released by Bruce Power one year ago identified the area between Prince Albert and Lloydminster as the possible region where a nuclear reactor could be located.

But SaskPower is looking at sources such as wind, natural gas, clean coal and hydro to meet power demand over the next decade, and Boyd said those projects call into question the need to add 1,000 MW from a large-scale nuclear reactor in 2020 -- the approximate year a nuclear plant could open if regulatory work began now.

Boyd said the research into the possibility of smaller nuclear reactors holds promise and may be a better option for the province post-2020.

"We want to match demand with the generation capacity as it goes forward. So while we may be looking at the need for an additional 1,000 MW by 2020 it's not in one lump sum," Boyd said.

The decision on nuclear power appeared to mark something of a shift for the Saskatchewan Party government, which had earlier seemed warm to the possibility.

But the NDP questioned why the government took several months -- and spent $3 million on the UDP process -- to arrive at what it called a non-decision.

"The door is completely open to Bruce Power post-2020. It shows huge indecision on this government's behalf," said Opposition MLA Trent Wotherspoon.

However, Ann Coxworth of the Saskatchewan Environmental Society called the government's direction wise and cautious, saying it will clear the air to plan for a "sustainable electricity future."

"Nuclear power has been the elephant in the room in all of our thinking about energy planning for the next decade and while the elephant hasn't been killed it's securely locked up in its cage," said Coxworth, adding she didn't anticipate a wholesale rejection of nuclear.

Coxworth also said there were "clear economic arguments against going with the nuclear option."

But Steve McLellan of the Saskatchewan Chamber of Commerce said the government didn't base its decision on good economics, charging it pulled the plug before even receiving a formal proposal from Bruce Power.

"They reacted to the fact that everybody thinks it's expensive but when you start to take into account the carbon costs, you take into account escalating infrastructure costs for any type of new power supply, they should have done full due diligence," McLellan said. "They've written it off for reasons that are unknown to us."

The costs of nuclear power generation might become more competitive after a price is put on carbon emissions, which could heavily impact traditional coal-fired generation, said Richard Florizone, the University of Saskatchewan vice-president who chaired the UDP panel.

"What we said is nuclear should be considered as a long-term option. We said that because nuclear is a clean, safe alternative and under the right circumstances it can be economically attractive as well," Florizone said.

"As we showed in our report, when you start to get carbon pricing in the range of $20 to $30 a tonne, the business case changes quite a bit. But until you have clarity on that I think going forward on nuclear is probably a bit too much of a risk."

As for Bruce Power, the company's outlook on the province hasn't really changed, spokesman John Peevers said.

"We see this announcement as not being very far off our take on what potential there is in Saskatchewan," Peevers said. "Saskatchewan obviously continues to consider nuclear energy as part of its mix. Nothing has been ruled out. We don't see it really changing that much as we've always looked at 2020 and beyond."

The private company is not looking for government subsidies, he said, contending that while up-front costs of nuclear are high it's a cost-effective source of electricity once a plant is up and running.

Lloydminster-area farmer Daron Priest, who helped spearhead a grassroots campaign against nuclear development, said he wanted to see the government take a more concrete position.

"I sure would like to see the door completely shut on it," Priest said.

© Copyright (c) The Regina Leader-Post

December 17, 2009

Alberta shale gas play in spotlight

Carrie Tait,

Financial Post

December 17, 2009

(Matt Nager/Bloomberg News) |

CALGARY - A new natural-gas shale play, akin to the Horn River gas field in northwestern British Columbia, is emerging in Alberta, and explorers made a multi-million gamble on the zone earlier this week.

Alberta, which has been pummeled by low natural-gas prices and a royalty structure that producers dislike, raked in $383.9-million in its last oil and gas rights auction of 2009. The Devonian Duvernay shale was the star area.

"We believe there is sufficient evidence to portray the Duvernay as a reasonable analog to the well known, related Muskwa shales of Horn River,"

Robert Fitzmartyn, vice-president and director of institutional research at FirstEnergy Capital Corp., said in a research note.

The Horn River gas field may contain up to 500 trillion cubic feet of natural gas – a mammoth find. The Duvernay zone, in comparison, is a mere speck considering Mr. Fitzmartyn estimates it may contain 25 trillion cubic feet of natural gas. However, the Duvernay, which sits west of Edmonton, might attract more attention.

"The Duvernay is going to have its advantages," Mr. Fitzmartyn said in an interview. "It has the infrastructure [like pipelines and gas plants] there; it might be better rocks."

"People don't appreciate how far north the Horn River is and how desolate it is and the logistical challenges of working up there."

Further, while initial estimates peg the new find at a fraction of the Horn River's size, 25 trillion cubic feet of natural gas is nothing to scoff at.

"It is still going to move the dial," the analyst said. Alberta does not disclose which companies participate in land auctions. EnCana Corp. and Talisman Energy Inc. are among those which Mr. Fitzmartyn believes may be involved.

The land auction has the oilpatch buzzing for another reason. Alberta has fallen out of favour when it comes to the natural gas business because explorers and producers can get better royalty deals in jurisdictions like British Columbia. The province will soon complete its so-called competitive review, which could lead to further changes to the royalty structure. Mr. Fitzmartyn thinks the oil companies' bet in the land sale could reflect confidence that a better fiscal deal is coming.

"Maybe people wouldn't make this bet if they didn't think changes might be imminent," he said.

British Columbia yesterday boasted about how the changes it made to its royalty structure throughout 2009 prompted oil and gas companies to spend more than they planned.

"Stimulus has incented producers to increase their expected 2010 investment by [$600-million] or 38.4%, to a total of $2.1 billion in 2010," the province said in a press release.

"Before stimulus, investment in B.C. in 2010 would have been 18.5% lower than 2009 investment levels," the province said. "With stimulus, investment in 2010 is expected to be 12.7% higher (estimated) than 2009 investment levels."

The statistics are based on a survey B.C. conducted with producers representing 67% of its 2008 natural gas production. The vast majority of B.C.'s oil and gas activity is contained in the Horn River and the Montney, another unconventional gas play.

December 15, 2009

The Enbridge Oil Sands Gamble

by Andrew Nikiforuk

Special to CorpWatch

December 14th, 2009

Cartoon by Khalil Bendib |

Patrick Daniel, the CEO of Enbridge Inc, is bullish about the future of unconventional oil from Canada’s massive tar sand deposits. And understandably so. His successful company not only operates North America’s longest crude oil and liquid pipelines, but transports 12 percent of the oil that the United States imports daily from Canada.

“Energy is necessary for us to live long healthy lives,” he told a business audience this past September during remarks to the Edmonton Chamber of Commerce. “The oil sands is the second largest reserve in the world, and we can’t deny access to the rest of the world to that huge resource.” [1]

Canada's highly unconventional resource (heavy oil from sand or rock) lies under a forest area the size of England (140,000 square kilometers) and is arguably the world’s last remaining giant oil field. Almost every major private and state-owned oil company has a presence in the tar sands. The project could make Canada the world’s fifth largest oil exporter by 2020.

But Daniel’s boosterism for unconventional oil is not shared by the band council of Hartley Bay, near the northern deep-water port of Kitimat, British Columbia (BC). When he showed up in September, community members of the Gitga'at people sat across from the proposed marine terminal for Enbridge’s $5 billion Northern Gateway pipeline.

The 1,170 kilometer-long dual pipeline would daily transport 525,000 barrels of bitumen, from Edmonton, Alberta, across two provinces and over mountains in some of the world’s most rugged terrain to Kitimat. From there, ocean tankers would take the inferior asphalt-like hydrocarbon to Asian refineries for processing into transportation fuels.

A parallel and smaller pipeline would move highly toxic condensate (a petroleum by-product used to thin heavy oil) imported from Russian and Indonesian markets to Alberta’s tar sands. Bitumen, a thick gooey resource with low gravity, simply can’t move through a pipeline unless diluted with up to 50 percent condensate. (For company information on the project, consult: http://www.northerngateway.ca/)

The project will traverse lands claimed or occupied by 40 aboriginal groups. The Gitga’at people, who have lived long and healthy lives by the Pacific Ocean for thousands of years without consuming much condensate or oil, told Daniel that his grand scheme threatened their traditional way of life as well as their food supply, including salmon, mussels and sea kelp.

“You are welcome in our territory as individuals, but your project is not,” declared Hereditary Chief Ernie Hill Jr. Other salmon-dependent people along the pipeline or tanker route – including the Haida and the Haisla – gave Enbridge similar blunt messages. The tar sands, said Haida Nation leader Guujaaw, "is one of the biggest unnatural disasters going on in the world right now.”

The stage is set for an epic battle between Asian and Canadian backers of North America’s most powerful oil carrier and an assortment of aboriginal and environmental groups in Canada’s greenest province, British Columbia. The unfolding petroleum drama, which will expose Asian refiners to extreme capital and carbon risks, could ultimately determine the pace and scale of the world’s largest energy development. The Northern Gateway pipeline also raises a moral question: Is it in Canada’s best interest to put more cars on the road in Shanghai at the expense of the world’s most valuable salmon-spawning watersheds and the security of the globe’s climate?

Global Reach

By any measure the tar sands project is a formidable energy power play. The world’s major petroleum companies including the U.S.’s Exxon, Norway’s Statoil and France’s Total have poured more than $100 billion into developing the project over the last decade, and it now produces 1.3 million barrels a day.

But bitumen, which is more than 50 per cent pitch, is not a secure replacement for sweet crude. For starters, the asphalt-like sludge remains the world’s most expensive hydrocarbon ($60 to $85 per barrel) because of the enormous amount of energy and water needed to extract it from the ground. Upgrading bitumen into synthetic crude, a process that removes carbon and adds hydrogen molecules, also requires more energy in the form of natural gas. But even the upgraded product remains so highly contaminated with sulfur, salt, acids and heavy metals that it needs additional, complex refining.

Not surprisingly, then, low quality bitumen from the tar sands has increased the energy and greenhouse gas output of U.S. refineries by 47 percent. [2] According to Canada’s National Center for Upgrading Technology, bitumen simply proves the industry maxim that “as crude prices increase, crude quality decreases.” [3] Although many Chinese refineries can process heavy crude such as bitumen, only five of Japan’s 50 refineries can currently handle the dirty hydrocarbon without fouling their facilities.

But Asia’s interest in Canadian bitumen is long standing owing to the region’s near total dependence on Middle Eastern crude. Japan now imports 90 percent of its oil, while China has increasingly exhausted its domestic oil resources to fuel its industrial revolution. Its oil imports rose from 1 percent in 1993 to nearly 50 percent today. The U.S. Department of Energy estimates that by 2025, some 70 percent of China's expected 14.2 million barrels daily consumption will come from oil fields in Africa, South America or Canada.

Not surprisingly, state-owned PetroChina heavily supported Enbridge’s first attempt to steer the Gateway project through Canada’s regulatory regime. But Asia’s largest oil company withdrew in 2007 after confronting Canadian political indifference and open U.S. hostility to the pipeline. (Some of that hostility directly relates to PetroChina’s unsuccessful 2005 attempt to buy out Unocal, a U.S. oil company with critical reserves in Asia.)

Last year Enbridge revived the Gateway scheme by securing $100 million in funding from 10 anonymous tar sand producers and Asian shippers (PetroChina is probably among them). A year later PetroChina paid $1.9 billion for a majority share of two tar sand properties. The state owned Korean National Oil Co. also gobbled up $1.8 billion in assets.

But bitumen investment comes with high carbon risks. The Chinese company purchased deep deposits of bitumen that can only be extracted in situ by steam plants (oil sands must be either mined or recovered in situ), perhaps the most greenhouse gas intensive industry in global oil production. (See Sidebar.)

China and the New Oil Order

A leading champion of Chinese investment in the tar sands is Paul Michael Wihbey, director of the Washington, D.C.-based energy consulting group (GWEST, or Global Water & Energy Strategy Team http://www.gwest.net/), and a former vice president of Canada's Liberal Party. Given that China and Canada rank as the largest trading partners with the United States (and that the three countries consume 35 percent of the world’s oil), Wihbey argues that “the nexus of China’s energy relationship with North America is the development of unconventional heavy oils.” Wihbey calls it “the new oil order” and believes that only the globalization of bitumen can keep the Chinese and U.S. economies afloat. [4]

| A Primitive and Flawed Technology

Critics charge that steam plant technology is primitive and riddled with problems. It burns natural gas to heat water to create steam to melt deep bitumen deposits. Greenhouse gas emissions can range between 71 to 276 kilograms per barrel of bitumen. [13] In contrast CO2 emissions from North Sea light oil range from 8 to 10 kilograms. [14] The U.S. National Energy Technology Laboratory calculated in 2009 that the Canadian bitumen used to make diesel fuel had a carbon footprint 244 percent greater than that of U.S. domestic crude. [15] The energy intensity of steam-based bitumen production has been the subject of much criticism. According to Petroleum Technology Alliance Canada (PTAC), an industry non-profit group, it takes one barrel of oil to produce four with the steam plants. But according to Charles Hall, a researcher at the State University of New York and one of the world’s leading experts on the energy created by energy investments, Middle East oil burns one barrel to produce 20 more. Hall calculates that modern oil-based civilization basically needs a return of one to three to function. But developers with a stake in extending the financial life of fossil fuels ignore the reality that steam plant production of bitumen offers barely enough surplus energy to “support continued economic activity and social function.” |

Wihbey even helped organize a 2009 gathering in Geneva, where Beijing expressed keen interest in establishing an energy corridor with Canada that would create a new Asian market for bitumen. “A larger commitment must be made to fully utilize our mutual strength,” said a government spokesman. [5]

Canadians such as Enbridge’s Daniel are only too anxious to make that corridor happen. The United States currently remains the only and largest market for Canada’s dirty oil. Enbridge, the number-one shipper of bitumen and synthetic crude from the tar sands, has already overbuilt capacity to U.S. markets in the Midwest. [6]

Moreover, the U.S. government has started to review its growing dependence on Canada’s dirty oil. Growing interest in low-carbon fuel standards, a new climate change program, and a push by some members of the U.S. military to reduce domestic oil consumption have made Canadian tar sand producers uneasy. A Chinese market would provide “an additional export outlet,” noted Hong Kong billionaire Li Ka Shing in Oilweek Magazine. “Then you won’t be subject to the U.S. as the one buyer.” [7]

But market diversification for bitumen would impose a high ecological price, and impact the northern British Columbia salmon-dependent communities particularly hard. The Northern Gateway pipeline will cross the 785 rivers and streams [8] that form the world’s most productive salmon habitat. Pipeline construction and operation will increase risks from pollution, oil spills and avalanches. And Enbridge’s record safety record is by no means stellar. When its 6,000 barrel spill threatened the Mississippi River in 2002, the company lit the oil ablaze, creating a smoke plume one mile high and five miles long. [9] In 2006 the company reported 67 spills totaling nearly 6,000 barrels, and the next year more than doubled the amount of oil released into the environment.

Respect for laws and landscapes is another issue. After building a bitumen pipeline across Wisconsin in 2008, the company paid the state $1 million in fines for 545 violations of its water and wetland laws. [10]

The Trans Alaska Example

The fate of BC’s wild and majestic coastline is what most worries northerners and aboriginals. The pipeline would not only accelerate bitumen production in Alberta, but bring as many as 300 supertankers a year to the port of Kitimat. Navigating the Douglas Channel, a narrow fjord, is no easy task. In the last two years, residents have witnessed two major boating incidents including the sinking of a ferry. According to Environment Canada, increased tanker traffic would also expose BC coastal waters to average spills of 1,000 barrels every four years and 10,000 barrels every nine years.

“It’s not a matter of if, but of when an oil spill happens,” says Cam Hill, a teacher and council member in Hartley Bay. “It would be catastrophic to our people and our way of life.” It would also disrupt marine life, including many whale species and dolphins, seals, and porpoises.

Opponents argue that the Gateway Project poses many of the same risks to northern British Columbia that the Trans Alaska Project (TAP) brought to rural Alaska: ecological and cultural disruption, persistent leaks, and massive spills – the worst of which was the 1989 Exxon Valdez disaster that released 240,000 barrels of pipeline oil when the tanker foundered. That spill dramatically altered the lives of 39,000 people living in coastal communities, and left residue that "is nearly as toxic [today] as it was the first few weeks after the spill,” [11] according to a 2009 report.

But although the risks from TAP and the Northen Gateway pipeline are similar, the benefits are not: Because bitumen carried by Enbridge's pipeline is neither refined nor produced in British Columbia, it will produce little or no royalty income for the region. It is simply a hydrocarbon freeway, and the money, like the oil, will flow elsewhere.

Enbridge advocates counter that rather than replicating TAP's failures, their project will resemble Norway’s Mongstand facility in Fensfjord where 250 oil tankers do business every year. “One only has to look at Norway’s national trust fund, their standard of living, health care, the simple transformation from basically a subsistence economy to one of the richest in the world to realize the potential derived from the fossil fuel industry,” noted one Gateway supporter in a September letter to the Kitimat Northern Sentinel. The writer omitted that Canada, unlike Norway, has no sovereign oil fund. In contrast to Norway, which charges some of the world's highest royalties and taxes on oil, Canada and Alberta charge among the lowest. In other words, few benefits would accrue to the rural residents other than a boom and bust economy created by 4,000 temporary construction jobs.

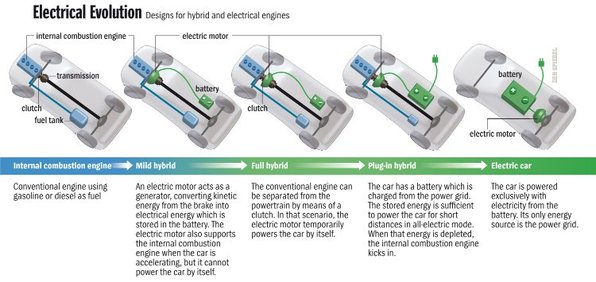

The capital risks are also significant. A 2009 Deutsche Bank study on peak oil concluded that carbon pricing and disruptive technologies such as the electric car could ease demand for petroleum products by 2015, the same year Enbridge hopes to bring its bitumen pipeline on stream. The bank study adds that, “We believe refining is a twilight business that will struggle in a world of ever declining gasoline demand.” Moreover strategic Chinese investments in natural gas and renewables could dramatically reduce that country’s “oil intensity of GDP growth.” [12]

“Canadian heavy oil sands” and other carbon intensive resources are unsafe investments, the report concludes, since the world, "will not grow the oil market.”

When the Northern Gateway project begins public regulatory hearings with Canada’s National Energy Board next year, the debate will include global carbon policies, sustained oil price volatility, electric cars, and the impact of building two pipelines across a fragile landscape claimed by aboriginal communities only to put more cars on roads in Asia.

(Andrew Nikiforuk is an energy and environmental writer based in Calgary, Alberta. His book, Tar Sands: Dirty Oil and the Future of a Continent, won the 2009 Rachel Carson Environmental Book Award.)

ENDNOTES:

[1] Patrick Daniels, Energy, Environment and the Economy, Remarks to the Edmonton Chamber of Commerce, September 23, 2009.

[2] Greg Karras, Refinery GHG Emissions From Dirty Crude, Communities for a Better Environment, April 20, 2009. Available at: http://www.cbecal.org.

[3] National Centre for Upgrading Technology, Oilsands Bitumen Processability Project, March 2006.

[4] Paul Michael Wihbey, Towards a New Oil Market Order: Heavy and Unconventional, World Heavy Oil Conference, Beijing, China, November 13, 2006.

[5] Claudia Cattaneo, “China’s Oil Giant Seeks Alliance with Canada, Financial Post, June 1, 2009.

[6] Sonja Franklin, Enbridge CEO Sees Pipeline Overcapacity to US, Bloomberg, October 7, 2009.

[7] Andrea W Lorenz, Opening the Door: Pipelines are Lining up Again to Satisfy Asian Thirst for Canadian Crude Oil, Oilweek Magazine, October 1, 2008.

[8] David A Levy, Pipelines and Salmon in Northern British Columbia, Pembina Institute, October 2009.

[9] US National Transportation Safety Board, Rupture of Enbridge Pipeline and Release of Crude Oil near Cohasset, Minnesota, July 4, 2002, Pipeline Accident Report, NTSB/PAR, 2004.

[10] Wisconsin Department of Justice, Enbridge Energy Settles State Lawsuit Over Environmental Violations for $1,100,000, January 2, 2009.

[11] Exxon Valdez Oil Spill Trustee Council, Legacy of An Oil Spill: 20 Years After the Exxon Valdez, 2009.

[12] Deutsche Bank, The Peak Oil Market: Price Dynamics At the End of the Oil Age, October 4, 2009.

[13] John Nenniger, N-Solve: The Profits of Energy Efficiency vs. the High Costs of Carbon Capture, presentation to PTAC Towards Clean Energy Production Forum, Calgary, Alberta, October 2008.

[14] Statoilhydro, 2008 Offshore Environmental Statement, March 23, 2009, p. 6.

[15] National Energy Technology Laboratory (NETL), An Evaluation of the Extraction, Transport and Refining of Imported Crude Oils and the Impact of Life Cycle Greenhouse Gas Emissions, DOE/NETL-2009/1362, March 27, 2009.

[16] Charles A.S. Hall et al, What is the Minimum EROI that a Sustainable Society Must Have? Energies, January, 2009.

December 06, 2009

Northern Gateway Pipeline: Availability of Funding

| NEB Project Registry CEAA Project Registry Terms of Reference |

Canadian Environmental Assessment Agency

December 4, 2009

Deadline for Applications

The Canadian Environmental Assessment Agency (the Agency) is making available $600,000 under its Participant Funding Program to assist groups and individuals to participate in the environmental review of the proposed Northern Gateway Pipeline Project.

The deadline to submit a funding application is December 18, 2009. Funding applications received by the Agency by this date will be considered.

The Joint Review Panel Agreement has been released. It describes the Panel’s terms of reference as well as the process to be followed for conducting the joint panel review. This will help applicants finalize their application for funding.

This funding is being made available to help successful applicants review and comment on the application to be submitted by the proponent, Enbridge Northern Gateway Pipelines. The application will include the environmental impact statement. The funding may also be used to prepare for and participate in the public hearings that will be announced at a later date.

A funding review committee, independent of the review process, will consider all applications and make recommendations on the allocation of funds.

Information on the funding program, the proposed project, and the environmental assessment process is available on the Agency’s Web site, registry number 06-05-21799.

To apply for funding or to obtain more information on the program, contact:

Suzanne Osborne, Participant Funding Program

Canadian Environmental Assessment Agency

160 Elgin St., 22nd floor, Ottawa ON K1A 0H3

Tel.: 1-866-582-1884 / 613-957-0254

Fax: 613-948-9172

suzanne.osborne@ceaa-acee.gc.ca

Enbridge Northern Gateway Pipelines proposes to construct and operate two pipelines, 1,170 km in length, between an inland terminal at Bruderheim, Alberta and a marine terminal near Kitimat, British Columbia. About 500 km of pipeline will be in Alberta and 670 km in British Columbia. One of the pipelines will carry petroleum west to Kitimat and the other line will carry condensate east to Bruderheim. The project also includes the construction and operation of an integrated marine infrastructure at tidewater to accommodate loading and unloading of oil and condensate tankers and marine transportation of oil and condensate.

Pipeline review draws criticism

By Judith Lavoie

Times Colonist

December 5, 2009

Environmentalists say scope of hearings is too narrow

Federal terms of reference for assessing the proposed Enbridge Northern Gateway Pipeline brought instant condemnation from environmental groups yesterday.

The Canadian Environmental Assessment Agency and the National Energy Board announced they will hold open forums on the pipeline, which would run from the Alberta oilsands to a port at Kitimat.

"The public and aboriginal groups are encouraged to bring their views on the Northern Gateway Pipeline Project forward to the Joint Review

Panel once the panel is established," said a news release.

The panel will consider whether the project is likely to cause significant adverse environmental effects and if it is in the public interest.

Once hearings are finished, the panel will submit recommendations to the federal government.

But environmental and aboriginal groups say the scope is too narrow and the panel will not have enough clout.

"The proposed Enbridge Northern Gateway project would result in a 30 per cent increase in average daily oilsands output, with major environmental consequences, but the environmental assessment of the project will ignore these impacts," said Karen Campbell, staff lawyer with the Pembina Institute.

Eric Swanson of the Victoria-based Dogwood Initiative said the process will not ask British Columbians if they want to accept the risk of an Exxon Valdez-type spill on the province's north coast.

"If it did, Canadian taxpayers could save a lot of money because 72 per cent of British Columbians are opposed to oil tanker traffic on our north coast," Swanson said.

Both the Pembina and Dogwood organizations promote sustainable development.

Opposition to the project will increase because of the weak terms of reference, said Jessica Clogg, West Coast Environmental Law executive director.

"Given the potentially devastating risks, citizens can be rightfully concerned about a federal environmental assessment process that has a track record of giving the thumbs up to over 99 per cent of the projects," she said.

If approved, the 1,170-kilometre pipeline would run between Bruderheim, Alta., and Kitimat, where crude oil would be loaded onto supertankers. A second line would carry condensate from Kitimat to Bruderheim.

About 670 kilometres of the pipeline would be in B.C.

December 04, 2009

Northern Gateway Pipeline: Joint Review Panel Agreement Issued

| NEB Project Registry CEAA Project Registry Terms of Reference |

Canadian Environmental Assessment Agency

National Energy Board

December 4, 2009

OTTAWA, December 4, 2009 – The Canadian Environmental Assessment Agency (the Agency) and the National Energy Board (NEB) issued today the Joint Review Panel Agreement (the Agreement), including the Terms of Reference, for the environmental and regulatory review of the proposed Northern Gateway Pipeline Project.

The joint review panel process will provide an opportunity for all hearing participants to make their views known on the project in an open and transparent forum. The public and Aboriginal groups are encouraged to bring their views on the Northern Gateway Pipeline Project forward to the Joint Review Panel (the Panel) once the Panel is established.

The Agreement was issued for public comment before being finalized. The Agreement describes the Panel’s terms of reference as well as the process to be followed for conducting the joint panel review.

The Panel has a broad mandate under both the National Energy Board Act and the Canadian Environmental Assessment Act to consider whether the project is likely to cause significant adverse environmental effects and if it is in the public interest. After conclusion of the review process, the Panel will prepare a Panel Report setting out its conclusions and recommendations relating to the environmental assessment of the project. Following the government response on the Panel Report, the Panel will then issue its reasons for decision under the National Energy Board Act. More specifically, the Panel will:

• examine all matters related to the project such as safety, engineering and economics;

• conduct an examination of the environmental effects of the proposed project and the significance of those effects;

• consider measures that are technically and economically feasible to mitigate any adverse environmental effects, the need for and the requirements of any followup programs with respect to the project;

• consider comments from the public that are received during the review;

• hold public hearings;

• submit to the federal government a report with recommendations about the project; and

• issue its Reasons for Decision pursuant to the National Energy Board Act.

Additional information on the Agreement is available in the accompanying backgrounder.

The Agreement, including the Terms of Reference, as well as additional information on the project are available on the Agency’s website at www.ceaa-acee.gc.ca , under reference number 06-05-21799, and on the NEB’s website at www.neb-one.gc.ca.

The Agency administers a Participant Funding Program which supports individuals and non-profit organizations and Aboriginal groups interested in participating in the review panel process. Next steps in the review process will include the appointment of the Panel members, the announcement of the participant funding recipients and the filing of the project application by Enbridge Northern Gateway Pipelines to the NEB. The Panel will provide additional opportunities for public input and input by Aboriginal groups on the List of Issues to be considered by the Panel. Additional information will be available when the Panel issues its Hearing Order.

About the Project

Enbridge Northern Gateway Pipelines proposes to construct and operate two pipelines, 1,170 km in length, between an inland terminal at Bruderheim, Alberta and a marine terminal near Kitimat, British Columbia. About 500 km of pipeline will be in Alberta and 670 km in British Columbia. One of the pipelines will carry crude oil west to Kitimat and the other line will carry condensate east to Bruderheim. The project also includes the construction and operation of an integrated marine infrastructure at tidewater to accommodate loading and unloading of oil and condensate tankers and marine transportation of oil and condensate.

About the Canadian Environmental Assessment Agency

The Canadian Environmental Assessment Agency administers the federal environmental assessment process, which identifies the environmental effects of proposed projects and measures to address those effects, in support of sustainable development.

About the National Energy Board

Celebrating 50 years of regulatory leadership, the National Energy Board is an independent federal agency that regulates several parts of Canada's energy industry. Its purpose is to promote safety and security, environmental protection, and efficient energy infrastructure and markets in the Canadian public interest, within the mandate set by Parliament in the regulation of pipelines, energy development and trade.

- 30 -

Media may contact

Annie Roy

Manager, Communications

Canadian Environmental Assessment Agency

Tel.: 613-957-0396

Kristen Higgins

Communications Officer

National Energy Board

Tel.: 403-299-3122

Northern Gateway Pipeline Project

Joint Review Panel Agreement and Terms of Reference

BackgrounderCanadian Environmental Assessment Agency

National Energy Board

December 4, 2009

The Canadian Environmental Assessment Agency (the Agency) and the National Energy Board (NEB) issued the Joint Review Panel Agreement (the Agreement), including the Terms of Reference, for the environmental and regulatory review of the proposed Northern Gateway Pipeline Project.

The Agreement was signed by the Minister of the Environment and the chair of the NEB. The Agreement includes the process for appointing the Panel members, the proposed Terms of Reference for the Panel, the role the Panel will play in the Crown’s overall approach to consultation with Aboriginal groups, and procedures for conducting the joint review process including public hearings.

Comments on the Draft Joint Review Panel Agreement

A public comment period on the draft Agreement was held between February 9 and April 14, 2009. Comments were received from the public, Aboriginal groups and other interested parties. All comments were carefully considered before the Agreement was finalized.

Some of the comments received concerned items that were already captured within the Agreement and Terms of Reference. Other comments led to changes in the Agreement, such as comments received on marine traffic and the need for increased explanation of the joint review panel process.

Issues to be Considered by the Joint Review Panel

The Joint Review Panel (the Panel) has a broad mandate under both the National Energy Board Act and the Canadian Environmental Assessment Act to consider whether the Northern Gateway Pipeline Project is likely to cause significant adverse environmental effects and if it is in the public interest. The public and Aboriginal groups are encouraged to bring their views on the project forward to the Panel. There will be opportunities for the public and Aboriginal groups to provide input on the List of Issues to be considered by the Panel. Information on how to submit input will be available when the Panel issues its Hearing Order.

Marine Traffic

Many comments submitted on the draft Agreement focused on the issue of marine traffic and the perception that there is a moratorium on tanker traffic in the coast waters of British Columbia (B.C.). It is the Government of Canada’s position that there is presently no moratorium on tanker traffic in the coast waters of B.C. Tanker traffic currently exists in the Ports of Vancouver,

Kitimat and Prince Rupert.

The Agreement defines the boundaries for the assessment of potential environmental effects associated with marine transportation for this project.

The boundary area is:

• the Confined Channel Assessment Area, as defined by the proponent, which includes the marine and shoreline area of Kitimat Arm, Douglas Channel to Camano Sound, and Principe Channel to Browning Entrance;

• Hecate Strait; and

• the proposed shipping routes to be used for the project that are within the 12 nautical mile limit of the Territorial Sea of Canada.

Joint Review Panel Process

The Agency and the NEB also received requests for additional information on the joint review panel process. To provide a better understanding of the process, a new Part IV section has been added to the Terms of Reference. The joint review process will provide the public and Aboriginal groups with an opportunity to make their views known in an open and transparent forum. The Hearing Order issued by the Panel will provide a detailed description of the hearing process. After conclusion of the review process, the Panel will prepare a Panel Report setting out its conclusions and recommendations relating to the environmental assessment of the project.

Information Requirements

To bring more clarity to the type and amount of information the proponent should consider in preparing its application, the Terms of Reference were revised to refer to the NEB’s Filing Manual. In addition, a Scope of Factors document was prepared by the Agency. If the Panel feels information submitted by the proponent is insufficient to assess the environmental effects of the project, the proponent will be required to provide more evidence to satisfy the Panel.

Aboriginal Matters

In response to questions on how the Crown’s duty to consult will be met, the Agreement was revised to include details on the information the Panel will receive and include in its report regarding the adverse impacts that the project may have on potential or established Aboriginal and treaty rights.

Regulatory Decisions

Following the government response on the Panel Report, the Panel pursuant to the National Energy Board Act will determine if the project should proceed and under which conditions. The other federal responsible authorities for the project will also take a course of action according to the government response on the Panel Report.

A copy of the Agreement, including the Terms of Reference, as well as additional information on the project are available on the Agency’s website at www.ceaa-acee.gc.ca , under reference number 06-05-21799, and on the NEB’s website at www.neb-one.gc.ca.

November 29, 2009

Copenhagen: Seattle Grows Up

NAOMI KLEIN

The Nation

November 30, 2009

The other day I received a pre-publication copy of The Battle of the Story of the Battle of Seattle, by David Solnit and Rebecca Solnit. It's set to come out ten years after a historic coalition of activists shut down the World Trade Organization summit in Seattle, the spark that ignited a global anticorporate movement.

The book is a fascinating account of what really happened in Seattle, but when I spoke to David Solnit, the direct-action guru who helped engineer the shutdown, I found him less interested in reminiscing about 1999 than in talking about the upcoming United Nations climate change summit in Copenhagen and the "climate justice" actions he is helping to organize across the United States on November 30. "This is definitely a Seattle-type moment," Solnit told me. "People are ready to throw down."

There is certainly a Seattle quality to the Copenhagen mobilization: the huge range of groups that will be there; the diverse tactics that will be on display; and the developing-country governments ready to bring activist demands into the summit. But Copenhagen is not merely a Seattle do-over.

It feels, instead, as though the progressive tectonic plates are shifting, creating a movement that builds on the strengths of an earlier era but also learns from its mistakes.

The big criticism of the movement the media insisted on calling "antiglobalization" was always that it had a laundry list of grievances and few concrete alternatives. The movement converging on Copenhagen, in contrast, is about a single issue--climate change--but it weaves a coherent narrative about its cause, and its cures, that incorporates virtually every issue on the planet. In this narrative, our climate is changing not simply because of particular polluting practices but because of the underlying logic of capitalism, which values short-term profit and perpetual growth above all else. Our governments would have us believe that the same logic can now be harnessed to solve the climate crisis--by creating a tradable commodity called "carbon" and by transforming forests and farmland into "sinks" that will supposedly offset our runaway emissions.

Climate-justice activists in Copenhagen will argue that, far from solving the climate crisis, carbon-trading represents an unprecedented privatization of the atmosphere, and that offsets and sinks threaten to become a resource grab of colonial proportions. Not only will these "market-based solutions" fail to solve the climate crisis, but this failure will dramatically deepen poverty and inequality, because the poorest and most vulnerable people are the primary victims of climate change--as well as the primary guinea pigs for these emissions-trading schemes.

But activists in Copenhagen won't simply say no to all this. They will aggressively advance solutions that simultaneously reduce emissions and narrow inequality. Unlike at previous summits, where alternatives seemed like an afterthought, in Copenhagen the alternatives will take center stage. For instance, the direct-action coalition Climate Justice Action has called on activists to storm the conference center on December 16.

Many will do this as part of the "bike bloc," riding together on an as yet unrevealed "irresistible new machine of resistance" made up of hundreds of old bicycles. The goal of the action is not to shut down the summit, Seattle-style, but to open it up, transforming it into "a space to talk about our agenda, an agenda from below, an agenda of climate justice, of real solutions against their false ones.... This day will be ours."

Some of the solutions on offer from the activist camp are the same ones the global justice movement has been championing for years: local, sustainable agriculture; smaller, decentralized power projects; respect for indigenous land rights; leaving fossil fuels in the ground; loosening protections on green technology; and paying for these transformations by taxing financial transactions and canceling foreign debts. Some solutions are new, like the mounting demand that rich countries pay "climate debt" reparations to the poor. These are tall orders, but we have all just seen the kind of resources our governments can marshal when it comes to saving the elites. As one pre-Copenhagen slogan puts it: "If the climate were a bank, it would have been saved"--not abandoned to the brutality of the market.

In addition to the coherent narrative and the focus on alternatives, there are plenty of other changes too: a more thoughtful approach to direct action, one that recognizes the urgency to do more than just talk but is determined not to play into the tired scripts of cops-versus-protesters.

"Our action is one of civil disobedience," say the organizers of the December 16 action. "We will overcome any physical barriers that stand in our way--but we will not respond with violence if the police [try] to escalate the situation." (That said, there is no way the two-week summit will not include a few running battles between cops and kids in black; this is Europe, after all.)

A decade ago, in an op-ed in the New York Times published after Seattle was shut down, I wrote that a new movement advocating a radically different form of globalization "just had its coming-out party." What will be the significance of Copenhagen? I put that question to John Jordan, whose prediction of what eventually happened in Seattle I quoted in my book No Logo. He replied: "If Seattle was the movement of movements' coming-out party, then maybe Copenhagen will be a celebration of our coming of age."

He cautions, however, that growing up doesn't mean playing it safe, eschewing civil disobedience in favor of staid meetings. "I hope we have grown up to become much more disobedient," Jordan said, "because life on this world of ours may well be terminated because of too many acts of obedience."

EnCana grapples with gas glut

By Shaun Polczer

Calgary Herald

November 28, 2009

Company split takes effect Monday; Eric Marsh: Managing a natural gas 'renaissance'

EnCana executive VP Eric Marsh is pressing government to develop policies that encourage consumption of natural gas, which is both clean and abundant. (Photograph by: Ted Rhodes, Calgary Herald) |

Starting Monday when the company's split into two comes into effect, he'll be charged with finding ways to use them up when he takes over the position of "Executive Vice-President Natural Gas Economy"--a fancy way of describing a natural gas evangelist whose job is to extol the virtues of North America's cleanest and possibly most abundant fossil fuel.

It's probably the first time a major energy producer has created a senior executive position focused solely on demand instead of supply.

"This industry has gone through a period of time over the last three to five years that we've

never known before," he says. "We would say it's a renaissance in natural gas development. The big change is that it's brought on by technology."

The new EnCana is coming to market at an odd and some say troubling time for natural gas producers, as one of the purest play natural gas producers in North America. Virtually all of its production is gas of the "unconventional" variety, an abundant but relatively difficult type of gas to produce from hard to reach rocks like shale and tight sandstone.

The original EnCana was a pioneer in this regard, practically inventing the concept of "resource plays." Today, every major multinational oil company from Exxon to Shell is scrambling to take up positions in every shale basin they can find.

Some estimates by the U.S. Geological Survey and others suggest North America has 100 years of gas in the ground, thanks to the discovery of big new shale plays in places like Horn River and Louisiana.

In fact, shale--which was once considered impossible to extract gas from--has proven to be so prolific that it currently accounts for 13 per cent of North America's total production and full-blown development has barely begun. Huge reserves lie untapped in places such as Quebec and Pennsylvania that could dramatically alter the production landscape for decades to come. Marsh says scarcity is no longer an issue in a market that has been characterized by volatile spikes in supply and demand.

That in turn has driven prices down to multi-year lows, as storage levels reach all-time highs. The more successful companies like EnCana are at finding and developing new reserves, the lower the price goes.

Speaking at the meeting to approve the split on Wednesday, EnCana CEO Randy Eresman warned of a looming shakedown among gas producers due to lower long-term prices. Conventional exploration and development that can only be profitable at $7 to $8 will probably fall by the wayside.

"We've got exposure to all of the plays that are actually causing the value of natural gas production we're seeing today," he said. "Over time we think that clear itself up and the best producers at the lowest cost will survive."

Finding the solution to the glut is Marsh's job. Already, he's pressing governments to develop policies that encourage consumption of natural gas as a substitute for coal and nuclear to generate power and as a transportation fuel in cars and heavy trucks.

Marsh estimates that a third of North America's greenhouse emissions could be eliminated by switching vehicles to burn natural gas. To set the example, EnCana is switching its 1,800-strong vehicle fleet to natural gas and configuring rigs to use it instead of diesel.

Marsh says many government leaders often aren't aware of the magnitude of the opportunity to reduce oil consumption and cut emissions. It's this "green" mantra the new EnCana will try to make as the cornerstone of its emerging corporate culture.

"We think you can make good inroads on commercial transport infrastructure in three years. We have this abundance of natural gas, it's affordable and we can count on the supply being there."

In a recent meeting with the Herald's editorial board, Texas oilman T. Boone Pickens complained that North Americans are unable to buy natural gas vehicles. Only one manufacturer actually produces a natural gas passenger car --the Honda Civic GX--and it's only available in limited quantities. About 150,000 cars are configured to run on natural gas out of a total North American fleet of 250 million automobiles. By contrast, natural gas-powered cars are common in places like Europe with almost 40 to 45 models to choose from. Europe currently imports most of its natural gas from Russia.

Pickens has described North America as the Saudi Arabia of natural gas. "We have more of it than anyone," he said.

Pickens is promoting his own plan to encourage natural gas in eighteen-wheelers and federal vehicles with a pair of bills working through the U.S. House of Representatives and Senate that he hopes will be passed by the end of the year. He said he has met personally with President Barack Obama to discuss the issue and described natural gas as "the only fuel we have in North America that can take out foreign oil."